Can we still say “To the Moon?” The Road Ahead For Rocket Lab.

Hello all – here is the hotly anticipated analysis on RKLB from Bryce. Also, we will do this week’s chat Wednesday 3/15/23 at 12:00 p.m. EDT. Rocket on!

Rocket Lab USA, Inc.

NasdaqCM: RKLB

Share Price At Time of Analysis: $3.92

Key Metrics.

Exhibit 1

| Market Cap, curr (mm) | $1,868 |

| Total Revenue (ttm) | $211 |

| Current Gross Margin | 9% |

| Current Operating Margin | <64%> |

| Net Cash Per Share (as of 12/31/22) | $0.80 |

| Price/Sales (ttm) | 8.85 |

| YoY Revenue Growth (ttm) | 239% |

| Consensus 2023 Revenue Growth Est. | 34.8% |

| Consensus 2024 Revenue Growth Est. | 59.7% |

Source: Yahoo Finance.

Synopsis.

Since the bubble-blowing bull market of 2008-2021 had its blow off top 18 months ago, space stocks have done anything but “go to the Moon.” So is Rocket Lab a buy at these levels? While we have written about Rocket Lab fairly extensively in the past, it remains in our view one of the only publicly-traded companies likely to succeed in the space industry. Unlike almost all of its competitors, Rocket Lab has demonstrated the ability to achieve orbital-launch success time and again. After SpaceX, Rocket Lab’s Electron rocket was the second-most launched rocket in the United States last year, and the pace of the launch cadence continues to increase. Moreover, the company is expanding its total addressable market (“TAM”) by (1) creating a midsize payload vehicle known as “Neutron” to target the fast-growing constellation market; and (2) making targeted acquisitions in the space-services space which allows Rocket Lab to continue to vertically integrate its business, and thus adding to its gross margin potential. Given our view of the potential for significant secular growth in the space economy over the next ten years and RKLB’s position as the single best pure-play in the public markets, we remain convicted in the long-term prospects of the company and are certainly buyers at these levels.

The Space Economy.

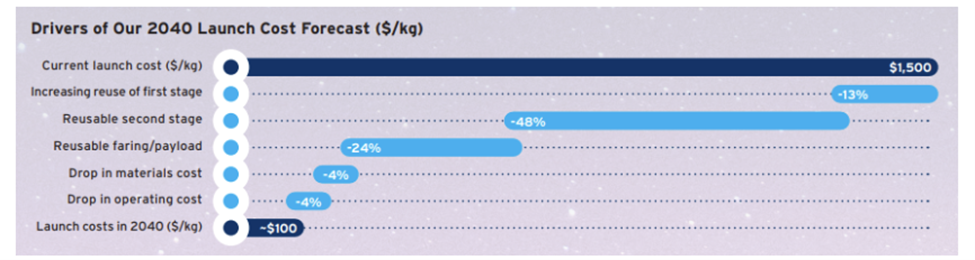

According to McKinsey, the costs of heavy launches to low-Earth orbit (“LEO”) have fallen 95% over the last 60 years, from roughly $65,000 per kilogram to $1,500 per kilogram (in 2021 dollars). The most recent drop is attributed mostly to the increased efficiency of SpaceX’s Falcon Heavy launch vehicle. As shown in the chart below, Citi estimates that this cost will drop to roughly $100/kg by 2040, further opening the door to new industries and use cases that have yet to be thought of.

These falling costs have enabled companies like SpaceX and Rocket Lab to place thousands of small satellites in the sky at relatively low cost. Despite the lackluster state of the economy, we expect these market forces will continue to propel the space industry forward in full force. Accordingly, we remain bullish on space and are continuing to look for the best companies positioned to capture share in this ever-growing industry.

RKLB Background.

Rocket Lab was founded in 2006 by CEO Peter Beck and has quickly grown to become a leader in the space economy. Rocket Lab is a launch company that designs, manufactures, and launches rockets into orbit for companies seeking to place satellites into space. Unlike most of its peers in the small-launch market, RKLB is one of the few space companies which is currently generating substantial revenue and conducting regular launches.

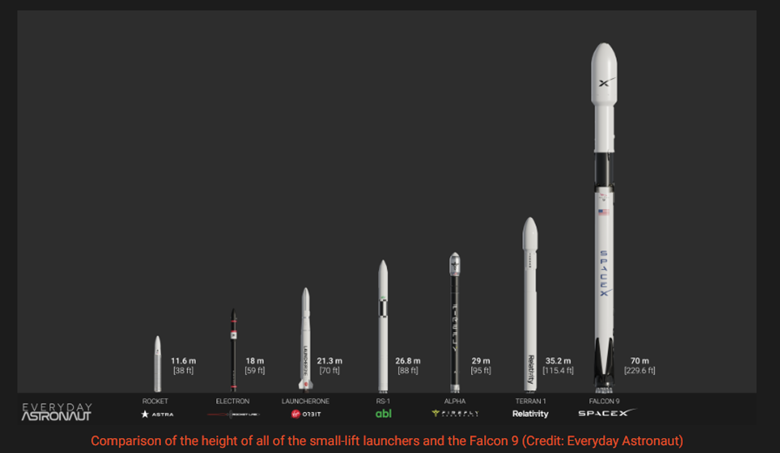

Rocket Lab’s success stems from the development of its Electron rocket, which completed its first launch in 2017. The Electron rocket stands 59’ tall, has a “wet mass” of 28,660 lbs., and has a payload capacity to LEO of 661 lbs. Since its first launch, Electron has successfully delivered 155 spacecraft to orbit across 33 missions for both commercial and government customers. Here is a comparison to scale of Rocket Lab’s Electron (second from the left) to other small-lift vehicles in development and operation:

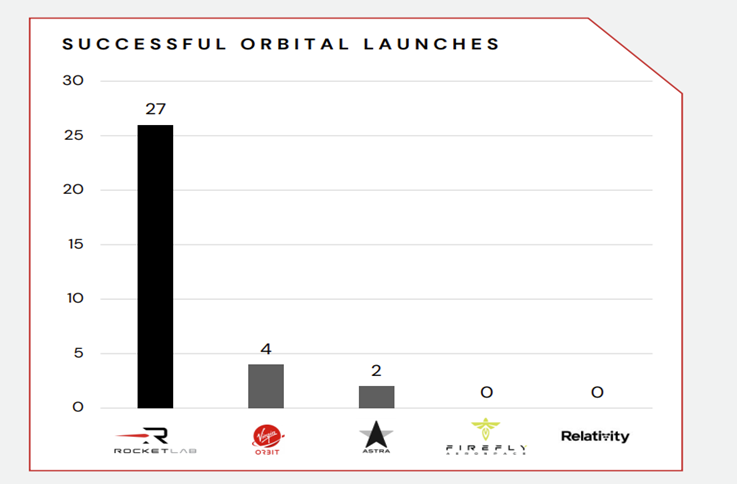

Despite significant optimism surrounding the space economy in recent years, only SpaceX, ULA, and Rocket Lab have successfully completed orbital launches in the US. ULA is set to retire its primary platforms in the next few years and SpaceX is focused on much larger payloads (carrying 22,800 lbs. to LEO). Thus, Rocket Lab is uniquely positioned to dominate the small-sat market. The below chart shows the number of successful orbital launches by small-lift vehicles in development:

Source: Rocket Lab

In addition to being one of the only companies to successfully complete orbital launches, Rocket Lab is also rare in that it owns and operates its own private launch facilities. Rocket Lab operates a launch complex in New Zealand which historically was the location of all its launches. However, in 2022 Rocket Lab opened its second launch complex in Virginia (next to NASA’s facility) and successfully launched the first rocket from this location in January 2023. Owning and operating its own launch complex gives Rocket Lab much greater flexibility and control over its launch program and should also provide long-term cost savings to the company as Rocket Lab gradually increases its launch cadence.

RKLB’s Execution and Growth Plan.

As discussed, Rocket Lab has done an excellent job executing on its goal of becoming the leading company for sending small payloads into orbit. Despite a fairly challenging global economy, inflation, and geopolitical tensions, Rocket Lab continues to steadily increase its launch cadence month after month. In 2022, Rocket Lab successfully completed 9 Electron missions at an average price of $6.7mm per launch. This is an increase over the 6 missions completed in 2021 and 7 in 2020, and the company expects to complete 15 orbital launches in 2023.

In addition to its core launch business, the company has also vertically integrated by making targeted acquisitions in the space-services sector. These acquisitions have been focused on companies that make satellite buses, components, and software for space systems. Because Rocket Lab is uniquely positioned to offer launch services for small satellites, it can cross-sell these services to its existing and growing customer base. The company reports that 38% of addressable launches in 2021 globally featured technology created by Rocket Lab’s subsidiaries. Additionally, the services market gives Rocket Lab a near-term growth driver with substantially higher gross margins than its traditional launch business.

As Rocket Lab continues its growth trajectory in launch, we see the services segment as providing a relatively more stable source of growth and cash flow going forward, as this part of the business could generate significantly higher gross margins for the Company. Rocket Lab has already shown remarkable success with its own line of satellite busses, known as “Photon,” one of which was recently used as part of NASA’s Artemis mission which seeks to return humans to the moon.

While Rocket Lab’s existing launch and services businesses are enough to separate it from the competition, the real upside comes from the expected introduction of its mid-size launch vehicle, known as Neutron. Following SpaceX’s lead, in March 2021 Rocket Lab announced plans to increase its TAM by creating a larger vehicle that could take more weight into orbit and also be reusable. Neutron will have a 13,000 KG payload and will be tailored for commercial and U.S. government constellation launches and ultimately configurable for and capable of human space flight. Rocket Lab will build and launch the Neutron rockets from its location near the NASA Wallops Flight Facility in Virginia. The company is currently building out these facilities and expects first launch of the Neutron rocket no earlier than the end of 2024. Clearly, Neutron presents a substantial growth opportunity given the growth in the number of constellations in LEO and will leverage Rocket Lab’s existing technology and expertise with Electron.

Rocket Lab’s operational excellence, sophisticated technology, and position as the only viable alternative to SpaceX have landed it high marks with US government officials. For example, the US Space Force awarded Rocket Lab a $24.35 million contract for the development of Neutron’s upper stage. As further evidence of Rocket Lab’s dominance in the governmental market, Rocket Lab recently opened a wholly owned subsidiary in Australia that will work with the Aussie government as it has pledged to triple the size of the country’s space sector by 2030. Because Rocket Lab has established itself as a reliable provider of small-launch services for the US government’s civil and defense needs, it should be a beneficiary of increased space spending by governments around the globe.

Despite this success, Rocket Lab has its work cut out for it as it seeks to continue to execute on its growth strategy. As of the end of last year, the company had a backlog $503.6 million, and it will take continued operational excellence to successfully work through this backlog. That said, view Rocket Lab’s large backlog of orders as a further sign that Rocket Lab is dominating its competitors in the small-launch and space-services markets.

Our Model.

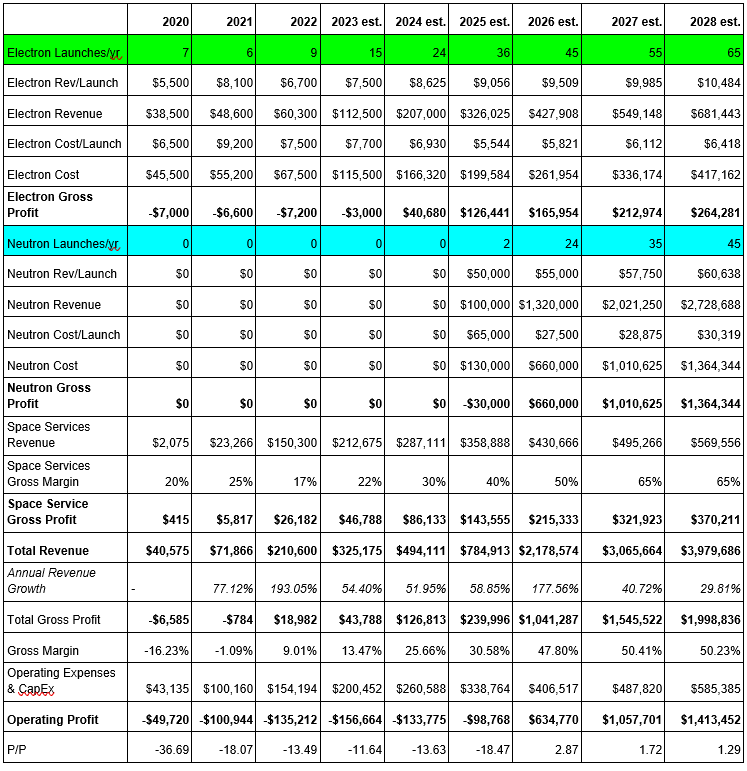

This model is built off of Rocket Lab’s guidance given at its September 2022 investor day and their update during the 4Q ’22 earnings call in February.

For the topline, our model assumes that Rocket Lab executes on its current plan to complete 15 Electron launches in 2023, and we are modeling steady increases for Electron going forward as the company moves toward its ultimate capacity of 120 launches per year. Additionally, we are modeling Neutron coming online in 2025 and quickly ramping to 24 launches per year in 2026, which is in line with company guidance. While the pricing and cost of Neutron is presently unknown, our model assumes cost per kilogram of roughly $6,250 which would be about 14% higher than current pricing for SpaceX’s Falcon 9. Because so much of the value of the company depends on the success of Neutron, there is significant risk if development of the rocket gets pushed out or is ultimately unsuccessful. However, given that development of Neutron is already underway and Rocket Lab has proven its technology and operational excellence with Electron, we are willing to take the company at its word when it comes to Neutron’s timeline. We’ve also had the opportunity to speak with some of the folks over at Rocket Lab’s IR department and feel more confident in the company’s growth plan and relative competitive advantage because of those conversations. Additionally, we are modeling steady increases in gross margin across the board as costs come down with incremental increases in launch cadence and as pricing power improves with the absence of any real competitors for Electron’s small-launch services.

In terms of costs, we are forecasting operating expenses and CapEx to increase roughly 30% per year as R&D continues on Neutron. As R&D is complete for Electron, we do not expect substantial increases in operating costs for that side of the business. Ultimately, we are forecasting roughly $200mm in additional operating expenses and CapEx related to Neutron development over the next 4 years which we think is in line with company estimates.

Discussion of Downside Risks.

To begin, Rocket Lab is not profitable and should be viewed as a speculative, venture-capital type of investment. Our primary concern at this point is the availability of capital to fund Rocket Lab’s development of Neutron and its other growth plans discussed above. As mentioned, Neutron is the key driver of our valuation and that segment is not expected to generate meaningful revenue until at least 2026. In the meantime, we expect that Rocket Lab will continue to generate operating losses as it continues to ramp up its existing launch business and simultaneously develop Neutron. Given the current rate environment and the lack of availability to attractive financing, Rocket Lab could be adversely affected if it is forced to raise capital in the near term. However, we believe this risk is mitigated for two reasons: (1) the company’s current cash balance and burn rate give it roughly 29 months of operations before it needs to raise money; and (2) Rocket Lab’s unique position as the only alternative to SpaceX in the US should allow it to raise money at relatively more attractive terms than its peers if needed. Our view is that the US government needs Rocket Lab to continue on its path so that the government is not stuck with SpaceX as the sole company offering orbital launches. Assuming Rocket Lab can wait for two years or so before it needs to raise money, that would allow the markets to recover and hopefully allow Rocket Lab time to raise cash on more favorable terms.

Below is a table showing our estimate of how much time Rocket Lab has left before it needs to raise additional capital:

| Balance Sheet | 12/31/21 |

| Cash & ST Invest | $471,794.00 |

| LT Debt | $100,043.00 |

| Net Cash | $371,751.00 |

| Annual Cash Burn | $150,000.00 |

| Months Remaining at Current Burn | 29.74008 |

However, this assumes that Rocket Lab’s burn rate stays at or close to where it was for 2022. While this might seem unlikely, our model suggests that Rocket Lab’s incremental revenue growth from Electron and space systems, along with improving gross margins for both, should offset the increased operational expenses we expect to be attributable to Neutron’s development. Obviously, the risk is that Rocket Lab ends up spending more money developing Neutron than it currently projects and is forced to raise capital sooner rather than later.

Although we feel Rocket Lab has clearly beaten its competitors in the small-launch space, it will likely face some level of competition from SpaceX for the mid-size launch market that Neutron will target. SpaceX has established itself as the launch leader and will continue to drive innovation and likely bring down costs/kg over the next few years. If Neutron is not as economical, safe, and efficient as SpaceX’s Falcon 9 or Starship, it may struggle to be competitive in the mid-size launch market.

Additional risks include the possibility of a global contraction in the space economy and/or a reduction in space spending by global governments. Although we feel the space economy as a whole is somewhat recession-proof, Rocket Lab could face headwinds if future governments decide to reduce spending on speculative space projects (nobody wants to spend money going to the moon if we cannot pay for education). However, we think the trend amongst world governments is clearly moving in the direction of increased focus and attention on space as the next frontier in the defense environment. The United States’ current weapons systems, communications platforms, and intelligence devices all are highly dependent on reliable access to satellites. Accordingly, we do not expect to see a pullback in global space spend, at least in the defense sector, any time soon.

Summary.

As mentioned, Rocket Lab is still speculative, and at these levels the market is basically pricing in a future capital raise/dilution of the current shareholders at very unfavorable terms. However, Rocket Lab’s position as the leader in small-launch, with the enormous upside presented by Neutron and the high-margin services business presents RKLB as an attractive buy at these levels. We think Rocket Lab has enough capital to weather this current storm in the equity markets and will come out as one of the clearest winners in the space economy.