Cody’s Latest Positions Round Up

Here is a list of my latest positions with updated commentary and ratings for each position. I’ve broken the list into Longs and Shorts. And from there, I’ve broken down each list into refined categories in order from the largest positions within each category to the smallest. I also give each stock a current rating from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.”

I added another new name to my portfolio last week as I’ve started buying Wall Street’s most-hated sports brand, Under Armour. That makes a total of four new names in my portfolio over the last 90 days as I finally started seeing some pitches that I had been patiently waiting for.

So here’s the list:

Longs –

- Forever assets and other permanent holdings –

- Media and other private investment/business holdings (9+ because betting on yourself and running a business is always a best bet)

- Real estate, including land and the ranch I live on in NM (8)

- Physical gold bullion & coins (7)

- Primary stock exposure portfolio

- AAPL Apple (8) – I kept telling you guys that Apple’s next moves would be mostly based upon how well the iPhone X sells. As I wrote in the prior Latest Positions Round Up: “If the iPhone X sells well, the stock is likely to top $175 next year. If the iPhone X sells extremely well, the stock will likely top $200 next year. And if the iPhone X bombs — we’re looking at $140 or so next year. I’d bet on the iPhone X selling like hotcakes and that $200 is likely next year.” Upon its release for pre-ordering a couple weeks ago, Apple told everybody that the iPhone X demand is “off the charts.” If the next quarter or two prove out that the iPhone X sold like hotcakes, I do think the $200 target is still quite likely.

- FB Facebook (7) – What another monstrous quarter from Facebook, doing eleven figures (more than $10 billion) in sales over the last 90 days. The company is proactively stepping up its spending on network security and — especially since social networks depend by definition upon secure networks — is a very important thing to do. Protect your customers! With a $500 billion market cap, Facebook is one of the most valuable and powerful companies on the planet. Not sure I’d chase it right now, but then again, this stock has hardly paused on its way from $20 to $180 since we first bought it five years ago, so who knows if or when we’ll get the next big pullback in this stock.

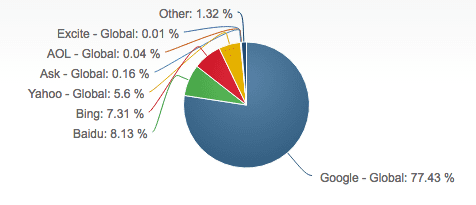

- GOOG/GOOGL Google (7) –Google is a complex conglomerate. So many irons in the fire, but also so many winners already. Did you know that 11 million children watch YouTube Kids every week? Did you know that people search the web nearly 7 billion times per day and that Google’s share of search actually climbed another ten percentage points in the last year, to 77% of the market?

- AMZN Amazon (8) – Amazon reported yet another amazing quarter or growth and the Amazon juggernaut just keeps juggernaut-ing. At its current projections of 30% per year topline growth from the $180 billion that Amazon will do in sales this year, by 2020 Amazon would be the first company to do half a trillion dollars in annual sales. For years, I’ve said that Apple, Google and Amazon would be the first trillion dollar market cap companies and I still believe that. Amazon might even sneak up there and get to $1 trillion market cap before Apple does.

- NVDA Nvidia (6) – The brand is over-loved. The stock is over bought. The hype is over the top. Interestingly, the sellside analysts covering Nvidia expect topline growth to slow from 30% this year to just 10% next year. The market is pricing in much higher growth than just 10% next year, but the fact that the analysts are still at only 10% growth estimates, means that analyst estimates should be heading higher. That said, with a stock that’s up 1000% in the last five years, Nvidia sure as heck better keep delivering the strong growth and profitability or the stock will get cut in half. I recently trimmed some more of this long-held big winner and am a bit nervous about the stock heading into its earnings report this week.

- SNE Sony (7) – When I first bought Sony a couple years ago when it was around $17 or so, I noted that the company’s market cap was less than $20 billion and that I thought it could be a $100 billion market cap in coming years. The company is now over $60 billion. The upside now that the stock has tripled isn’t as exciting as it was, but I do think this stock can get to my $100 billion market cap. I’d likely trim back and/or start selling all of this stock if and when it gets closer to that $100 billion market cap soft target.

- AXGN Axogen (7) – Another beautiful earnings report from one of our long-held big-winners — Axogen. We paid less than $5 per share two years ago when we started investing in this stock and today it’s above $23. Take a read of Axogen’s earnings call transcript and you’ll see a remarkable contrast of confidence vs the confusion in the Impinj call. Axogen’s margins, growth, penetration and business overall has continually improved even as they set the bar high. Here’s a sample: “As in prior quarters, our revenue growth is continuing from both active and new accounts as we continue to build and strengthen our commercial team. This increased focus on commercialization will allow us to drive penetration of our existing markets, expand into new applications, introduce new products and build global markets. These efforts along with the continued development of our certain education events, market awareness activities and further development of clinical data are helping surgeons develop confidence in the adoption of the AxoGen platform for nerve repair.”

- AMBA Ambarella (6) – With consolidation in the chip business accelerating (see Broadcom bidding for Qualcomm in what could be called the biggest takeover deal in the history of technology as one of dozens of examples), I’m surprised that we don’t hear more rumors that Ambarella could be a takeover target. The stock has rallied strong in the last couple months since reporting a disappointing earnings report and I’m still a bit concerned about the company’s lack of execution in the last year. I’m leaning towards going ahead and taking our profits on Ambarella and moving on from this name.

- FSLR First Solar (7) – Yet another one of our stocks that has been on fire lately and reporting very strong fundamentals in their earnings reports. That said, we bought this stock when it was hated and now I just recently trimmed some since it’s so loved.

- LGFA/LGFB Lion’s Gate (6) – What I wrote in the most recent Latest Positions Round Up about this stock was: “New highs for this stock recently but I’m wondering if we’re getting a bit late in the Golden Age of Great TV Content cycle. That is, how many more shows can Amazon, Hulu, Netflix, the old cable companies and the even older TV networks possible put out in the market place and hope to make money? Netflix will be okay and so too with Amazon, I suppose but spending on TV shows is likely peaking soon and this might be another name to sell sooner rather than later.” We took some profits on this one and the stock is down 20% since then but I’m still leaning towards selling this one sooner rather than later.

- TWTR Twitter (6) – Nice pop after a strong earnings report and, as a surprise to no one, I trimmed some of this one after the big rally. I also think that Twitter could end up being an acquisition target before 2018 is over.

- PI Impinj (6) – The market was markedly unimpressed with Impinj’s earnings report. I’m trying to be patient in this stock, as I’ve long warned us that we would have to be. Patience is strongly negatively correlated with the pain of seeing a stock get hit like this one did. But I’m going to listen to my earlier words of warning that it would require patience and stick with this name for now. As I said in the most recent Latest Positions: “We should be able to see some signs that it is becoming the de facto standard RFID solution in the marketplace over the next 12 to 18 months. Steady as she goes for now.”

- SEDG SolarEdge (7) – Solar Edge has tripled off its bottom from a year and a half ago as the company has won new supply deals and estimates have continually been raised. Solar is my favorite revolutionary energy sector and SolarEdge is doing a great job executing on their plans.

- Palo Alto Networks (9) – Boring stock since I bought it. I’m thinking this one might be ready to take off though. I’m likely to nibble some more on this one soon. Cybersecurity spending budgets at major enterprise that has any serious web business are going higher. See Facebook’s commentary above, for example. This is my favorite cybersecurity company.

- INTC Intel (8) – Woohoo, just a few weeks after we bought this stock, it has caught fire and broken out to multi-year highs. Intel’s a very profitable company and has a lot of exciting potential new revenue streams and I think this stock could triple from where we first bought it and get to $100 per share in the next 2-3 years.

- VZ Verizon (8) – WVerizon’s been trashed in the last week after Sprint and T-Mobile couldn’t agree on terms to merge. Four competitors is less profitable than three. No change for me on this stock just yet. I might buy more around $44 or so. No rush — this a play on Verizon being set to dominate 5G in the US regardless of whether there are four or three major wireless carriers in the US.

- BB Blackberry (7) – Bored with this one already. The cybersecurity enterprise Android angle should work out well for this company in the next few years and any interest in their smart automotive platform would be a kicker.

- SNAP Snap (8) – Earnings will be out tonight. Any semblance of stronger than expected user growth and/or better monetization will likely get the stock to pop 5% or 10%. Any miss on either the user growth or the topline will likely mean a 10-15% hit in the stock. This is a tiny position and I’m in no rush to make a move to buy more or panic out of it.

- Under Armour (8) – I’ve just started buying Wall Street’s most-hated sports brand, Under Armour while it’s been under $11 per share. This one could take some time to get back to its $50 levels of two years ago, but I do think the risk/reward here strongly favors owning this stock while it’s trading at less than 1x sales. Over the next two to three years, the stock could drop another 50%, but it could rally 300%.

- TST The Street (7) – Want to see some revenue growth and more cash flow generation in the next earnings report or two. Holding this tiny position steady for now.

- Primary short portfolio

- P Pandora (8) – Haha, this is actually what I wrote about Pandora in the most recent Latest Positions Round Up: “Pandora radio sucks. Their subscription product is worse. And the company’s trying to compete against Google, Amazon, Apple and Spotify. I remain short even when the stock hits new lows.” Since then, the company reported another terrible quarterly earnings report and the stock sold off yet another 30%. I’m still short but might cover a little bit of this one soon, just to be disciplined and lock in some of these huge profits.

- Biotech ETF IBB (8) – The major biotech companies’ earnings were pretty terrible this past quarter and guidance was bad too. I’m thinking it might be time to build this IBB short position up a bit more.

- SouthKorean ETF EWY (6) – Okay, okay, I keep saying I’m going to cover this loser short and move on, and I am indeed going to do that this week.

- HLF Herbalife (7) – Another disappointing earnings report as Herbalife’s cockroaches seem to come out every 90 days. In between those disappointing earnings reports though, Herbalife does all kinds of hyping and financial gimmick-ing and the stock hangs tough. I’m sitting tight on this name for now.

- Small cap ETF IWM (8) – The IWM hasn’t been able to break through $150 for many months now and it looks like it might fail there again. I might put a few more shares on this short as a hedge in the next few days.

Remember: I wouldn’t rush into a full position all at once in any of these stocks or any other position you’ll ever buy. Patience and allowing the market and time to work to your advantage by buying in tranches is key. Maybe 1/3 or 1/5 of whatever you might consider to be a “full position” in any particular stock. And I wouldn’t ever have more than 5-15% of your portfolio in any one stock position at any given time. The younger you are and/or the higher the trajectory of your career income, the more concentrated and risk-taking you can be with weighting in your portfolio. But spread your purchases and your risk out over time and over a several positions no matter your age or risk-averse level.

Scaling into a position using an approach of buying 1/3 or 1/5 tranches over time is how I build my personal portfolio positions, but there’s no scientific way to go about investing and trading. Sometimes you have to pay up for the latest tranche but I try to be patient and wait for a temporary sell-off to add to the existing position.

** NOTE FOR NEW SUBSCRIBERS:

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.

You can find an archive of Trade Alerts here.