The Most Important Shot

“The most important shot in golf is your next one.” – Ben Hogan

“Achievements on the golf course are not what matters, decency and honesty are what matter.”-Tiger Woods

I play golf by myself most of the time when I play. I like to be the first one off the tee box in the morning so that I can hustle to my ball and play a full 18 holes in less than two hours. The other day Bryce and I went to play golf late in the afternoon and we got behind a few people even though the course was mostly empty. We sped past the group ahead of us on a par 3 and Bryce said, “We have to tell them why we’re passing them.”

I was like, “Dude, we’ll be so far ahead of them by the time they get done with this whole it won’t be a problem, but Bryce countered with “We should err on the side of courtesy and tell them/ask them about passing them by.”

I liked that phrase and agreed with him. We should always err on the side of courtesy when we are around other people. And it got me thinking about how when we invest that we should also allow ourselves to err on the side of caution sometimes. And right now, we might even allow ourselves to err on the side of bearishness.

The fact is that the markets have been pretty stable this year after last year’s tech demolition. Semiconductor stocks have been strong, tech has been strong, and some of the worst tech stocks have hung tough (others, like Fisker FSR and Nikola NKLA have been terrible and have been hitting fresh 52-week lows). Bryce wrote an article for us a few weeks ago that talked about how many traders and investors have decided that the stable-to-strongish stock market action means that the economy will be fine. We’re about to get another batch of earnings that will help figure if this is the case.

But I tend to think that we should err on the side of cautiousness right now. To be sure, I make most of my money in bull markets and have had my biggest homeruns and claims to fame when I get outright bullish while others are scared. But I don’t think there’s much fear out there right now. Being an innovation investor or a cryptocurrency bull is still a crowded field right now. Few traders have given up on investing in technology, fewer still have given up on energy stocks or bank stocks or speculative cryptocurrency plays.

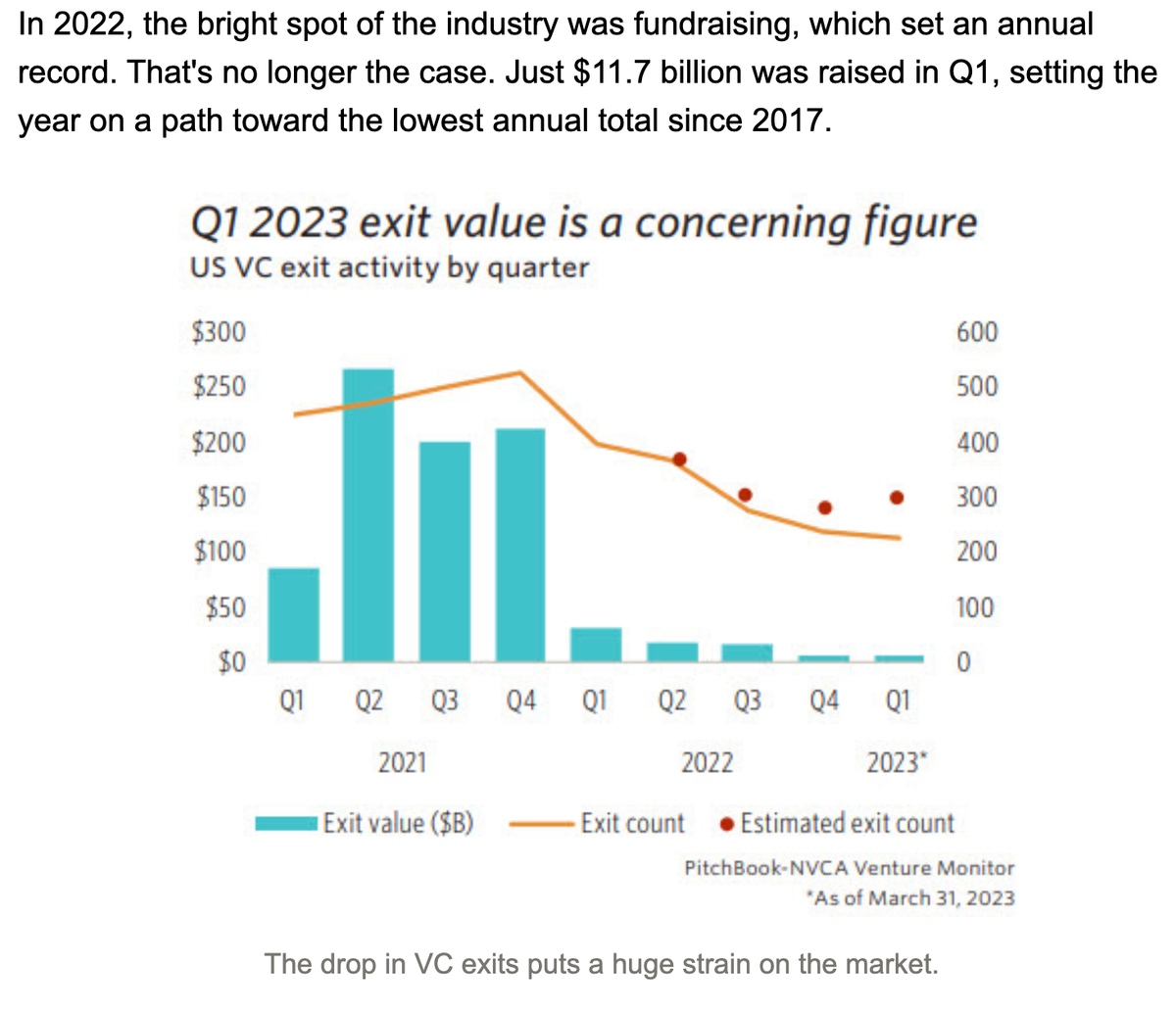

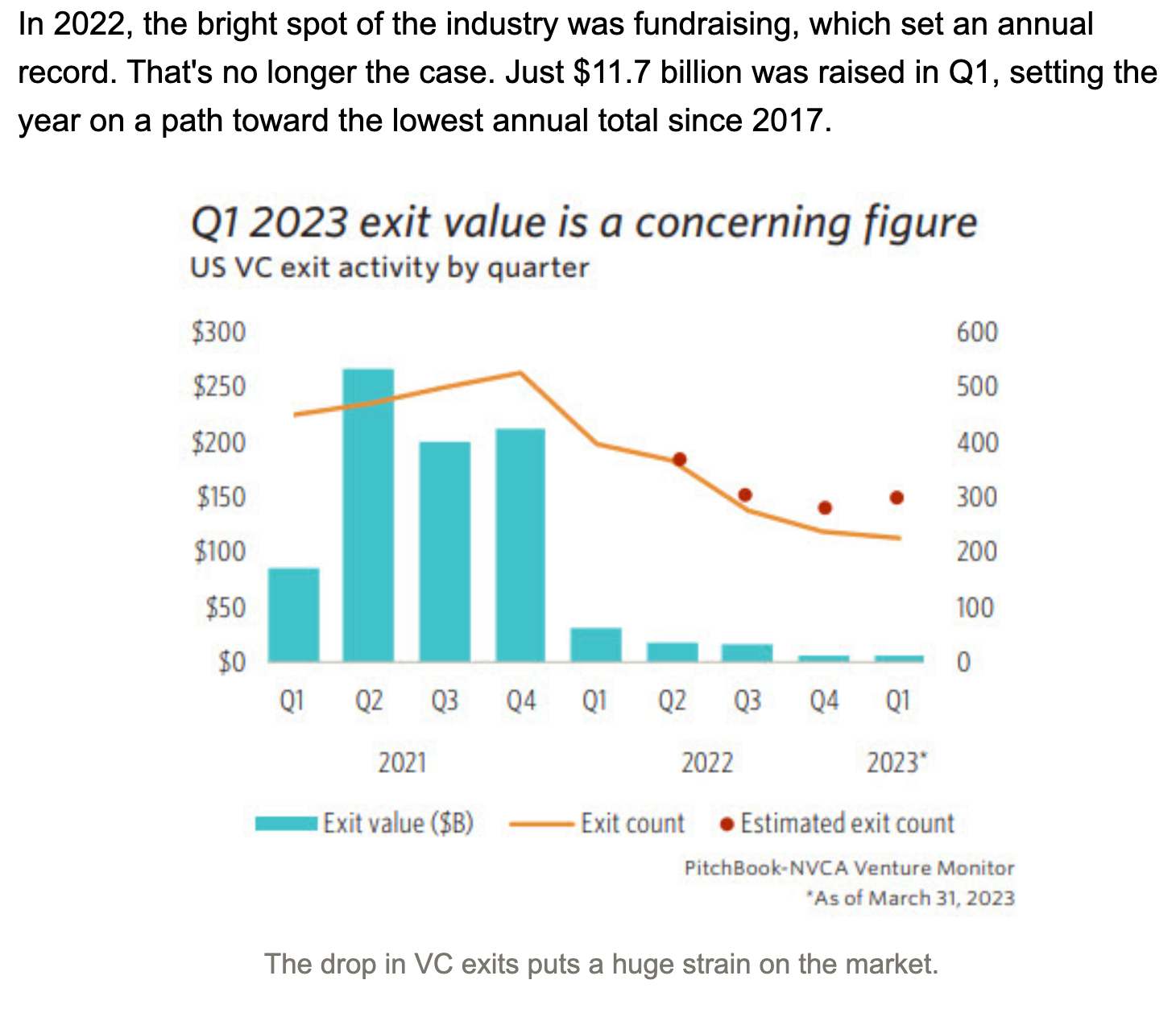

Meanwhile, the flow of money going to start ups has dwindled. It seems venture capitalism, which itself was in an outrageous bubbled up spot two years ago, has slowed to a standstill. VC funding was down 70% year-over-year in the first quarter. Exits were down even more.

That’s a 98% drop in exit deals for VCs. Venture investing, indeed technology/innovation investing in anything not related to AI, is down 70% or more this year over last year according to most reports I’ve seen. Last year there was a major disconnect between the public and private markets as publicly-traded tech stocks got demolished and it took into this year before the private market started marking down their valuations. This year, I think it’s backwards again — this time publicly-traded tech stocks in general are stretching their valuations while the private markets are still trying to mark their valuations down and are forcing companies to raise money at much lower levels than the entrepreneurs would prefer.

And it’s not just the VC market that’s in trouble. The banks and any companies that loaded up on supposedly like-cash Treasuries in the last few years are facing major losses on those investments and many are trying to extend and pretend that those losses don’t matter as long as they aren’t officially recognized. That’s not really how it works though. The losses are there and are real even if the banks and other Treasury-heavy balance sheets don’t bother to recognize those losses.

I’d much prefer to be bullish and to have fewer short bets on the sheets and to be loading up on undiscovered and under-covered innovation stocks that will be changing the world. I very much like our longs and think there’s a lot of upside potential for most of our picks, including SMR, UBER, RKLB, MP, ROK, INTC, WOLF, etc and will continue to scale into more of each of those in coming days and weeks, especially when the get hit like WOLF was this morning.

But we have to trust our analysis. And my analysis indicates that there’s a lot of economic turmoil and losses to be dealt with and that valuations and hype and love for innovation, for crypto, for AI stocks is still high.

Semiconductor stocks and solar stocks in particular seem crowded to me with optimism and hype and little concern for potential downside risk. Software stocks are less crowded but still not exactly unpopular right now.

I’m not saying we should sell everything — far from it. But I do think erring on the side of cautiousness is a good idea right now and that we’ll eventually have some more ideal opportunities to load up on our longs. When others are scared and when it’s harder to buy than it is right now.

Don’t be greedy. Don’t be scared. Be cool. Be courteous to others. As usual, I suppose even if the last few years have been and this time right now is anything but usual.