2007 vs 2019: What’s changed, what’s the same, and what’s next?

I found a batch of old emails last week and stumbled across an article I’d written for The Street a dozen years ago, back in August 2007. My economic and market analysis from the time made me think a lot about these days and the current market set-up. I covered a lot of topics that are still very relevant to traders, investors (and voters) today, so I’ll add modern day commentary to give us some new context.

How I’m Trading This Setup

By Cody Willard

RealMoney.com Contributor

8/17/2007 3:31 PM EDT

Another week, another wild up-and-down roller coaster of dislocating markets. Heck, things have been so volatile you could substitute “hour” or “day” for “week” in that sentence and it’d still make sense. On Thursday, the market dislocated to both the upside and the downside — several times!

(2019 commentary: I could have written that paragraph to explain the market action from this past week — after the Fed spike, sell-off, big rally, big sell-off action.)

Here’s what I’ll be thinking over this hot and humid weekend:

(2019: It’s not humid or hot here in Ruidoso NM this March weekend with my wife and two daughters. I was single, living full-time in NYC back in August 2007 and about to become a TV news anchor. A virtual lifetime or two ago.)

* I want to address the primary question that remains first: How to trade this setup? I remain convinced that the real estate bubble popping and all the still wildly mis-over-priced assets and derivatives related to that mess are going to create a lot more market pain.

(2019: In 2007, at the same time I had been selling stocks and preparing for a real-estate induced market crash, Ben Bernanke’s Federal Reserve was still saying that the real estate market wasn’t a bubble about to burst and that real estate derivatives weren’t a threat to the broader economy. You have to remember that the stock markets were at all-time highs in August 2007, and I’d been riding what I used to call a “Steady Betty Bull Market” for five years at that point (as opposed to the “Bubble-Blowing Bull Market” that I’ve been calling this market for the last eight years). It’s worth noting that, just a month later the markets put in their long-term top when, as the NY Times explained at the time: Fed Cuts Rate Half Point, and Markets Soar September 19, 2007. It’s another example of why I often tell you guys that if and when the Fed does actually start cutting rates again at some point, that I expect the markets would soar for a few days but that I’d probably be looking to sell and increase my shorts when that happens. Everybody who “didn’t fight the Fed” back September 2007 soon saw their stock portfolios and mutual funds pull back 50-70% while they “weren’t fighting the Fed”. You always have to FLIP IT!!)

At which point, I still fully expect the Fed to give into the short-term political pressures from the Republicans and Democrats in power and the brokerages and banks that support them and get serious about formally pumping more liquidity into this economy with real rate cuts and other “helicopter” tricks.

(2019: The playbook for the TARP and other bank/corporate bailouts of 2008 and 2009 was pretty obvious in hindsight, but I did actually see it coming at the time. The pretend back-and-forth from Bush and Obama and the rest of our leaders in DC — doing one vote that got voted down only to bring it back with more pork and corporate welfare to get it passed, and then bringing additional bills and regulations written by the banks and corporations themselves and acting like they weren’t going to bailout the banks — was a silly sideshow for what was a fait accompli. Sounds a bit like Brexit though with much small numbers and less meaning to the world’s economy.)

And when we’re closer to that point, I’ll get more serious about buying more stock and long-dated calls for my echo techo bubble.

(2019: I find it interesting that I was looking about six steps ahead with this analysis — and while the analysis actually turned out to be correct the question is how to apply to to “What’s next?” Back in 2007, I was looking for a (point #1) real estate crash to (point #2) hurt the economy which would also (point #3) cause a stock market crash. I was then looking for (point #4) the government/Fed to bail out and then (point #5) create new tricks to pump free money into the economy. And perhaps most importantly, which takes us to where we are today (point #6) in another stock market bubble lead by technology. This old analysis is a large part of why I’ve been able to remain so overall bullish for the last eight years now. We do finally have some pretty high valuations and this Bubble-Blowing Bull Market that we’ve been riding this go around might finally exhaust itself out and turn down. Unlike in 2007 when I turned from outright bull/long to bear/extremely cautious, in 2019, I don’t see a catalyst like the real estate crash was back in 2007. That said, at some point in the next few months or years, for some reason or another, we are going to see the Fed cut rates again. And when they do, it will be because the stock market is down 10-15% — I suppose there might also be an economic catalyst such as a war or freezing of global trade or something like that. And while I hope to be able to foresee what might cause such a downturn/crisis, the fact is that there will likely be another crash of 30-50% after the Fed cuts rates next time. Not beforehand. Just like every other time the Fed’s started cutting rates in my lifetime. And then, at some point during that downturn/crash/crisis, when the panic is at its highest point, we’ll want to once again reposition for another Echo Techo Bubble, a Bubble-Blowing Bull Market lead by tech once again.)

I’m not sure how I’d trade this very near-term setup, but I do expect I’ll be shorting and/or reloading my puts if the market can run another few percent higher in the next few weeks. Otherwise, I’ll be patient. Been a heckuva year already, huh?!?

(2019: The market did rally another 2-3% after I wrote that and I did reload some puts. More importantly, I hit on the never-losing theme of patience.)

Other trades of late: I sold my Novellus puts for a big gain. I might reload at a lower strike price if the stock will rally close to $30 again soon. I bought more New York Times long-dated out-of-the-money calls. There’s a cheap premium on them and lots of leverage if this stock will work higher at all. That NYT trade’s been a dead loser for me so far, though.

(2019: Novellus bottomed at close to $10 as I recall, about a year later. I don’t recall buying those puts again, but I might have. I do recall losing a bunch of money on my NYT call options. Sort of silly that I could talk about “patience” in one paragraph and then about buying puts and calls in the next paragraph.)

* I truly hate my iPhone. All because the email functionality is so unreliable and slow and arcane and frustrating and … you get the point. I sure love the maps feature. I never use the YouTube feature. I can’t wait to get my Blackberry back and get back on Verizon. AT&T’s gotta get serious about upgrading its ridiculous network.

(2019: “Truly hate” the iPhone? Wow, that’s harsh man. But I do remember waiting for email to load on the first iPhone that was only available on AT&T and how painfully slow it was. I was running a hedge fund and balancing 80 hour work weeks with trying to have some fun too and I needed my emails instantly back then. Notice I called it a YouTube “feature” not a YouTube app. In 2007, there were no apps, not even an app store — the commercial for “There’s an app for that” certainly hadn’t aired yet. People hardly texted each other back then. Email was king. So forgive me for wanting my Verizon Blackberry back. Two things that haven’t changed — Verizon’s got by far the best network and AT&T’s network sucks.)

* I sold my Apple puts on Thursday and am looking to add to my long-held long again, perhaps with out-of-the-money, longer-dated calls. I still like but don’t own Verizon and AT&T, but that’s only for the next year or two as they continue to plow billions into broadcast technologies that will be completely undermined by Internet video technologies. Google — holding it steady and might add to my position again soon.

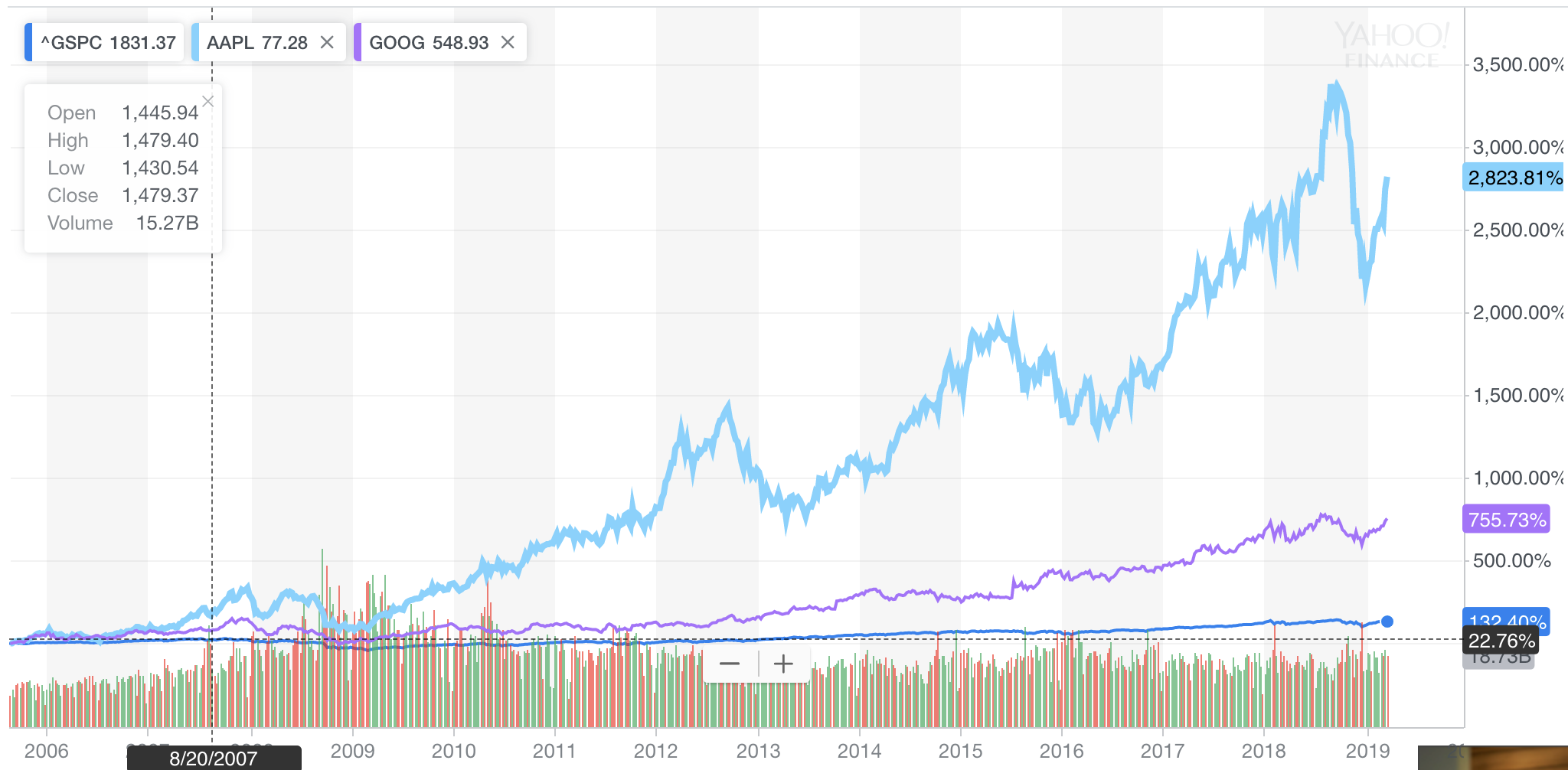

(2019: I guess back in August 2007, I had added some AAPL puts to hedge the AAPL common stock position that I’d held since 2002. I don’t remember the puts, but it was a great idea, even back right before the market crash in 2007, to hold onto core positions in the most Revolutionary companies in the world. I mean, AAPL and GOOG are each up more than 500% from the levels they were at on the day I wrote that in 2007. Apple’s up quite more over that time than Google but both are up much more than the S&P 500:

For what it’s worth, Apple and Google did crash a good 50%+ in 2008, but you could have just nibbled more the whole way down if you believed in your bullish analysis on them like I did. And in 2019, I still do believe in my analysis.)

* So the Fed and the other fallible bureaucrats around the world who control our global fiat currencies think they can fight the free-market forces that always rule in the long run with more wealth redistribution to the wealthy, speculative and misleading? When the Fed injects money into the system, it makes the value of the dollar decrease relative to every other asset out there. “Creating”

more dollars with no production behind those dollars simply makes people and companies spend more, and that can be good in the very short term. That’s why the Fed will cut — to help out the politicians in the short run.

But all of us who have saved and produced to create the dollars in our bank accounts are punished because the Fed is giving away free dollars to the banks, the brokers and the hedge funds of the world. If you know that the Fed gives away dollars every time Wall Street gets in trouble, then why wouldn’t you always just risk everything? That’s the moral hazard component that Alan Greenspan, the S&L crisis, Long Term Capital Management and now Bernanke are creating. If the government will always bail me out with taxpayer money, why wouldn’t I always borrow and go for as much gain as I possibly could? Unlimited upside, and protected downside — the American Dream? I don’t think so. Let the gamblers, liars and speculators who risked too much lose their shirts. Another cut and the Fed will simply create another tech bubble to replace the real estate bubble they created to replace the last tech bubble they created when they started freely cutting rates to protect the system in 1998 from LTCM and right before the Y2K disaster that didn’t come. Leave the system alone, because chasing short-term performance always hurts in the long run.

(2019: Nothing’s changed in that analysis in 12 years. Hopefully at some point in my lifetime, people will step up and stop bailouts and repeal the Republican Democrat Regime’s corporatist/bankist monopoly on our political and financial system. Speaking of which, Bitcoin and cryptocurrencies didn’t even exist back in 2007. But they do now and they will help people avoid getting screwed by fiat currencies and financial monopolies in future decades. Which is why I’m about to start buying some bitcoin and crytpos again. And by the way, I am going to print this out and paste it on my main computer screen: “Chasing short-term performance always hurts in the long run.”)

At the time of publication, the firm in which Willard is a partner was net long New York Times, Apple and Google, although positions can change at any time and without notice.

(2019: Can you tell I still have the same attorneys today that I had back in 2007? See the 2019 disclosure below.)

Disclosure: At the time of publication, the firm in which Willard is a partner and/or Mr. Willard had positions in some of the stocks mentioned above although positions can change at any time and without notice.