I’m continuing to work on building up th…

I’m continuing to work on building up the Google position. I just bought some longer-dated, out-of-the-money Google calls. I’m looking going out to December 2011s expiration dates with $550-600 strike prices. I’ve already started buying some and will likely work these orders most of today. Here’s an expanded version of some notes I passed along to you guys last week on why I think Google’s a good set up right now:

Google’s got $37 billion in cash. That’s about $114 per share in net cash. The Street consensus estimates that Google will earn about $33 a share in 2011 rising almost 20% to $39 a share in 2012. More realistically, even if the economy remains in its fragile state or even if it weakens, in my opinion Google’s going to earn at least $35 a share this year and over $40 a share next year. And unlike the Hewlett-Packards of the world, Google’s actually hiring and expanding, not just finding new ways to expand margins, as the top-line should grow close to 20% this year and next, or 10 times faster than the broader economy.

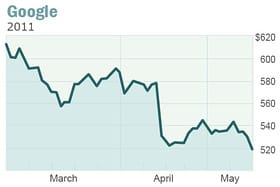

Google right now is trading at $520 a share. That means it’s trading at a 13 multiple to next year’s earnings. Take out the $114 per share in net cash that you get for free and as a cushion as a shareholder,and the stock is trading at 10 times next year’s earnings. That’s one half its top-line growth rate. That’s less than one half its earnings growth projections for the next two years.

Meanwhile, the broader stock market is trading at a 14 multiple to next year’s earnings or about 12 times next year’s earnings when you exclude the broader market’s cash balances. The top-line for the broader market is supposed to grow about 5% for the next couple years. Bottom line growth should be double that. So from a near-term valuation perspective, Google is growing three or four times as fast on both the top and bottom lines yet trading cheaper than the broader market.

From a trading perspective, let’s look at Google’s near-term set up like we did last year, on, Aug. 31 2010, as Google was trading at $450 a share and I wrote:

In the three months after that, Google ran from $450 to $620 a share. The calls I’d suggested looking at, those Google calls with a $500 strike price were up 600% by the time the year ended. Now let me be clear in reminding you that had Google not gone up at least 10% after you bought those Google calls, you would have lost the entire capital you risked on them. At any rate, let’s look at the recent chart for Google and compare the set up to last August:

See how Google dropped from the mid $500s to the mid $400s back in the chart last year and how it has dropped from the low $600s to the low $500s in the more recent chart? History might rhyme, and a technical chart reader would tell you there’s some nice “higher highs” action being built into the set up here.

Finally and most importantly in regards to Google here is that over the next five to 10 years, the company will be displaying trillions of ads daily in front of hundreds of millions if not billions of Android/Chrome/GoogleNet users every month. The core search and content distribution businesses like YouTube will continue to grow for many years too. Google’s got big upside 10 years out that few analysts realize.

Stick with Google. I am, just as I have since I first bought and highlighted Google for readers at $90 the day it came public.