Biotech topping, energy stocks not bottoming and Gerald Celente podcast interview

Join Cody Willard for The World MoneyShow Orlando, February 4-7, 2015.

| Register FREE! |

on the PlanetSaturday, February 7 | 8:00 am – 8:45 am EST

Cody will highlight three new sectors poised to become the next trillion dollar industries and the key to long-term success with your portfolio is getting in front of revolutionary trends. He will also offer a few stocks from each sector to finish off the presentation before opening it to Q&A.

US stocks rally, with a 50th record close for S&P 500 this year Stocks rally to record highs…rinse and repeat?

Put another way, the markets hit new all-time highs 1 out of every five trading days this year. All the handwringing, worrying, panicking, energy crash, Ebola fears, 0% interest rates, emergency measures from the FED, the “too small” stimulus, bailouts and so on…markets hit all-time highs 1 out of every 5 trading days this year.

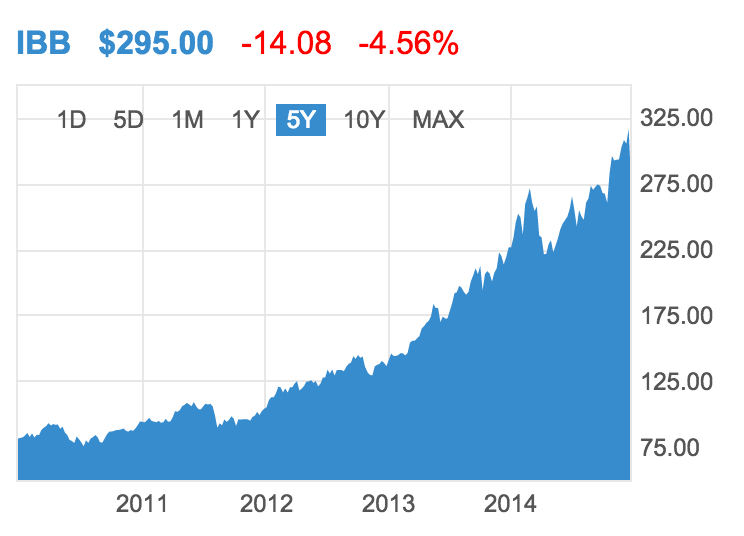

With a business model dependent on forcing taxpayers to pay prices for biotech products that carry 90%+ gross margins and growing like mad…I wonder if it’s as good as it can get for biotech right now. Might $IBB and the major biotechs like $GILD be putting in long-term tops right now? Look at this 5 year chart of the IBB and you’ll see it’s still up 500% from its lows 5 years ago and just might be starting to break down.

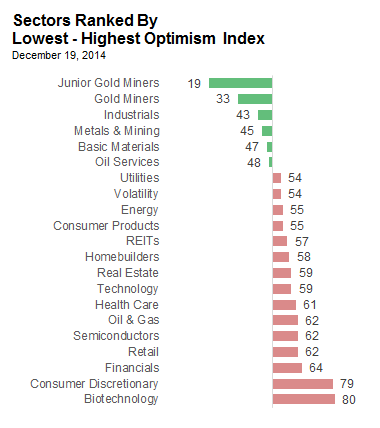

It shouldn’t be a surprise to anyone that sentiment for biotech stocks is the highest of any sector. I do wonder how much this chart will be changed and where gold miners (the lowest rated sector by sentiment) vs biotech (the highest) sentiment will be in two years.

I might be looking to add a short or two from the biotech sector in coming weeks.

Natural Gas getting crushed now, making the sell off in oil look mild. A bottom in energy prices is illusive still. I still say the best time to buy energy stocks will be when the first publicly traded stock bankruptcy in the sector gets filed.

Real estate here in southeastern NM will probably be hit over the next few years if energy/oil stays down in the $50s or heads lower. Had a residential real estate appraiser who’s been here for many cycles tell me that this weekend. Bankruptcies in the sector would negatively impact jobs and regional banks and some larger banks and other still unknowable things. But as to investing/trading energy stocks, I think it’s wise to wait until some bankruptcies hit the public energy stocks.

For investors and traders in a cyclical industry like energy is, it’s all about the timing. Markets ebb and flow. Fear builds in a decline, feeding on itself and contributing further to the decline. Greed builds in a rally, feeding on itself and contributing further to the rally. Overcorrections happen. Cycles take time to play out — commodity cycles can play out over decades. I think it’s way too early to try to time a long-term bottom in energy.

PS. I got a lot of information, analysis and emotions out of Gerald Celente in the latest Cody Underground Podcast. We talked about gold, banks, oil, currencies, stocks, political parties and more. Yeah, seriously, a lot of good topics covered in 35 minutes of interview. Check it out and learn from one of the best trend forecasters ever https://soundcloud.com/cody-willard/gerald-celente-and-cody-willard-talk-about-revolutions-political-parties-gold-stocks-and-more