Autodesk, The AI Software That Will Build Everything.

Key Metrics

| Market Cap, curr | $43.2 bb |

| Share Price (11/28/2023) | $203.53 |

| Headcount | 13,700 |

| Total Revenue (ttm) | $5.3 bb |

| Gross Margin | 90.55% |

| Operating Margin | 20.39% |

| Net Cash (Debt) | ($404 mm) |

| Price/Sales (ttm) | 8.15 |

| Forward Price/Earnings | 27 |

| 2024 Consensus Revenue Growth Estimate | 9.00% |

| 2025 Consensus Revenue Growth Estimate | 9.80% |

Synopsis

With its unique Revolutionary ecosystem enabling everything from building design & construction to 3D gaming development, Autodesk is one of the best-positioned software companies for the AI Revolution. With Autodesk’s AI, not only can computers now start designing our buildings, but soon they might even start complaining about the long hours! Ha!

Autodesk, the 50-year-old maker of engineering software AutoCAD, has at least four major secular tailwinds that will propel it mid- to high- double-digit revenue growth for years to come, including (1) the AI Revolution, (2) the Reshoring/Automation/Robotics Revolutions, (3) the Gaming/Streaming Revolutions; and (4) the AR/VR Revolutions. Importantly, this is a stock that is on very few investor radars at the moment and is rarely, if ever, talked about in the mainstream financial media. Autodesk commands the highest gross margins (90%+) in the universe of software companies we follow, has significant growth on the horizon, and trades at a reasonable valuation (current forward P/E is 27 and our 5-year price/profit estimate is 8.4x ). Accordingly, we see Autodesk as one of the most compelling buys in tech right now.

Background

Founded in 1982, Autodesk was started by a group of twelve programmers who in the same year released their flagship product AutoCAD. AutoCAD (CAD is short for computer-aided design) is used by engineers and architects to design buildings, bridges, roads, and pipelines. It is also used in manufacturing to design cars, computers, furniture, tools, and almost everything else that is built using modern manufacturing methods. In 1999, the company started its media and entertainment business which sells software that helps video game designers and movie producers create 3D graphics, animations, and other visual effects.

The current CEO is Andrew Anagnost who took the helm in February of 2017. Anagnost is an engineer by trade and received his master’s in engineering science and a Ph.D. in aeronautical engineering from Stanford. Anagnost joined Autodesk in 1997 and rose up through the ranks to eventually become SVP of Business Strategy & Marketing. As SVP, Anagnost led the company’s transition away from perpetual licensing to a software-as-a-service (SaaS) model utilizing cloud computing.

Today, over 100 million people and businesses use various Autodesk software products to create, design, and build much of what we see and interact with in the physical world (plus games and movies too!).

Business Model

Autodesk operates through three primary business segments: (1) Architecture, Engineering and Construction (AEC); (2) Manufacturing (MFG); and (3) Media and Entertainment (M&E).

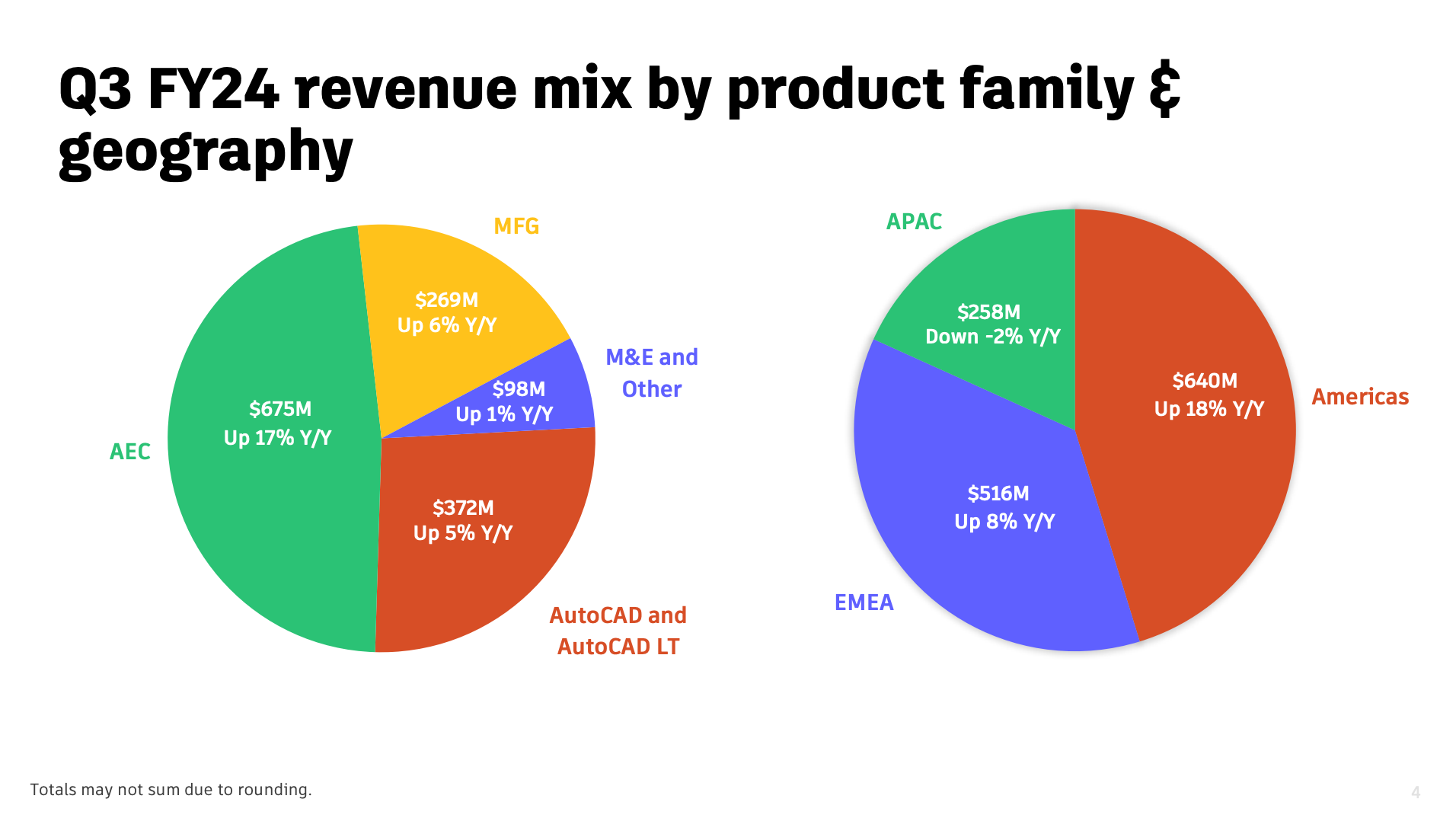

Of its three business lines, its AEC and AutoCAD businesses combined make up nearly 75% of its revenue:

Autodesk’s products are the industry standard in construction and manufacturing. For example, AutoCAD’s .dwg file format is universally used in the construction industry to store data for plans and drawings (similar to how Adobe’s .pdf is the standard file format for most documents). Autodesk’s strategy of giving its software to universities and students for free has further entrenched its status as the de facto standard industry software for designing things.

The defensibility of Autodesk’s position as the industry standard for design software is high. Because most engineers learned to design things on Autodesk software in school, they continue to use it once they enter the workforce. Many, if not most designers have never used CAD software from another vendor, thus resulting in high switching costs if firms decide to use an Autodesk competitor. Furthermore, Autodesk now is more than just a single application, it is an ecosystem for managing all forms of data related to the design and production of goods and projects. In construction, the company’s platform is used to manage the entire lifecycle of a building from design to construction to ownership. All parties involved from engineers to contractors to owners use the Autodesk platform to share and manage data so everyone in the project is on the same page. As more contractors, engineers, owners, suppliers, subcontractors, etc. use Autodesk’s platform, the more valuable it becomes, thus creating substantial network effects.

With substantial network effects in play, high switching costs, and very little competition, it is no surprise that Autodesk has been able to maintain 90%+ gross margins despite its core product now being over 50 years old. This is also thanks to the company’s switch to a cloud-based, recurring revenue model similar to most other software companies. The company has very little churn and consistently keeps net revenue retention around 100%-110%, meaning most of its customers never leave.

Growth Outlook

We see four key secular growth trends that will propel Autodesk’s revenue growth given its unique positioning for each of these Revolutions: (1) the AI Revolution, (2) the Reshoring Revolution, (3) the Robotics Revolution, and (4) the Gaming Revolution.

- The AI Revolution

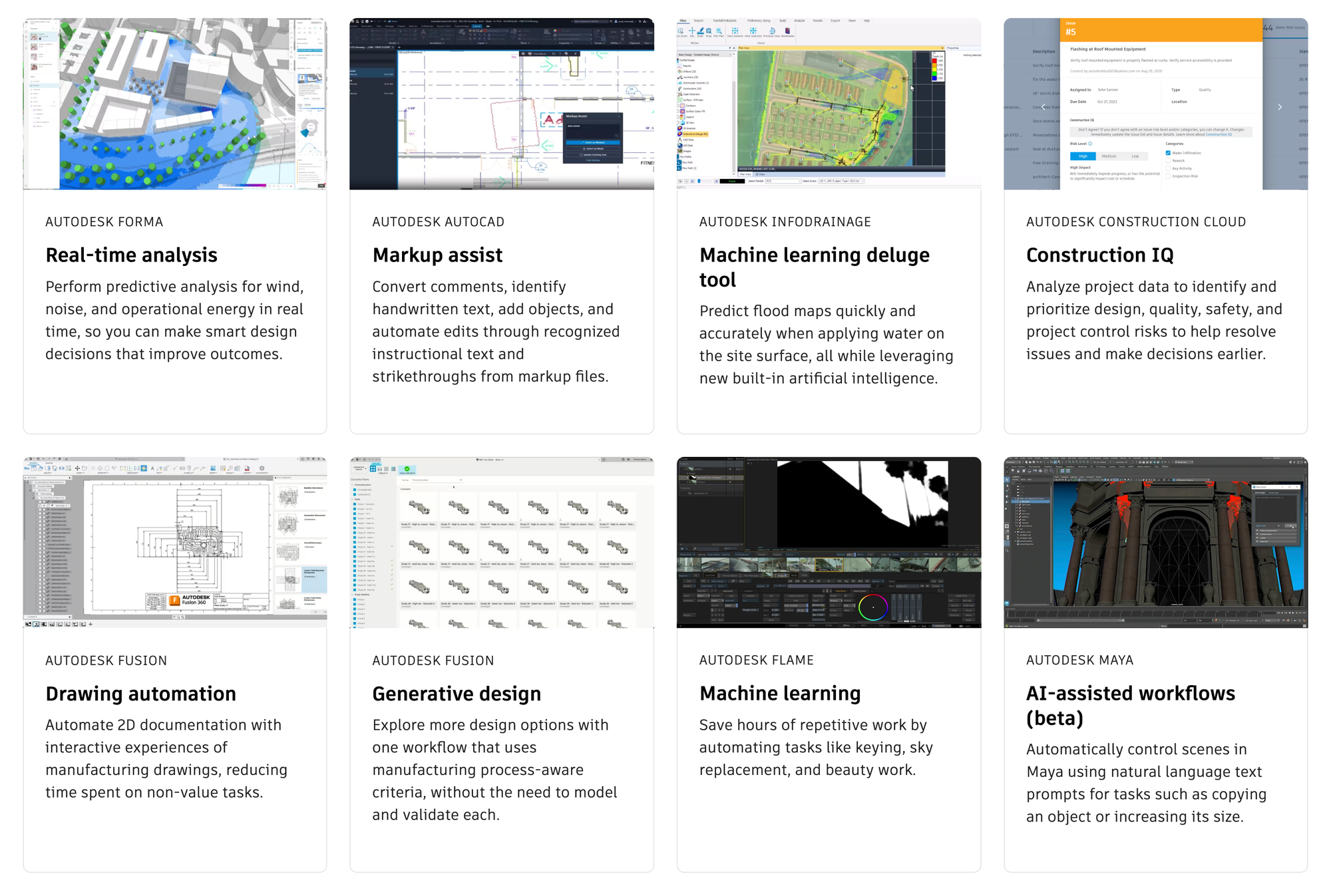

Unlike many “AI companies” that have popped up recently with the hype around the technology, Autodesk has been building AI into its products for over a decade now. Below is a snapshot of Autodesk’s existing suite of AI products that are fully integrated into its platform:

Here is a brief overview of Autodesk’s current AI tools as described by ChatGPT:

- Real-Time Analysis: Offers immediate feedback and analysis for design and engineering projects, enhancing efficiency and decision-making.

- Markup Assist: Helps in automating the process of interpreting and implementing feedback and markups in design documents.

- ML Deluge Tool: A machine learning tool that assists in managing and analyzing large datasets in the construction and design fields.

- Construction IQ: A predictive analytics tool that identifies project risks in construction, improving safety and project management.

- Drawing Automation: Streamlines the process of creating technical drawings, saving time and reducing errors.

- Generative Design: Uses AI to explore a wide range of design alternatives, optimizing for specific goals and constraints.

- Machine Learning: Implemented across various Autodesk products, this enhances capabilities like predictive analysis and pattern recognition.

- AI-Assisted Workflows: Integrates AI into various design and engineering workflows to improve efficiency, accuracy, and creativity.

Autodesk also recently announced a partnership with semiconductor electronic design automation (EDA) firm Cadence Design Systems (CDNS) to integrate Autodesk with Cadence’s AI-powered chip design software. This essentially merged Cadence’s electrical-engineering capabilities with Autodesk’s mechanical-engineering to make even better chipsets using AI. This is just one of the many AI initiatives that Autodesk is currently working on.

We have studied many of Autodesk’s AI tools in-depth and it is clear that they make engineers, architects, project managers, etc. much more efficient and productive. As Autodesk’s software saves its customers more time and makes them more efficient with AI, it becomes incrementally more valuable to the customers. As the software becomes more valuable to the customer, Autodesk can charge more for the software. Thus, as Autodesk integrates more and more AI tools into its ecosystem, it should have plenty of room to increase average selling prices (ASPs) and help drive revenue growth.

While Autodesk’s current AI tools certainly are Revolutionary, what really has us excited about the stock is the potential for what Autodesk can do with AI in the future. Starting very soon, Autodesk will be leveraging its immense cloud data to do AI and machine learning for its clients. Autodesk is sitting on a mountain of unique and valuable data that is not readily accessible to the public or nearly any other company. Autodesk is storing millions of plans, drawings, blueprints, specifications, images, etc. that have been created by Autodesk’s customers in the cloud. To the extent it has the right to use and analyze this data (which we think it does based on our review of the license agreement), Autodesk has the potential to build extremely powerful AI models that will further automate the design of products and construction projects.

Autodesk can potentially pool its customers’ data to build AI models that result in massive productivity gains and product improvements. Although the company is still somewhat opaque in its discussions with respect to the specifics of pooling/aggregating customer data to build AI, it definitely seems like it is moving in that direction. We think Autodesk has the potential to feed the thousands of designs stored on its system into an AI that can then analyze and learn from those designs so that the AI can design things itself. Not only will this result in efficiency gains for designers of projects and products, but the projects and products themselves will likely be much better. For example, this hypothetical Autodesk AI should be able to design the best bridge possible for a certain application by analyzing thousands of previously designed bridges, taking the best qualities from each, and optimizing for this specific application using constraints (including cost) and parameters set by the human designer.

Additionally, at some point, we expect that engineers will be able to design products on AutoCAD using natural language. Some designers are already using Autodesk’s APIs to drive Autodesk’s software with ChatGPT. As LLMs and AI as a whole continue to advance, it is not hard to imagine a world where entire buildings or products are designed by AI and reviewed/approved by humans using only natural language from a human as the only input. This is probably several years down the road, but once that capability exists, the productivity gains could be exponential. Not to mention the buildings and other structures designed with AI should be much safer as they are not subject to human error in calculations.

In summary, Autodesk is uniquely positioned to see extraordinary growth as it leverages the AI Revolution to dramatically improve the capability and efficiency of the designers, engineers, architects, builders, and artists that use its platform to build our world. While it remains to be seen exactly how Autodesk’s software will be transformed with AI, there is virtually no other company on the planet that is better positioned to create AI that will better aid engineers and builders as they create our physical world.

2. The Reshoring/Automation/Robotics Revolutions

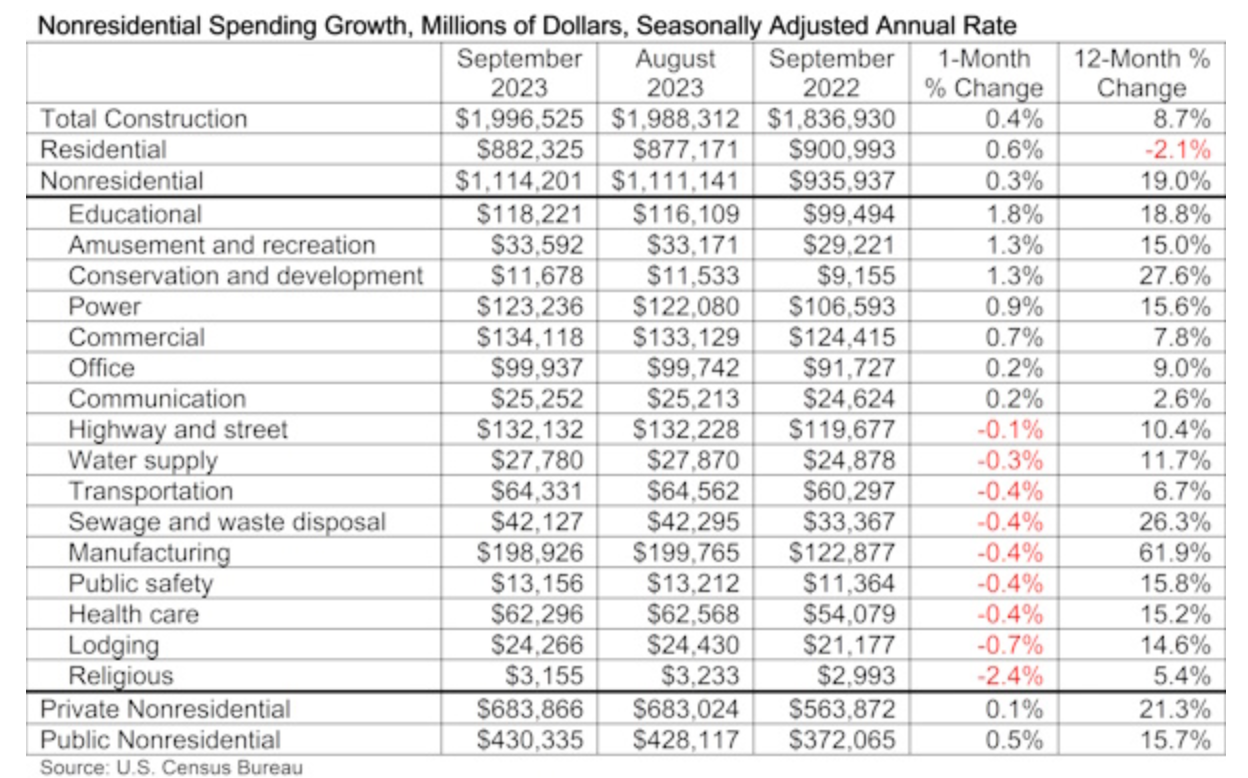

We have written about the Reshoring and resulting Automation/Robotics Revolution(s) extensively in the past. Even with inflation on the rise, higher interest rates, and an extremely tight domestic labor market, companies are continuing to bring manufacturing capacity back to the United States. According to the Census Bureau, manufacturing-related construction spending rose 62% Y/Y in September. Autodesk is the de facto standard for design software in the US and as more companies build factories in the US, they will design both the factories and the products which the factories will produce with Autodesk software.

Moreover, as labor costs continue to rise, the incentive to accomplish more with less rises as well. Autodesk’s automated design platform is deflationary in that it can significantly reduce design fees for construction projects which currently average anywhere from 5-15% of the total cost of the project. This same logic applies to the design of manufactured goods, video games, movies, etc. As Autodesk integrates more and more AI into its products, it enables its customers to become more productive and thus reduce costs.

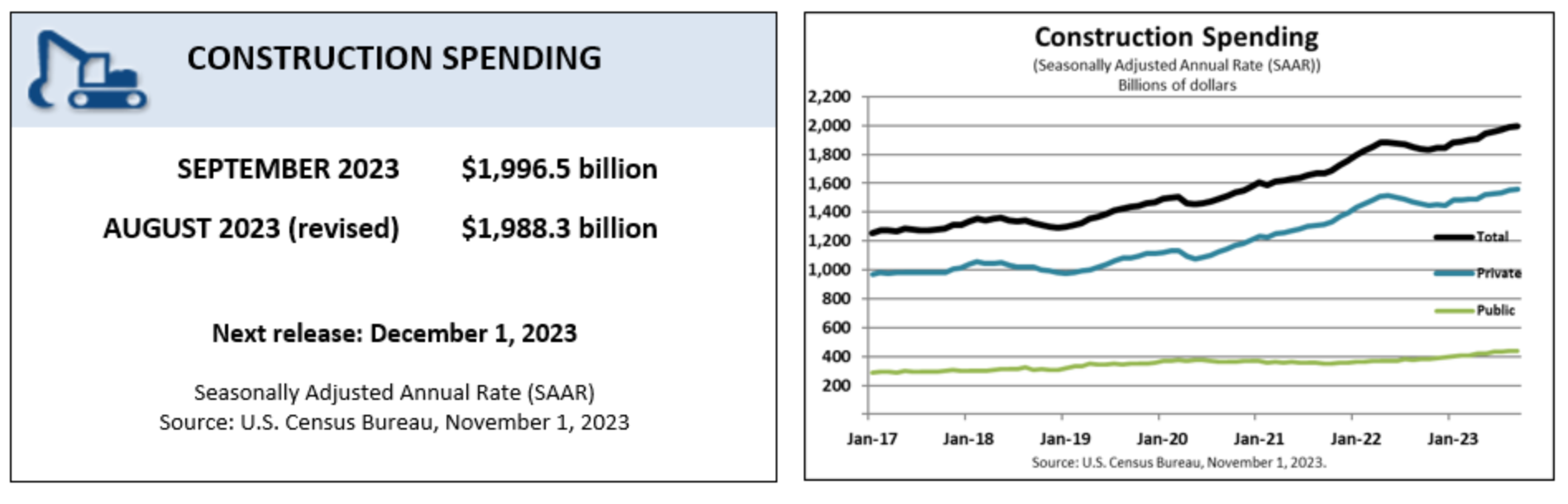

Lastly, government infrastructure spending is continually on the rise and these projects are getting bigger and more complex all of the time. As of September, the annual rate of total construction spending (government + private) stands at nearly $2 trillion and is still rising.

Total construction spending grew 8.4% Y/Y in September 2023, with public funding accounting for 72% of September’s gains. With much of America’s infrastructure in outright horrible condition, we expect governments will be forced to continue to increase construction spending in the years to come. In order to manage larger and more complex infrastructure projects, the stakeholders will rely increasingly on advanced software from Autodesk to enable the efficient flow of information between the parties.

In sum, Autodesk’s platform will be used to design the billions of dollars of roads, bridges, pipelines, schools, hospitals, and factories that need to be built in the US over the coming decades. Autodesk has a commanding share of the market in the US and thus the reshoring of American manufacturing will only add to the company’s long-term growth trajectory.

3. The Streaming/Gaming Revolutions.

Autodesk’s gaming & media division is nothing new (originally launched in 1999) but it’s still a relatively small portion of its business, constituting only 7% of its revenue in the most recent quarter. That said, Autodesk’s 3ds Max and Maya programs are some of the most widely used design softwares in the gaming industry. Top tier gaming companies (like Activision Blizzard (now part of Microsoft), Electronic Arts, and Ubisoft) and movie/TV studios alike (like Disney, Netflix, and HBO) use 3ds Max and Maya to design 3D characters, animations, and other visual effects. Autodesk’s gaming programs were used to help build games like Assassin’s Creed, Call of Duty, Halo, and Grand Theft Auto to name a few. Maya was also used in popular series like Game of Thrones to create many of those eye-popping battle scenes.

Together with products from Adobe, Unity Software, and Epic Games, Autodesk’s media platform is used to create many of the highest-quality games, movies, and series we have come to enjoy. High-quality content creation is a secularly growing industry and we expect the major media and gaming companies to continue to use more and more technology to improve the quality of their offerings and make them ever more realistic. Autodesk’s gaming division is already a standard in developing 3D imagery and growth will likely continue to accelerate from here. The recent Hollywood actors/writers/directors’ strikes have hurt this business and it should re-accelerate now that those strikes are mostly over.

4. The Augmented Reality/Virtual Reality (AR/VR) Revolutions

For years, engineers have used Autodesk’s platform to design products. However, until recently, there was no way to see what that product would look like in the real world until it was built. Now, Autodesk is using AR and VR to let engineers, designers, and owners visualize the designs in the real world and make adjustments before the products are actually manufactured/built. Autodesk’s building information modeling (BIM) technology is used to create full-size 3D models of buildings (a/k/a digital twins) so that the future owners of the buildings can inspect and visualize them before they are built. This technology is also used to analyze how the building may interact with wind, sunlight, and other real-world phenomenon that designers previously may have overlooked. AR/VR is also used by manufacturers like Rivian to analyze full-scale mock-ups of vehicles and make adjustments before the design is sent to the assembly line, thereby reducing design time and wasted materials.

Our Model

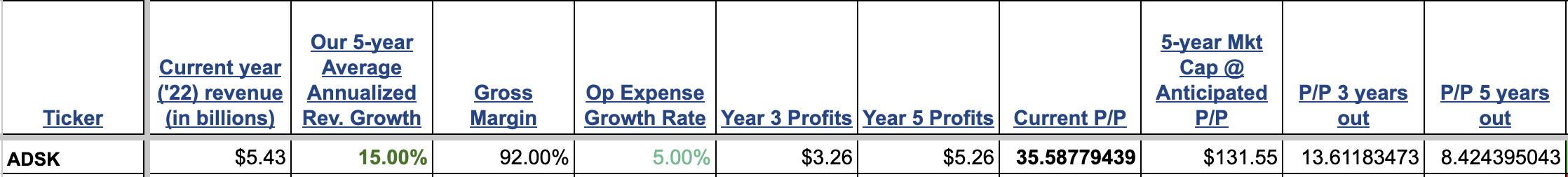

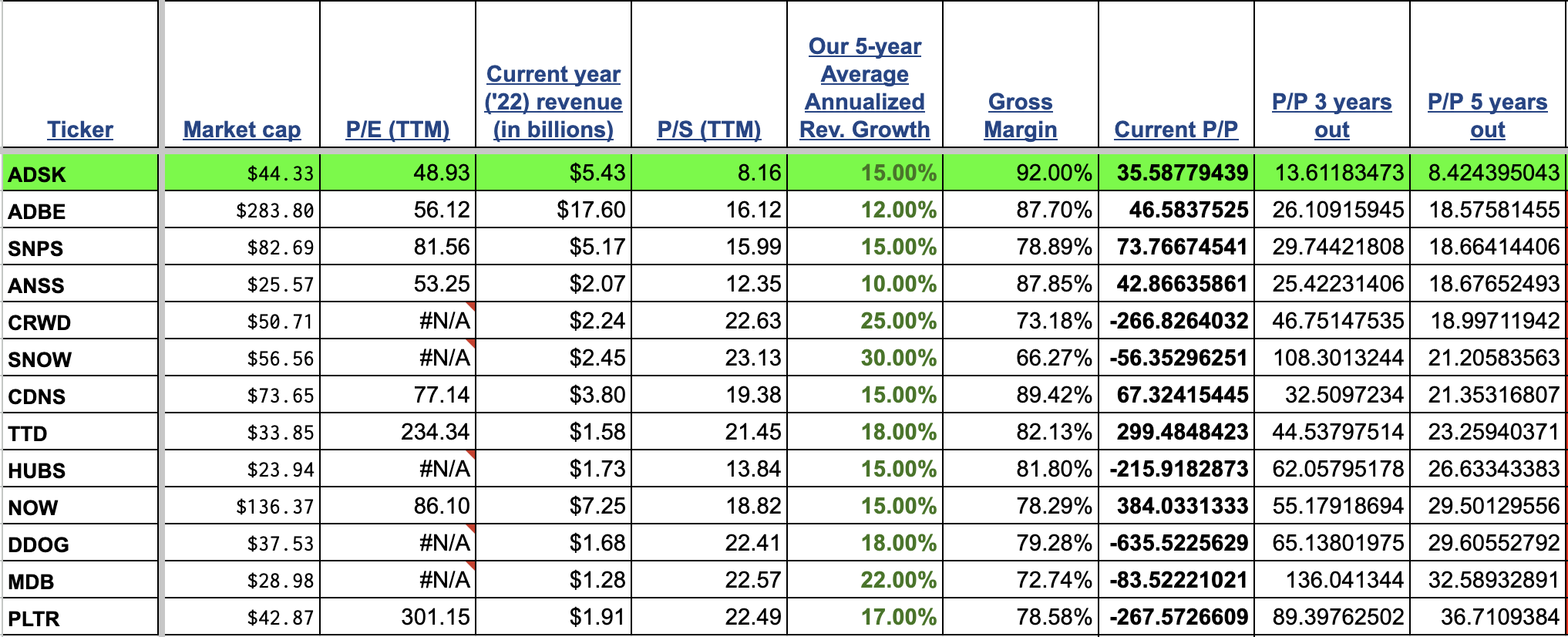

We model revenue growth accelerating to 15% annualized for the next 5 years which is above consensus estimates of 10% for 2025 but in line with the upper range of management’s long-term growth estimate. We expect no change to Autodesk’s 92% gross margins and have expense growth slowing slightly to 5% annualized for the next five years. This yields a 13 price/profits (P/P) ratio 3 years out and an 8.4 P/P 5 years out, significantly lower than almost all other software companies, as shown in the table below. Also note that Autodesk trades at roughly 8x sales while its direct peer group (ADBE, SNPS, CDNS, and ANSS) trades at twice the valuation with a 16x price/sales ratio.

Discussion of Downside Risks

While we are confident in Autodesk’s competitive moat, the company faces competition from the likes of Dassault Systèmes, Siemens, Bentley Systems (PSY), Ansys (ANSS), and Procore Technologies (PCOR) for CAD and construction management products. And while Autodesk’s products mostly complement those from Adobe (ADBE), Unity Software (U), and Epic Games in the media and gaming space, there is some overlap between their products and those companies have very powerful brands and may choose to compete with Autodesk in other areas as well. However, given Autodesk’s 50+ year history protecting its moat, we feel strongly that it will be able to continue to grow and maintain its above-average gross margins for years to come.

With respect to Autodesk’s potential AI strategy, those efforts could be stymied by privacy / intellectual property (IP) issues. We have reviewed Autodesk’s licensing agreements and feel confident that Autodesk generally has the right to build an AI model using customer data but that could certainly be challenged by its customers. We think there should be no problem using most blueprints and other construction-related documents to train a model since there is not a ton of IP value associated with those documents beyond the specific project itself. However, Autodesk may run into issues if it tries to train a model using proprietary designs for manufactured goods like for example Rivian’s electric motors. The CEO stated that they are going to work with customers to use their data to make the whole ecosystem better and expects that most customers will understand the trade-off between massive productivity gains and these IP/privacy concerns. Nevertheless, Autodesk could be subject to litigation if it uses customer data without consent to train an AI model, as we have seen with companies like Midjourney, Stability.AI, and Stable Difusion.

Additionally, there is execution risk if management at Autodesk fails to successfully implement its AI strategy. As mentioned, the company has been working on AI for over a decade but it is still being somewhat secretive with respect to its greater plans for implementing the technology over the long term. We are confident that Autodesk is working on fully integrating modern AI into its platform but obviously, the stock will suffer if the company fails to seize this moment. High gross margins attract competition, and there could be several AI startups that are working to build new AI-based design systems that could disrupt AutoCAD and the rest of Autodesk’s software suite.

Moreover, Autodesk could see a slowdown in sales growth if higher interest rates, geopolitical issues, or other problems slow down the rate of the American factory/infrastructure boom. We think that spending on the Reshoring Revolution has proven resilient given the massive change in interest rates we have seen already and feel confident that the long-term trend towards manufacturing more goods in the United States is a generational shift that will not be easily thrown off course.

Lastly, valuation is always a risk with software companies although it is a smaller risk with Autodesk than some of our other software names given Autodesk’s current pricing (see above comp table). We actually think Autodesk is relatively undervalued and could rally simply based on mean reversion. As shown on the chart below, Autodesk is trading significantly below its historical P/E:

Summary

Autodesk is in a prime position to capitalize on the AI Revolution by integrating AI with its already Revolutionary design platform. With multiple secular tailwinds propelling growth for years to come and a very attractive valuation, we think this is a great opportunity to invest in an established software business with a Revolutionary platform and lots of upside potential. We started buying this stock in the hedge fund using common stock and some December call options with $195 and $210 strikes which we intend to exercise if the stock price cooperates. We will be buying it in our personal accounts this week.