Are We Gambling Or Investing? Staying Objective In A Frothy Market.

First off, let’s do this week’s chat Wednesday at 1:00 p.m. EDT in the TWC Chat Room, or just email us your question to support@tradingwithcody.com.

Image Source: MyPokerCoaching.com

“Stocks And Stud Poker.

Frankly, there is no way to separate investing from gambling into those neat categories that are meant to reassure us. There’s simply no Chinese wall, bundling board, or any other absolute division between safe and rash places to store money. It was in the late 1920s that common stocks finally reached the status of “prudent investments,” whereas previously they were dismissed as barroom wagers–and this was precisely the moment at which the overvalued market made buying stocks more wager than investment.

For two decades after the Crash, stocks were regarded as gambling by a majority of the population, and this impression wasn’t fully revised until the late 1960s when stocks once again were embraced as investments, but in an overvalued market that made most stocks very risky. Historically, stocks are embraced as investments or dismissed as gambles in routine and circular fashion, and usually at the wrong times. Stocks are most likely to be accepted as prudent at the moment they’re not.“

-Excerpted from One Up On Wall Street by Peter Lynch.

We certainly live in an era where the vast majority of the population view stocks as safe investments, rather than “barroom wagers,” like they did in the early 20th century. Remember when articles like this dominated the headlines in March:

Big tech definitely still feels like the “safe haven” trade, with the Nasdaq up about 30% year to date:

The Nasdaq is now only about 19% from its all-time high set back in November 2021 in perhaps the first- or second-biggest tech bubble of our lifetimes:

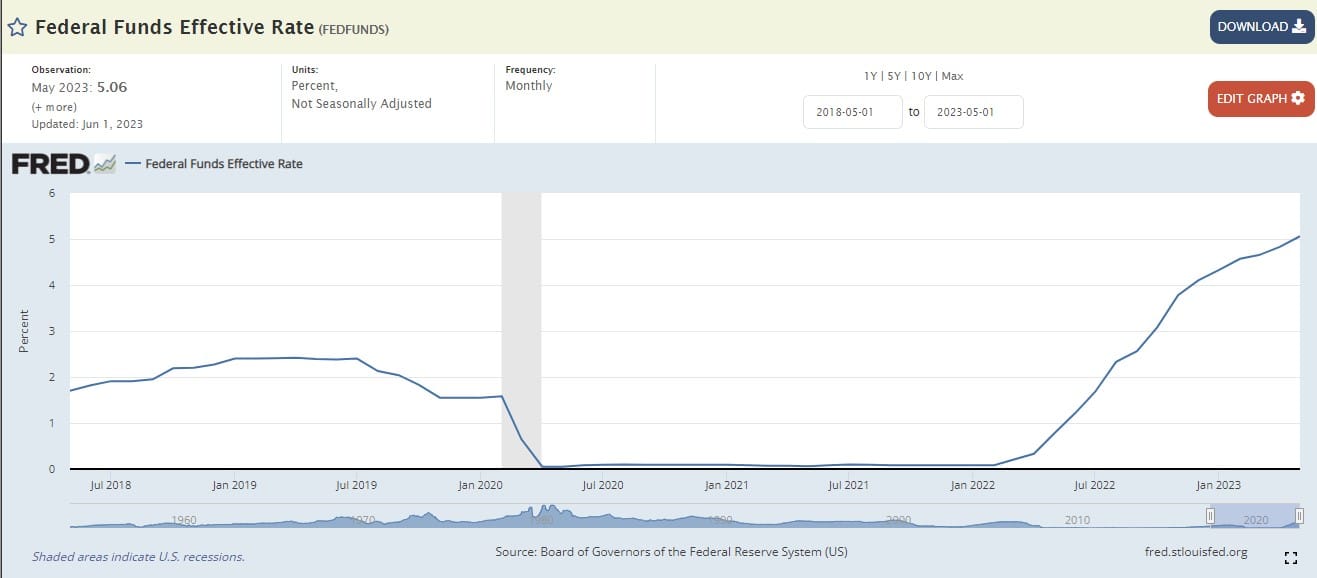

Meanwhile, the Fed Funds rate went from 0% to 5% in about 12 months:

Our framework for investing in any asset must always be viewed through the lenses of risk and reward. Going back to the Peter Lynch quote above, investing always involves a certain degree of risk, and no investment should ever be considered truly safe or truly prudent. It was only three months ago when we had a banking crisis in this country and many companies and individuals were at risk of losing significant amounts of uninsured cash from their checkings and savings accounts. Banks and other companies lost billions of dollars on “cash-equivalent” Treasuries and MBSs when interest rates went up last year. Any time you part with your hard-earned capital and hand it to another person/company to hold/manage/invest on your behalf, you are taking the risk that the capital will never be returned to you.

Is it not funny that today, uninsured bank deposits seem riskier to most investors than mega-cap tech stocks trading at 30x-300x earnings? Almost everyone (ourselves included, at least in our personal accounts) is content to sit on their AAPL (32 P/E), AMZN (298 P/E), MSFT (36 P/E), GOOG (27 P/E), META (35 P/E), and NVDA (225 P/E) in their brokerage accounts and ride them forever. There is very little perceived risk to any of these names at the moment. Even for us, it is so easy to believe in the continued bull case for mega-cap tech. We bought these stocks and sent out Trade Alerts (ex-MSFT) many years ago before they were loved by the mainstream (and when they were growing revenue much faster) because we understood the business models and how they could grow to become $1 trillion+ companies. Having been proven right, we hold an outright fondness for most of these stocks and it was not easy to sell them out of the hedge fund earlier this year.

But we cannot let ourselves become emotionally attached to any stock or investment. We must always be guided by fundamentals, conscious of the risks, and then trust our analysis. While we are not saying that big tech is going to crash, we just don’t like the risk/reward setup at these levels.

For comparison purposes, you can currently earn anywhere from 5.4% to 3.7% on Treasuries, depending on the maturity:

If you flip a company’s P/E ratio, you get the earnings yield. This is the return you would earn on a stock if the company paid out 100% of its present earnings to you in the form of dividends. So for example, the consensus 2023 EPS estimate for AAPL is $5.98. When you divide that by the current stock price of $186, you get 3.22%. A 3.22% yield even on the almighty AAPL is not very good when you could earn 5% on “risk-free” Treasuries. AMZN is another good example (although Amazon has always commanded a high multiple). The 2023 EPS estimate for AMZN is $1.58, giving us an earnings yield of 1.22%. In the range of possibilities, AMZN or AAPL could reasonably drop 20-30% from these levels, and in a real crash (see 2000 or 2008) could see 50%+ pullbacks. Unless the U.S. Government defaults on its debt or short-term interest rates go to 15% in the next year, you are not going to see the value of your Treasuries have equivalent pullbacks.

Obviously, both AAPL and AMZN have the potential to grow their earnings over time, so your earnings yield can potentially increase, whereas you are locked into the yield of the Treasuries at the point you buy them. However, AAPL needs to grow its earnings 55% and AMZN needs to grow its earnings over 400% to provide the equivalent yield (~5%) that you could secure on Treasuries at the moment! That is a lot of future growth to bank on.

That said, AMZN can and likely will be earning $6-$7/share in the next four, five, or six years. AAPL could be earning $10/share in that timeframe. But there is also a reasonable chance that those companies don’t earn as much. That is a risk you are taking when you buy the stocks at these levels. To be clear, most of these companies need to continue to grow earnings and revenue substantially in order to justify the present valuations given what you could earn on much-safer investments like Treasuries. If earnings stay where they are, big tech is wildly overpriced.

We say all of this not to scare you out of owning big-tech names. Again, these are some of the greatest and most revolutionary companies on the planet, with amazing products/services, and we still own these stocks in our personal accounts. But that doesn’t mean we shouldn’t be objective and adjust our holdings in these companies when they give us the opportunity to do so. There are many other names in the portfolio that are growing faster and priced at more attractive valuations than big tech at the moment.

We are also not trying to predict a recession or a market crash, but we are trying to view stocks through an objective lens (by properly considering the risk/reward tradeoff). Thus, we have trimmed and/or sold some of the longs that we view as probably overpriced (as noted in the Trade Alerts from two weeks ago), and added to other names that present more compelling upside. Most of those stocks that we trimmed (PL, RKLB, TSLA, and WOLF) have come down a decent amount since then, and many of the shorts worked well too (BE, BLDP, BLNK, REMX, QQQ, SPY). Even if we are entirely objective in our analysis and stock picking, we are still “gambling,” (as Peter Lynch points out) to some extent and must be prepared to lose money on some of our investments. But if we do our job correctly, “an investment is simply a gamble in which you’ve managed to tilt the odds in your favor,” as Lynch said.

Today, we are mainly holding tight after we rolled down some puts late last week following some pullbacks in a handful of our shorts. We are also working on a few more long ideas and may have some new names for you all in the next few weeks.

We’ll do this week’s chat Wednesday at 1:00 p.m. EDT in the TWC Chat Room, or just email us your question to support@tradingwithcody.com.