Do We Have To Have A Catastrophic Ending To The Giant Bubbles That Popped?

In the ten days since I sent out the post called “Top 5 Reasons For A Market Sell-Off”, here’s an overview of the broader action in the markets:

ARKK is down 10%

Bitcoin is down 5%

SMH is flat

Nasdaq is 1%

S&P 500 and DJIA and Russell 2000 (small cap index) are up 2%.

It’s clear looking at those numbers that speculative tech stocks have been the hurting lately. I do find it interesting that the small cap index has been able to perform equal to the broad big cap indices but I think that might be in large part because of institutions buying the indices as they rotate out of individual speculative tech names.

So much of the recent rally action off the early June lows was based on short covering. It just got so easy to short stocks and so hard to own stocks during that crashy action from January to early June that the shortside got crowded. That’s not the case any more as the shorts squeezed themselves and then the retail meme and momentum trades piled in and now I’m not sure the shorts are crowded. I think there’s a lot of stocks, thousands of them, that have gone up 30-150% during the recent rally action that will return to their recent lows and many will continue on to zero from there.

I was talking about how Wall Street found a SPAC under every rock back at the top and that reminded me of something I wrote back when everybody else on Wall Street was throwing SPAC parties:

‘But it’s not just about earnings, it’s also about valuations, right? At least, it will be again at some point. Earnings and valuations matter.

My problem is that if you’re not investing based on fundamentals and you’re not even bothering to analyze earnings trends and valuations, then you’re truly betting that you’ll be able to sell to a great fool at some point. I don’t want to bet that there are bigger fools out there. I want to invest in Revolutionary companies at terrific risk/reward set-ups.

So what will make the markets go down one day? What’s the downside catalyst? Heck, it could be fear of another wave of Covid, it could be a war, it could be a Black Swan we’re not looking for or it could just be an exhaustion of buyers.

I don’t know, but I do know there’s no better time to re-read some hard core value investing lessons from Warren Buffett’s teacher, Ben Graham, which is what I’ve been doing. I’ve been re-reading his book “The Intelligent Investor” which I’d marked up back in 2006, when I had sold every long except for Apple, Google and Microsoft (as I explained to Brianna Golodryga on CNBC back at the time):

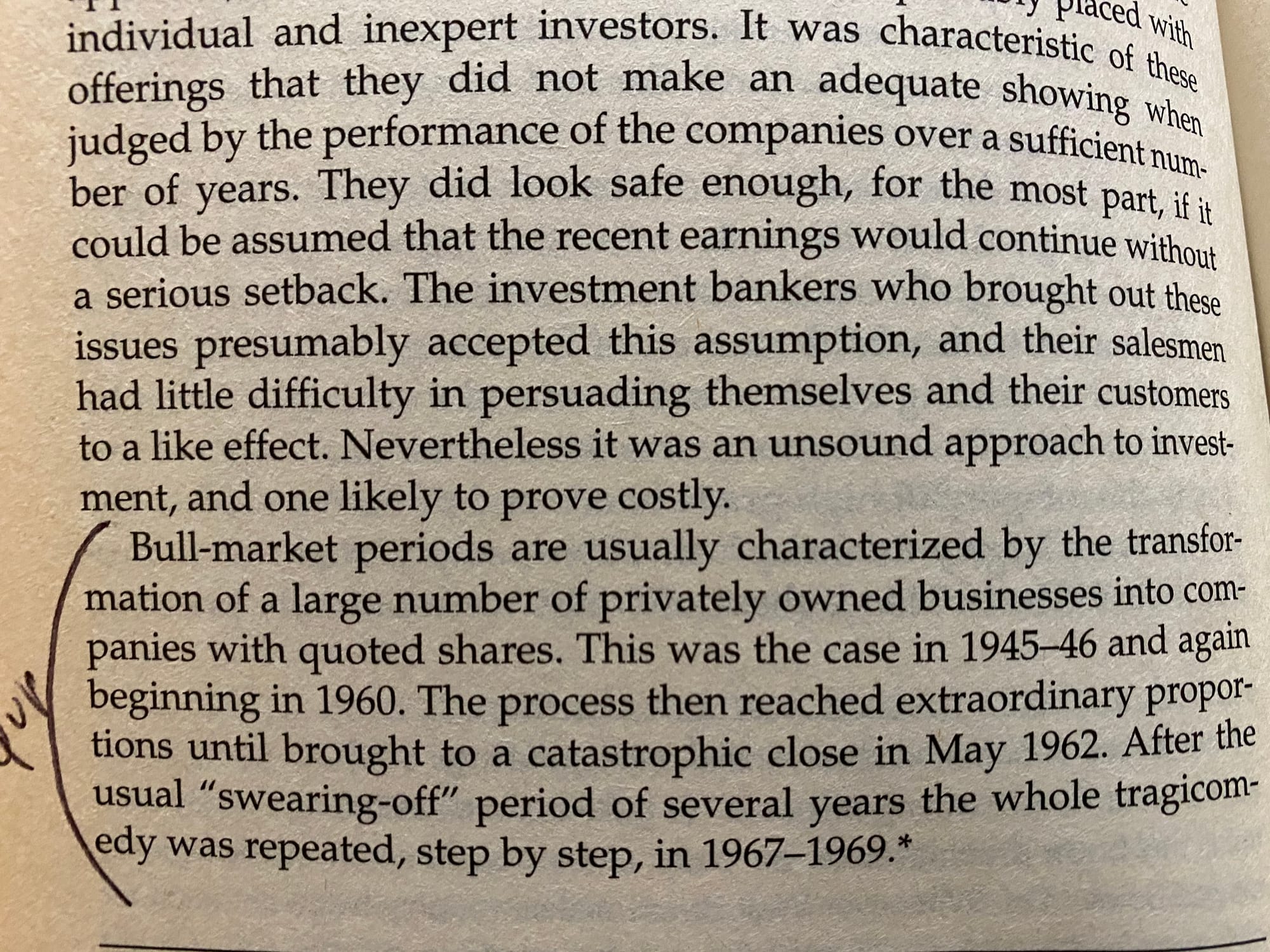

Notice the part there I’d put “yup” next to:

“Bull-market periods are usually characterized by the transformation of a large number of privately owned businesses into companies with quoted shares. The process then reached extraordinary proportions until brought to a catastrophic close. After the usual ‘swearing-off’ period of several years the whole tragicomedy was repeated, step by step.”

Does that sound familiar in a time of the ongoing SPAC bubble? See the next part about there being a catastrophic close to such bubbles?

Ben would tell us to nip this greed bug that so many traders have right now in the bud and to stick with doing our homework and being disciplined about the risks we take with our capital.’

I wonder if the recent 20% pullback in the S&P 500, the 70% drop in ARKK and the ongoing economic malaise is enough to call it a “catastrophic” close to the recent stock market and asset bubbles that might have been as big of bubbles as any bubble ever bubbled. Do we have to have a catastrophe to put a period at the end this bubble of bubbles? Feet-to-fire, there will be more pain the broader markets and economy before the next Bubble-Blowing Bull Market takes off. But then again, things usually do work out for the US and our stock market.

In the meantime, there is no stopping the next multi-trillion dollar trends of The Space Revolution (Rocket Lab remains my favorite publicly-traded space stock, but there are dozens that will be coming public in the next three years that we’ll be ready for), The Reshoring Revolution (Intel, Rockwell Automation remain my favorites on this trend) and The Biotech/Life-extending Revolutions that I’m working hard on every day.

To remind you, here are the Top 5 Reasons For A Market Sell-Off, as I wrote them ten days ago:

1. We had an historic Bubble Of All Bubbles that just popped over the past year. I don’t think the odds favor a quick resolution in the midst of a new Federal Reserve/inflation paradigm.

2. Valuations for most of the former high-flyers that have crashed and then bounced are still too high to be good risk/reward for the long-term.

3. Everyone seems to agree that the Fed can and will simply go back to easy money policies in two months or six months or something. I don’t think the Fed/inflation playbook that will work for the next 10 years or longer is the same playbook that has worked for the last 40 years.

4. Crypto’s crash doesn’t seem like to be over, and I don’t think the tech stock market can bottom until crypto finishes washing out. Too many people who own cryptos that are 70% to 95% off their all-time highs from last year are still talking trash to crypto bears and crypto luddites: “You’re so stupid if you can’t understand that my crapcoin is going to go back up to its all-time highs after this latest crypto winter is over.”

I have people talking trash to me who have lost tons of money on cryptos that I had warned them to get out of before they crashed. It reminds me of the time when I was leading the state in scoring but my team was 5-17 on the year.

5. I expect a Big Broad Sell-Off because greed seems to be back driving the market action lately. Many of the trashed former high-flyers that were down 90% or more are now up 50% or more from their lows (which means that those stocks are still down 80%-90% from their all-time highs and almost none of them are ever going back to those levels.

Look, we don’t have to sell everything and panic just because the odds favor a pullback. Indeed, I think we should remain flexible about scaling into great companies as the opportunities arise, especially if the markets will sell-off for a while.

We’l do this week’s Live Q&A Chat at 11am ET tomorrow (Friday) in the chat room or hit reply to this email with your question.