115 years of inflation, highest rated stock picks right now and other notes

It’s an early close at the stock markets today, but stocks are indeed trading and the prices they quote today are as real as on any other day.

The Shanghai Composite Index SHCOMP fell 5.5% to 3,436 wiping out Shanghai’s gains this month. Chinese stock markets are still down 40% from their peak in June and up about 15% from its August lows. US stock markets will open flattish and it looks like the markets have finally come around to my view that we shouldn’t read much if anything into the Chinese stock markets as they gyrate and bubble and pop on questionable valuations and financials in a Communist country. Of course that doesn’t mean our US stock markets won’t ever sell-off or that we can rest on our winners. And heck yea, I’m hard at work on new names and researching our existing names further.

On another note entirely, I was thinking about how we still hear that we’re supposed to fear “deflation” in the economy as I was flipping through a 1902 Sears Catalog yesterday. Most everything in the catalog is 100x or more expensive today, such as a pocket knife for 30-50 cents in 1902 vs $30-50 today for a comparable quality knife. Cameras, most of which sold for around $10 in 1902 could be considered an example that prices for some things are deflating and maybe even headed to zero, as cameras come standard on your phone today.

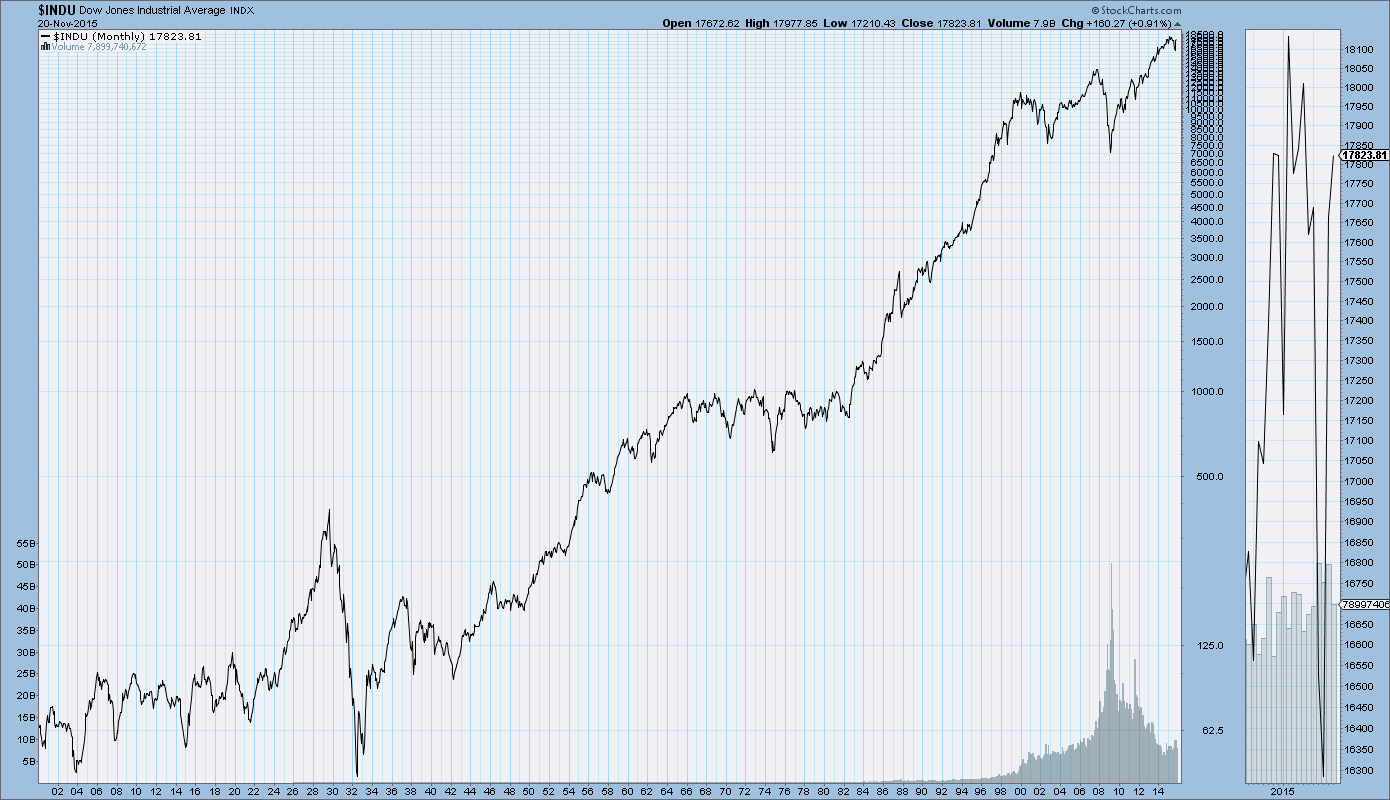

I used to tell Kudlow on CNBC and write on TheStreet all the time and wrote an article called ” that most consumers should welcome deflation because it means your money is getting more valuable and that your buying power is growing. It’s an out of the box theory that deflation would benefit Main Street and help reduce the trend of growing wealth disparity in this country, but it’s probably a moot point anyway, as the 10,000% growth in prices from 1902 to today underscores. The stock market has gone up even more than that over the same time frame.

Before we move on from that 115 year DJIA chart, make sure you look at that chart and see the decades os sideways movement and the many crashes along the way to 20,000% gains in the stock market since 1902 and know that we’ll see both of those again in coming decades.

No trades for me today, but here are the names at the top of my Revolution Ratings right now:

- Fitbit FIT (Long)

- F5 FFIV (Long)

- Sony SNE (Long)

- GW Pharma GWPH (Short)

Stay vigilant, stay objective, keep cool and have a great weekend.