Blade, The “Uber” Of Air Mobility.

We started a small position in Blade early in July and have been working hard analyzing this stock since then. We have had several meetings with the management team (including the safety officer), one of which took place at Blade’s HQ in NYC, and we have been very impressed with the company thus far. While in NYC, we even got the chance to experience the product firsthand on our trip back to JFK from Manhattan’s East Side. As we mentioned last week, we thought the service was first class and it reinforced our excitement about the potential for this investment. So without further delay, here is our BLDE deep dive. Also, let’s do this week’s chat Thursday, 8/10 at 2:00pm EDT in the TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com.

Blade Air Mobility Inc.

Nasdaq: BLDE

Share Price At Time of Analysis: $3.94

Blade, The “Uber” Of Air Mobility.

Key Metrics

| Market Cap, curr (mm) | $276mm |

| Total Revenue (ttm) | $147mm |

| Gross Margin | 15%-20% |

| Net Cash (mm) | $156mm |

| Price/Sales (ttm) | 1.9 |

| Q1 2023 YoY Revenue Growth | 70% |

Source: Yahoo Finance.

Synopsis.

With the potential to be the Uber of air travel, Blade is a unique Revolutionary platform play on the future of air travel. Traffic is a growing problem in every major city around the world, and alternative forms of transportation are constantly being discussed and developed (think of Elon Musk’s Boring Company). Blade’s platform uniquely solves this problem in part by offering by-the-seat helicopter rides in some of the most congested cities in the world. Further, its model has enabled it to do so at a price that opens up air travel to a large demographic that could not afford to charter their own private helicopter/plane ride in the past. We think the traffic problem is not going anywhere anytime soon, and Blade is positioned to capture more and more share in a secularly growing market. If electric aircraft (EAs) ultimately enable mass adoption of air travel in congested cities as we expect, the long-awaited prospect of flying cars would seem more like reality. When it comes time to book your ride on your flying car (sort of), you will do so on Blade.

With the stock currently trading at around 5.7 times our 2028 earnings estimates and with nearly $150mm in net cash on the balance sheet, Blade stands out as an attractively priced and well-capitalized growth stock in a market where many of the high-flyers are still years from profitability and may not have the cash to get there. While the company is poised to be a key winner in the eventual transition to EAs, unlike many of the other players in the space, Blade has attractive near-term economics and is not dependent on the success of any one EA maker. After meeting with the management team several times and using the service, we are confident in the company’s ability to successfully execute the growth plan and we plan to build up this position in our portfolio.

BLDE Background.

Founded in 2014 by Rob Wiesenthal and Steve Martocci, Blade offers a tech platform that enables short-distance air travel in some of the world’s most congested markets. The company originally focused on offering helicopter rides between Manhattan and the Hamptons where a car ride can easily take two to four hours or more depending on traffic. Cody has done that trip many times and talks about how painful it almost always is.

Utilizing rideshare economics, and an asset-light model where it contracts with third-party operators to provide the aircraft, Blade offers tickets by-the-seat that make short-distance air travel significantly more affordable. For example, Blade offers flights to JFK from Manhattan for $195 per seat with a flight time of less than 5 minutes. If you are not familiar with NYC, that trip usually takes at least 45 minutes and can last as long as 2.5 hours if traffic is backed up. For comparison, at $195/seat, the cost of Blading to the airport is roughly comparable to an Uber Black, and is a little over twice the cost of a taxicab.

Since its founding, Blade has rapidly expanded to new markets and added more business lines and services. Currently, the company’s short-distance service is available in Manhattan, Vancouver, Nice/Monaco, and Mumbai. Additionally, the company has built up a substantial organ transplant business utilizing the same concept that enabled its success in the passenger market. And like some of its competitors in the air travel world, Blade offers chartered and seasonal by-the-seat jet flights primarily between NYC and South Florida.

Blade came public via SPAC on May 10, 2021 in which the company raised $365mm in cash at a $825mm valuation. The company has continued to grow since then and invested the proceeds from the SPAC deal to secure additional heliports, continue building out its app, expand its marketing efforts, and for acquisitions. The stock is down about 60% from its de-SPAC price.

BLDE’s Business Model.

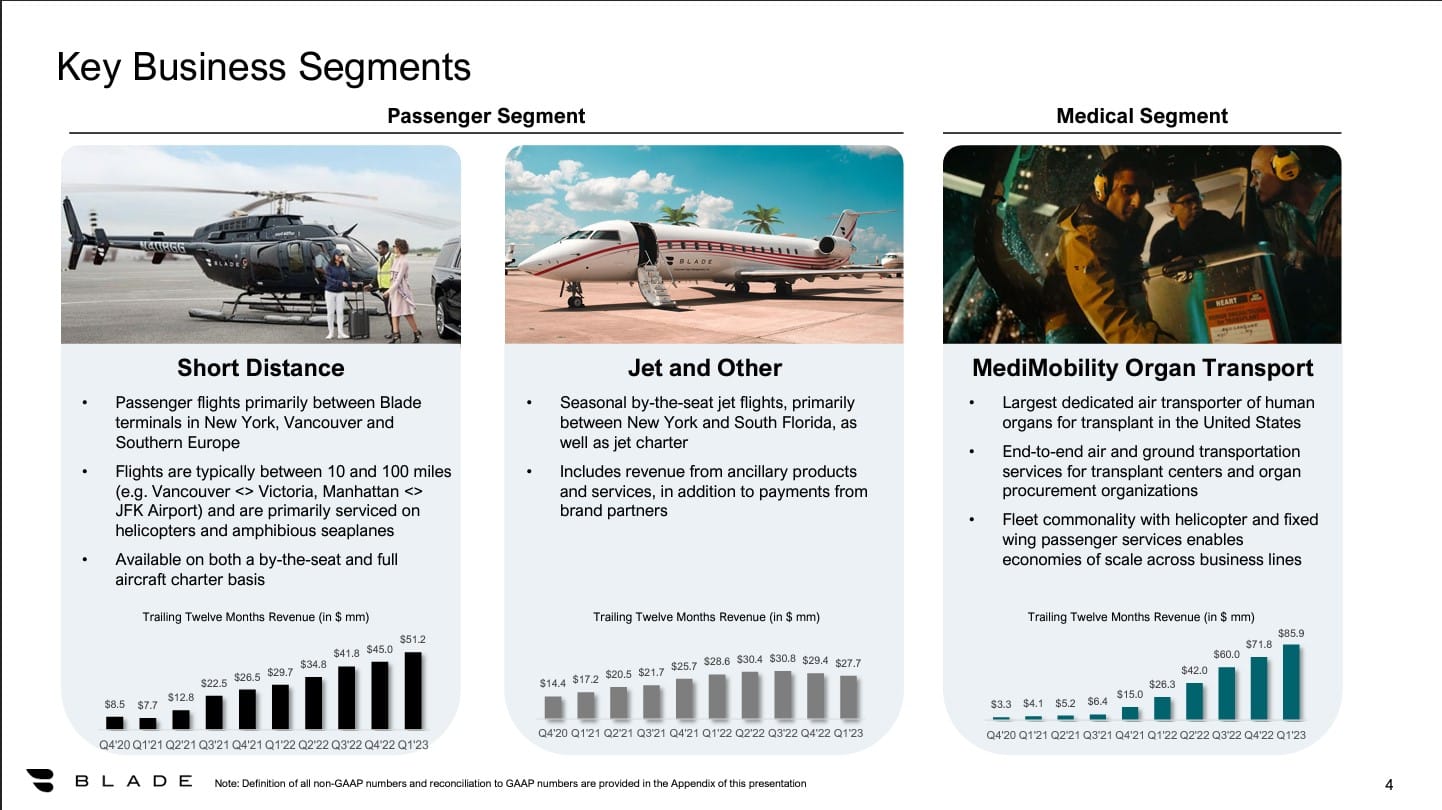

Blade has three revenue sources as shown below: short distance, organ transport, and jet/other. Blade has driven growth across these three business units both organically and through acquisitions.

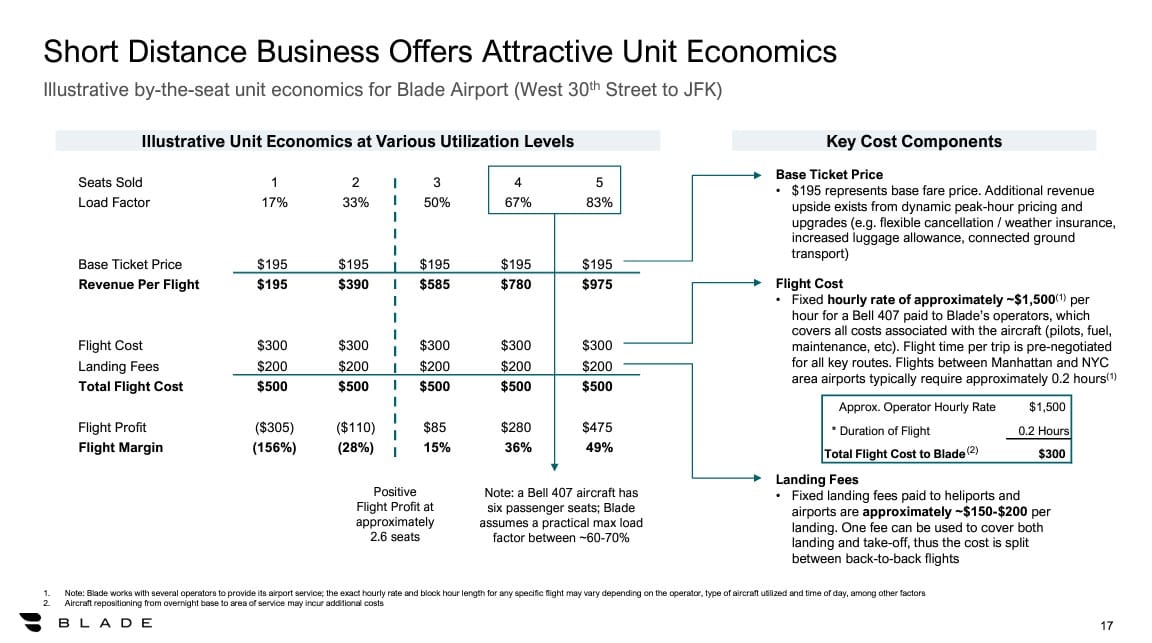

As mentioned, Blade utilizes an “asset-light” business model. Like Uber and Lyft, Blade does not own or operate its own vehicles. Rather, Blade contracts with third-party operators who provide the aircraft, pilots, fuel, insurance, maintenance, hangars, etc. Blade provides the app and the customers, the landing zones, marketing, etc. Blade pays the operators by the hour and it guarantees revenue for the pilots, and Blade only makes money if it can sell enough seats on each ride, as shown below:

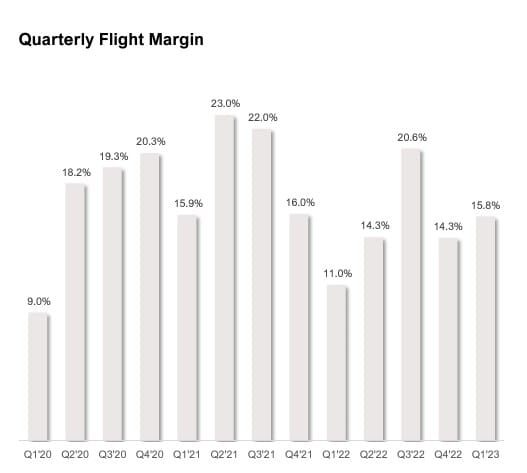

In order for this business to be profitable, Blade needs to sell at least 3 seats per flight on average. The incremental revenue from additional seats obviously juices the margins significantly since Blade is paying a fixed cost per flight. As Blade has been in growth mode over the last few years, its quarterly flight margin has varied between 9% and 23%, as shown below. We think that as the business matures, margins should stabilize around the 20-25% range.

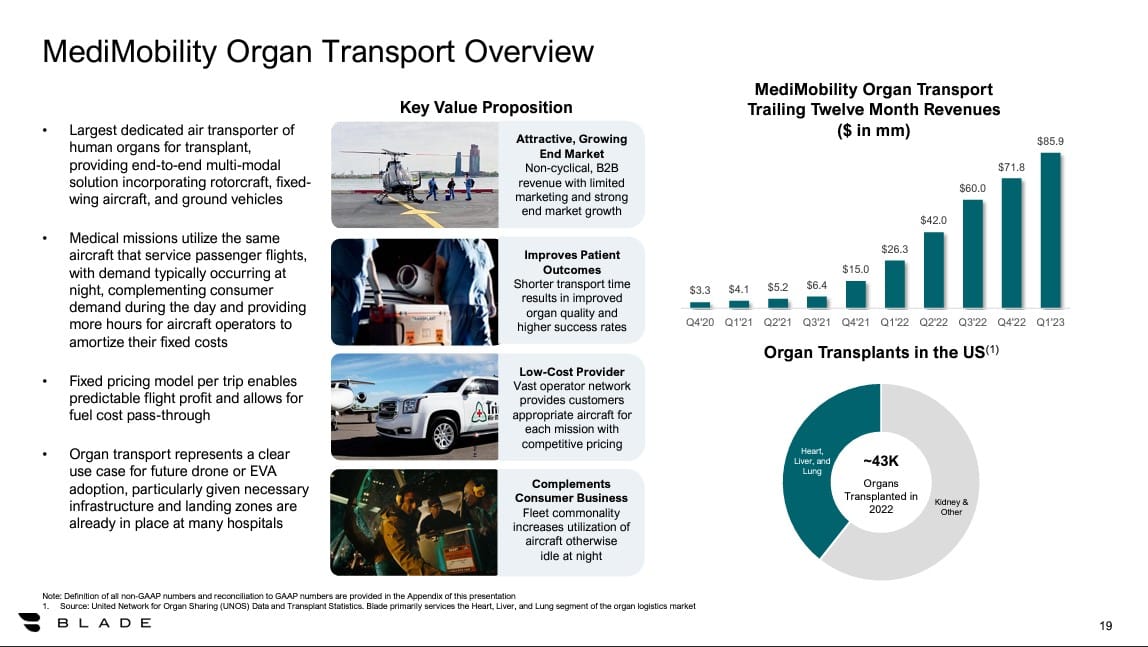

Blade’s medical transport business utilizes the same concepts that enabled the company’s success with passenger rides. Today, Blade has grown into one of the largest transporters of organs for transplant by incorporating end-to-end rapid delivery through its network of dedicated operators. The organ transplant business is growing rapidly and also offers diversification away from the somewhat cyclical travel business.

The speedy growth in the medical transport business has been two prong. First, Blade has gained significant share through its acquisition of MediMobility in combination with its organic growth in this area. Second, the market for organ air transportation is growing because of recent technological developments which enable longer-distance flights. This technology, known as perfusion, keeps organs alive for longer than was possible using the traditional method of placing the organs on ice. The perfusion machine keeps the organ warm by continuously pumping blood through it, which is better for the organ and increases the window of time that it can live outside the body. Because of these advances in technology, Blade was recently able to fly lungs to Alaska from locations on the East Coast that would not have been possible only a few years ago. As perfusion technology continues to develop, we expect the market for long-distance organ transplants will only continue to grow. We are hard at work learning about perfusion and the companies that provide it.

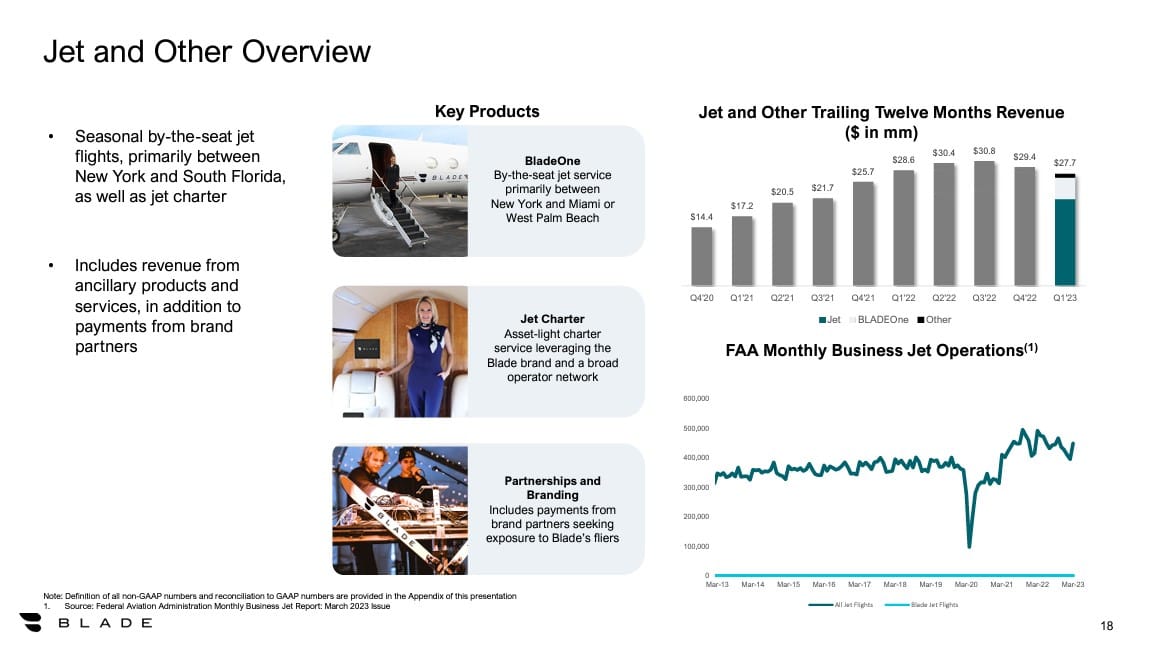

Revenue in Blade’s jet business has been flat to down over the last few quarters as the company faces competition from traditional charter operators like NetJet and WheelsUp. However, this line of business helps the company secure favorable pricing for the organ transport business and also offers incremental revenue for Blade’s helicopter customers who want to take a private jet for the next leg of their journey. So while it is not a stand-alone growth driver, it increases the value proposition to Blade’s rideshare customers and keeps those customers on the platform rather than going with a competitor.

Safety.

When we started looking at Blade, the safety issue was one of our main reservations with investing in the company. The entire company could clearly be at risk in the event of just a single crash of one of its aircraft. Accordingly, we asked management if we could meet with the safety team to learn more about how Blade ensures its third-party operators are keeping safety top of mind.

In meeting with the safety team, we learned that, unlike traditional rideshare companies, Blade is not contracting with one-man shops or any random dude that owns a helicopter. Because we were thinking Blade was like Uber or Lyft, we literally imagined that anyone who owned a helicopter could sign up as a pilot and haul people to the airport. Boy were we wrong.

As you might expect, safety is a top priority at Blade and it would simply be unsafe to let any schmuck with a helicopter offer rides through the Blade app. Thus, Blade contracts with established operators in the cities where it is located, most of which have eight to ten helicopters each. These operators are subjected to rigorous safety requirements from Blade that go above and beyond the minimum FAA requirements. Each operator is subjected to an annual safety audit by Blade’s team, and any operator that is not in compliance is removed from the platform. Additionally, Blade’s team constantly monitors the weather and will not allow its operators to fly if the safety team is even remotely concerned about the weather, regardless of whether the FAA allows the operators to fly or not. To date, Blade has only experienced one forced landing which did not result in any injuries, and has never had any aircraft crash. Obviously, flying in helicopters has inherent safety risks but we think Blade has implemented the right policies and procedures to ensure its customers are as safe as possible.

BLDE’s Revolutionary Platform and Growth Plan.

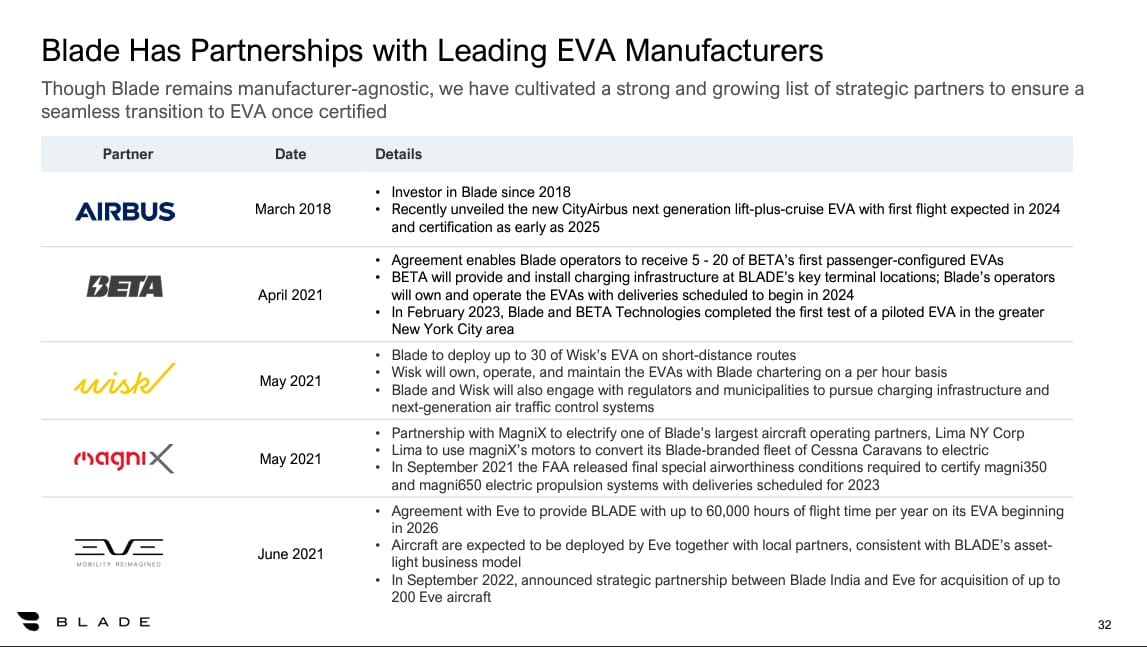

Blade is unique in that it is the only company to our knowledge that is offering affordable by-the-seat helicopter/plane rides without owning the aircraft. Additionally, the company will be a prime beneficiary of the transition to EAs in congested cities as the traffic problem continues to worsen. As you may know, many companies like Joby, Archer, Eve, and Wisk are currently developing electronic vertical take-off and landing (eVTOL) aircraft. Traditional players like Boeing, Airbus, and Delta Airlines have made significant investments/partnerships in the companies developing eVTOLs. eVTOLs are much quieter than traditional aircraft and therefore are expected to be able to land at many more locations than are currently available to traditional helicopters. If these aircraft are successful, they will open the door to much more frequent and affordable short-distance air travel in big cities. We think short-distance air travel, as an alternative to driving on congested highways, will likely be a secularly growing business for years to come.

While we are not ready to make a bet on any single eVTOL manufacturer, we think Blade is the perfect platform to bet on the transition to eVTOLs and has the potential to lead the mass adoption of air taxis in major cities. The company is well on its way to achieving profitability and is not under pressure to quickly develop and adopt its own EAs. Once Joby or Boeing or Wisk gets eVTOLs figured out, Blade’s operators will start buying them and using them on Blade’s existing platform. Blade has already partnered with several of these manufacturers and we really like the idea of a manufacturer-agnostic platform play on the mass adoption of short-distance and affordable air travel.

Additionally, while the transition to EAs is likely several years down the road, Blade has multiple secularly-growing business lines that will provide profits and cash flow in the meantime. After riding on the service, we think the value provided by Blade is exceptional given the cost and is truly Revolutionary. Blade’s platform enabled us to save 1-2 hours in an Uber at roughly the same cost, and the experience was obviously much more enjoyable. From the high-class lounge, and complimentary drinks, to the leather seats in the helicopter and the branded car service to the JetBlue terminal, everything about Blading to JFK was absolutely incredible. Check out the pictures from our trip at the end of this article.

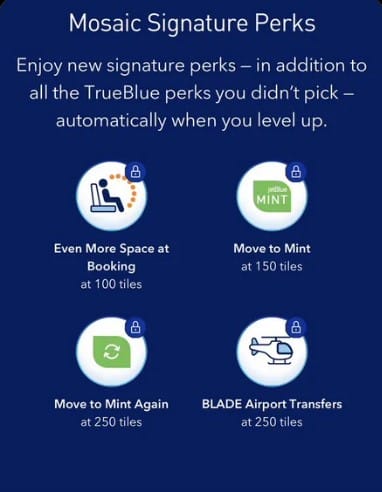

Blade also has developed some amazing corporate partnerships and we feel that the potential for more growth in that area is significant. For example, JetBlue announced this week that Mosaic 4 members get free trips on Blade once they reach a certain level of membership points:

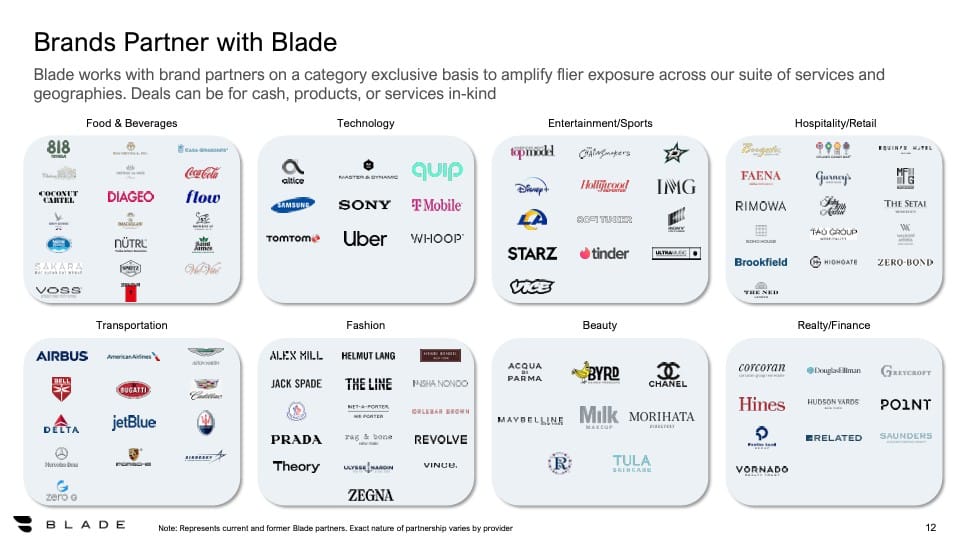

And that is just the tip of the iceberg. Blade is partnering with tons of other corporations to offer benefits for their employees and customers:

Cody even mentioned that when he was at Fox, they would have gladly paid a couple of hundred bucks to fly him in a helicopter to the airport rather than sending him in a private car service. We think as Blade’s brand awareness increases, it just makes sense for lots of businesses, from small to very large, to use Blade to move their employees and customers around town in a much more time and cost-efficient way.

Additionally, management foresees that they will work with building owners in large cities to incorporate helipads for eVTOLs onto buildings and offer access to those as an amenity for tenants, workers, etc. who use the facilities. This would really help facilitate the mass adoption of air mobility as a form of transportation throughout major cities.

Lastly, we think the organ transport business will continue to grow as perfusion technology advances. Blade is truly helping doctors save lives by getting organs to places that otherwise would not have received them without Blade’s end-to-end rapid transportation capabilities.

Our Model.

| Operating Profit Model | 2023 (est) | 2024 (est) | 2025 (est) | 2026 (est) | 2027 (est) | 2028 (est) |

| Short Distance | $66,939 | $96,338 | $134,419 | $182,238 | $240,586 | $309,912 |

| MediMobility Organ Transport | $111,929 | $158,884 | $192,211 | $228,497 | $267,320 | $308,196 |

| Jet and other | $30,823 | $31,747 | $32,382 | $33,030 | $33,691 | $34,364 |

| Total Revenue | $209,690 | $286,970 | $359,012 | $443,765 | $541,596 | $652,472 |

| Revenue Growth | 43.51% | 36.85% | 25.10% | 23.61% | 22.05% | 20.47% |

| Gross Margin | 17.00% | 19.00% | 20.00% | 22.00% | 24.00% | 24.00% |

| Gross Income | $35,647 | $54,524 | $71,802 | $97,628 | $129,983 | $156,593 |

| Operating Expenses | $81,000 | $87,480 | $91,854 | $96,447 | $101,269 | $106,332 |

| Operating Profit | -$45,353 | -$32,956 | -$20,052 | $1,182 | $28,714 | $50,261 |

| Price/Profits | -6.36 | -8.75 | -14.38 | 244.04 | 10.04 | 5.74 |

We assume growth is in-line with analyst estimates of roughly 43% this year, and rises roughly 37% next year (above consensus of 27% for 2024). Further, we expect margins to continue to improve from their current 15% level over the next few years. Blade has achieved ~23% gross margins in the past and we think as the business matures and Blade optimizes its cost structure, it should be able to grow those margins going forward. Lastly, Blade has done a good job of reining in operating expenses in the last few quarters and we model high to mid-single-digit growth in OpEx for the foreseeable future.

Discussion of Downside Risks.

First and foremost, keep in mind that BLDE is scheduled to report earnings tomorrow 8/9 after the close, and with that comes the risk of increased volatility. This is obviously a long-term position for us and we don’t want to rush in right before earnings are released in case the stock gets crushed as we have seen with many small caps this earnings season.

As mentioned earlier, our main concern with investing in Blade is the safety risks. These risks are inherent to air transportation and given Blade’s small size, even one incident could be enough to take the entire company down. Even if no one is seriously injured, if consumers lose confidence in the safety of air travel, Blade’s business could be irreparably harmed. While this risk is very real, after conducting significant due diligence, we are as confident that Blade has taken every appropriate precaution to ensure the maximum safety of its passengers.

Blade’s stock would also be hurt if the company is unable to grow as expected or if margins continue to come under pressure. We think Blade needs to get its gross margins up to the 20%-25% range from the current 15%-20% range ASAP.

And while we think there is plenty of room to grow the traditional aircraft business for the next few years, this growth will likely stagnate if the company is unable to expand its landing points with eVTOLs. But given Blade’s valuation and diversified revenue stream, we think the risk/reward setup is attractive here.

Blade is also at risk of cyclical downturns in travel. While the airport service is relatively cheap compared to an Uber Black, it is certainly still a luxury service that will probably never be adopted by the vast majority of travelers. While the prospect of eVTOLs could someday lower the cost of air transportation for the masses, that is still a long way off. However, for the demographic that uses Blade (upper-middle-class and above), we think the value proposition of the service is second to none. As mentioned, Blade reduces the time to get to JFK from 45-120 minutes down to 5 minutes. A flight to the Hamptons reduces the travel time from 2-5 hours to 45 minutes. There is still a very large group of people who are more than willing to pay Blade’s prices to save that kind of travel time and inconvenience, as a matter of fact, we saw George Stephanopoulos in the lobby while we were waiting for our Blade.

We would also mention that Blade could be subject to competition from Uber or others. While Blade is currently the only company offering by-the-seat flights in major cities via third-party operators, if the market continues to grow at its current pace, it will likely attract more competition. This competition could come from startups or established players like Uber. As we are big believers (and long-time investors) in Uber and its platform, we would be worried if Uber entered this space as a direct competitor to Blade. That said, Uber had its own NYC helicopter service as recently as 2019 and shut it down/sold it for undisclosed reasons. We think the current market is simply too small to get Uber interested and it wasn’t enough to move the needle for the company. If the market continues to grow and Blade continues to dominate it, we also think Blade would be a good acquisition target for Uber.

Lastly, don’t forget that Blade is a very small-cap company and that comes with its own unique set of risks and challenges. The stock will likely be volatile and the company may not achieve profitability as fast as it thinks. Moreover, eVTOLS may not prove to be successful which would ultimately limit Blade’s ability to scale its offering to a larger audience.

Summary.

Blade is uniquely positioned to be one of the ultimate winners if the mass adoption of short-distance air transport takes off. Additionally, the company has a diversified revenue stream and multiple near-term growth drivers that make the valuation attractive even if the transition to eVTOLs takes longer than expected. With a healthy balance sheet and profitability just around the corner, we think Blade is an exciting buy at these levels.

And don’t forget, let’s do this week’s chat Thursday, 8/10 at 2:00pm EDT in the TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com.