Everything You Need To Know About Investing In Intel, Or, Why I’ve Started Loading Up On INTC

What if I told you I was buying a Revolutionary tech company’s stock, one of two or three of the best companies in the world’s most important technology industry. It’s a company that is probably about to take market share for the first time in at least half a decade in an industry that is facing a potential decade-long supply constraint problem that this company could fix giving it a potential trillion dollar side business along with yet another side business that is one of two or three leading companies solving another trillion dollar side business. Did I mention that it’s trading at a 12 P/E with a 3% dividend?

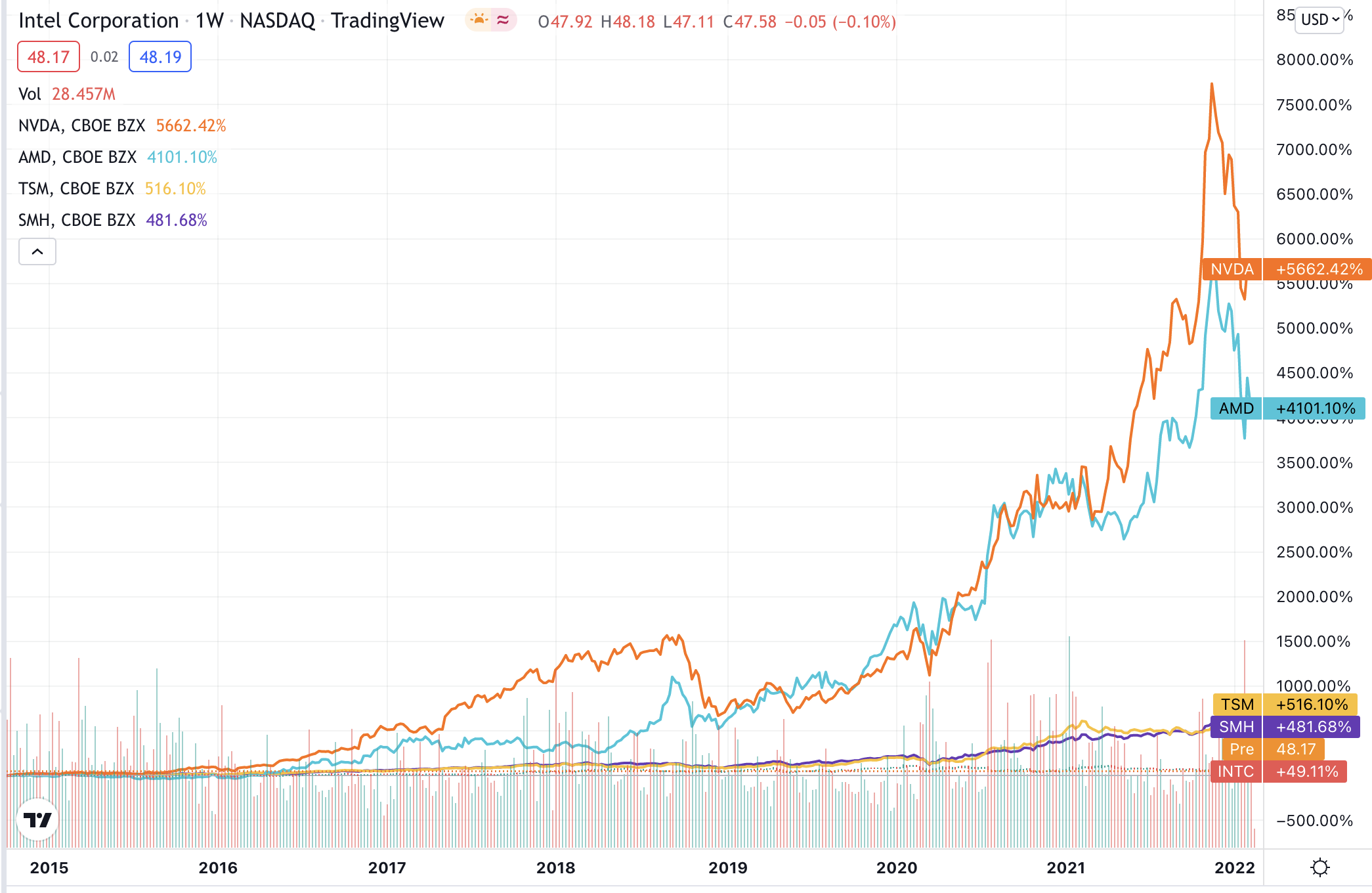

Let’s unwind all of that as I mention that most investors think that Intel’s boring. I agreed until recently. Look, INTC has been dead money for years. In fact, I’d surmise that with Intel having been trading in the low teens P/E and with a 2-3% dividend over the last ten years while vastly underperforming just about every other semiconductor stock on the planet, that just about every value investor has churned themselves in and out of INTC at some point in the last decade.

Same thing with the sellside analysts, most all of whom at one point or another have upgraded INTC only to be disappointed when the stock had basically gone nowhere. In fact, did you know that INTC is still way below its year 2000 bubble peak when its closing price was 74.88 on August 31, 2000.

Intel’s boring old CPU semiconductor business has been losing market share to AMD and self-designed chips by Apple and Google and others for years. The company had pretty much become an IBM-like or GE-like financial engineering firm with a declining annuity business with boring CEOs and no risk-taking. But then they went and got this guy to head up the company (bold and italics are mine):

“Patrick (Pat) Gelsinger is chief executive officer of Intel Corporation and serves on its board of directors. On Feb. 15, 2021, Gelsinger returned to Intel, the company where he had spent the first 30 years of his career. Before rejoining Intel, Gelsinger was CEO of VMware. In that role, he transformed VMware into a recognized global leader in cloud infrastructure, enterprise mobility and cyber security – almost tripling the company’s annual revenues. Gelsinger was also ranked the best CEO in America in 2019, according to an annual survey by Glassdoor. Prior to joining VMware in 2012, Gelsinger was president and chief operating officer of EMC’s Information Infrastructure Products business, overseeing engineering and operations for information storage, data computing, backup and recovery, RSA security and enterprise solutions. Gelsinger began his career in 1979 at Intel, becoming its first chief technology officer, and also serving as senior vice president and the general manager of the Digital Enterprise Group. He managed the creation of key industry technologies such as USB and Wi-Fi. He was the architect of the original 80486 processor, led 14 microprocessor programs and played key roles in the Intel® Core™ and Intel® Xeon® processor families, leading to Intel becoming the preeminent microprocessor supplier.”

Yea, this guy created the x86 chip platform that changed the world. This guy is brilliant and has a track record to prove it. You know I love to bet on brilliance (see Always bet on brilliance and revolution or Trade Alert: Betting on brilliance (and EV)).

Meanwhile near-term, all indications are that the company’s latest chipset, the Alder Lake is actually demonstrably better performer than AMD’s latest laptop and desktop chips (see Core i9-12900HK review: Intel ‘Alder Lake’ laptops crush the competition or Intel’s Alder Lake Mobile 12900HK Gets High Praise in First Reviews).Technology companies are about products…and if the product isn’t good. But these latest chips look like they are cheaper and better than the competition and that’s the kind of thing that can change gross margins, growth rates and eventually P/E multiples.

There’s also the Sapphire Rapids chipset that is the fourth generation of Intel’s Xeon Scalable Processor brand data center server CPU. According to Intel it “will offer the largest leap in data center CPU capabilities for a decade or more.” If it happens to take any market share, that would also reverse years of marketshare loss in Intel’s other major existing business.

INTC’s stock would likely double if the company takes any meaningful share in those two businesses and would likely be up at least a bit from these current high $40s levels if the company takes market share in just the laptop/desktop business. One of the reasons I like the risk/reward of this trade so much is that I think the downside here is probably limited to about 20% or so, as I think it is quite unlikely that we’d ever walk in one day and see INTC down 50% (it could happen though!) while you have pretty good odds that the stock could double on marketshare gains. And then you have the virtual call option on the potential that Intel’s MobileEye autonomous vehicle technology, which is certainly getting closer to solving the problem along with Tesla, Waymo and maybe a couple other companies, actually getting it solved.

And most importantly, it’s the virtual call option on the fab business, making chips for other companies, that makes Intel so compelling here. See, Taiwan and Samsung and Intel will be trying to make new semiconductor chip factories to try to meet the huge demand for new chips in everything in the physical world, from cars and computers and phones to shirts and wearables and shoes and doorknobs and streetlights and roads and probably just about everything but toothpaste (and if they can figure out a way to put semiconductors in toothpaste to make it more effective, they will, now that I think about it).

The semiconductor industry just crossed a half trillion dollars in annual sales for the first last year and that number will continue to be a mostly secular growth story for the next decade or two. Intel’s got the US government and state governments kicking in a big portion of money to help them pay for what will probably end up being close to $100 billion invested in new fabs over the next five years. Those fabs could create a trillion dollar valuation if Intel pulls this off and the demand for semiconductor chips remains as growth-y as it probably will.

Intel’s finally got some real, actually pretty amazing potential catalysts along with the potential to take market share for the first time in years even as the market hates it. The Intel investment set up here does remind me a bit of when I was pounding the table to buy Tesla back at a split-adjusted $45 a share in 2019 because like Intel now, Tesla was hated and doubted by investors and analysts even though the company had finally set itself up to win with new products set up to take market share and new factories being partially paid for by governments.

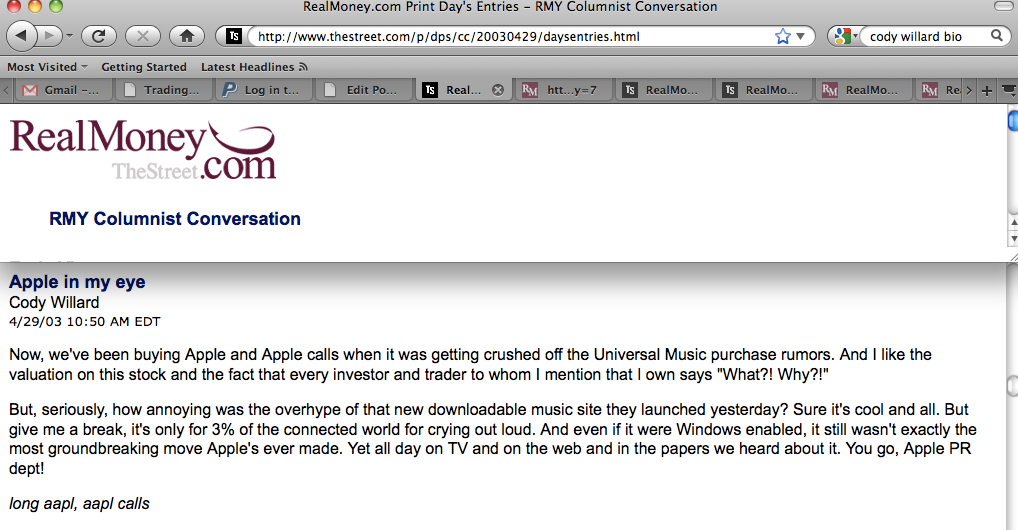

Even the responses from my friends and/or Trading With Cody subscribers when I started buying Intel recently and started pounding the table on it last week with the stock below $50 a share has been similar to that when I’d first starting buying/pounding the table on Tesla back in 2019 or even when I first started buying Apple back in 2003: shock, exasperation or just confusion that I’m seeing something exciting and very investable on a risk/reward scenario here.

With Tesla, my calculus was that if the company sold 250,000 cars in 2020 it’d go bankrupt and the stock would have gone to $0, but if it sold 500,000 cars (which it did) the stock would go up 1000% (TSLA went up more than 2000% after we bought it). With Intel, my calculus is that if company doesn’t take any market share and/or loses market share, the stock will stay around these levels or drop closer to $40. Meanwhile, the potential upside for INTC could be 500-1000% over the next ten years if the company pulls off taking market share plus some sort of winning business in self-driving and especially if the fab business works out.

This Intel investment, like any, has its risks. But the potential and likeliness of the upside makes this the first time since Tesla in 2019 that you’re seeing me pound the table on a new idea. Nothing’s easy out there and Intel’s got a lot of work ahead of itself to pull some of this potential off so I’ll remain balanced even as I have made INTC a top 3 largest position in my personal account and in the hedge fund and I plan to buy more on any weakness in both places. Be careful, as always.