Earnings Round Up, Tesla FSD and Elasticity, Apple’s Stretched Valuation, Etc

Here’s the transcript from this week’s Live Q&A Chat.

Q. Cody – Can you please provide your thoughts on the latest batch of earnings for some of our long positions? META (caution?), INTC (is the worst behind it?), AMZN (strong earnings but soft guidance) and GOOGL.

A. META was strong but the valuation is now probably a bit stretched at 25x this year’s earnings. The last 90 days of business for INTC was okay but the talk about new nodes and taking market share is very bullish. AMZN was good but the commentary on the call about cloud demand dropping in April rightly shook investors. The valuation on AMZN is probably stretched here too. GOOG’s got potential problems with the threat of ChatGPT.

Q. Cody, when does valuation matter? APPL, MSFT, AMZN, and now even META seem to be sitting at elevated valuations. I am an older guy and sometimes it seems they do not matter until they matter, if that makes any sense?

A. I agree. Valuations are not a reason to short a stock but if the company’s earnings don’t eventually grow into stretched valuations, the stocks can fade lower and just bumble around for years.

Q. $TSLA: FYI, i have been noticing improvement on FSD. IMO, it’s still a way to go to get to level 4 (no human intervention). Having said that, i don’t think any OEM would reduce it’s prices multiple times if there is no demand issues.

A. I do think there’s a lot of elasticity in Tesla prices/demand (price elasticity refers to the degree to which individuals, consumers, or producers change their demand or the amount supplied in response to price per investopedia). I personally know people who had little interest in buying a Tesla Model 3 at $45,000 but are very interested in it at $39,900 plus a $7500 welfare credit from the Republican Democrat Regime, bringing the total price down to $32,400. Tough to find a decent new car for that kind of money and as I’ve always said since I bought a Tesla Model 3 in 2019 and bought TSLA stock because the product itself is so much better than any other car I’ve ever owned. I do see the major improvements in Tesla’s Full Self Driving technology and enjoy letting the car drive me around town to my destinations even here in tiny rural NM towns. If/when Tesla ever gets full Level 4 figured out, the stock will go up 3-4 fold from here.

Q. Elon, childish senseless destruction of Tesla brand could be one of THE main causes of the demand problem. Auto is probably the most competitive industry and just a slice of potential customers could make a huge difference. And I believe Elon disenfranchised a huge portion of potential customers in US. Hopefully, Tesla superiority (with Tesla supercharger system) could overcome the reluctancy of those potential customers. $7500 incentive and lower prices could prompt pinched nose buyers.

A. I wish Elon would get off of Twitter entirely but I do think the Tesla product is so good compared to other cars that you’d have to be crazy to let Elon’s politics and tweets and personality keep you from buying one.

Q. Cody: with earnings and everything going, mind if I ask your highest conviction options positions? And of those, a general strike and DTE? ENPH puts absolutely printed.

A. Yes, the ENPH puts printed money and we’ve had some great options trades I’ve mentioned for you all lately. But options are hard and please be careful trading them. I like COIN puts, but I’m using in-the-money puts dated out 3-4 weeks with $60 or higher strike prices. I like AAPL puts here dated out 2-4 weeks using $160 or so strike prices. I like FSR puts dated out 4 weeks with $7.5-8.5 strikes. GM puts, June $35ish. INTC May or Junes $33 or so strikes. That’s enough for now.

Subscriber reply: Cody: thanks! I have a riskier account that focuses on options, so this helps a lot!

Q. cody will you be sending out trade alerts for the short plays? Like when you will cover them? Thanks.

A. I sold some of my ENPH and FSLR puts this week when each crashed. I still have some puts on those and other solar names but fewer than I did last week. I also still own COIN puts and have a small outright short position in COIN. I don’t think most Trading With Cody subscribers and retail investors should be messing with shorts and puts though. I will send out a Trade Alert if I close these positions out entirely.

Q. Hi Cody,You make a compelling argument in your latest position report for not owning AAPL; you even rate it a 5+, which is the lowest rating I can remember ever seeing for any stock you follow. Yet you still say: “I still own it in my personal account obviously and will likely never sell it…. I don’t own it in the hedge fund and haven’t for some time” Can you please provide some insight into why you would “obviously” continue to hold AAPL?

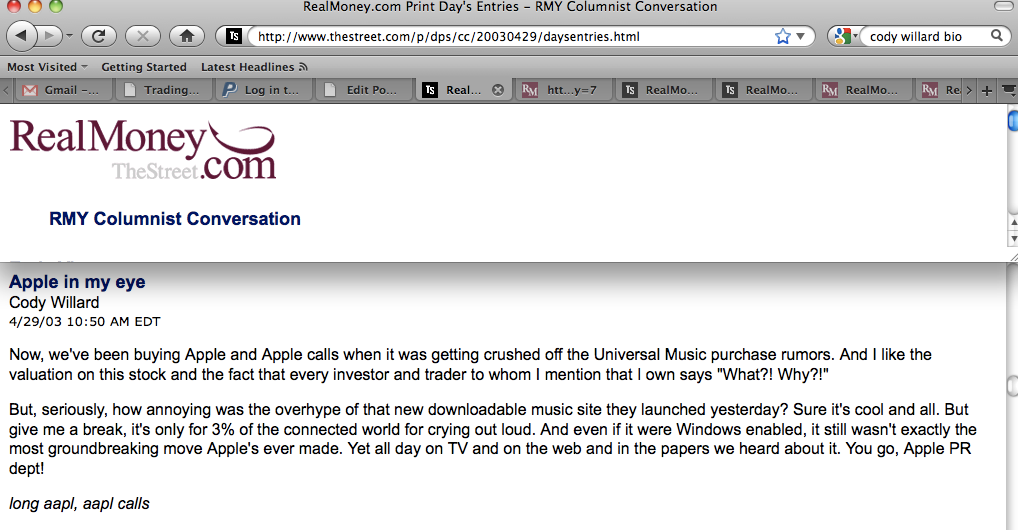

A. As noted here:

I bought AAPL at a split-adjusted 40 cents per share or so back in March 2003 and as I’ve said for years — I plan to hold AAPL forever in my personal account. It’s still a great company and it’d have to drop by 50% from here to make it worthwhile selling those shares and paying the taxes on them. I do think AAPL is valuation-stretched here and might bob around here or $150 or so for a year or two.

Q. Cody: re AAPL: Why not short against the box? No taxable event takes place until you cover or close the position.

A. I just confirmed with ChatGPT: Model: Default (GPT-3.5) Cody Willard “Can you short-against-the-box in the US?” ChatGPT: “Short-against-the-box is a strategy where an investor simultaneously holds a long position and a short position on the same security. This strategy is often used to defer capital gains taxes on a highly appreciated stock while continuing to maintain exposure to the underlying security. However, the IRS has eliminated the ability to use short-against-the-box as a tax-deferral strategy. Under current tax law in the United States, when you sell a stock short, you trigger a taxable event. This means that you must report any gains or losses from the short sale on your tax return for the year in which the short sale occurs, regardless of whether you still own the underlying shares. Therefore, while you can still engage in short selling in the US, short-against-the-box is no longer a viable tax-deferral strategy. It’s important to consult with a tax professional or financial advisor to understand the tax implications of any investment strategy you are considering.”

Q. Cody WOLF earnings came in pretty weak ,thoughts ?

A. The push out of the factory and the fact that revenues this year will be lower than expected because of the slow ramp up of the factory is the problem. Looking out three to five years I think there’s a lot of potential upside from here though. I nibbled some more for the fund yesterday as noted in the Trade Alert we sent out.

Q. How about RKLB AND SMR. AND MP. could these still be multi-baggers and what time frame sir ?

A. Still like all three here. Rocket Lab is one of the few companies on the planet that can get to space. SMR is likely to be the leading nuclear company in the world in five years. MP will probably miss estimates this quarter as prices for what they mine are down big so far this year but it could end up being a key to US independence.

Q. Cody, thoughts on Helium? I think Binance delisted it?

A. I haven’t worked on Helium in months. I’ll take a look. I’m not looking to buy any crypto but maybe the SKTL Space Debris-Cleaning token.

Q. Years ago, you mentioned investing in the Republic Note (201. I invested, but months later my investment was cancelled and money returned. I contacted them and was told that they had no explanation for the cancellation, but the opportunity was closed. Today I was contacted regarding a new Republic Note that I could invest in. Any comment?

A. I got that email too. I didn’t click through because I just didn’t have the time to. I still like Republic but I’ll need to dig in.

That’s a wrap. I leave you with a couple pics from my ride to and from work this week. The first shot has our colt, our mini donkey (named Dawn Key Willard, get it?) and girl goat in it.