BRICS Thoughts, INTC Update, Disney, WBA, And Much More

Here’s the transcript from today’s live Q&A chat. And don’t forget to follow us on Twitter/X.com @TradingWithCody.

Q. What do you know/think about BRICS and how much of a threat is it to the US Dollar?

A. Brazil, Russia, India, China, and South Africa (aka BRICS) is not even close to being a single unified unit and probably never will be. That said, it seems to me that forcing countries like these from around the world to use the US Dollar as a reserve currency is not cool and that it’d be in their self-interest to get the hell off the US dollar. That means they probably will someday whether it’s next year or in five years. On the other hand, the US dollar and the US financial system, for all of its horrible, corrupt practices and gimmicks, is still by far the cleanest fiat currency in the global fiat currency laundry basket and always will be, so maybe it’s actually in their citizen’s best interests to continue to use the US dollar as a reserve currency. In the end, this whole discussion is part of why I say that “All currency roads lead to Bitcoin eventually.” The BRICS should just start using Bitcoin as their reserve currency if they really want to do the right thing for their citizens.

Q. ProShares Bitcoin Strategy ETF (BITO) is below the levels we were buying it a few weeks ago. Thoughts on buying another tranche here?

A. I can think of worse ideas than nibbling on some more bitcoin/BITO but I’m not doing it just yet.

Q. Saw earlier in the thread a question about acquiring bitcoin at these levels and you said you’d bite at $25 – plus “all roads lead to bitcoin”…. $25k still the number? What % of a portfolio do you believe should be in bitcoin for someone with above-average risk tolerance?

A. I’m a buyer of bitcoin pretty much anywhere around these levels, $25,675 currently and lower. I own BITO in the hedge fund and as long-time subscribers know, I’ve owned bitcoin personally for the last 11 years. I’m not looking to buy any more personally right now and I’d probably be a buyer in the hedge fund of more bitcoin every 3-5% lower here.

Q. What are your thoughts on SOL (Solana)? Recently announced partnerships with Shopify (SHOP) and Visa (V).

A. I’ll take a look but I’m pretty sure that the only cryptos that I want to own right now are bitcoin and the SKTLs token I helped create.

Q. Why the buy on Apple (AAPL) and Nvidia (NVDA) today? Any particular reason(s)?

A. I’ve had a hard time reconciling my rational and emotional baselines for the last few weeks while I’ve remained long my Forever Positions in my personal account in names like Apple, Nvidia, Meta, and Amazon which I’ve owned for 20 years, 7 years, 11 years, and 8 years respectively in the personal account while not having them in the hedge fund. I’m not making them huge positions in the hedge fund right now but I want/need to be long in the hedge fund with most of the forever positions in my personal account, as I still very much believe that all of them are still good investments for the long term. Make sense?

Q. Can you please provide your thoughts on the recent Intel Corporation (INTC) news? The latest write-up on INTC was bearish but seems like the company is starting to build momentum.

A. My biggest problem with Intel right now is that the CEO keeps talking up their AI business but I’m less than confident that they have much AI business. Broadcom (AVGO) and Palantir (PLTR) were similar in their recent commentary about how huge AI is supposedly driving demand but their quarterly results were just okay, not like Nvidia’s (NVDA) blowout quarter which was based on huge demand from AI for Nvidia chips. We’ve trimmed our INTC down a little bit in the hedge fund over the last few days and I’m recalibrating my analysis on it.

Q. When are you going to add to NuScale Energy (SMR)? Thank you!

A. I’d probably buy some more near $5 or so. It’s a long road from here to when the company’s Small Modular Reactors are nuclearizing (made up this word right now) energy.

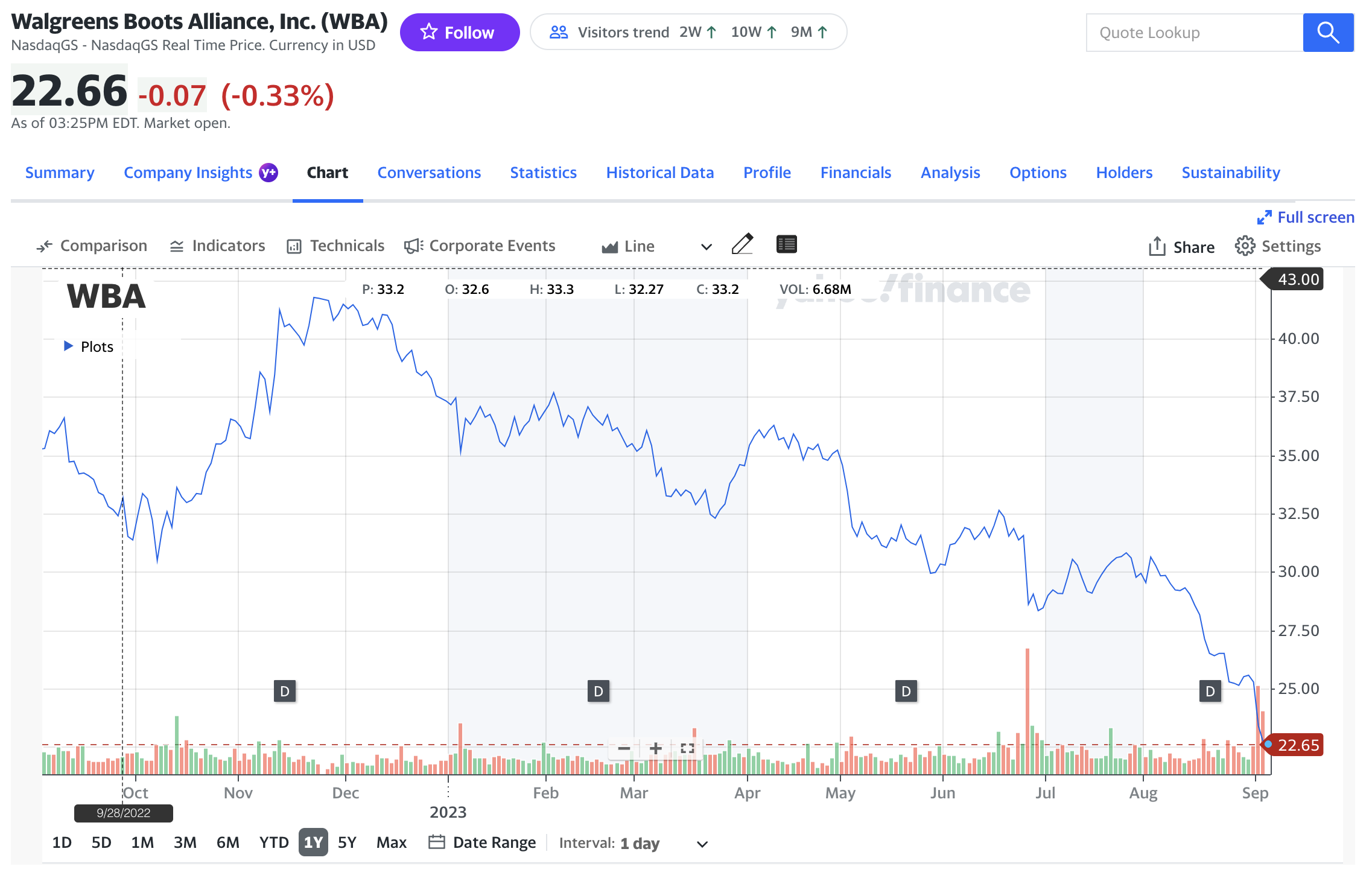

Q. What is your thesis on Walgreens Boots Alliance (WBA)? I know it’s trading 3x projected profits, etc. Do you feel the dividend is safe too?

A. As bad as the chart of WBA has become and how far down it has fallen and how big its dividend yield has gotten as a result of how far it’s fallen, I’m a bit hesitant to confidently say that the dividend won’t be cut. I’m putting it in the penalty box for now and I might have to sell it at a loss using the $20ish or maybe $19ish level as a soft stop loss. No easy answers in this market. Walgreens (WBA) is certainly hated, bashed, and cheap on a projected profits-to-price ratio.

Q. Saw a nibble on Walt Disney Co (DIS) calls… good spot for a long-term position with common?

A. Disney’s got some great intellectual property what with Mickey Mouse, Star Wars, Marvel, Pixar, and of course ESPN and ABC, and a model that allows them instant distribution and monetization of high-quality content. The theme parks are not as exciting to me. The cruise ships seem like an awful business (I’ll never get on a cruise ship in my life after having been trapped in downtown Manhattan on 9/11). The biggest problem with Disney is that the stock is still not terribly cheap on a price/profits or a P/E ratio. I like Disney for a trade here but probably won’t consider an outright investment in the common stock unless it drops down below $70 or so.

Q. What do you think about Block (SQ)? The stock has gotten beaten down but Cash App is performing well and I feel fintech still has a long runway.

A. I think Block (SQ) is fine but after seeing how badly Jack Dorsey was running Twitter before Elon took it over and released all those Twitter files about how the company was cowering to Republican/Democrat pressure to punish/deplatform/hide posts from people with controversial opinions along with how the company was so wildly overstaffed, I don’t think I’ll ever invest in anything related to Jack Dorsey (the CEO and founder of Block (SQ) too) again.

Q. Speaking of fintech, any thoughts on PayPal (PYPL) at current levels and maybe your longer-term outlook?

A. I’ve had Bryce working on a financial/payments system graphic for a few weeks because I’m always amazed at all the different and disparate finance/payments companies out there, many of which are worth billions. For example, Shift4 (FOUR), Paypal (PYPL), Block (SQ), Visa (V), MasterCard (MA), Sofi (SOFI), Apple (AAPL), Google (GOOG), Amazon (AMZN), Fiserv (FI), Toast (TOST), Par Technologies (PAR), Coinbase (COIN), Affirm (AFRM), Greendot (GDOT), Global-E (GLBE), Bill.com (BILL), StoneCo (STNE), Global Payments Inc (GPN), Paygaya (PGY), etc etc etc. Until I get my head wrapped around how the whole system fits together and which ones are at risk of losing market share, I’m probably not going to invest in any of them. It’s sick how much money flows into all of these companies (not to mention the banks themselves!) whenever we move OUR own money for anything!

Q. Any updates on the Immersed Spac deal? Timing of when that is happening? Or key insights or learnings from the process?

A. Only that it’s always a bit shocking to see sausage made. Cable TV News sausage, Spac sausage, D1 college basketball sausage, etc. Sausage, baby!

I leave you all with a couple pictures of me doing that golf thing at Sandia Resorts last week for my birthday. Thanks wifey.