Anti-Trade Alert: Make sure you’re not over-trading (and my latest positions)

It’s Friday! And we have about 8″ of snow already on the ground outside and more is falling as I type. I’m going with a buddy skiing at Ski Apache this afternoon, so this will likely be my final post of the week although I’ll have some more stuff for you this weekend too.

As for the markets, well, they’re up a bit this morning. Greece and the EU…whatever, you know. There’s some headlines about some latest developments with Greece’s eventual bankruptcy. Today’s headlines might have been good. Must have been good. The markets up a little bit this morning, right? What a waste of most traders’ and investors’ time these endless Greeece and EU headlines are. Remember when commercial real estate was the headline crisis du jour throughout 2008? Wasn’t a crashing commercial real estate market going to crash the markets (even though they had already just crashed and barely come back)? I guarantee there will be a new crisis du jour (or maybe we’ll still be doing the Greece/EU thing) this time next year and this time next year and every time you ever check, you can find a crisis that the media wants you to freak out about.

Same topic — Apple’s iPad/TV product announcements came and went this week. What a waste of time it would have been to try to game a sell-the-news reaction or otherwise game how this stock traded in the last few weeks? Holding it steady as our largest position worked out all right — the stock is right now back to touching its all-time highs. I still might trim some Apple soon, but not yet.

Once again, I’ll remind you of the importance of not-trading to successful traders over the long-term. Make sure to think about whether or not you’re over-trading your own account trying to catch too many fleeting moves.

Here’s more testimonial that we got last night on how important this topic really is from our subs:

Two of my friends bailed in late November as the market was tanking, and your level headed insight kept me in the market with some nice cash on the side to buy when it seemed right. My account is now nicely above its high off the “debt Ceiling “ crisis, back in June. So yeah, not trading and not selling in a panic over BS headlines probably made me more money than anything.

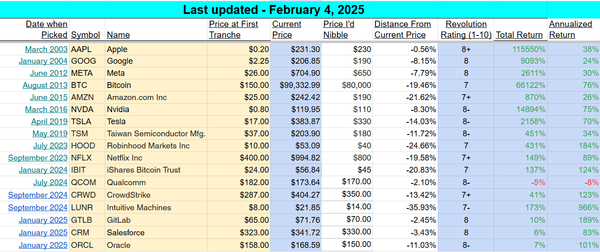

Let’s wrap up what I hope was a very profitable and educational week of trading here with a list of my latest positions in approximate order from largest to smallest. I give each stock a current rating from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment” (there will never be a 10 rating, because there is no such thing as a perfect investment, of course):

Longs –

- Apple (9)

- Google (8)

- Fusion-IO (8)

- Seagate (7)

- Sandisk (9)

- Cisco (6)

- F5 (7)

- Amazon (7)

- Microsoft (6)

- Cypress (5)

- Nuance (5)

- Autodesk (6)

- Riverbed (7)

- DBA (6)

- VIX (4 as a net position, but since this is a hedge against our longs, I’d rate it a 8 as a hedge right now)

Shorts –

- Apollo (8)

- LPS (6)

- GLD (6)

- WDC (6)

- PNC (5)

- Live Nation (5)

- SLV (6)