Bear Strategies, Real Estate Damage, Why Sell NVDA Not TSLA, And Much More

Here’s the transcript from today’s Live Q&A Chat.

Q. Also, are you bearish from all of the greed right now? If so, where do you like PUTS (or maybe even CALLS on things like VIX).

A. I’m not sure I’m out right bearish or anything but I’m definitely not an outright bull right now like I was back at the end of December when I was putting money to work on common and calls. I like puts on AI, RBLX, RIOT, LYFT, CVNA, SI, PLUG, BE and a few others like that but BE CAREFUL if you’re going to buy puts or short anything. I do this for a living as a HEDGE fund manager, meaning my job is partly to make sure I’m hedged when I”m not outright bullish. I don’t have any puts or hedges on in my personal account right now, as, probably like most of you, I don’t have the time to manage the PA so closely day to day like I do the hedge fund.

Q. Cody, do you feel like real estate still has a ways to fall or is most of the damage done? THanks.

A. What damage has been done?

Q. Q. Cody: Sounds like you are much better!!…hoping to get you and your teams take on the quarter reports from Meta and Intel, and expectations for rocket Lab coming up if any at this point….thanks.

A. META’s report was much better than the market had feared, but much of it is a result of the company cutting people and allowing more money to drop to the bottom line for shareholders, exactly as I’d been saying during the last month of last year when I was buying call options in META when it was about $100 lower than the current quote. “I’m selling lots of puts that I have on as hedges in the hedge fund and am doing some nibbling on the long side there in AMZN, SHOP, UBER, INTC and a few calls on QCOM, NVDA, META, and U. Mostly buying calls dated out 4-8 weeks, slightly out of the money. And yes, bought some TSLA calls in the hedge fund and am even buying a little TSLA common around $122 here.” https://tradingwithcody.com/2022/12/22/trade-alert-putting-some-money-to-work-on-the-long-side/ Intel’s quarter was awful and we’re going to need to see some better results from INTC this year. RKLB reports in a couple weeks and I have no feel for how the report will come out. Longer term, I still think that Rocket Lab’s ability to send things to orbit when so many other launch companies keep failing is going to make this company end up being bought and/or grow quite a bit from here.

Q. hi cody great to hear you are feeling better !! thoughts on goog after the past couple weeks and should we be buying on this weakness

A. Feet-to-fire, I like GOOG here below $95 or so for a trade and maybe for a lont-time investment too.

Q. I think I remembered you not liking FSLY, SHOP, and selling out of ROKU (all earnings AM today). Are you still bearish on these? Also, are you bearish from all of the greed right now? If so, where do you like PUTS (or maybe even CALLS on things like VIX)?

A. I hated FSLY and told you all how I was short the stock back in April 2021 when the stock was at $70 before it dropped 90%. I’m not short the stock and haven’t been in a long time but I still wouldn’t want to own it over AMZN or MSFT: “I’ve shorted FSLY off and on in the hedge fund for the last few months though I don’t have any position in it presently. The company isn’t profitable and isn’t going to be profitable any time soon and I would rather own AMZN or MSFT as my way to bet on The Cloud Revolution.” As noted above, I was buying SHOP in December before it doubled. I’d rather trim than buy SHOP right now after this huge move though. I’m out of ROKU.

Binary Outcomes, Shadow Contract Swaps, Space CEOs, Cheap VR Play And More

Q. Why sell the cloud stocks now? They are disruptors and could have a long run.

A. I’m holding the SNOW but have taken nice profits on all the other cloud stocks for now. I think their valuations are quite stretched after the huge moves they’ve made this year.

Q. Cody so glad you are on the mend sir G0D Bless do you consider META TSLA AMZN forever holders and what ABOUT RKLB AND UBER. where are they in 2025?

A. Thanks for the kind words. Yes, I’ve said that META TSLA and AMZN are forever positions for my personal account for years now. RKLB ins’t a forever position (yet?). UBER is probably going to end up being a forever position but I want to see one more good year out of the company’s fundamentals.

Q. What will the reaction be if INTC cuts their dividend? Would this change your opinion?

A. I think INTC needs to cut that $6 billion dividend to help fund its growth and they probably will unless they somehow take a ton of market share in PCs before the end of this year, which is still possible. The stock would probably drop 10% the day they announce the dividend is over.

Q. Is INTC still an 8? Can it reverse its processor market against AMD? Does the 10x long term potential for INTC remains in your opinion?

A. INTC probably a 7 right now. Yes, it can start beating AMD badly if its chips leap forward in performance as they look like they might be. The 10 bagger potential remains but is diminished.

Q. Seeing $ASAN as I’m browsing dumpsters… does the Cody-Bat-Computer have anything on it?

A. I don’t know the company but it’s spending $800 million on operating expenses while revenues are $500 million. Seems insane and that will keep it from having a good result in my WiNR Batmobile analysis machine.

Q. Cody: re TSM From your latest positions in Dec: “My recent Where I’d Buy More list said that I’d like to buy more of this one around $60 which it did recently get near and that’s still where I’d be looking to buy more although it might not drop quite that far now that Buffett’s been buying this one”…..Any change now that Buffet is reportedly selling?

A. No, I’ve been in TSM for the last 300% move and am still holding it steady. Didn’t buy it or sell it based on Buffett. I still doubt it gets to $60 anytime soon though.

Q. You’ve sold $NVDA after an epic run… curious as to why not $TSLA as well after its double off the lows?

A. NVDA has a half trillion market cap and it doesn’t own a single factory and it depends wholly upon the TSM fabs, based in Taiwan. TSLA has a half trillion dollar market cap but is vertically integrated and has the robot and the Dojo supercomputer and the potential for full autonomous driving. I’ve sold pretty much all the TSLA calls I was buying before it doubled here but I’m holding most of the common steady.

Q. Nice to hear you’re feeling well Cody. Regarding Rockwell, when a stock is breaking out after a nice run, are you more apt to trim the position, hold your position or add to the position?

A. Depends on all kinds of factors. I’m holding ROK steady as I like its fundamentals a lot here and the onshoring factory Revolution is just probably in the 2nd inning.

Q. Happy to hear that you have bounced back from your recent health scare. May your unfortunate event serve as an important reminder for us all to focus on our greatest investment; the health of ourselves and family. Any thoughts of taking a deeper look at ABNB after reporting a solid Q4? I took the opportunity to close a position leading up to earnings and am wondering if I should jump back in as leadership focuses on restructuring the pricing to better serve the customer.

A. Thanks for the kind words. I love ABNB’s business model but I think there are way tooooo many people/companies who have bought properties for the sole purpose of overnight rentals and there is an oversupply problem and that pricing has to come down hard. Also, that $300 cleaning fee shit has gotta stop.

Q. Serious question. With disruption in Fintech bringing 4.5% online savings accounts while the legacy banks offer <1%, what happens to those banks when they can’t compete and try to chase those rates? As we know, banks make money by loaning out our savings and checking accounts. If that deal flow slows dramatically? Massive layoffs? More AI emphasis?

A. I think the traditional banks are in trouble long-term. I’m long some BAC puts in the hedge fund.

Q. I’m curious about your thoughts on the legacy US banking system and the disruption we’re seeing with Fintech companies offering higher interest rates. I’m getting north of 4% from Wealthfront on some cash I have, and Betterment does the same thing… How does BOA and WF compete with that? Seems like they could hemorrhage savings accounts if people start voting with their feet. So if they chase those rates, I suppose they just have way lower margins… Might be a reason to short the banks if we’re confident rates stay this high for a longer time period.

A. Again, please be very careful if you short anything. And most of the banks pay a dividend which you have to pay for them if you’re short. But yea, I can think of worse ideas than shorting the old TBTF banks.

Q. I just read your trade alert and was shocked to read about your heart attack. I am sure that your subscribers and thousands of others who know you from outside of the Trading with Cody community wish you all the very best with your recovery. I appreciate the human approach you have to your work, sharing the health challenges with your youngest daughter and now your own experience. Our health is so valuable and no matter how many people we know who have issues, its always a wake-up call when it happens to us. In my experience, lifestyle changes made after a health scare make us feel better than we did before the health related event – so here’s hoping you’re about to feel a lot better than you have for years. Please take care of yourself. Lots of love to you and your family.

A. Thank you! And yes indeed, cutting out fried foods and beer has already done wonders for my energy level and appetite through out the day.

That’s a wrap. Thank you for the kind words and prayers and vibes.

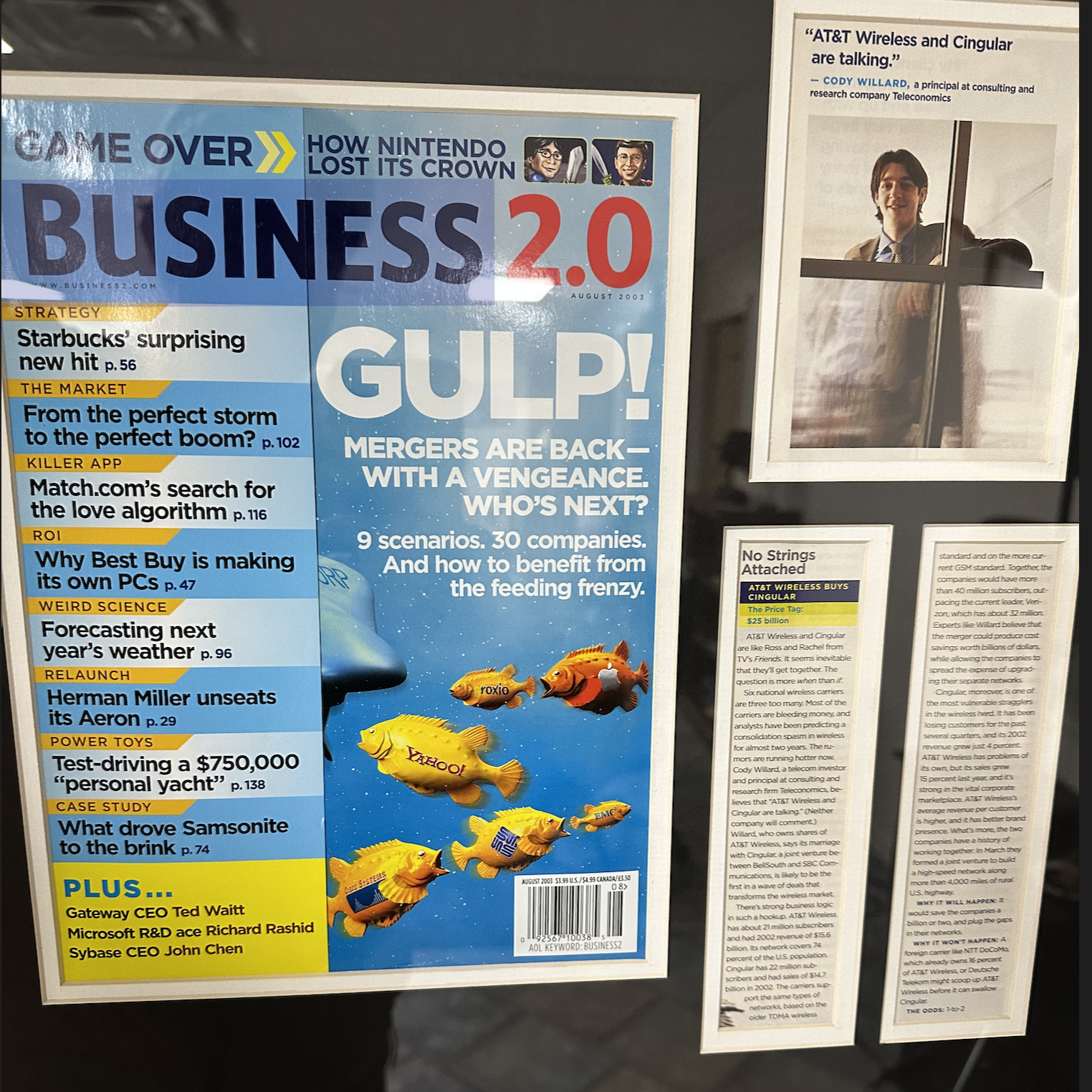

I leave you all with a picture of an article that Om Malik wrote about me 20 years ago long before he was a VC legend.