Cody’s Latest Positions, Scutify rocking, and a hyped-up Ebola stock trading idea

Join Cody Willard at the Las Vegas Trader’s Expo Thursday, November 20, 2014 from 8:30 am – 9:30 am for a presentation that will help you become a better investor and trader for the rest of your life.

10,000 Days: The Shocking Concept That Will Change the Way You Trade and Invest Forever

Why are you risking your hard-earned capital investing and/or trading in the first place? Whether you’re daytrading, swing trading, or taking a buy-and-hold approach to your stock market interactions, it’s critical to look out over the next 10,000 or more days. 10,000 days is about 30 years, and unless you are over the age of 70, you probably need to be thinking about your money, your portfolios, and your entire net worth in terms of the next 20, 40, 50 years or more.

Cody Willard is the editor of www.TradingWithCody.com, where he posts all his stock and option trades from his personal account. He is the co-CEO of www.Scutify.com and the principal of CL Willard Capital. Mr. Willard was an anchor on the Fox Business Network, where he was the co-host of the long-time #1-rated show on the network, Fox Business Happy Hour. He was a former hedge fund manager, and his stock picking ideas and economic outlooks have been featured on NBC’s The Tonight Show with Jay Leno; ABC’s 20/20; CBS’ evening news; CNBC’s SquawkBox; Jon Stewart’s The Daily Show; as well as in the Financial Times, the Wall Street Journal, the New York Times, and many other outlets.View More Experts

HYPED-UP EBOLA STOCKI’ve explained many times why I don’t trade biotech, in short because I know too many brilliant doctors and Ph Ds who can’t successfully navigate the approvals and opportunities and costs and so on that go on in the industry. But you also know that I’ve been keeping an eye out for hyped-up bubbled-up “trendy” stocks so that we can either short them or buy puts on them.

Which brings me to Tekmira Pharmaceuticals TKMR and the big move its made here off the ebola scare.

I’ve no idea if they’ve got any viable treatment for ebola in the works or not, but my gut tells me that this stock is up on hype similar to how DGLY was up a few weeks ago on Ferguson/Wearable Cop-Camera hype.

I’m not making the trade myself for the aforementioned reasons of my staying away from a biotech stock, but Tekmira TKMR does have options available and if you’re a risk-taker kind of reader, I thought I might flag the TKMR puts dated out six months or more and with strike prices around $20-24 or so.

Prayers to all affected by the ebola outbreak, and I hope this thing gets contained asap globally and in the US. Ebola should be on our radar as a possible Black Swan. But I don’t think TKMR’s huge move here is going to work out well for new shareholders.

SCUTIFY ROCKINGScutify has just literally created the Social Trading industry. We are the first Social Network platform where you can actually trade stocks and options (and you’ll get great execution, customer service at only $3.49 per stock trade from our partners at Tradier).

Did I mention that you don’t ever have to leave the Scutify platform to buy or sell a stock or option. Learn more –http://www.scutify.com/trade.html

Nice plug from our partner, Tradier: “Today Scutify is one of the fastest growing Social Trading Platforms. It’s an ‘One-stop Social Trading’ experience.” http://blog.tradier.com/blog/2014/09/scutify-is-redefining-social-trading.html

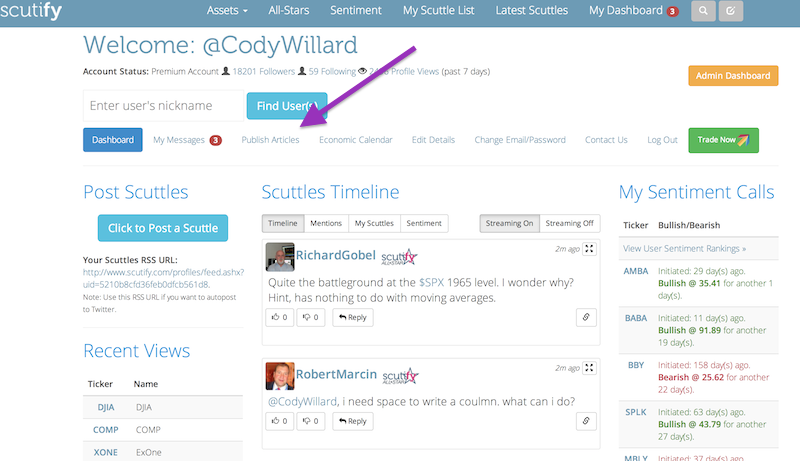

We also just added the ability to post full articles on Scutify. Just go to your dashboard (http://www.scutify.com/scuttle…) and click on the “Publish Articles” tab at the top as shown in the picture below.

And here’s a well-written recent Scutify review: “Scutify provides several tools that help users make informed trading decisions. Its research capabilities, and ease of use, make Scutify an incredibly valuable app.” http://www.economix101.com/#!f…

LATEST POSITIONSHere’s a list of my latest positions (I’m removing the aforementioned four positions that I’m closing out this week, even though I’ll be taking a few days over the next rest of this week to close them). I’ve broken the list into Longs and Shorts. And from there, I’ve broken down each list into refined categories in order from the largest positions within each category to the smallest.

Finally, I give each stock a current rating from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment” (there will never be a 10 rating, because there is no such thing as a perfect investment, of course).

Remember: I wouldn’t rush into a full position all at once in any of these stocks or any other position you’ll ever buy. Patience and allowing the market and time to work to your advantage by buying in tranches is key. Maybe 1/3 or 1/5 of whatever you might consider to be a “full position” in any particular stock. And I wouldn’t ever have more than 5-15% of your portfolio in any one stock position at any given time. The younger you are and/or the higher the trajectory of your career income, the more concentrated and risk-taking you can be with weighting in your portfolio. But spread your purchases and your risk out over time and over a several positions no matter your age or risk-averse level.

So here’s the list:

Longs –

- Forever assets and other permanent holdings –

- Media and other private investment/business holdings (9+ because betting on yourself and running a biz is always a best bet)

- Real estate, including land and the ranch I live on in NM (8)

- Physical gold bullion & coins (8)

- BitCoin (7) *Not a meaningful amount

- Primary stock exposure portfolio

- Apple (8)

- Facebook (8)

- Google (9)

- Intel (7)

- Ambarella (8)

- First Solar (8)

- InvenSense (8)

- Sandisk (8)

- Amazon (7)

- Yelp (8)

- Stratasys (7)

- Sony (9)

- Calgone (7)

- Lindsay (7)

- Himax (7)

- IXYS (6)

Shorts –

- Primary short portfolio

- EWY (9)

- JRJC (6)

- Apollo (8)

- Barnes & Noble (8)

- GSV Capital (6)

** NOTE FOR NEW SUBSCRIBERS:

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

First, step back and catch your breath before moving any money anywhere and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look below at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Weekly Trades that I’ve personally been scaling into.

You can find an archive of Trade Alerts here – http://tradingwithcody.com/category/trade-alert/.