I’m finally buying a cryptocurrency for the first time since I bought bitcoin at $100

Since last year when I started selling the bitcoins I’d acquired five years ago when it was at $100, you’ve heard me talk repeatedly about how there are lots of parallels between the dot com bubble from two decades ago and the current cryptocurrency bubble.

Let’s walk through and update some of the parallels to explain why I’m starting to nibble a cryptocurrency or two again despite the fact that I think The Great Cryptocurrency Crash, as outlined in my book, isn’t over.

- Back in 1999 and early 2000, most any company with the words “dot com” attached to their name could go public using an IPO and raise billions. Small cap penny stocks could announce that they were going to launch a dot com for their company, like K-Tel Records, and their stock would go up 5-10 fold immediately.

- In 2017 and early 2018, most any company with the words “blockchain” and “cryptocurrency” attached to their name could go public using an ICO and raise billions. Small cap penny stocks could announce that they were going to launch a blockchain strategy for their company, like Riot Blockchain, and their stock would go up 5-10 fold immediately.

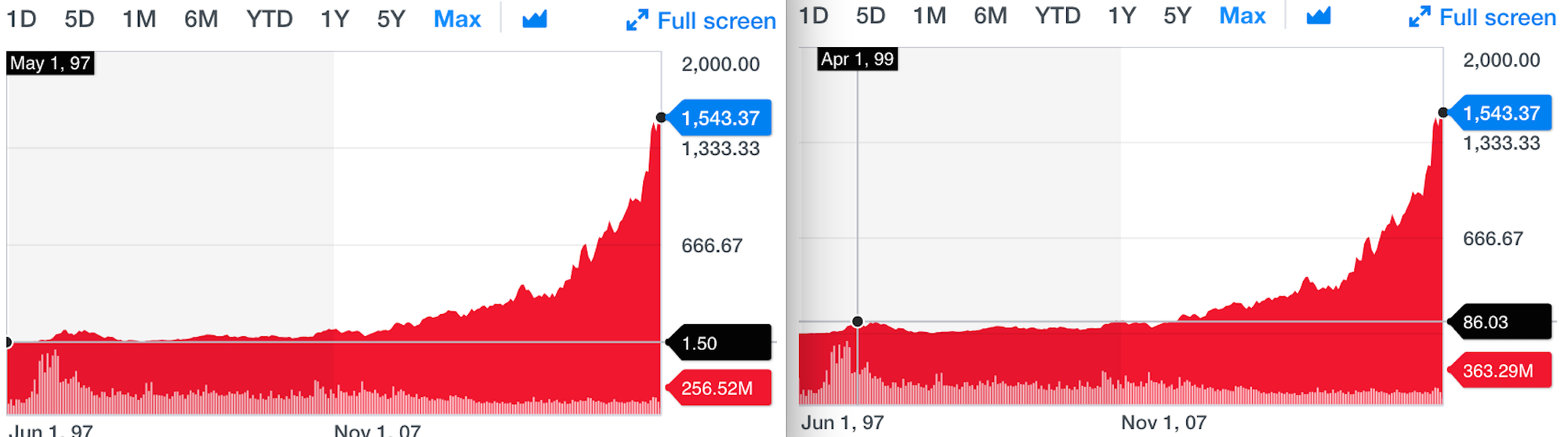

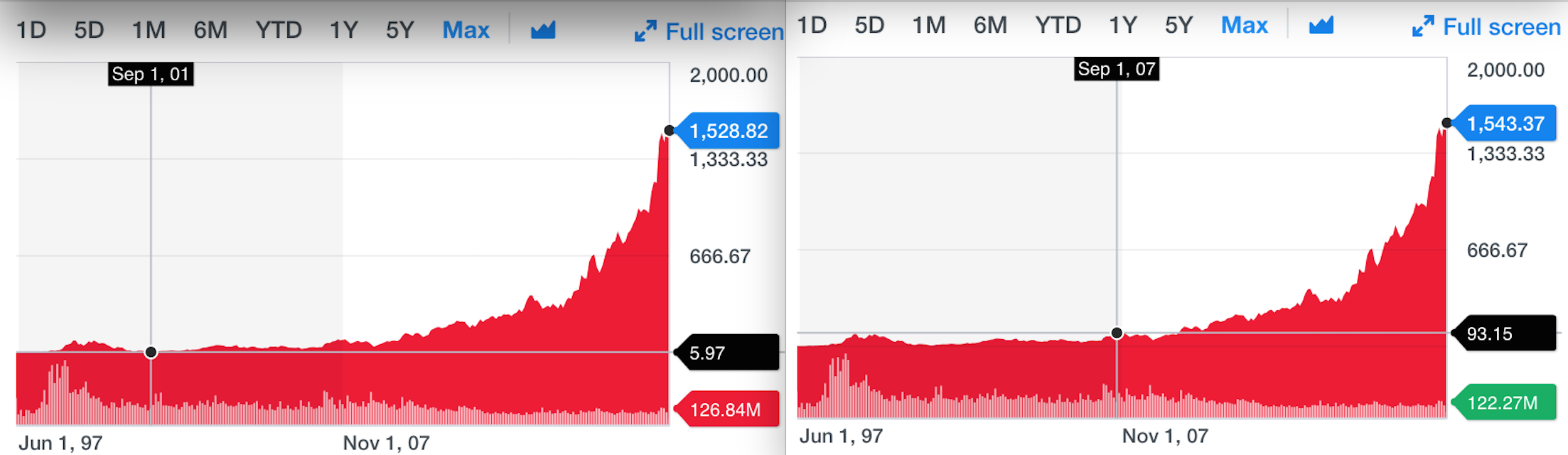

- Back in 1999 and early 2000, the good, the bad, the fraudulent dot coms had all gone up so much that their valuations were insane, as hundreds of them were worth billions. Amazon went from $1.50 in 1996 to $85 in early 2000 (see charts below). Priceline.com hit $900 per share, giving it a valuation of tens of billions of dollars.

- In 2017 and early 2018, the good, the bad, the fraudulent cryptocurrencies had all gone up so much that their valuations were insane, as hundreds of them are presently worth billions. Bitcoin went from $100 in 2013 to $19,000 in early 2018. Ethereum hit $1400, giving it a valuation of more than $135 billion.

- Then, as the bad and fraudulent dot coms went to $0 as the bubble popped from its top in March 2000 to its bottom in October 2002, even the great dot coms crashed too. Amazon fell 95% from $85 back to $5 per share before the crash was over and it took six years before it got back to $85 (see charts below). Priceline fell 99% from $900 to $8 before the crash was over. There were some spikes as the stocks collapsed, of course — they didn’t head straight down.

- Now, as the bad and fraudulent cryptocurrencies and blockchain companies are headed to $0 as the bubble has popped, even the great cryptocurrencies and blockchain companies are likely to crash too. Bitcoin has so far fallen 70% from nearly $20,000 back to $6,000 and I expect it’s headed much lower before the crash is over. Etheruem is also down 70% (so far). There were some spikes as the cryptos have collapsed, of course — they didn’t head straight down.

- Amazon actually bottomed in 2001, a full year before the Nasdaq and dot-com bottom was put in as 90% of the dot-coms that came public went to $0 (see chart above).

- It’s possible that Stellar Lumens and/or Bitcoin and/or some other existing publicly-traded cryptocurrencies could already be putting in their bottoms even if the broader cryptocurrency market itself is still going to crash further as 90% of the existing cryptocurrencies go to $0.

So here’s the story. I’m starting to nibble a tiny bit of [Subscribe to TradingWithCody.com to find out which cryptocurrency Cody has started buying].

I’ve seen several companies, ideas, blockchain ideas being built upon this underlying platform. I spent an hour on the phone with one of the platform’s founders just last week as I continue to do my homework on which cryptocurrencies and blockchain companies we will eventually start buying.

I do think I’m starting to find a cryptocurrency or two that look like could they become an Amazon and/or Priceline of cryptos. But remember even if they become HUGE in another decade or two, that they could drop much further first. And remember that cryptocurrencies have no underlying fundamental value in the way that stocks with earnings and revenues and assets do.

To read the full post, which includes more analysis and the actual name of the new cryptocurrency that Cody is purchasing, sign in or subscribe below:

Get a free copy of all of Cody Willard’s investment books, including The Cryptocurrency Revolution and The Great Cryptocurrency Crash PLUS one free month of Trading With Cody so you can see all Cody Willard’s real-time trades and all of his personal positions. Sign up now and we’ll refund your first month’s payment (first time subscribers only). You can cancel at anytime.