Revisiting all those marijuana penny stocks

It was just over a year ago that I went on an anti-penny-stock crusade with articles like:

You’d have to be a dope to buy marijuana stocks

A true story about how penny-stocks really work

Hype, fraud and theft are always rampant on Wall Street

Best stocks for legalized marijuana (Hint: None were penny stocks)

The reason I highlighted marijuana-related penny stocks back then was simply because the building hype around legalizing pot in the US was all the rage and there were dozens if not hundreds of pot-related insider-controlled micro-cap penny stocks that were being hyped to retail investors. But the playbook of these penny stock and OTC and Pink Sheets reverse-merger shell games are always the same, and the retail investor is always the sucker at the table.

Investing and trading is hard enough, what with trying to compete against the best traders and investors in the world, dealing with bubbles and crashes, complicated tax regimes, changing demographics and so on. Why would you ever want to risk your money on dubious penny stocks.

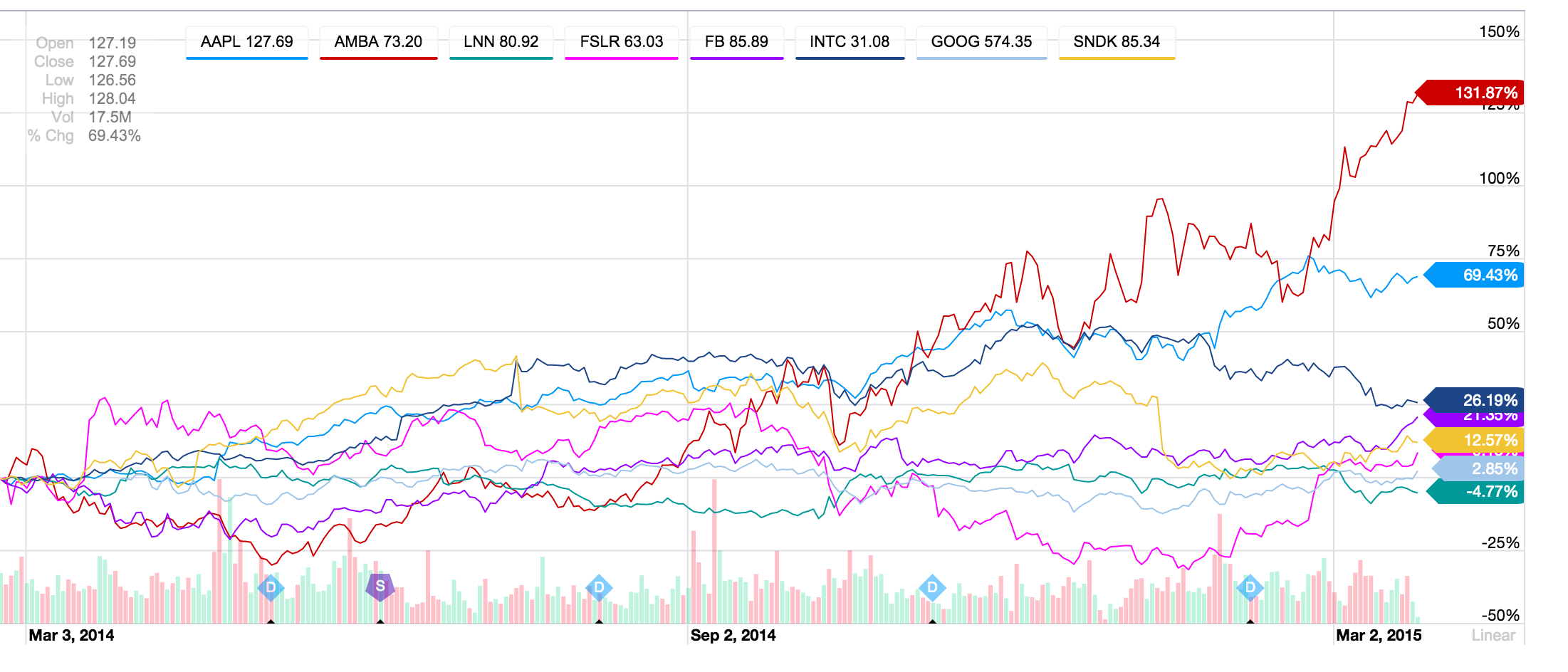

The eight stocks I was recommending this time last year and still hold included Facebook, FB, Google GOOG, Apple AAPL. The best performer over the last year or so has been Ambarella AMBA which is up nearly 150% and my worst performer was Lindsay LNN which was down 3%. I did sell a few positions during the last year, mostly for gains with a couple losses in there like CREE.

If you’d bought and held the stock I was recommending this time last year when I was pleading with you guys to sell your pot penny stocks, you’d be up nearly 40% on average:

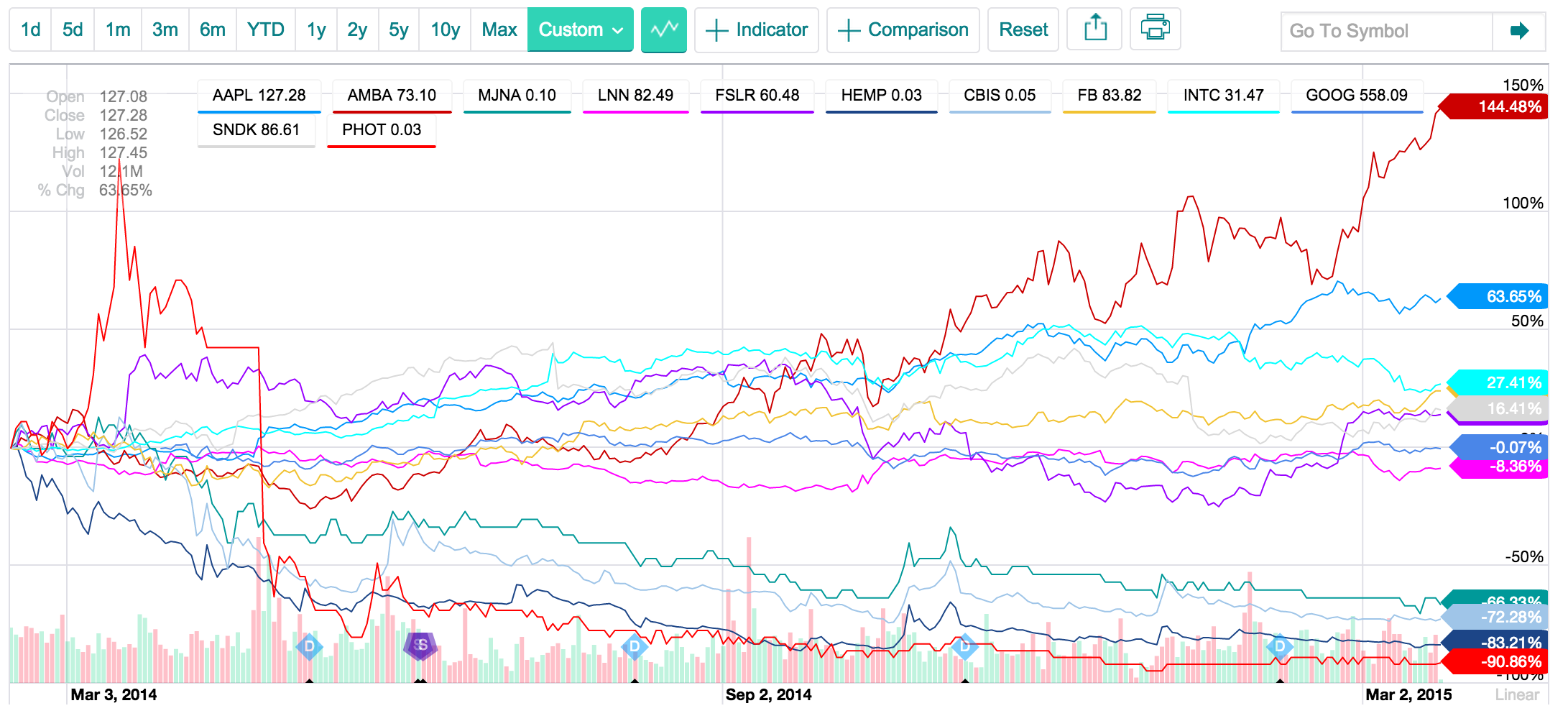

If you’d bought and held the pot penny stocks I was bashing this time last year instead of having bought the stocks I was recommending, you’d be down an average of 80%. You read that right, without a single exception, every pot penny stock I’ve bashed over the last year is down at least 66%:

In real dollar terms, there were those of you throwing $100,000 into those pot penny stocks, and those portfolios are now worth $20,000. If you’d put that same $100,000 into those eight stocks I owned in the Revolution Investing Portfolio and still personally own, it’d be worth $133,000. Here are all these charts on one screen:

You’d have nearly 7x as much money if you’d bought real Revolution Investments as you’d have left playing the sucker in the penny stock promotion scheme. Look at the stock chart from any of the penny stock names I’ve warned against in the last year and you’ll find they all are down similarly without ever having given those retail investors who were convinced they’d at least get a chance to trade around their positions that chance. Here are some more of the penny stock symbols I’ve warned you guys about LINK: BRDT, ERBB, GRNH, and here’s a great example in real-time of me explaining this entire scam where already-defunct LGLRD was being promoted by a Forbes and Huffington Post columnist named Mark Fidelman.

So you tell me, what are the best penny stocks to buy right now? Correct, none. Come learn more here.