4 near-term catalysts for the next stock market crash redux PLUS Trade Alert: Selling my smallest position

Millions of innocent people who just want to work and contribute to a global community who live in Russia and the Ukraine and all over the world who are suffering as a result of all these currency wars, so let’s remember them as we analyze this stuff. Most scenarios in a currency war end game with the US Dollar on the winning side vs the other sovereign fiat currencies, as has been the case for the last few decades. But war, including currency war, sucks and war is not prosperous and war destroys value and hurts innocent people around the world.

And currency wars, crashing energy prices and other economic dislocations have real ramifications for our own markets and economy. A few months ago in 4 near-term catalysts for the next stock market crash, I wrote:

What would cause the next crash and when? Near-term potential catalysts for a new stock market crash would include:

- A drop in oil to the $50s or lower – Just another $20 drop in oil would cause tremendous pain in the entire energy sector and would quickly spread to the financial sector levered to higher prices.

- A spike in gold to $2,000 an ounce – A spike in gold prices would cause major pain for the Treasury, Fed and too-big-to-fail banks who have a lot bet on gold not spiking anytime soon.

- Food prices and inflation take off – Deflation is a silly concept when applied to food and clothes for the vast majority of Americans. Beef, chicken, vegetable, candy, coffee prices, and so on, are all up big at the grocery store.

- Currency wars – Currency wars create dislocations and unsustainable cycles that then catalyze real crashes in markets and economies.

Of the four bullet points, we’ve already seen #1 and #4 play out to a T.

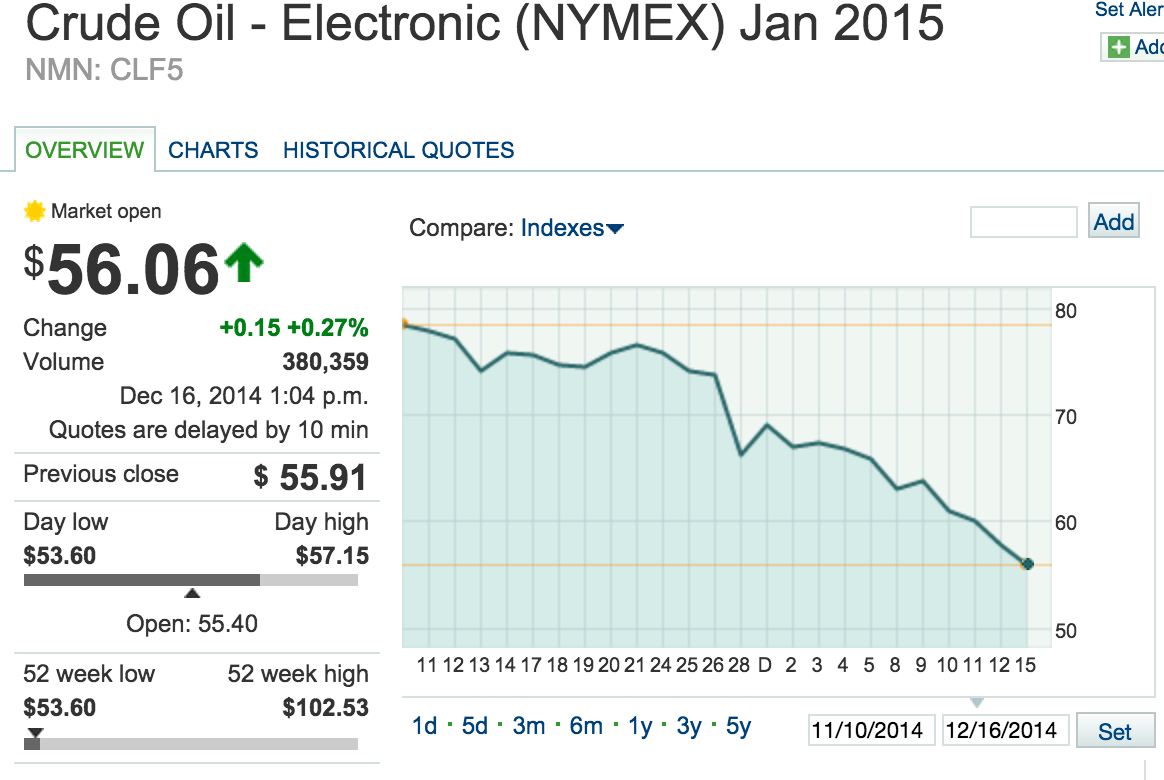

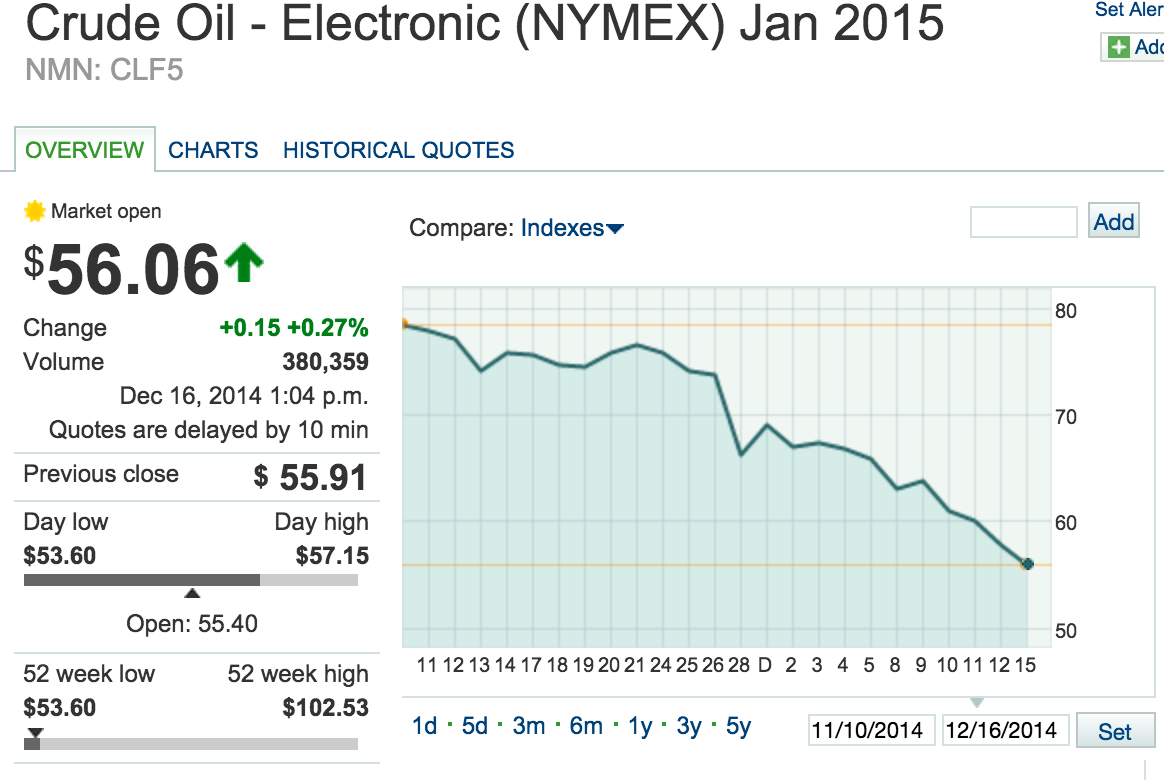

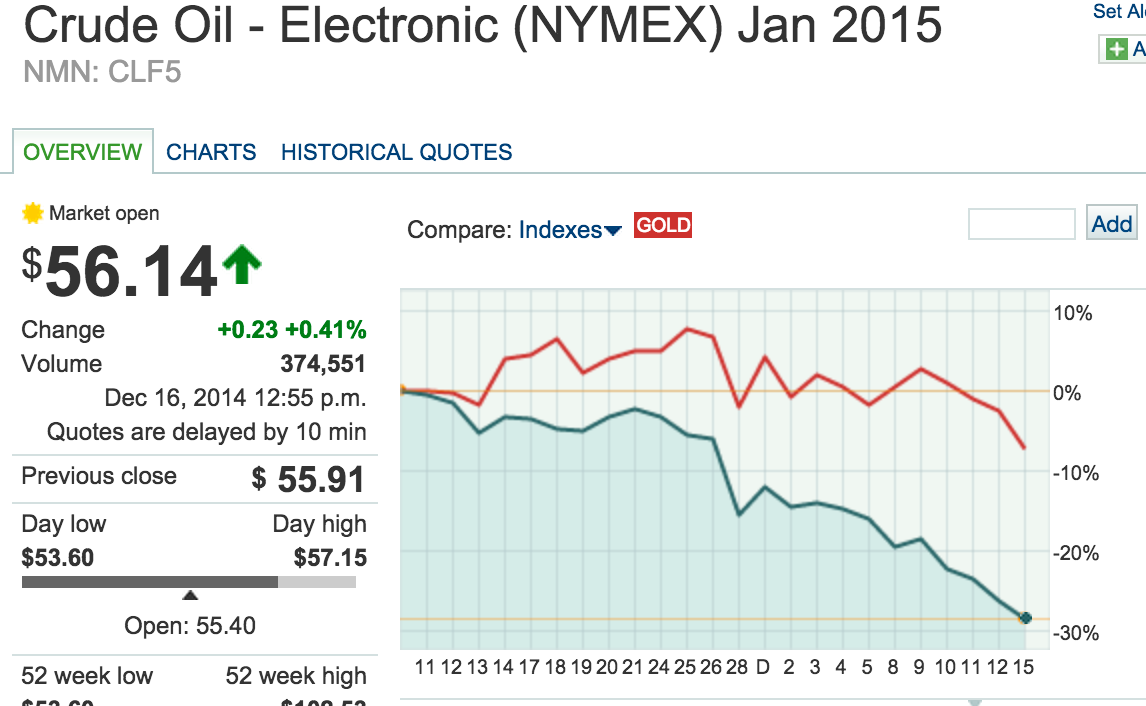

Oil has crashed into the $50s.

Russia’s and Ukraine’s currency has collapsed and so Russian stock markets and Russian stocks like Yandex have crashed. Currency wars, as I’ve been saying for a year now, are in full effect and currently having the kind of market dislocating, pain causing, prosperity destroying outcomes that they always do.

Gold has been hanging tough during the last six weeks despite/because of oil during oil’s collapse. But $1200 per oz, gold is still far from $2000 per oz I’d mentioned in the article as a potential near-term catalyst for the next crash.

And prices at the grocery store and for rent and home necessities are still higher than ever and probably still climbing higher despite the drop in energy costs.

I have heard many argue that oil can’t go lower than $50 or so. Why not? Cycles happen, markets over correct, panic ensues, etc. And what did we read in Brian Gallo’s latest Premium Scuttle, Trade Like a Venture Capitalist: “The least expressed sentiment is the most likely outcome.”

I think, anecdotally, that broad awareness/mentality and today’s 3% tanking on top of yesterday’s 3% tanking in oil, just might mark a short-term bottom in oil’s collapse. I say $60 comes before $40. Longer-term, I still plan to wait til the first oil co’s go bankrupt before buying oil stocks.

I’ve been getting more cautious and cash heavy of late and while I’m not turning into an outright bear, seeing two of the four bullet points from my own playbook detailing 4 near-term catalysts for the next stock market crash has me wanting to remain a bit cautious and cash heavy. If I didn’t own Google as one of my largest positions, that’d probably be the one stock I’d look at starting to scale into.

Meanwhile, I think it’s time to go ahead and just remove Himax from the portfolio. I’ve owned it as a play on the future of Google Glass being a success in coming years but I’d rather just stick with Google itself as a bet on Google Glass success. We learned a lesson about owning early-stage suppliers when we got burned with Invensense, and I don’t want to take that kind of risk again right now.