Don’t Be A Chicken In A Market Full Of Them

You ever been around chickens? I hadn’t spent much time around chickens since the days when I was a kid and my dad was a vet and a friend from down the road kept some chickens at our farm house for a year or two. But others in the midst of the pandemic, we had a garden and also ordered some chickens for land. I have to admit, I’ve grown quite fond of the chickens over the six weeks that we’ve had them and which are getting big enough to start laying eggs any day now. All twelve of them. My wife doesn’t even like eggs and we’ll be giving almost all of them away, I suppose.

Anyway, the reason I ask about chickens is because they sure are funny about sticking together. All of them, especially at first, were scared to be the first ones to go out the gate, to try new food, or to trust the grass (or treats) that we throw around for them to eat on. But once one of them commits, they all run to join her and they chat and talk to each other as they peck away — “What stocks are those chickens pecking at? I better try some of it!” Until something scares one of them, and then they all run back to the coup, some flapping their wings in a panicky attempt to fly to safety — “Why are all those chickens selling those stocks in a panic? I better sell some too!”

You can see the market action has been increasingly driven by chickens by looking at candle charts. First, look at the increasingly volatile action in some longer term monthly charts, in this case, a couple of index charts:

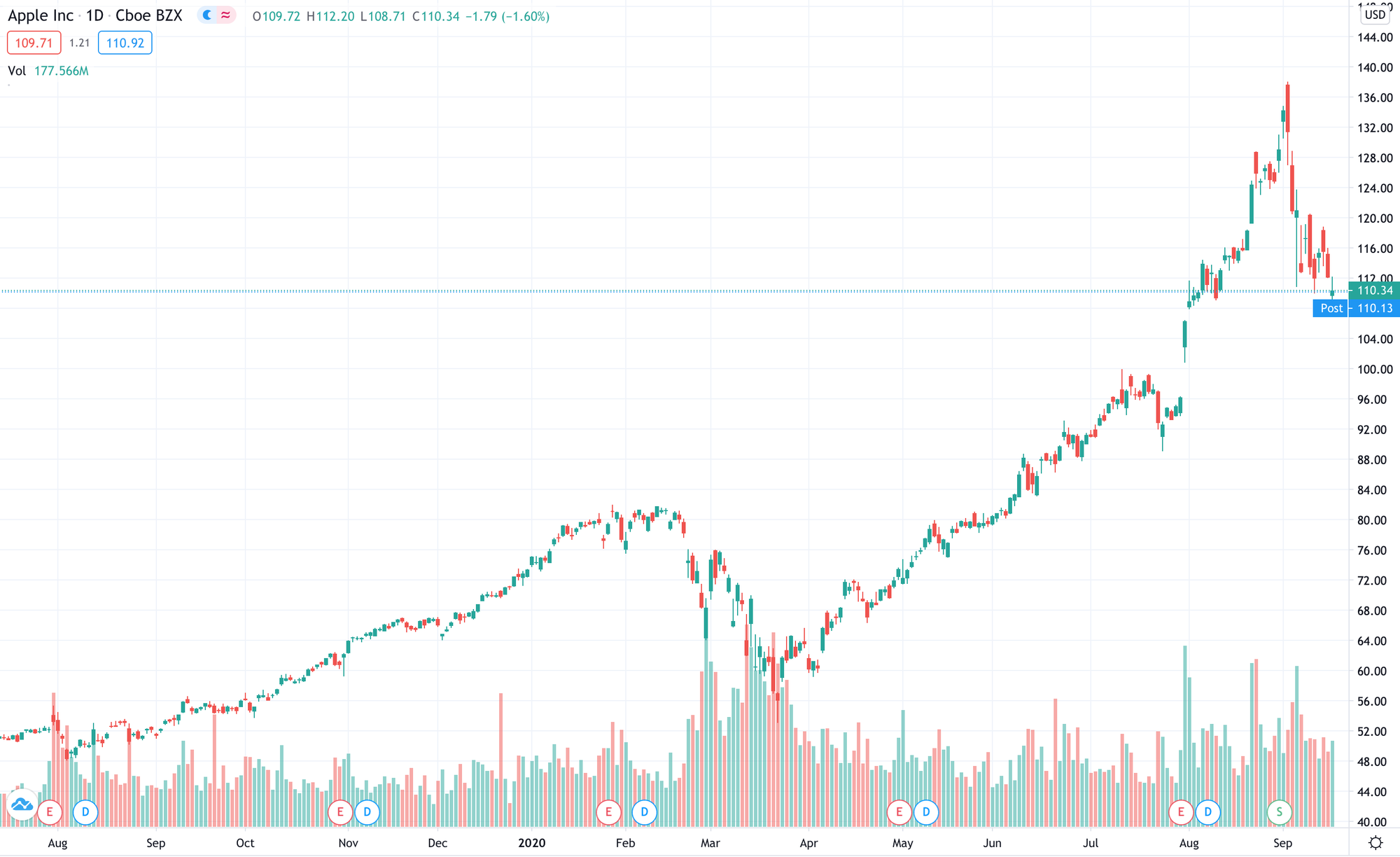

And you can see the daily action is getting volatile in some shorter-term daily stock charts:

Now I’m not saying we investors, traders, pros and/or the people who give pros money are like chickens when it comes to investing, trading and/or chasing a trend….well, then again, yes, I am saying that.

Let’s not be chickens. Which is not to say that we shouldn’t be risk-averse, of course. But let’s continue to avoid chasing after the favorite pecking items of investment themes and to avoid panicking flights of selling either.

Many stocks have come down 20-30% off their recent highs and I am likely to start nibbling on (not to be confused with pecking away at) some of our stocks that we’ve owned forever, including SPOT and FB, in coming days and weeks. I’ve got my eyes on about three potential new names for the portfolio that I’m patiently finishing up work on.

In the meantime, here’s a collection of bullish vs bearish arguments for the broader markets:

Possible bullish factors:

Maybe Covid trends will really improve and flu season won’t be bad either.

Maybe a real, actual proven vaccine hits sooner (say by year-end) than later (say by next summer).

Maybe the election is a landslide for one side or the other and the risk of a contested election goes away.

Maybe the Republicans and Democrats in power get a fiscal agreement gets done so more stimulus comes sooner rather than later (I actually expect this part won’t happen unless the stock markets drops another 10% before the end of October).

Fed pumps and creates even newer sillier free money monetary programs (what’s to stop the Fed from buying stock ETFs some day?).

Good outcome to the US-China trade and political tensions (Is there such a possibility?)

Possible bearish factors:

The markets decide that there could somehow be a meaningful corporate tax hike.

Election uncertainties, including the possibility that the Democrats and/or the Republicans will not concede.

Small business depression as millions of small businesses remain closed and/or are closed forever because of The Coronavirus Crisis.

Covid second wave hits badly into and throughout this winter.

Fiscal free money spigot from the Republicans and Democrat Regime might have run out (though I don’t think the Fed’s monetary is anywhere near running out, as noted in the possible bullish factors above).

Ugly bar charts and dislocating stocks can portend a meaningful top.

Seasonality isn’t favorable for the next few weeks.

Bad outcome to the US-China trade and political tensions (What would define an anything other than a bad outcome? If trade with China booms, is that actually good?)

Let’s do this week’s Live Q&A Chat tomorrow (Thursday) at noon ET. Come directly to the TWC Chat Room or just email us your question to support@tradingwithcody.com.