Google’s even worse than Facebook, Mother-in-Law investment strategies, Gold and much more

Here’s the transcript from yesterday’s Trading With Cody livestream Q&A. You can also watch a replay of it on YouTube or on The IAm Cody Willard App. But first, let’s talk stocks this morning…

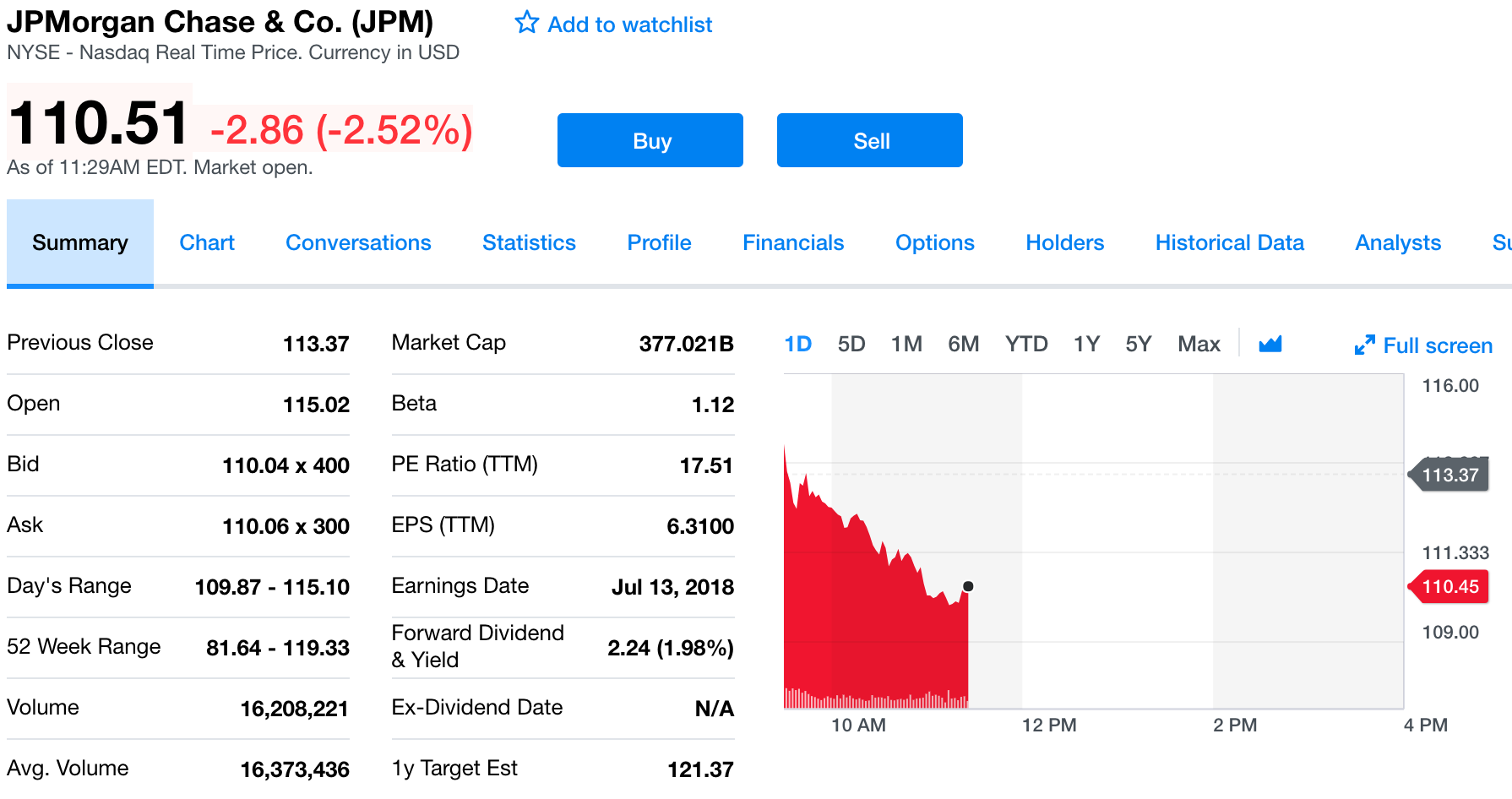

Well, remember yesterday and for the last week, I’ve been saying that even if earnings reports as really strong, that the bar has been set so high that it’s most likely stocks will sell off no matter what they report, when they report their earnings this season. Well, voila, the banks reported very strong earnings this morning with almost all of them “better than expected on the top and bottom lines.” The bank stocks were bid up early but have sold off hard as the first hour of the trading day has worn on. JP Morgan, for example, has sold off nearly 5% from where it opened up this morning just an hour ago.

That’s exactly the kind of action I’ve been warning us about as everybody expected strong earnings reports to bail out this stock market near-term. The market does its best to make fools out of the most number of participants as it can, most of the time. Careful out there. And on that note, check out the transcript from yesterday’s Trading With Cody livestream Q&A.

Cody: Twitter, YouTube, Facebook, it’s all the same, right? The internet. Actually, I might start with that topic today. It is all in the news because Data from Star Trek was testifying in front of … Wait, not Data. Zuckerberg from Facebook was testifying about data, not the character, but your data to Congress and the Senate and a bunch of show boaters.

The first day that Zuckerberg was in there wass better than the second day but whatever. It’s just revealed how stupid our the elected Republican, Democrat regime officials are and the broader that I’m wanting to make though, let’s talk about this and what I’m thinking about here is … I’ve talked before how Facebook and Google have quite literally built their entire business models around things that are annoying to you, serving up ads. You don’t want ads in your life but their entire business is built around that. They’ve taken that concept to a somewhat terrifying level where it’s not just about serving you ads, it’s about monitoring everything about you, your interests, your locations, your search, what sites you visit and gathering all that information to sell, just leave it, it’s fine, to sell you even better ads that you’re even more likely to engage with I guess.

From an existential perspective, are these companies and their models threatened? Yes, they are because … I guess it’s possible that we are already too entrenched Facebook and we’ve all got what’s called lock in and sunk costs into our Facebook lives. We’re locked in because we’ve sunk so much information, pictures, relationships, communications onto that platform. The same thing with Google. The amount of data that Google has on you because of Gmail, browsers, the Chrome browsers, cookies, the ads that are being served up on sites that you visit even if you’re not using a Chrome built by Google browser or Gmail and you don’t go to google.com, if Google is serving ads on that site, they’re still tracking you.

There’s an opportunity. There’s a trillion dollar opportunity to follow through on idea that I actually built a company 15 years ago with this concept and never developed it because I’m doing TV and running a hedge fund and things, but it’s truly a secure, private network, internet, riding on top of the internet. You don’t want your ISP knowing what you’re doing, you don’t want Google knowing what you’re doing, you don’t want Facebook knowing what you’re doing, unless you’re choosing to post that picture, and this is the one thing, I think, if I could just go back to that for a moment, that Zuckerberg’s commentary in front of the Republican Democrat regime elected officials underscored:

I agree There isn’t as assumption of privacy when you’re posting something on Facebook, but there is an assumption that everything you’re liking, and everything you’re looking at, and everything you’re clicking on, sometimes even not on Facebook, shouldn’t be tracked, shouldn’t be used against you, shouldn’t be sold to third parties who can do whatever they want to it and resell it.

The whole concept is blowing up in Facebook’s and Zuckerberg’s face, and to a lesser extent, for some reason, Google which is not being bashed like Facebook is even though Google’s much worse with your data tracking and usage in many ways. If you think Facebook data gathering and privacy invasion is bad, what Google is doing to you is worse, and there’s a potential for serious backlash here, and I’ve owned these stocks and made hundreds of percent, lots of gains over the years. I’ve owned Google since the day it became public, I owned Facebook since 20, since it was at 20 bucks, so it’s not like I’m some [lutite 00:05:58] who’s long bashed these companies and missed the revolution that we actually ended up profiting on, we nailed this. Looking at where we’ve ended up, it’s not a good thing. Google and Facebook don’t have a good business model, and we will need to somehow just … I don’t know. We need to be aware. We need to be aware that Google and Facebook … I’ve been saying this for a year or two now, that existentially, their business models are a threat. It’s probably not today’s business, but it seems to be getting closer doesn’t it?

My brain’s got them all confused, it’s all the same: YouTube, Facebook, Google, even Apple, Amazon. These are all nearly-trillion dollar companies.

Is Amazon tracking as much as they might be? Is there gonna be some cockroaches to come out on the, again I can’t keep the companies straight, on the Amazon data situation? Amazon’s got a lot of information on you. I don’t think they’re selling it to anybody, or even allowing anybody to get access to it, but there’s a lot of information on you. Apple, also, but Apple definitely is not in the business of advertising to you, and selling, and brokering, and profiting off of that data per se, specifically, but they’re all guilty. Ouch.

Alright. Okay. First Question.

Subscriber: Cody, thanks for taking my question. Do you think the Facebook fallout will significantly impact earnings going forward? My concern is that forward guidance will be dramatically cut and the stock will get hard and languish lower. It would be a sad thing to continue to hold it over the next five years and the stock price not keep up with the market, provided the bull market continues. Thanks again, cheers.

Cody: There’s actually several things I want to point out there. Number one, that is a huge assumption that after eight years of this beautiful, bubble-blowing bull market, not necessarily beautiful, I take that part back, but this bubble-blowing bull market that we have profited tremendously on cause we set up for it, is going to continue another five years. Number two, sometimes you’re going to own great stocks for 2 or 3, maybe 5 years, that’s a long time, that will underperform in the market for a few years. If you’ve owned Apple since March 2003 when it was at a dollar per shares, I have, you know that there have been 2 or 3 years at a time when it’s underperformed the market. It didn’t go straight up from a dollar to a 170, so that might happen even if earnings aren’t dramatically cut. Then, let’s get to the first part of the question about, yeah, I think it is possible that Facebook has some fallout, some of this Facebook backlash impacts earnings. At least near term, month of two.

Unless you and I, you … I’m live streaming stuff on YouTube right now, I wondered why I didn’t stream it on Facebook today. Are we gonna stop using Facebook? Honestly, Piper. What are the odds that in the next month, you just absolutely delete your Facebook account?

Piper: Not quite zero.

Cody: Okay. Not quite zero, but as mad as you and I are, and we’re two of the most aware, angry, rebellious — we are the backlash against Facebook, but you and I are still like, “Well, my buddy’s on there, I’m running a business, I’ve gotta promote it.”

Piper: I would start with nonparticipation before I’d delete it.

Cody: Nonparticipation is really, still participation. It’s like the Rush song, Neil Peart, right? “He who refuses to decide, still has made a choice.” Is that the line?

Piper: It’s close.

Cody: Neil Peart, drummer. Oh, I should have the drumsticks out, Piper. Got the guitar in the back. Look, we got light-up-able drumsticks. I didn’t know I was gonna take a truck Neil Peart reference here. Alright, rock and roll, right? So the answer to that questions is, there’s risk man. You know I sold some of my Facebook along the way here, I sold some most recently at about 190, I believe, right before this fallout thing happened, and I’m not in any rush to buy more Facebook back, still have a lot of it.

My mother-in-law put 3,000 dollars into a stock account five years ago, maybe six years ago right before I got married to her daughter, and she put almost all of it into Facebook because, at the time, I was loading up on Facebook, it was in its twenties, and along the way, she sold a little bit of Facebook at 100 and bought some Weight Watchers at 18, so now it’s 65. She bought some Apple at my recommendation, about 140, went to 175. She bought some Netflix on her own choice, I think she made 20% on that, bought some Twitter at 48, not my selection, she’s lost money on that one. Her stock account, hope she doesn’t mind, I know she doesn’t mind me telling cause I told her I was gonna talk about this to my subscribers, went from 3,000 dollars to 18,000 dollars in five and a half, six years, mostly because of her Facebook account. She owns some amazon too, I got her in that one at 500 or something, so now she’s tripled her money on that one. She ended up with 18,000 dollars in her account.

She came to me the other night and she said, “Cody, my stock account was fun. I started with 3,000 dollars in it, but it’s really sort of real money now. I don’t want to lose my 18,000 dollars.” At that moment, it had already dropped to 15,700 dollars. She was like, “I don’t want to lose all of it, should I sell?” I said, “You should sell half. You are exactly right, mother-in-law. You took 3,000 dollars and turned it into something” … Oh this one works … “Somewhat meaningful, but what’s the point of investing. Sell half.”

Now she still has 6,000 dollars worth of Facebook, which is twice as much money as she even put in her stock account. Now she has 7,000 dollars in cash, so what’s the point? I’ve been selling, I’ve been trimming for a year, a year and a half, two years, three years. People who are Trading with Cody subscribers or followed me seven years ago, I was telling everyone, “You should be aggressive and load up on anything in the app revolution.” I’m not know. I’m not loading up on stuff. I will probably start buying some Crypto Currencies after this crash plays out, but even that I’m not gonna be wild and aggressive. Stocks have gone, the dow has gone from 6500 to 25000 in the last ten years. Unless you sold everything at the bottom, you’ve probably benefited from that. Well, trim a little. Maybe not have, as was the case of my mother-in-law’s situation, but sell 10%, sell 20%, sell 30%. Raise cash when you can, not when you have to, as the great Jim Cramer has always said to me.

Subscriber: Are these bots, are those bots accounts with Twitter a real problem we should worry about?

Cody: Now we’ve owned Twitter since about 12 or 14 bucks, we had some nice gains, we sold some recently even, I think when it was near 34, 35 bucks, but we still own some. The bots are these things that, at least in the last election, were the Russian government, whoever, whatever, the Russian people, were doing the stuff; they were out there trying to inflame tensions, and racial tensions, and conservatives versus liberals and republicans, democrat, and all that stuff that you’ve read about a million times. Those bots retweeting, and retweeting the retweets, and trying to make those stuff in people’s eyes.

I don’t think it’s really a problem, longterm, for Twitter. I think those bots, and the concept of bots, are playing themselves out. I don’t see the bots on Twitter, and I don’t know if it’s the same thing, it’s not really a bot, but I do see, at least three of four times a week, I am invited to friend someone of Facebook that’s clearly a fake accounts because they’re none of my friends, I’ve never heard of the girl’s name, and it’s some girl in a bikini wanting me to friend her and go look at her page. I don’t know what the scam is those people are wanting to do, whether at some point then they send me a messenger note that says, “Hey.”

Actually, it probably is. I was told recently of a story here on Facebook where a preacher’s wife that I was visiting with, probably 60 years old, asked me if I had heard of this program that a friend of her had just let her know about that the government was giving out grants for two hundred thousand dollars that would never need to be paid back, and her friend sent her a Facebook note that said he was spending all his time on the internet, trying to figure out how to invest this two hundred dollars the government had given him and she should click on this link. So maybe that’s what that bikini girl fake account that I get invited to friends three or four times a week is all about. I don’t know, but that’s fake. I don’t know about Twitter, I don’t follow any fake Twitter accounts, so I don’t see any Twitter stuff.

Subscriber: Cody, in our 401k accounts, where we are limited with investment options, how do we get defensive? Should we move money to the money market accounts or the bond funds that are available in our 401k accounts? I believe that I do not have an option to move into cash inside of the 401k account. Thank you, Cody.

Cody: The answer to that question is: Yeah. In your 401k, and some of those IRA’s and stuff, you don’t have the option to just truly go to cash. Money markets are the next best thing. As you saw in 2008, at the height of the crisis, really at the beginning of the crisis, money markets broke also. So money markets are not as good as cash, it’s why they’re paying you a slight interest because there’s a risk you’re taking with that, but it’s as close as you can get to cash, and if you are trying to get more defensive, as I’ve done before these recent crashes, since then I’ve sold some of those puts, but if you’re trying to be defensive, and just in the grand scheme of things, I think it’s probably wise.

We have had so many gains and such a run from the bottoms that a lot of my trading with Cody subscribers and I have been getting more defensive, raising more cash, and in your case, that would mean basically just moving it to a money market account.

A bond fund, no, that’s not the same thing. Being defensive equate entirely to buying bonds. If someone is giving you interest, it’s because you’re taking a risk with your money, so whether you’re lending the US government interest, which is a very low risk, because they can go and print more dollars, and make sure they can pay their interest rates, there’s obviously economic repercussions in just printing dollars to pay interest rates, but if someone’s paying you interest, even the government, you’re taking a risk with your money. So buying bonds is not the same as going into cash; bonds can sell off, interest rates can go higher, so you would lose capital in that case, so be careful with bonds.

Subscriber: Cody, what is the Trading with Cody stock for the rest of 2018 that you will say to yourself, “Dang it! I wish I woulda bought more when I had the chance”?

Cody: I think Verizon. IMaybe Intel too, both of those two of my favorite stocks right now, been buying some of those, my two recent buys, well Intel, six months ago maybe. I like them both, they’re good dividend, I think there’s good potential upside to the stocks themselves, and I am kicking myself for not having bought Verizon the last two or three times that it dipped down to 45 or 46 dollars per share, I think I paid 49. I’d like an opportunity to buy it a little bit cheaper, and I’m kicking myself for not having bought it a little bit lower because Verizon, if you look at the beta on Verizon, beta meaning, relative to the market, how much does it move, Verizon doesn’t move a lot compared to the markets. It’s actually, I would guess, less than one beta.

Subscriber: Cody, what sectors might you be considering as possible shorting opportunities in 2018?

Cody: I mentioned yesterday at Trading with Cody subscribers, that I am doing homework actively at trying to find out a few new names to short, bet against, that I think might be headed lower. A good example was when I wrote a book several years ago, and talked about shorting Fossil because smartwatches were going to displace demand, and one that I talked about, didn’t do, well I didn’t do the Fossil one either, for that matter, but I was kicking myself for this one: When Uber and Lift started taking over the world five years ago, you should have shorted, we should have shorted the rental car companies. They all got crushed, and they’ve come back a little bit since then, but they were down 80, 90 percent over 3, 4, 5 year span. Those are the kind of opportunities that we’re trying to look for here.

I don’t know yet. Driverless cars are clearly going to displace drivable cars in the next five years. Suppliers to drivable cars and one of the things that I’ve talked about, and one of the things that I should probably go ahead and start shorting, betting against some of the companies, the worst ones in the sector at least. It’s not just good enough to go against the sector that’s in declining, you want to find the worst companies, the worst positioned, the most tight-fold management in those sectors. So car insurance … Yes the driverless cars with require insurance, but the number of customers, because millions of people won’t be buying their own cars anymore, it will be a fleet of driverless cars that will take a lot of people around. Number one, you’ll have less people to ensure, and number two, driverless cars will be much safer than drivable cars, five years from now. So the cost and returns of selling insurance to driverless car entities will be a fraction of what it is today selling drivable insurance to millions of Americans who are forced, by the Republican Democrat regime to buy said insurance.

I think the car insurance companies might have lobbied for years to get it mandated in all 50 states that you had to have insurance. Now, don’t get me wrong, it’s actually a societal benefit in many ways to force people to have insurance because you’re out there taking risks to other people’s lives and property when you’re driving a vehicle, choosing to be on public roads. I’m talking to Piper, that’s why I’m not looking at the phone camera thing there.

Piper: They lobbied for sure.

Cody: They lobbied for it. Might be one of the very few corporate lobbyist laws that was passed that isn’t entirely sucky.

Subscriber: Cody, what is your take of TSM? Is there going to be a trend that companies design their own hardware and have it fabbed in Taiwan by Taiwan semiconductor, TSM, for example?

Cody: That’s not going to be a trend, isn’t that been a trend? Again, ten years ago, I guess it’s been eight years ago, I wrote book called “Fifty Stocks for the App Revolution”, and TSM was one of them, and I talked about how, yes, people will outsource fabrication of hardware and that’s not going to change. I don’t like investing in overseas companies per se, I don’t know … Do you know who the rulers, the ruling regime, elected or not in Taiwan is? No? Then don’t buy stock in Taiwan. It’s hard enough to buy stocks in America where you know who your government is and what they’re up to a little bit. Anyways, it’s not like I don’t ever buy a company that’s overseas, I mean, Sony.

Subscriber: Any thoughts on gold, GLD, right now?

Cody: He said gold, GLD, in the question, but that’s two very different things. Gold is a physical asset, and I tell everyone, “You should own a couple of gold coins somewhere that you can physically get to.” So if there’s ever a solar flare, the internet goes down, Russia hacks the electrical grid, who knows what, but there’s a chance you could have a few days or a few weeks without electricity and the internet, so you wanna have some gold on hand somewhere, and you wanna have some cash on hand.

GLD is a promise from a bunch of brokers that if you buy the GLD that they have gold, they promise you it’s represented physically somewhere, and the GLD is as good as gold, but no way, do not believe this to be the case. If you remember anything from the 2008 financial crisis, what the brokers say they’re going to do, and what they will do in times of crisis is two very different things. Why do you want to own gold? Partly for times of crisis. I do think there are times to trade the GLD, and I have done so, both long and short, but just a few weeks ago, back in January, December, everybody was in the Bitcoin, Crypto Currency manias. Bitcoin was going from 15000 to 20000, and gold got crushed, and I wrote at the time that might be a good time to trade gold. If you were ever going to trade gold and buy the GLD, you would do that at that moment. In some, I think gold is a great investment longterm with a little bit of your capital, the GLD I do not think is a great longterm investment, but you can trade the GLD sometimes, and I personally would not be trading the GLD at this particular moment.

Don’t know why I missed that question. It is showing. Alright, anything else? See if the chat room … Nope. Alright, guys, that was all the answers as best as I can make them up. Now’s when I shoulda had the guitar out, Piper. I was gonna use this for a prop at some point and be like, “Uy, Trump really put the fire out with those tariffs. Fire extinguisher Trump”. I don’t know, not that funny. That wasn’t even in the camera the whole time, either. Someone did just ask another question on there and I missed it, darn it. How do you do that? Got nothing. Ask that question again, Bart. He popped up, but I am YouTube chatting incompetent. Now I don’t know how to get rid of what I just pushed. There it goes.

Alright. I’m not gonna bore the people who are hoping to hear something insightful at this moment any longer. I’ve given you all the insights I’ve got, at least for now. I’ll come up with some more tonight.

Thanks guys.