EV Facts To A Candid World

“…let Facts be submitted to a candid world.”

-Excerpted from the Declaration of Independence.

Let’s start with a quick trade alert: we trimmed a tiny bit of RIVN today. Also, let’s do this week’s chat Wednesday at 3:00 p.m. EDT in the TWC Chat Room, or just email your question to support@tradingwithcody.com.

As you all know, remaining objective in our stock and economic analyses is one of our primary goals here at tradingwithcody.com. “Objective” is defined by Merriam-Webster as: “expressing or dealing with facts or conditions as perceived without distortion by personal feelings, prejudices, or interpretations.”

Especially when the markets are at their extremes, it is easy to be led by our emotions. At the top, investors end up buying because of “FOMO,” which is really just a form of greed. At the bottom, people panic and sell because of fear. Anytime you buy, sell, or hold because of greed or fear, you are not being objective. Despite our consciousness of this phenomenon, all of us our subject to making decisions at times based on fear and greed. The best, and perhaps the only way to avoid making decisions based on fear or greed is to remain objective. And one of the best ways to remain objective is to look at the cold, hard facts in front of you.

Today’s relevant facts are the EV delivery numbers from TSLA, RIVN, XPEV, and others. All three of these companies beat expectations and demonstrated impressive production and delivery numbers.

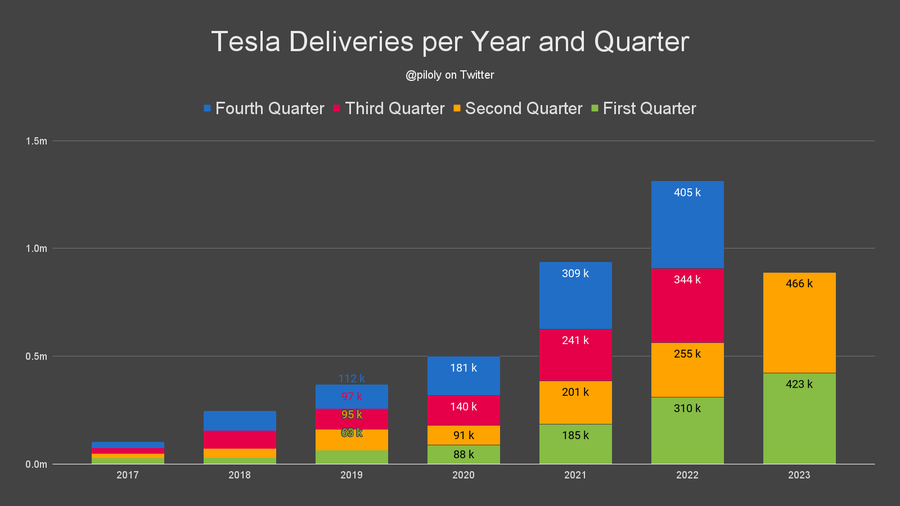

TSLA is one of our biggest longs and RIVN is also a pretty-good-sized position for us, so let’s look at the facts (the numbers) to get a sense of where things stand in the EV industry. To start, here is a chart showing TSLA’s deliveries (broken down by quarter) over the last 6.5 years:

Impressive that TSLA delivered more vehicles in the last 90 days than it did in all of 2019, just four short years ago when we first started buying the stock. According to Morgan Stanley, total 2022 global light-vehicle sales were about 77.6 million units, 8 million of which were EVs. EV growth is expected to continue at 23.6% CAGR through 2025, while ICE (internal-combustion engine) growth is expected to remain flat over that period. While TSLA faces some serious competition for EVs in China, in the US, TSLA has a commanding lead over the other automakers.

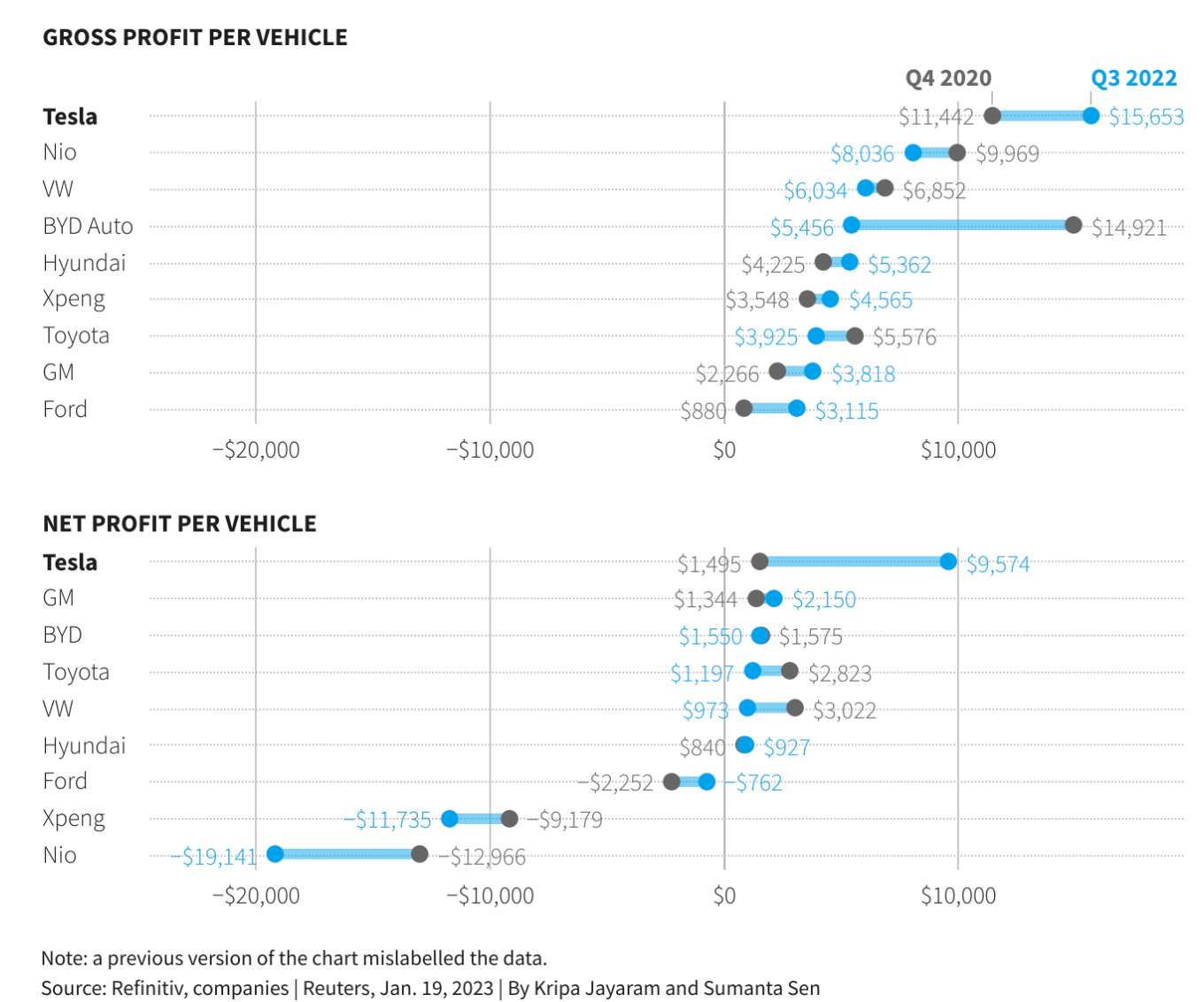

Most importantly, TSLA is one of the only companies that is actually earning significant profits from EV sales:

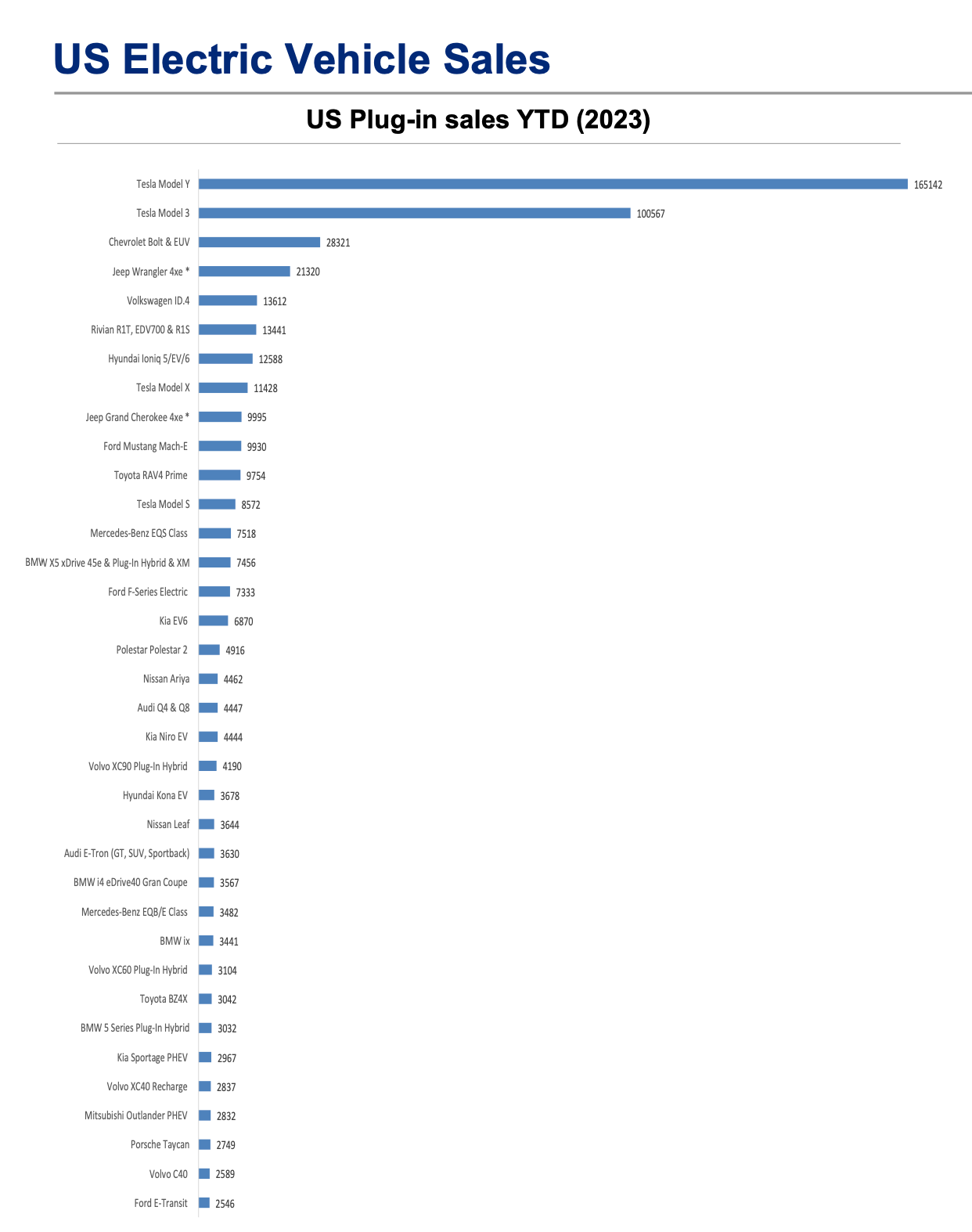

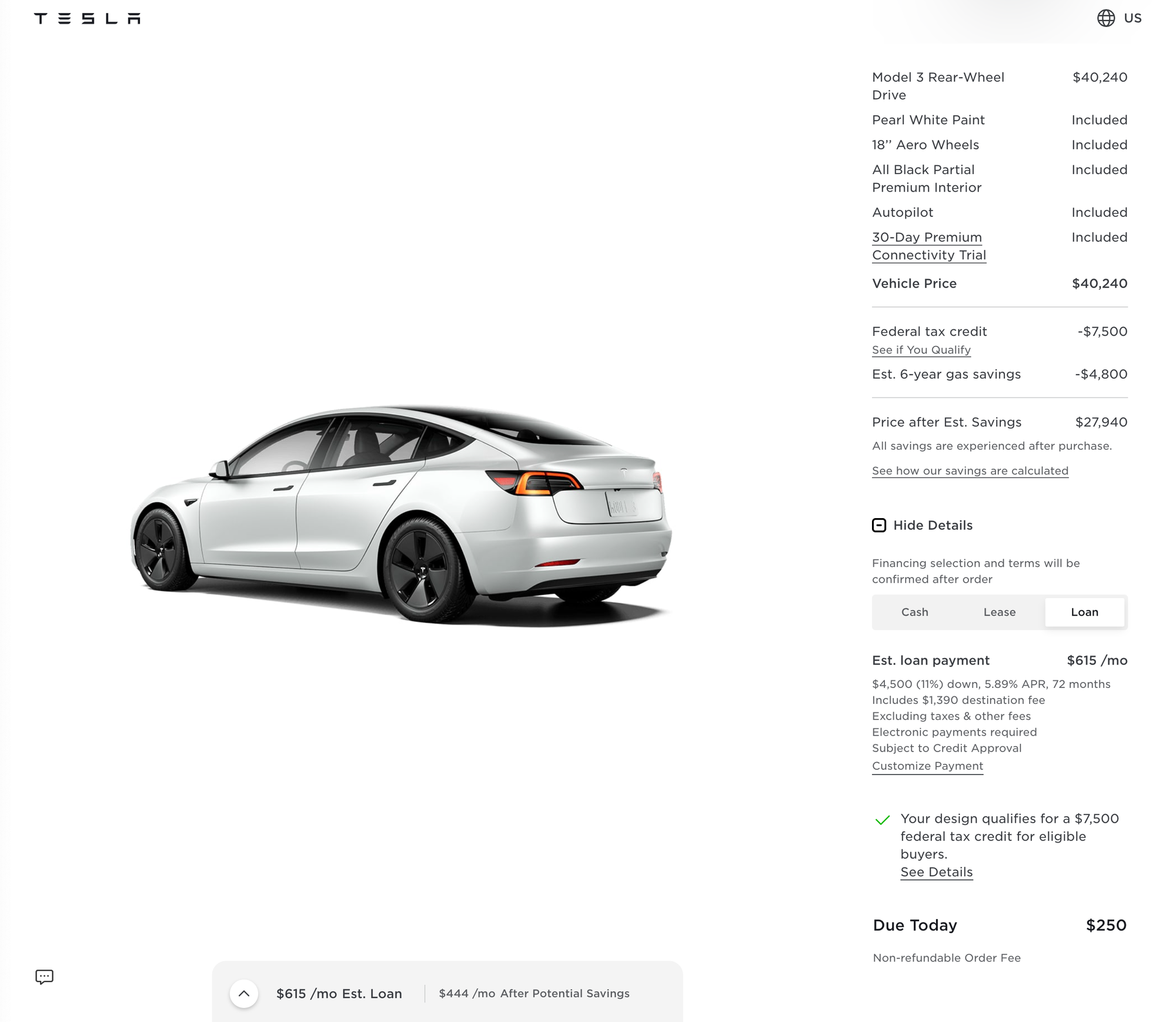

As yesterday’s delivery numbers demonstrated, TSLA is continuing to accelerate growth despite purported “competition” from traditional automakers like GM, F, VW, etc. While those companies have rolled out EV models of their own, they have thus far been unable to produce those vehicles at scale, nor at price points that are attractive to most consumers. As you will note in the TSLA delivery numbers, almost all of TSLA’s sales (~96%) come from the cheaper Models 3 and Y rather than the more expensive Models S and X (~4%). For reference, the Model 3 starts at about $40k and the Model S starts at about $88k. We think it will be difficult for Ford, for example, to sell a substantial number of F-150 Lightnings (which run from $60k to $95k), or for Lucid to sell tons of Airs (which start at around $90k) to a public which is spending more money than ever just to survive because of higher inflation and interest rates. With a TSLA Model 3, you can get a brand new car for about $33k (when the federal tax credit is included), which comes out to $615/month (TSLA quotes financing at 5.89% for a 72-month loan). Check out the details here:

Analysts are expecting TSLA to produce anywhere from 1.7mm-2.0mm vehicles this year, which would put it at about 2%-2.5% of the global light vehicle market share, or 17.5%-25% of the global EV market. If TSLA can grow to just 10% of the global vehicle market in the next few years, it would sell around 8.5mm units. Using an average selling price (ASP) of $46,000, TSLA would generate $382.5bb in revenue, and about $72bb in gross profits using a 19% gross margin. Operating expenses would probably be about $10bb which means the company would generate somewhere around $62bb in operating profits. That gives TSLA a 13.4 price/profits ratio in a few years, which is pretty cheap considering the company is growing revenues by around 25% per year, and has multiple trillion-dollar kickers (Cybertruck, Dojo Supercomputer, Robotaxi, Optimus Robot Charging Network, etc.).

When it comes to RIVN, obviously the company is not in the same position as TSLA, but it is also not trading at a $830bb market cap. With today’s move, RIVN has an $18.3bb market cap, which is about 2% of TSLA’s. Coincidentally, RIVN’s 2023 production target of 50,000 units is also about 2% of TSLA’s stated goal of 2mm units.

RIVN is targeting a more niche market (premium pickups and SUVs), and unlike its EV rivals in this area, RIVN is actually producing and delivering these vehicles at scale (see US EV breakdown above showing RIVN in 4th place in 2022 EV sales behind only TSLA, GM, Stellantis (Jeep) and VW). RIVN delivered 12,640 vehicles in the second quarter, compared to estimates of 11,000 vehicles. And RIVN produced 13,992 vehicles, which was 4,597 more than in the first quarter. As we have stated before, RIVN’s biggest challenge in the near term is getting its production up in order to drive down its COGS (cost of goods sold) per unit. Our golden rule for startups like RIVN has been execution, and thus far management has done a good job of executing on its plan to produce at least 50,000 units in 2023. If RIVN hits that target, we expect the company would generate sales this year of about $4.5bb, up from $1.6bb in 2022.

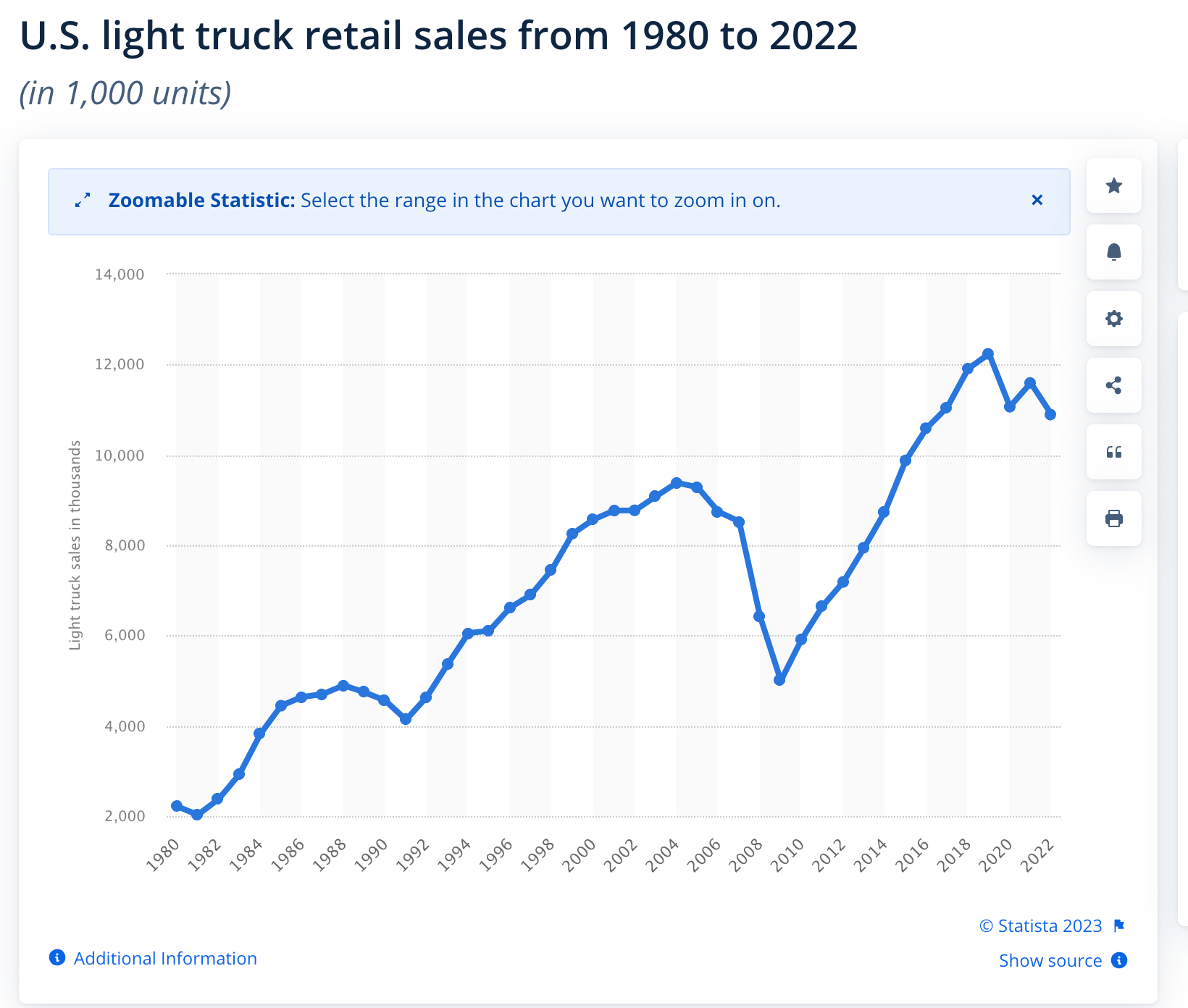

The US pickup market has ranged from 10-12mm units over the last four years:

In short, America is obsessed with trucks and SUVs. RIVN builds a great product and is poised to capture this trend if it can get its production ramped quickly. If RIVN could garner even 10% of the US pickup market in the next five years, it would be shipping 1mm-1.5mm units per year. At 1mm units, RIVN would be generating $87bb in revenue at an ASP of $87,000. Assume the company can generate 10%-12% gross margins, and we are looking at $9-$11bb per year in gross profits. Plug in operating expenses of $4bb and we have profits of $5bb-$7bb, yielding a p/p range of about 3.6-2.5 five years out.

Looking at the facts before us, we remain convicted in our TSLA and RIVN longs. Both of these companies are growing rapidly and executing well. Although there is always risk involved, we think these are the best names to own in the EV Revolution.

We want to wish all of our American followers a very happy and safe Fourth of July! And don’t forget about this week’s chat on Wednesday at 3:00 p.m. EDT in the TWC Chat Room, or just email us your question to support@tradingwithcody.com.