Deep thought of the day: Tech revolutions take decades

At 2pm ET today on The IAm Cody Willard App, I’ll be Live Streaming today’s Trading With Cody conference call, answering questions about individual stocks, the markets, the economy, politics and anything else that comes up. Click here to download The IAm Cody Willard App.

I’ll also take questions over the phone on our conference call line. (Dial-in: 641-715-0700 Access Code: 709981), in the Trading With Cody chat room or just email us your question to support@tradingwithcody.com.

Here’s a Trading With Cody Deep thought of the day.

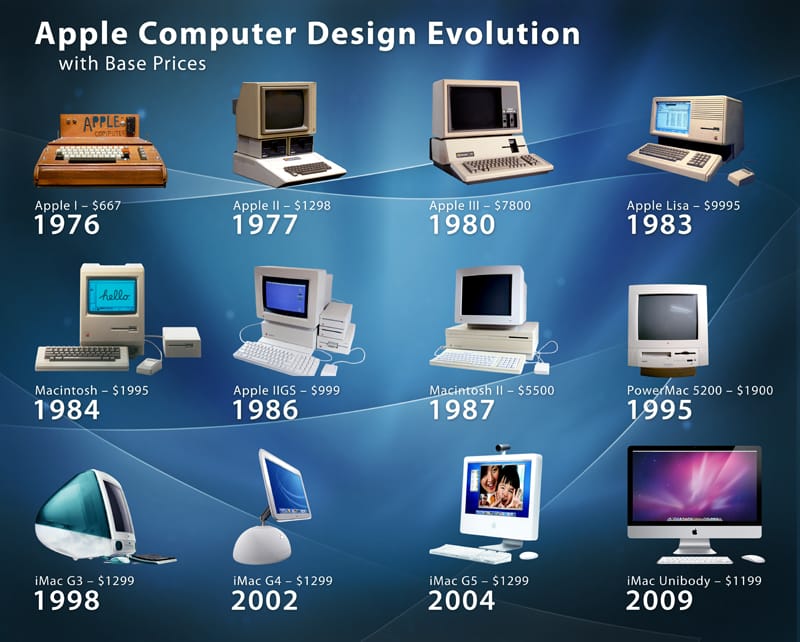

Ever think about just how much the personal computer changed over the decades?

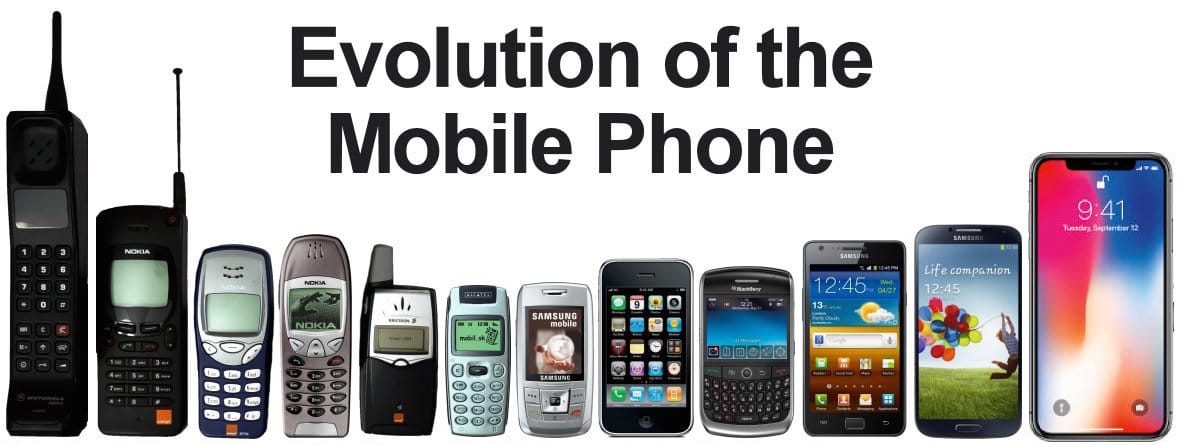

How about the mobile phone over the decades?

And so here’s the deep thought. Imagine what the next two or three decades will mean for the smartphone, the app, the PC and every other tech industry.

Will the concept of a personal computer even exist anymore? After all, in another twenty years or so, all of our smart devices, Internet of Things, cars, displays, clothes, shoes, implanted wearables and so on — they will have more processing power than the iPhone X. Billions of devices will be used every day and each of those devices, screens, wearables, IoTs, etc will be more powerful than the world’s best cloud supercomputer networks — in fact many will do their instantaneous processing in those cloud supercomputer networks.

Will we even hold a smartphone up to look at its screen? Will we talk outloud to every device, each of which knows us from our Amazon, Facebook, Google, Apple and/or some other personalized accounts? Will we take selfies or just tell our cloud assistant to post the pictures from the satellites and drones and stationary VR cameras to our public profiles?

As for Snap, recall that just yesterday I wrote: “Any semblance of stronger than expected user growth and/or better monetization will likely get the stock to pop 5% or 10%. Any miss on either the user growth or the topline will likely mean a 10-15% hit in the stock. This is a tiny position and I’m in no rush to make a move to buy more or panic out of it.” They missed user growth and topline. Stock’s down 15%. I will probably give the company one more quarter before bailing on the stock. Might even nibble a little bit more if it gets to $11 or $10 before the next earnings report. Just going to sit tight on this small position for now.