BTC v BITO v IBIT: Bitcoin Vehicles Explained

We thought we’d put together a post explaining the problems of owning bitcoin directly and the differences between BITO, GBTC and the newly approved spot ETFs like IBIT.

After yesterday’s trade alert, we got several questions from subscribers regarding our swapping of ProShares Bitcoin Strategy ETF (BITO) for the new iShares Bitcoin Trust (IBIT).

Let’s start by looking at bitcoin (BTC) itself. Like any commodity or currency, the only way to truly own bitcoin is to hold it yourself (like keeping your U.S. dollars under your mattress or gold coins in a safe). In the case of cryptocurrencies like bitcoin, that means buying bitcoin through an exchange like Robinhood, Coinbase, or Binance and then transferring the private keys to a hardware wallet (basically a fancy flash drive) for storage.

However, personal ownership of bitcoin in this fashion — like every other commodity and currency — presents its own set of risks and is operationally challenging for most investors.

First of all, crypto exchanges like Coinbase charge steep commissions — up to 4.5% — to purchase bitcoin. A good hardware wallet will cost you another $50-$100 and the process of transferring the private keys to the wallet is fairly complex. Additionally, the hardware wallet itself could be lost, stolen, or destroyed.

Because of these risks and complexities, most bitcoin investors do not choose to physically hold bitcoin via a hardware wallet.

The next most secure way to hold bitcoin is via a “cold” wallet. A cold wallet is simply a digital way of holding your private keys offline. Cold wallets are available from Robinhood, Coinbase, Metamask, and others.

While in theory, cold wallets should be very secure, they are still a digital means of holding crypto and could be hacked. Additionally, if you forget/lose your special password or pin, you might be completely unable to recover your cold wallet. You also typically have to pay network fees when you transfer cryptocurrency to a cold wallet.

Lastly, once your crypto is in a cold wallet, you won’t be able to sell it. In order to sell your crypto, you have to transfer it back to an exchange, typically incurring more fees in the process.

The easiest but least secure way to hold bitcoin is directly on an exchange like Coinbase or Robinhood. In this scenario, the exchanges “custody” the bitcoin for you which means you don’t have to keep track of any special private keys or passwords, other than your normal login credentials for the app. This also avoids the fees of transferring your coin to a cold wallet and it is easy to sell your bitcoin since it is already stored on the exchange. The problem here is that you do not truly own your bitcoin. Unlike typical securities, cryptocurrencies are not covered by the federal government’s Securities Investor Protection Corporation (SIPC) which means that if Coinbase or Robinhood get hacked or go bankrupt, you will probably lose all of the crypto assets that they were custody-ing on your behalf.

This brings us to the concept of exchange-traded funds (ETFs). The myriad problems with holding bitcoin has kept many investors from owning the cryptocurrency at all. This is especially true for institutional investors like hedge funds, mutual funds, insurance companies, pension funds, banks, etc. that cannot feasibly custody bitcoin in any of the currently available options.

Therefore, fund managers like Blackrock, VanEck, ARK Invest, and others have been seeking approval from the SEC to launch bitcoin spot ETFs, and they finally got it on Wednesday. For background, here is an explanation of ETFs from the SEC: “Exchange-traded funds (ETFs) are SEC-registered investment companies that offer investors a way to pool their money in a fund that invests in stocks, bonds, or other assets. In return, investors receive an interest in the fund. Most ETFs are professionally managed by SEC-registered investment advisers. Some ETFs are passively-managed funds that seek to achieve the same return as a particular market index (often called index funds), while others are actively managed funds that buy or sell investments consistent with a stated investment objective. ETFs are not mutual funds. But, they combine features of a mutual fund, which can only be purchased or redeemed at the end of each trading day at its NAV per share, with the ability to trade throughout the day on a national securities exchange at market prices.”

Until yesterday, there were no publicly traded bitcoin spot ETFs. The only ETFs available (like BITO) were futures ETFs. Futures ETFs like BITO do not track the exact price of bitcoin. Rather, they invest the fund into bitcoin futures which typically expire in one or two months.

When that expiration date approaches, the fund then sells the futures contract and buys futures contracts for the next month or two. This process requires more active management and results in high trading fees, and thus BITO has a relatively high expense ratio (0.95%) for an ETF. As a futures ETF, BITO’s returns can also suffer from slippage (difference in the bid-ask spread) and time decay due to the nature of futures trading.

BITO does pay a dividend, although it is not the kind of consistent dividend that you are used to getting from owning stock in a company. Because BITO is constantly buying and selling futures contracts — rather than simply owning an asset — it generates realized gains and losses throughout the year. When the price of bitcoin is going up, BITO has realized gains on these futures contracts. Under federal law, ETFs are required to distribute all of their taxable gains to investors to avoid paying special excise taxes on the fund.

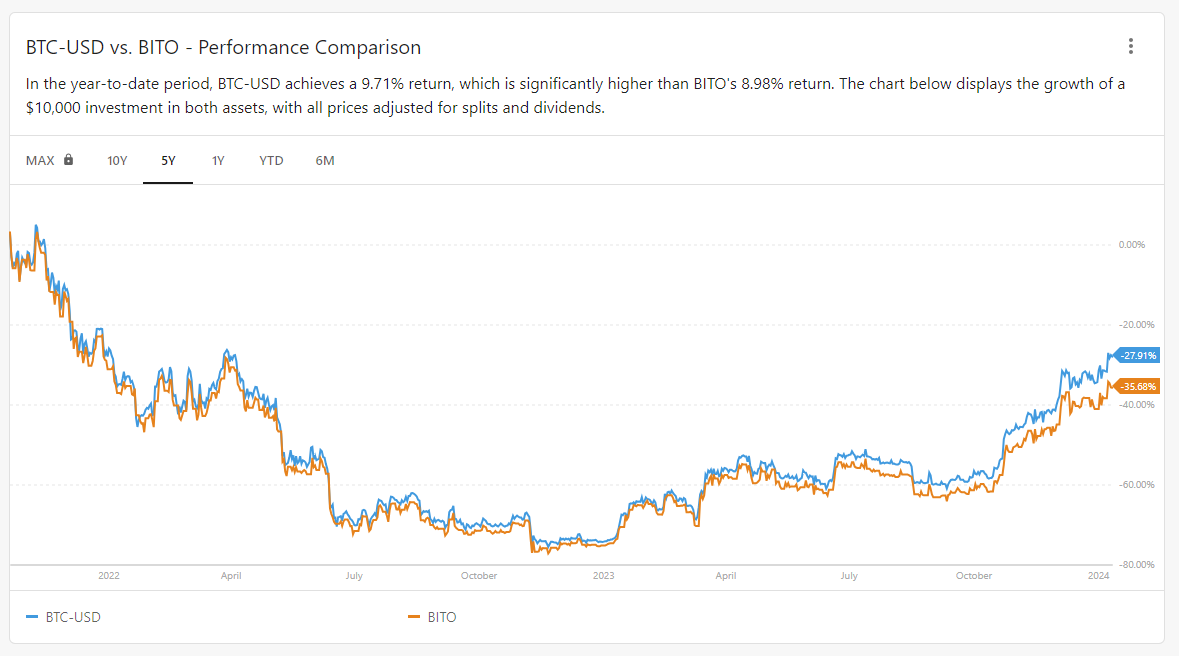

As BITO investors, we have to pay income tax on the dividends we receive from BITO. For these reasons, futures ETFs like BITO are an imperfect way of getting bitcoin exposure. Below is a comparison of BITO’s performance relative to bitcoin since BITO launched in 2021. You’ll notice that BITO is down over 35% while bitcoin is down 27% over the same time period.

Source: PortfolioLabs.com.

With the approval of the 11 new spot bitcoin ETFs like IBIT, BITB, ARKB, FBTC, and others, investors large and small now have direct access to low-cost and relatively secure bitcoin ownership.

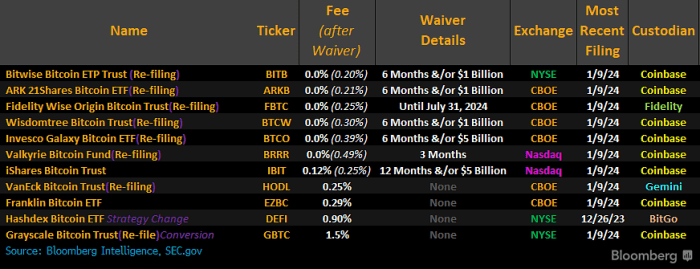

Below is a table showing the approved ETFs, their respective fees, and the custodian of the bitcoin:

Source: Bloomberg.

As you can see, all of the new bitcoin ETFs (except GBTC) have expense ratios that are significantly less than BITO. These new spot ETFs will track the price of bitcoin nearly perfectly.

ETFs work with major financial institutions like J.P. Morgan (JPM) to ensure that the net asset value (NAV) of the fund never gets too far from its trading price. These major financial institutions, known as authorized participants (APs), have the right to exchange shares in the ETF for the underlying assets and vice versa at the end of every trading day.

Unlike closed-end funds (like GBTC was previously), you will never see the new spot ETFs trade at significant discounts or premiums to their NAV.

The only real downside to the new ETFs is that the underlying bitcoin could still be hacked or lost if the custodian were to go bankrupt. Most of the new ETFs are using Coinbase as the custodian for the actual bitcoin. However, it is reported that the bitcoin held by Coinbase for the ETFs will be stored in special cold wallets, not on the exchange itself. In theory, this should eliminate the risk of losing the bitcoin if Coinbase goes under. But we are still not ready to say that the risk of a custodian bankruptcy is totally eliminated just yet.

Let’s wrap up by identifying the benefits of the new spot bitcoin ETFs:

- Actual exposure to bitcoin without the custodial issues;

- Closer correlation to bitcoin price compared to futures ETFs;

- Lower expense ratio than futures ETFs (0.25% v. 0.95%); and

- Lower commissions compared to purchasing bitcoin on an exchange.

In terms of which spot bitcoin ETF to use, we are going with iShares/Blackrock IBIT simply because we think it will be the one with the largest assets under management. There are a few economies of scale that come with larger ETFs (better buying power, lower cost structure, etc.) and some additional safety in that Blackrock is the largest asset manager in the world (something like $9.4Trillion AUM) and probably can weather any anomalies that come up or potential custody issues with Coinbase better than smaller asset managers might.

That said, we really have no problem with the other spot ETFs other than Grayscale’s GBTC which is still charging excessive management fees (1.5%).

Hopefully, this helps shed some light on the new world of bitcoin spot ETFs. And thanks to the subscribers who asked questions.

Long-time TradingWithCody.com subscribers have been in bitcoin since 2013 when it was at $150. While it looks like we were right that the ETF approval might turn out to be a sell-the-news type of event in the near term, the approval is nonetheless a historic development for bitcoin and only adds to the long-term bullish case for the cryptocurrency.