It’s a very ugly open this morning…bec…

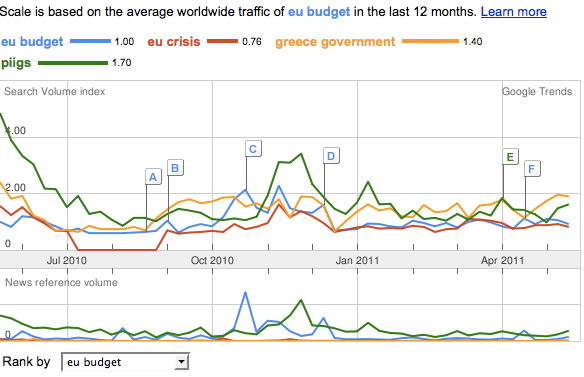

It’s a very ugly open this morning…because of new concerns that Spain and Italy are to join Ireland and Greece as problem children of the EU…again. Each and every time we’ve seen the markets get hit badly here in the US over some concerns about some smaller countries in Europe who are going to bail out their bankers and cut social services to kick the can further down the road, I’ve reminded you guys that we should use such catalysts as buying opportunities. And that has indeed been the right approach. Look at the recent trends of concerns about the EU and their budget over the last twelve months:

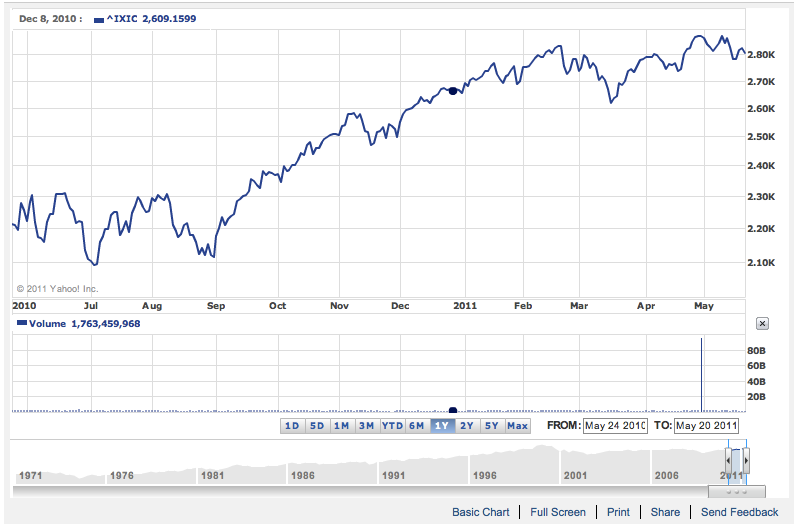

And how has the stock market done over those last twelve months:

If you’d sold this time last year when the mainstream media was trying to freak you out over “EU crisis”, you’d have missed a subsequent 25% move in the broader Nasdaq market. If you’d sold back around last Christmas when the people were trending “EU crisis” again, you’d have missed a subsequent nearly 15% move in the Nasdaq in the next few months.

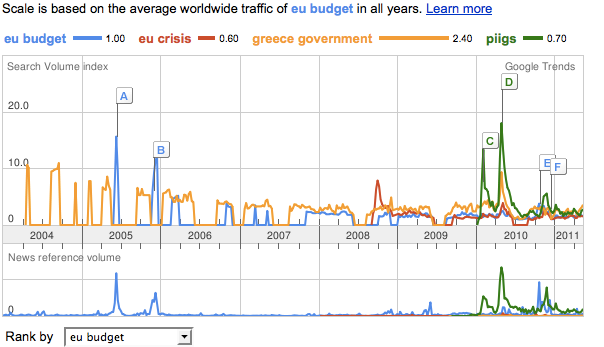

Let’s expand our time horizon out to the last six years of people and the mainstream media freaking out over “EU crisis!”:

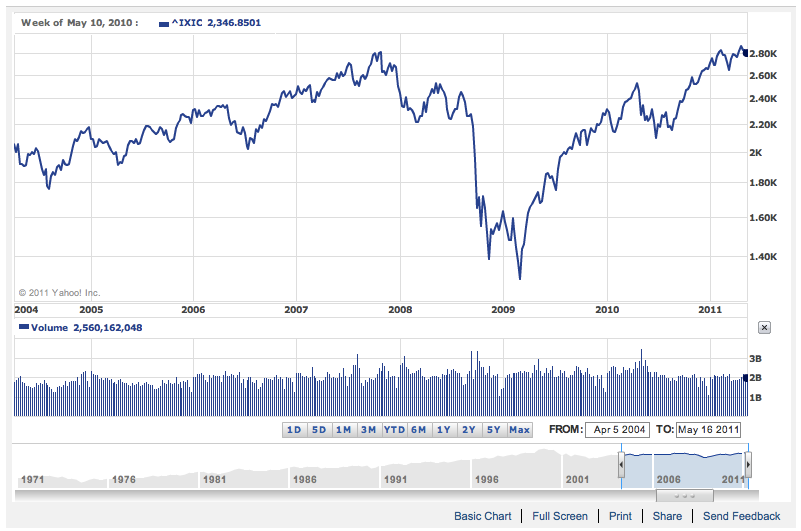

And the broader Nasdaq over the same time frame:

Look at those two seven-year charts above and you tell me if it has ever made more sense to sell when the headlines read, as they do today:Stocks open sharply lowerIcelandic volcano a cloud over airlinesFresh debt fears for

Italy and Spain crisis:

• Heavy losses for Socialists in Spain

• PMI slowdown for euro zone in May

• David Marsh: Europe must surrender IMF

• Obama visits Ireland on first stop of Europe trip

• Europe follows Asia lower | Shanghai off 2.9%

• Euro toys with $1.40 as dollar draws buyers

Long-time readers know exactly what I’m planning to do into today’s Europe-crisis-catalyzed sell off — I’m a buyer. I’ll be using the weakness in any stock like Nuance or Celestica that are down 3% or so today to build up my positions further. I’m still not as fully invested as I’d like to be and I do fully expect that we’ll look back at today’s panic over “Italy, Spain and the EU crisis”in six weeks and six months and six years and be able to put up charts just like we do in today’s column about why those concerns were irrelevant to our stocks. Except they give us opportunities to buy cheaper than we might not have had otherwise.

Use the opportunities that the markets give us.