21st century madness of crowds and popular delusions

Let us not, in the pride of our superior knowledge, turn with contempt from the follies of our predecessors. The study of the errors into which great minds have fallen in the pursuit of truth can never be uninstructive. – Charles MacCay MEMOIRS OF EXTRAORDINARY POPULAR DELUSIONS Volume III (of III)

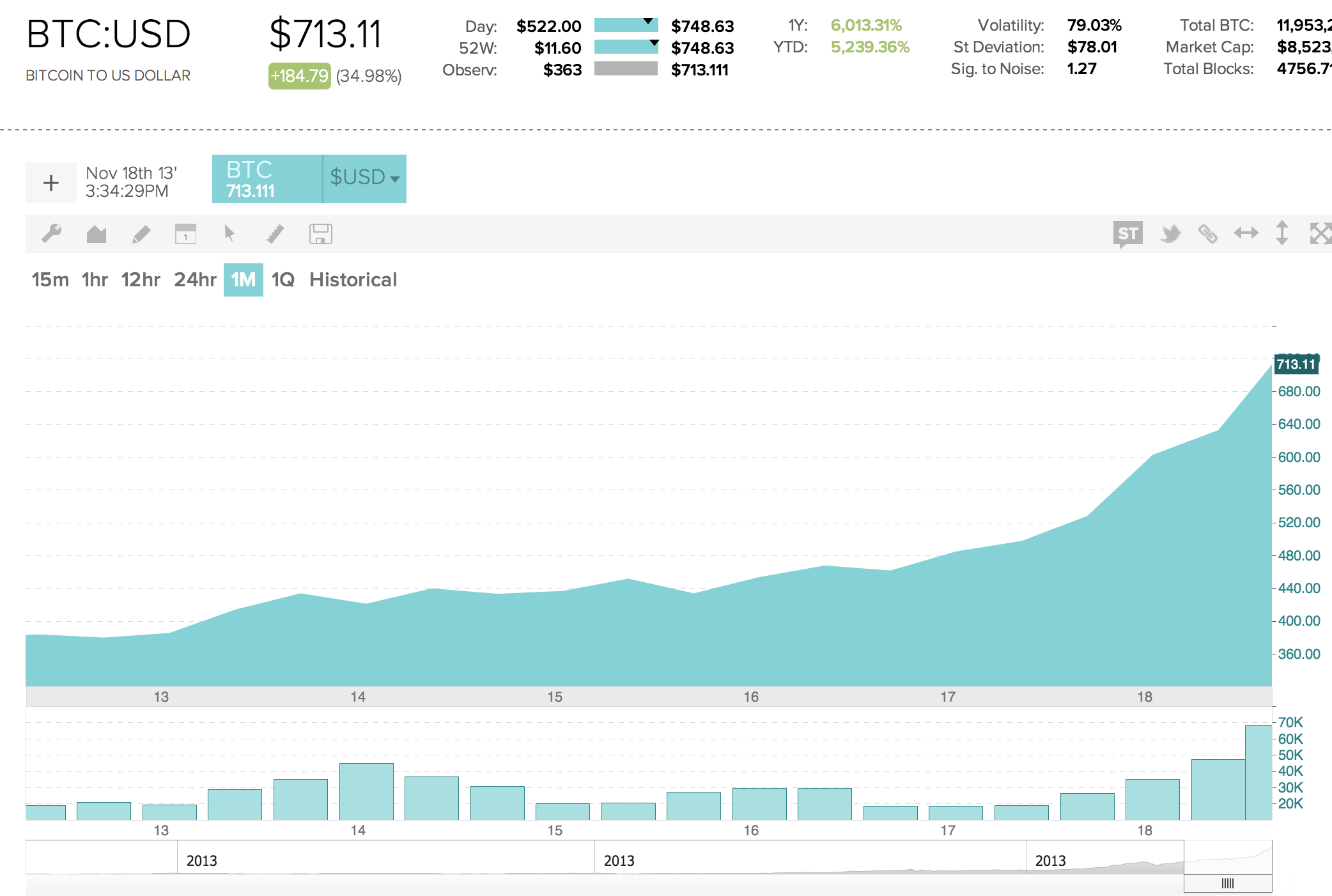

The fact that bitcoin is up more today than I paid for my bitcoin tranche just a couple weeks ago makes me MORE nervous about the state of our economy and stock markets than about a potential Bitcoin bubble. I don’t know whether the parabolic bitcoin action is indicative of a bubble in $bitcoin or indicating that the entire paradigm of sovereign currency is beginning to pop.

Forget about what this chart says about bitcoin for a moment while you look at it. What does this say picture say about the mindset of people right now?

I want to do something a little different in today’s newsletter, quoting from MacCay’s classic book on bubbles, Extraordinary Popular Delusions and the Madness of Crowds, written 120 years ago, and I’m going to insert in brackets some Revolution Investing commentary to help you apply his lessons to today’s markets, economy, politics and society. For example, MacCay writes, in his intro to the book:

“Some delusions, though notorious to all the world, have subsisted for ages, flourishing as widely among civilized and polished nations as among the early barbarians with whom they originated,—that of dueling, for instance, and the belief in omens and divination of the future [would you agree that all forms of technical analysis and charting and even economic predictions are modern-day equivalents of trying to divine the future?], which seem to defy the progress of knowledge to eradicate entirely from the popular mind. Money, again, has often been a cause of the delusion of multitudes [dot com bubble, real estate bubble, mortgage backed security bubble, etc]. Sober nations have all at once become desperate gamblers, and risked almost their existence upon the turn of a piece of paper [stocks, Treasuries, precious metal ETFs like GLD, SLV, etc].“

Later in the book, describing the the Mississippi Company bubble of 1719–1720, he writes:

The finances of the country were in a state of the utmost disorder. A profuse and corrupt monarch [the sovereign governments of the world in the 21st century, including the Republican/Democrat Regime and the Federal Reserve], whose profuseness and corruption were imitated by almost every functionary, from the highest to the lowest grade, had brought France [the US, the EU, UK, etc] to the verge of ruin.

The national debt amounted to 3000 millions of livres, the revenue to 145 millions, and the expenditure to 142 millions per annum; leaving only three millions to pay the interest upon 3000 millions [in the US right now, there’s $24.5 Trillion In US National Debt, $144 Trillion In Unfunded Liabilites, the tax revenue is $3 trillion, and expenditures are $4 trillion, leaving a negative trillion dollars to pay interest upon $25-144 trillion.].

The first care of the Regent [POTUS, Prime Minister, etc] was to discover a remedy for an evil of such magnitude, and a council was early summoned to take the matter into consideration [TARP, National Commission on Fiscal Responsibility and Reform, Simpson-Bowles Budget Plan, Dodd-Frank, etc].

The Duke de St. Simon [Ron Paul?] was of opinion that nothing could save the country from revolution but a remedy at once bold and dangerous. He advised the Regent to convoke the States-General, and declare a national bankruptcy [fighting the bailouts and forcing a financial markets re-set, including letting all of AIG’s counterparties like JPM, GS, etc simply fail and be sold of piece meal, as was the original intent of the 2008 Boston Tea Party, which I covered in person].

The Duke de Noailles, a man of accommodating principles, an accomplished courtier, and totally averse from giving himself any trouble or annoyance that ingenuity could escape from, opposed the project of St. Simon with all his influence [every single pundit, politician, economist, etc who says the bailouts and continued bank subsidies and protections are necessary]. He represented the expedient as alike dishonest and ruinous. The Regent was of the same opinion, and this desperate remedy fell to the ground.

…A chamber of justice was next instituted, to inquire into the malversations of the loan-contractors and the farmers of the revenues. Tax collectors [IRS, etc] are never very popular in any country, but those of France [the US, the EU, UK, etc] at this period deserved all the odium with which they were loaded.

The Chamber of Justice [Treasury, Federal Reserve, etc], instituted chiefly for this purpose, was endowed with very extensive powers. It was composed of the presidents and councils of the parliament [hmmm- The Board of Governors, or Federal Reserve Board, is the controlling body of the Federal Reserve System. The Federal Reserve Board, comprised of 7 members appointed to staggered 14-year terms, operates with a great deal of independence from both the executive and legislative branches of government], the judges of the Courts of Aid and of Requests, and the officers of the Chamber of Account, under the general presidence of the minister of finance [Treasury Secretary].

Informers were encouraged to give evidence against the offenders by the promise of one-fifth part of the fines and confiscations [Informants in the private sector who expose violations of securities law can receive between 10% and 30% of a penalty if it’s more than $1 million under a program created by the Dodd-Frank Act]. The Bastile was soon unable to contain the prisoners that were sent to it, and the gaols all over the country teemed with guilty or suspected personsj [Meanwhile in present day, the U.S. Has World’s Highest Incarceration Rate].

So let’s draw some more parallels here to wrap this up.

Is bitcoin this society’s version of alchemy, trying to create gold (currency) out of other substances, in this case, bits and bytes and algorithms and encryptions? Is bitcoin already in the midst of a Holland-Tulip bubble, which was also made famous from these very MacCay books I’m quoting today, by the way.

And that last point really underscores how hard it is to navigate these markets, this economy and the paper-currencies and paper promises and tax schemes that drive them. Bubbles are always the result of policy and I’m still quite confident that we are in the midst of an unprecedented global coordination of policy that are purposely set on fueling bubbles. We’ve been properly positioned for this bubble-blowing bull market since we launched and I think the lessons of the past indicate that this will blow much bigger before it pops. Be very careful — I continue to suggest that every investor needs to have some gold coins, some silver coins, a tiny bit of Bitcoin and some other assets that are not entirely beholden to the paper-promise policies of the 21st century.