Apple, Mark Twain, Dr. Evil and one trillion dollars

As promised, we’re going to do a Live Q&A Chat on a phone conference call.

Dial-in: #: 641-715-0700

Access Code: 709981.

You can also join us for today’s live Q&A in the Chat Room at 2:00 pm EST and post your question in there and I’ll answer it on the conference call and we’ll include it in the transcript. If you can’t attend live, email your questions to support@tradingwithcody.com and I’ll get them answered.

Now onto today’s report.

Number Two: Why not use your knowledge of the future to play the stock markets? We could make trillions.

Dr. Evil: Why make a trillion when we could make… billions?

Scott: A trillion’s more than a billion, numbnuts. – Austin Powers

As Dr. Evil, er, Mark Twain said, history doesn’t always repeat, but it does rhyme. And just like I did back in 2015 when Apple last got to $142 a share, I trimmed some of my Apple recently.

Here’s a flashback in a flashback, but take a look at this article I wrote in February 2015 to get some context from the last time Apple was here, which can then give us some contrast (and similarity) to today.

What happens when Apple gets to $1000 per share?

Published: Feb 24, 2015

Back in 2010, when Apple was trading for near $200 a share (the equivalent today to a 7-for-1 split adjusted $30), I wrote about my prediction that “Apple’s Going to $1000 by 2015. Here’s why.” Of course, I was mocked for making what was seemingly such an outrageous 300-400% move ahead for Apple stock over just a five year period, which meant that AAPL would need to make 50% annualized gains for my $1000 stock target to come to fruition. Taking my five year old $1000 price target for Apple and dividing it by seven to account for last year’s 7-for-1 stock split makes that a split-adjusted $142 price target.

Here’s one of my favorite mockeries of my 2010 prediction:

‘A more bullish, and more typical, point of view comes from Cody Willard, who predicts that Apple will trade for $1,000 a share by “2015 or so.” His argument is based on projections for “an installed customer base of 2 billion people using smart phones and the apps that run on them by the year 2020.”

That 2 billion figure seems quite high. It’s nearly one-third of the human race. If you eliminate children, the very old and the impoverished masses who don’t have fresh water or electricity, are there even 2 billion people left?

Even if there are, and even if every last one of them is destined to use a smart phone one day, Willard doesn’t seem to be taking into account the likelihood that phones and apps will generate far less revenue per unit than they do now. Gross overestimation of revenues helped create the tech bubble in the late 1990s, and reasoning like Willard’s may be inflating a bubble in Apple now.

I’ve been warning of the possibility that Apple’s stock is an accident waiting to happen. I’ve been wrong so far, although I’ve been closer to the mark in suggesting that Research in Motion (RIMM) offered lower-risk growth prospects. With a valuation that is barely more than half of Apple’s, Research in Motion still seems like the better, safer holding.’

Apple is up 350% since that guy wrote that article for CBS News and is right now at $130 per share, within 9% of my five year old target. RIMM changed its stock symbol to BBRY and is down nearly 90% since then. Apple, which as he pointed out at the time, was worth less than two Blackberry’s is worth more than 100 Blackberry’s now.

So what to do with Apple now that we’re basically at my $1000 price target?

The chart has gone parabolic (again). The stock pulled back 10% the last time it went parabolic like this into year end. Still cheap as all get out and I still own it like I have for a dozen years now, but parabolic stock charts aren’t bullish.

Cody back in real-time 2017 now.A lot has changed since I first predicted that Apple would hit $1000 per share but less so has changed since Apple first at $142 in February 2015 vs in March 2017.

Let’s remember that as we headed into 2015 Apple’s iPhone sales were expected to be huge and the stock rallied big into year-end 2014 and early 2015.

And today, analysts will point to how big expectations are for Apple’s 2017 iPhone sales as a reason to be bullish on the stock, even as the stock has rallied big into year-end 2016 and early 2017.

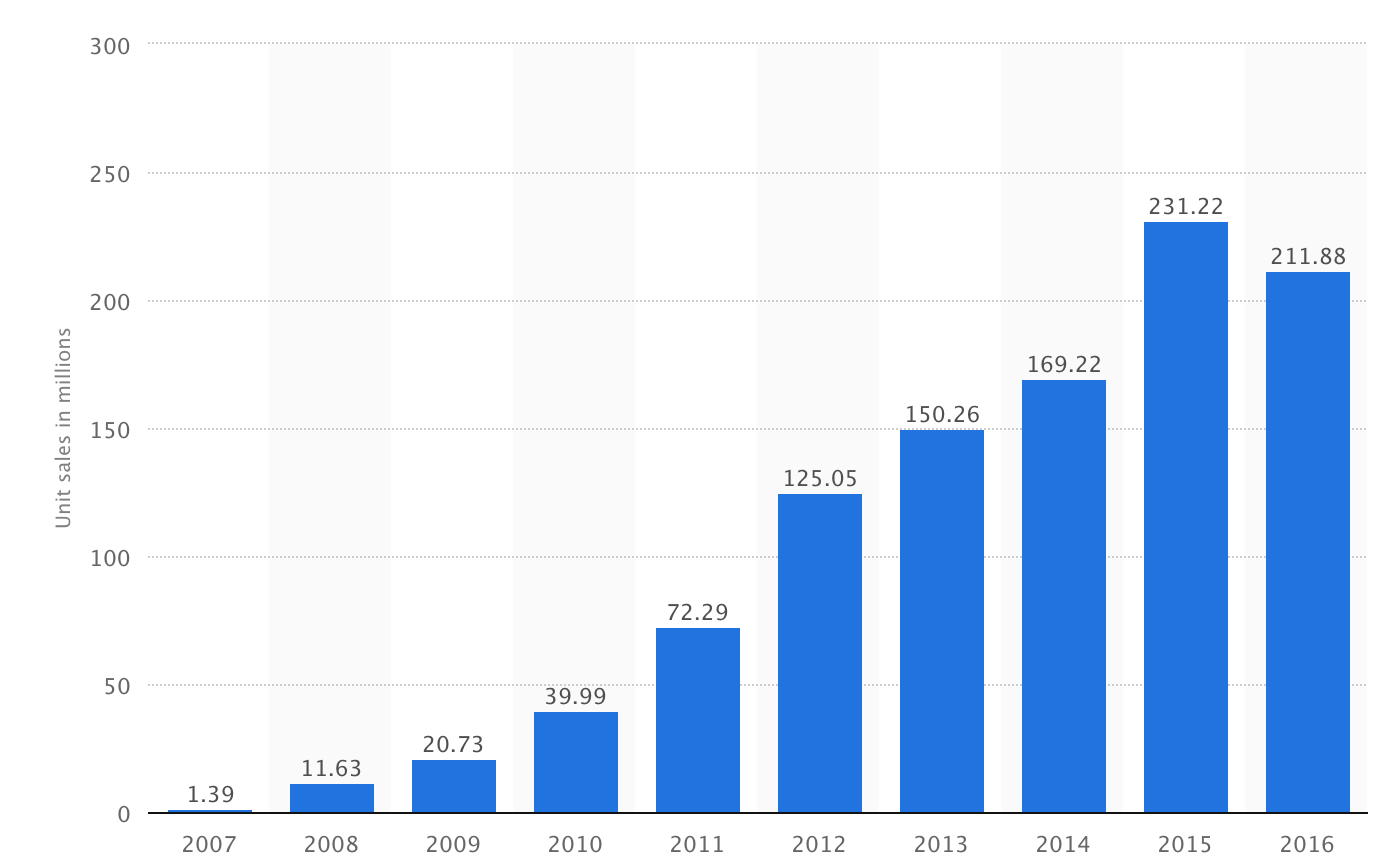

Does anybody ever go back and look at how Apple’s stock dropped 30% in 2015 even as iPhone sales blew past all expectations that year and hit 231 million units, up nearly 50% from 2014.

So I wouldn’t hang my hat on “strong iPhone 8 sales” to catalyze Apple higher this year. On the other hand, “Services” revenue is growing exponentially, as people use the App Revolution to consume content and goods ever more and a huge upside in services numbers in 2017 could actually propel the stock higher.

Did you know that Apple’s market cap is about 10% lower as it hits $142 in March 2017 vs when it hit $142 back in 2015? Did you know that Apple’s market cap is about 40% less than it expected it would be when I made my $1000 per share prediction back in 2010? As the LA Times explained about my prediction back in 2011:

“MarketWatch’s Cody Willard was about four months ahead of Altucher on the $1-trillion call. He predicted in September 2010 that Apple stock would reach $1,000 before 2015, which would get the company close to a $1-trillion market capitalization, assuming the outstanding share count continues to rise. Apple has about 917 million shares outstanding currently.”

Take that 917 million shares and multiply it by 7 (accounting for the 7-for-1 split in 2014) and the company would have 6.4 billion shares outstanding. But they’ve bought back more than a billion shares since 2010, making their share count about 5.2 billion, which at $142 a share, makes the market cap about $730 billion instead of the $1 trillion. Another note on the fact that Apple bought back 1.2 billion, or nearly 20% of their shares outstanding in the last six years. If they grow their share buybacks over the next ten years, the company could essentially take itself private and leave no shares in the public market.

Anyway, I trimmed some Apple again recently, but it’s still one of my largest positions and I do think it could be the very first trillion-dollar stock in the next year or two. It only needs to rally another 40% from here to become one.