The bitcoin/cryptocurrency crash will hit Nvidia, Tesla and tech stocks

Bitcoin is trading like a high-beta version of Nvidia and Tesla and other megacap stocks and the madness of the crowd in cryptocurrencies is likely to be the next catalyst for a serious stock market pullback.

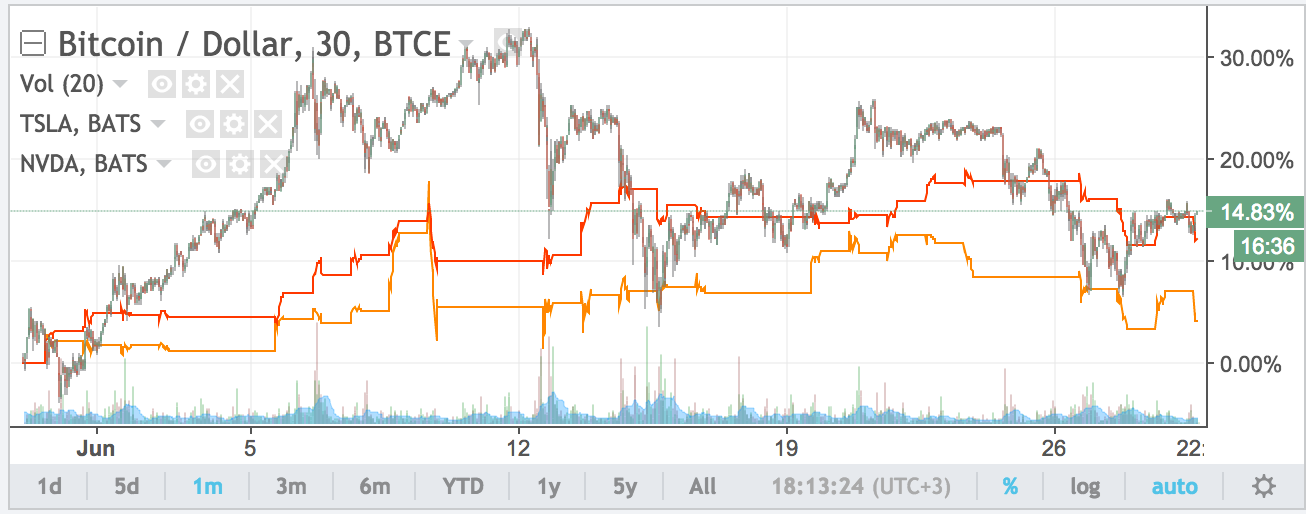

When I saw the NASDAQ and the stock market, especially tech stocks — Nvidia and Tesla specifically, up or down a bunch each day for the last couple weeks, I’ve noticed that Bitcoin has been trading in tandem with them. I went back and pulled up a chart of Bitcoin versus Nvidia and Tesla for the last five days, one month and three months.

It is a strange idea that Bitcoin and Nvidia and Tesla would be trading in tandem. That is, unless you are sort of having bubble-blowing bull market dynamics that I have been saying we have, where the tech-money, money that is seeking technology, and the revolution investing that we were doing and have been getting in position for 8 years ago — that money is getting into all things technology-related that have momentum. And Nvidia and Bitcoin meet that definition. So you’re seeing some apparent correlation. Bitcoin is trading like a high-beta version of Nvidia and Tesla and other megacap stocks.

It is fascinating, really! Except, it’s also somewhat depressing, because it probably is reflective that we are clearly in a later stage of this bubble-blowing bull market dynamic. Whether that means we are about to pop is, as always, a very different question. I always go back to that because when I talk about it being a bubble-blowing bull market for the last five years, even seven years ago, people would comment or ask me about “Why are you so bearish if you think the markets are going to crash?” Meanwhile, the entire article was about how we were just getting started on being in a bubble that would get much, much bigger and that you should be ready for it. So I was bullish, of course. Sigh.

And here still today, I am not saying that the markets are going to crash because we are in an a latter stage of the bubble. What I’ve been saying for the last 5 years is we are going to get in a bigger bubble, as this bubble grows. Of course, it will crash at some point. The bubble will pop. Maybe it will be a less severe crash than the year 2001, 2002 when the NASDAQ crashed 75%. I don’t think this bubble is as big as that one yet. “Yet” being the key word perhaps.

I do think we could see the broader stock markets cracking 5% or 10% here over the rest of the summer and I wouldn’t be surprised if the catalyst for a megacap tech stock pullback of 10-20% is Bitcoin and the cryptocurrency madness of the crowds in tech right now.

If all the traders and cryptocurrencies were to get panicked and learn the hard way that you can’t make quick, easy money, consistently for long-term in cryptocurrencies (or any other market, of course).

A panicky sell-off of 10-20% in Bitcoin could happen tomorrow or next week or next month. And if that happens, I would expect Nvidia and Tesla and broader tech stocks in general to get swept down some too because of the bubble-blowing mentality and the crowd mentality of “Hey, everything is down, better sell! Bitcoin is down so better sell Amazon.”

It is a weird thought that people would make lump tech stocks in with cryptocurrency speculation but it seems to be real right now as it’s been developing in the last few months. Since Bitcoin and cryptocurrencies are a high-beta reflection of broader tech stocks that could make them a potential catalyst. If you to were to have a 40-50% drop in Bitcoin measured in a few days’ or a couple weeks’ time – tech stocks would likely be down 10-30% across the board at the same time.

And, yes, such a Bitcoin-driven near-term market pullback would be a welcome opportunity to finally buy some more of our stocks on a panic whoosh down.

The flip-side is I am going to continue to ride our large holdings, all of our longs in other positions not just tech-stocks. I sure won’t get panicked about them if there is 5% or 10% pull back in the market, driven by Bitcoin crashing.

All that said, I want to be clear that I’m not betting on a crash near-term or long-term. Not right now. I’ve trimmed some of my big winners and have reduced the number of longs in my portfolio and in the Revolution Investing portfolio. It’s not like you have to sell all of Facebook, Amazon, etc., you can sell 5%, 10%, 20%. If they doubled or tripled, if Nvidia has gone up five-fold, sell 30% even and that is still a large position for you if you bought it at any reasonable position to start with. I welcome the opportunity to sell into strength. I love to sell a beautiful chart, especially when it is spiking. I love to buy a horrible looking chart if we’ve got an edge in the fundamental analysis.

So, trim a little if you have it, sell into the strength while the stocks are at an all-time high, don’t wait until 500 point down day because Bitcoin crashed.