Extra! Extra! DallasNews: An Old School Gem in the Age of AI

For the last few weeks or so, we have been building a position in a small-cap company, DallasNews Corporation (DALN), and today we are excited to release our report on it. As Bryce explains below, it is rare for us to find a company with this kind of a valuation with the potential to produce truly stellar earnings in just a few years’ time as the company transitions its business model. While this may not be our typical Technology/Revolutionary-type investment, this is very similar to the trade we did in 2016 with TheStreet.com (Ticker: TST). Long-time readers will remember that TheStreet.com was acquired after we purchased it and that trade, including the special dividend that the company paid, yielded us over 150% in returns. I am excited that a similar, perhaps even better opportunity is available to us right now in DallasNews. That said, this company has a TINY market cap and the stock is very illiquid (we suggest using limit orders any time you trade this stock). It took us weeks to build up an adequate size position for the hedge fund. The hedge fund currently owns just over 5% of DALN and we had to file a Schedule 13G beneficial ownership report with the SEC to disclose our interest recently. We would caution investors to not pay over $6.00/share, at least not until the company returns to profitability/growth. Now let’s get into the analysis.

DallasNews Corporation

Nasdaq: DALN

Share Price At Time of Analysis: $4.18

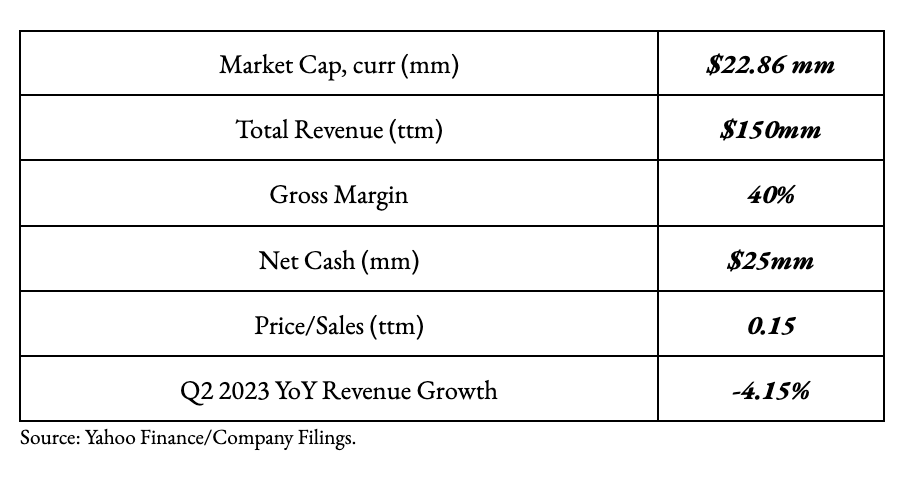

Key Metrics.

Synopsis.

Extra! Extra! Read All About It!

We’re talking about DallasNews Corporation (DALN). This is probably not a stock that you have read about before in the business section of the WSJ or NYT. DallasNews is a nanocap, which is defined as a company with a market cap of less than $50 million according to Investopedia. The company operates the second-largest newspaper in Texas, the Dallas Morning News, as well as a marketing/ad agency known as Medium Giant. Our investment thesis here is two pronged. First, with respect to its valuation, DallasNews currently has a negative enterprise value (meaning the total market cap of the company is less than the company’s net cash) which is almost unheard of in today’s market (long-time followers of Cody’s probably remember him buying AAPL in 2003 at a split-adjusted price of $0.20 which at the time gave Apple a negative enterprise value). Moreover, the stock is trading at only 0.15x its trailing twelve month revenue of $150 million and is paying a $0.16 quarterly dividend which equates to 15%+ annualized yield at present. Second, we see awesome potential to get this company growing and profitable again by leveraging its strategic location in the fast-growing DFW metroplex and implementing AI to increase content generation and drive online traffic.

Background.

With its roots tracing back to 1842, DallasNews is “the oldest continuously operated business in Texas.” DallasNews has won nine Pulitzer Prizes and today boasts 142,436 paid subscribers (both print and digital). The Dallas Morning News is the second-largest newspaper in Texas by subscriptions, trailing only the Houston Chronicle.

Formerly known as the A.H. Belo Corporation, this company has been a family business since its founding. In 1926, the Belo family sold their majority interest in the company to George Dealey. Dealey served as chairman of the company until his death in 1946. Dealey’s sons and grandsons ran the company for most of the 20th century until Dealey’s great-grandsons, Robert Dechard and James Moroney III took over. Dechard was chairman, president, and CEO of the company from 1987 until 2013 when his cousin James Moroney III assumed those roles. Dechard then returned to the company in 2018 upon Moroney’s retirement and resumed his prior roles which he held until May 2022 when the current CEO, Grant Moise, was appointed to the position. Dechard remained chairman of the Board until May 2023 and will continue to serve as an ordinary board member until September 21, 2023.

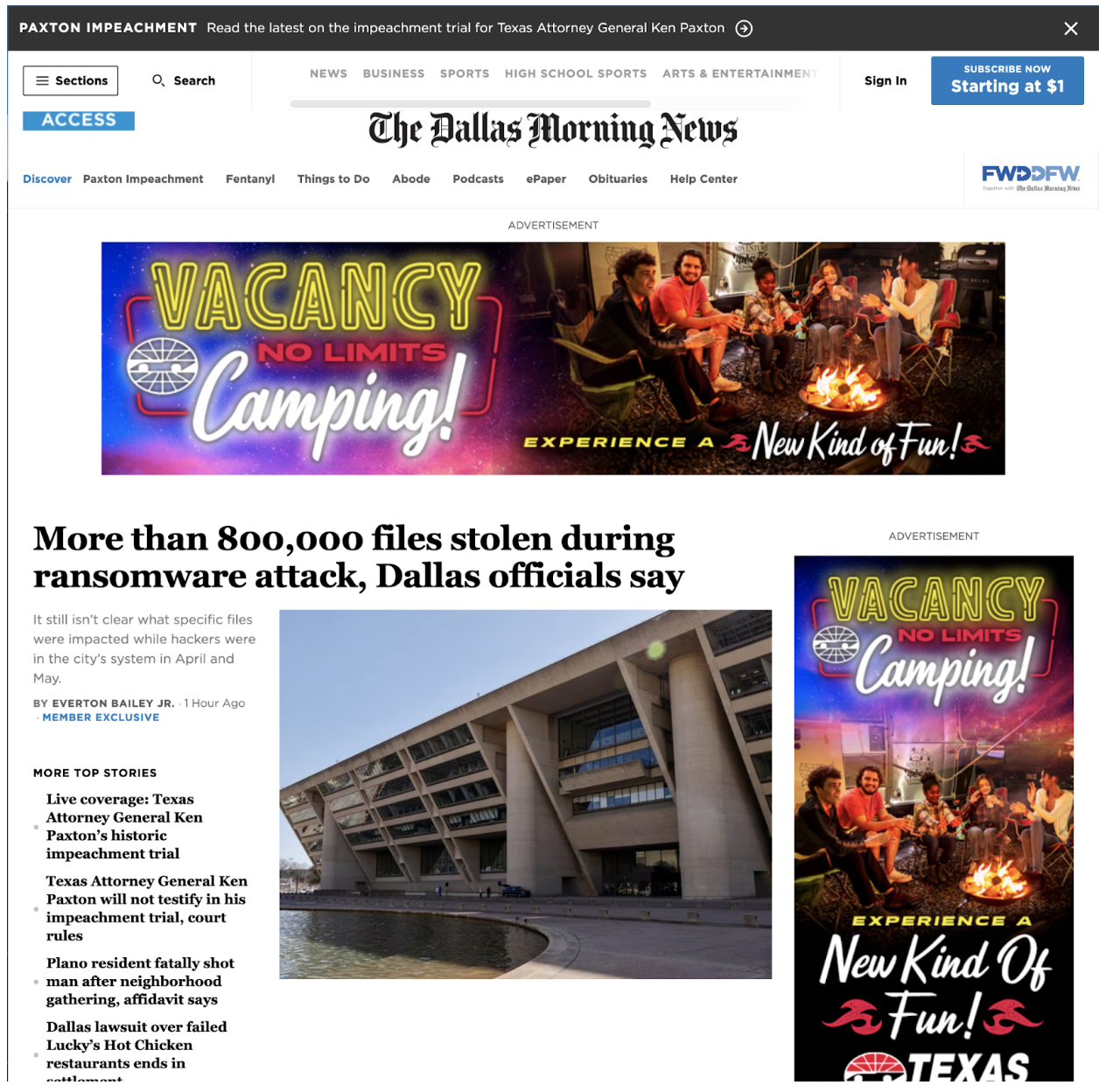

DallasNews operates both a traditional print circulation business and an online news website at DallasNews.com. The newspaper focuses on Dallas-Fort Worth (DFW) area news, and has sections dedicated to business, sports, arts & entertainment, and food. Within the sports sections, DallasNews has coverage of professional, college and high school athletic programs.

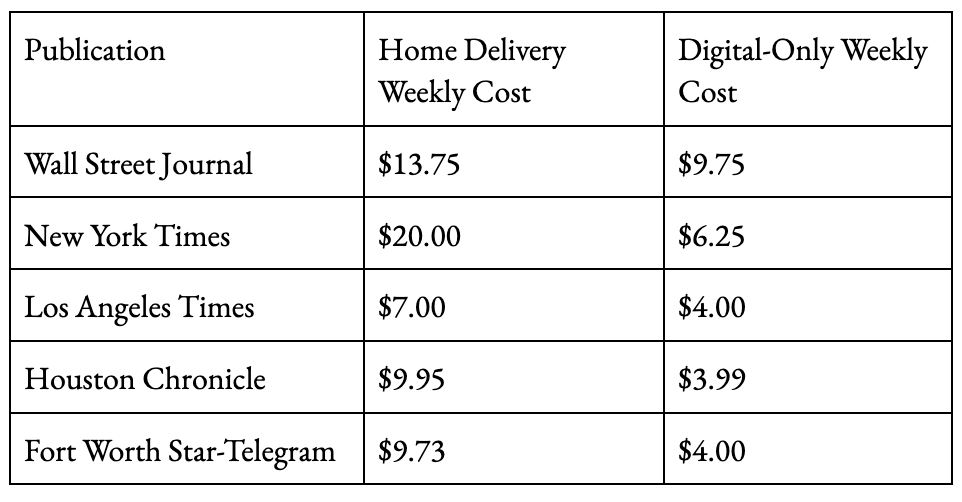

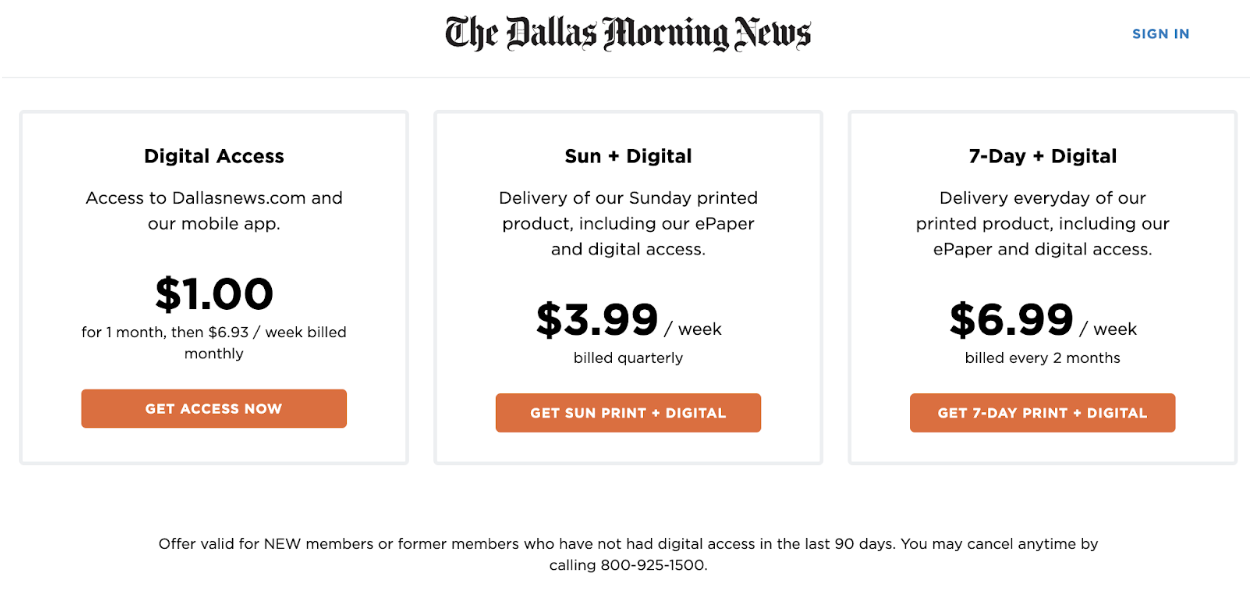

The regular rate for 7-day home delivery is $26.99/week and a digital-only subscription is $11.99/week. For comparison purposes, the full price of digital-only and home-delivery subscriptions from selected publications is shown below:

The company frequently runs promotions for new customers with discounted pricing. However, once the introductory period is over, the weekly prices of the subscription gradually increase over a 6 to 12 month period until the full prices stated above are reached.

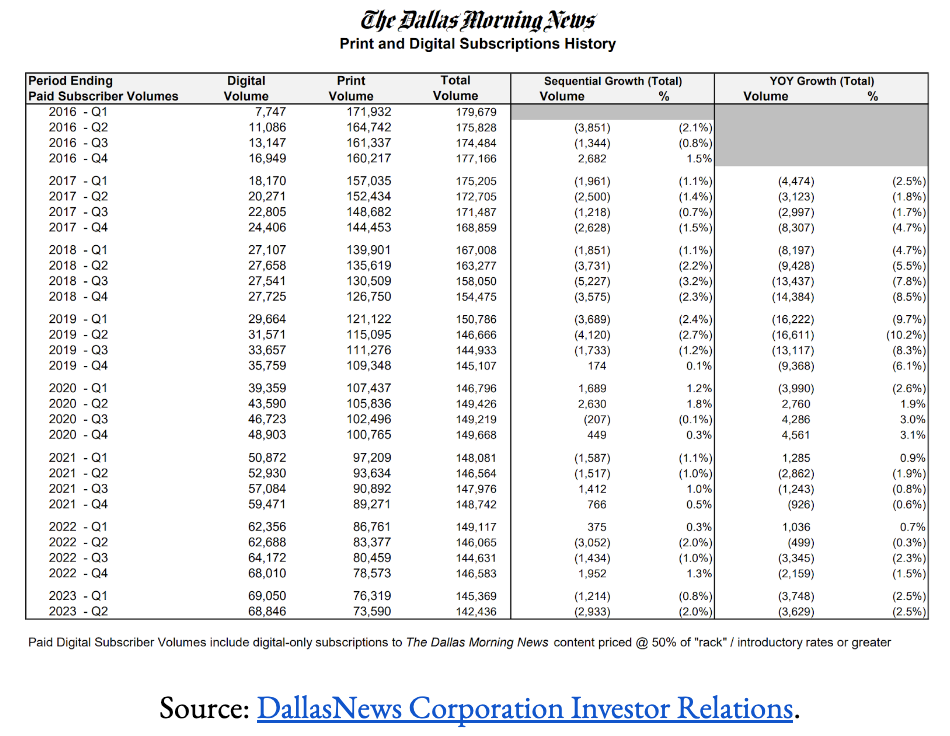

As you might expect, print circulation and the advertising revenue that comes with it have been on the decline in recent years. Since Q1 of 2016, print volumes have dropped 57% from 171,932 to 73,590 subscriptions currently. Accordingly, the company has placed a big focus on growing its more-affordable digital business. Over that same time period, digital subscriptions for the DallasNews have risen nearly 8-fold, from 7,747 in Q1 of 2016 to 68,846 presently.

Business Model.

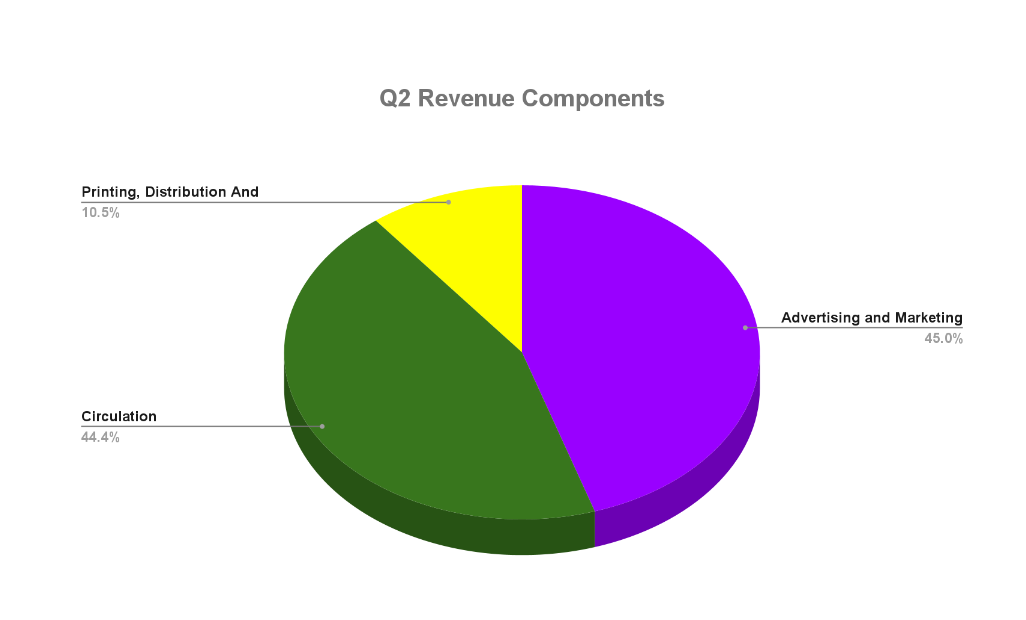

The company’s revenue falls into one of three categories: (1) advertising and marketing services; (2) circulation revenue; and (3) printing, distribution, and other revenue. Revenues generated by Medium Giant, the company’s wholly-owned marketing agency, fall into the first category of revenues. The percentage breakdown of the company’s revenue in the second quarter is shown below:

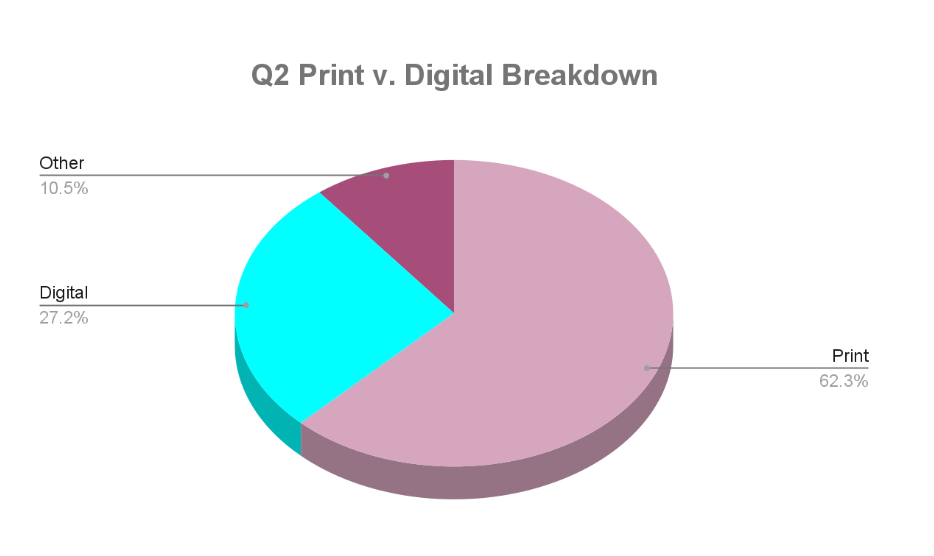

Each business segment includes revenue from both print and digital assets. Despite the substantial growth in digital subscriptions over the last 7 years, combined digital circulation and advertising revenue still only constituted 27% of the company’s total revenue in the second quarter of this year.

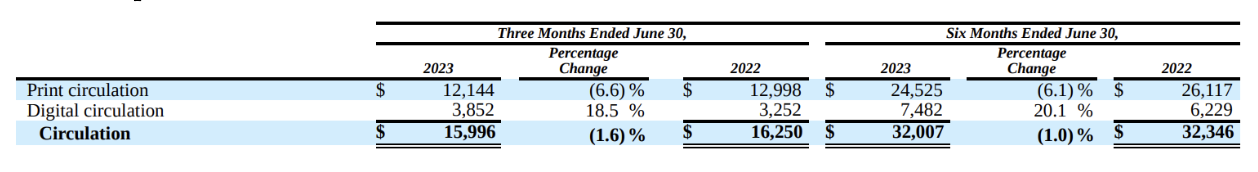

Digital circulation revenue growth of 18-20% YoY is almost enough to cover the declines the company has seen in print circulation:

This growth in digital revenue has helped the company keep the topline relatively flat, but because of cost pressures, the company continues to lose money. In 2022, it had an operating loss of $9 million compared to a loss of $9.95 million in 2021. DallasNews is trying to cut expenses, but the company will probably incur anywhere from $5-$6 million this year in operating losses. When the dividend is factored in, the company’s annual usage of cash comes out to roughly $8-$10mm per year. Accordingly, the company needs to make changes (either return to profitability or cut the dividend) within the next 24-36 months before it runs out of cash.

Growth Potential.

In our view, DallasNews has multiple levers it can pull to increase both revenues and profitability. To begin, its digital business is growing and can be expanded given its presence in the Texas sports market, rapidly growing DFW metroplex, etc. Among other things, this expansion could occur by using modern AI tools to generate news content about the Dallas metro area and Texas in general, especially sports news content. We think the availability of large language models should allow DallasNews to rapidly grow the amount of digital content it is generating without requiring a corresponding increase in expenses. For example, when the Allen High School volleyball team plays a game, the AI bot grabs the score and any data from the game and includes that along with historical data about Allen volleyball’s win/loss record, how many times they have made state, won state, etc. We think the expansion of AI generated content would help drive traffic to the website and result in increased digital subscriptions and advertising.

DallasNews also has a big opportunity in Texas high school sports. Texas, perhaps unlike any other state in the US, has a (sometimes unhealthy) obsession with high school football. DallasNews can capitalize on this by focusing on DFW high school football, which is a market that most other media companies have overlooked. This offering could include access to a live stream of every high school game on the DallasNews app. We think the company could implement a “wiki” model, whereby parents/students/alumni can use their smartphone camera to broadcast games and other events on the DallasNews app once they are approved by the company’s team. The company could also allow users of the app to get notifications whenever someone posts video content about the high school teams they follow in the app. This is just one example of how DallasNews could further drive traffic to the site by utilizing its established brand and without the additional expense of staff actually traveling to the games.

While the traditional print media business is a secularly declining industry, there will always be demand for high-quality content. Whether that be Texas-focused business news, local high school sports, or in-depth political commentary, we think there are a lot of ways to get DallasNews back on track and growing again. Dozens of traditional media companies have pivoted to online-based content creation and publishing and thrived. DallasNews has the potential to do the same.

The Risk/Reward Setup.

DallasNews caught our attention because of its extremely cheap valuation and attractive dividend yield. The company is trading at 0.15x its 2022 revenue and could produce an earnings yield of 32% per year if expenses were cut only 10% from last year’s levels, for example. DallasNews is in the process of reducing its headcount while simultaneously growing its digital circulation. As discussed above, DallasNews could further accelerate growth by expanding the depth of offerings and services in the DFW/Texas sports and business news markets using AI and a Wiki model. And as DallasNews makes this transition to digital, investors will likely continue to get a 15% annual dividend in the meantime. We see big upside if DallasNews can get any traction with its growth plan and bring profitability back into focus.

There is some downside protection with this trade in DallasNews’ balance sheet. The company is trading for less than net cash of $25mm (as of 7/21/23) and has no long-term debt. Its largest liabilities are its long-term leases (for office space and distribution centers) of $17.8 million and long-term pension liabilities of $19 million. The pension liabilities are associated with a legacy pension plan for former DallasNews employees (having been replaced by a traditional 401(k)) and the company is not required to make any contributions to the pension plan going forward. Thus, DallasNews does not have to commit much, if any, of its cash flow to servicing long-term obligations.

Additionally, DallasNews’ fixed assets include a 630,000 SF warehouse in Plano, TX where the company’s printing operations are located. The building alone has a tax assessed value of $17.8 million and it is full of printing equipment. We estimate that the book value of DallasNews is at least 2x the current market value. Given that the company has a negative enterprise value, there is some cushion if the return to growth/profitability takes longer than expected.

Comparison to TST trade in 2016.

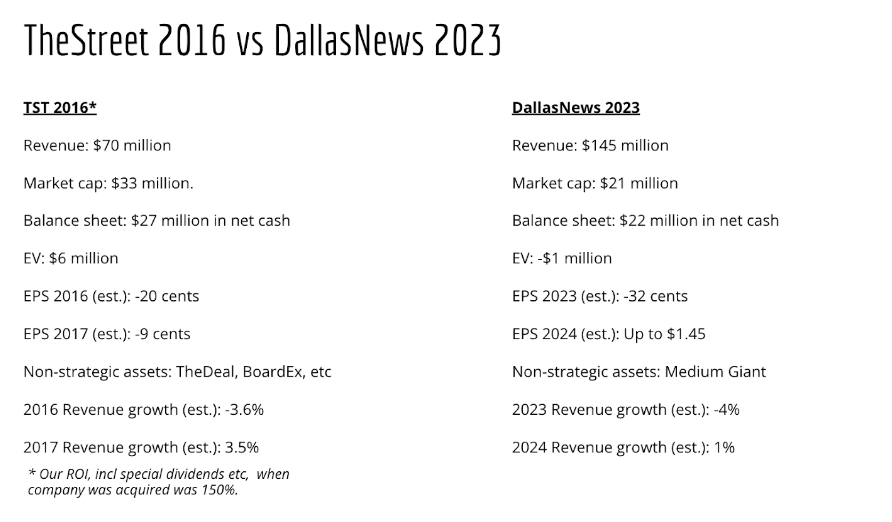

One of the exciting aspects of this trade is that it has a lot of similarity to our TheStreet.com (TST) trade made back in 2016, which yielded us 150% return. A comparison of the key metrics are demonstrated below:

DallasNews offers an even more attractive entry point as TheStreet.com was not trading at less than cash when we bought it. Additionally, DallasNews is trading at 0.15x sales compared to TheStreet.com trading at just under 0.5x sales. Nobody wanted to touch TheStreet.com when we started buying it and then it ended up being acquired by another media company. DallasNews is giving us a similar setup at an even more attractive valuation. Additionally, DallasNews has the advantage of covering a red-hot metropolitan area whereas TheStreet.com was competing with SeekingAlpha.com, Bloomberg, WSJ, and hundreds of other financial media companies competing for the same audience of retail-ish traders and investors. We think TheStreet.com gives us a good model for what this trade should look like, but frankly the potential upside here is much higher than what we were looking for when we went into TST.

Our Model.

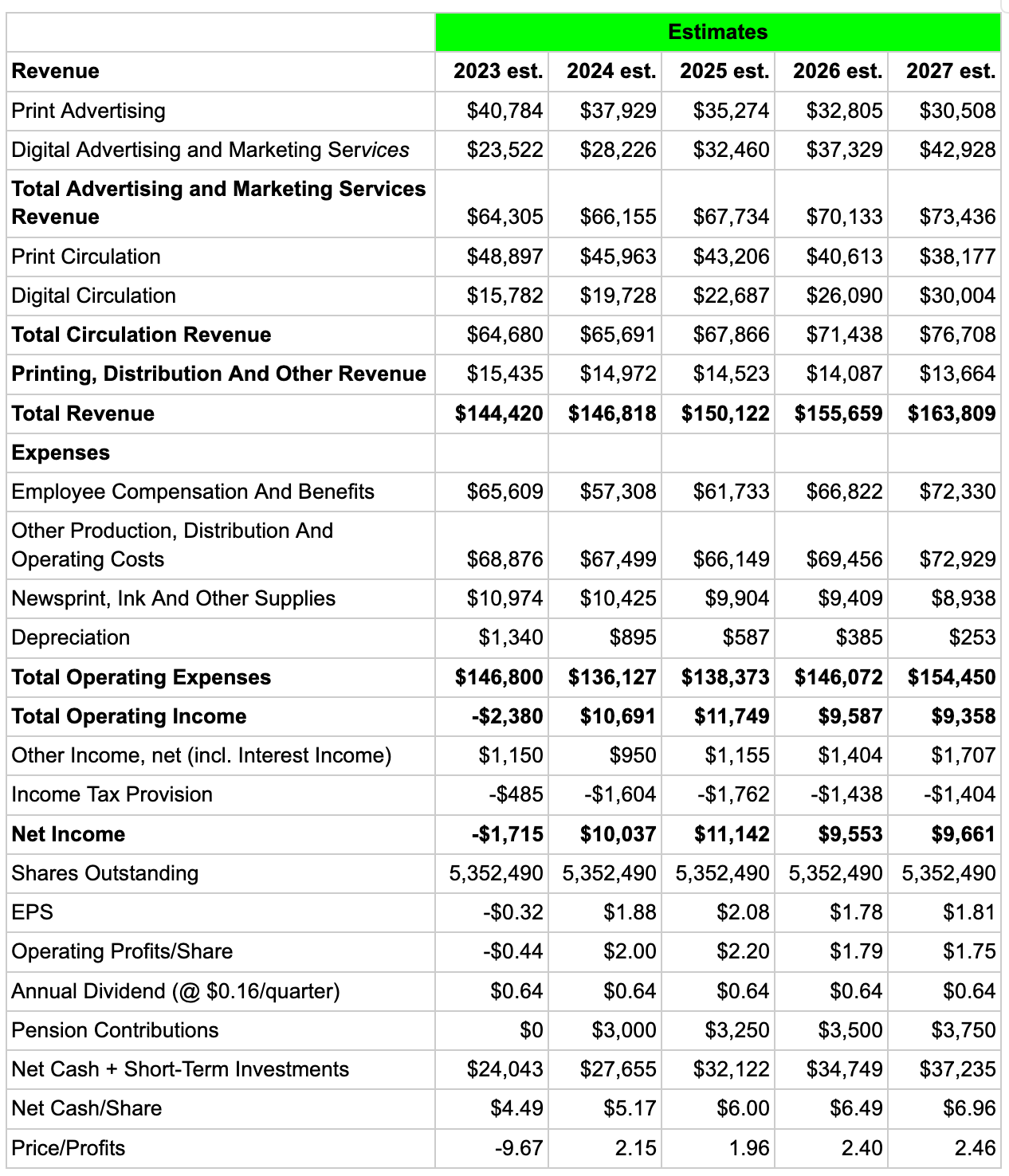

In our model, we assume that the traditional print advertising and circulation businesses continue to decline at about 5-7% per year. We model digital advertising revenues returning to 18-20% growth commensurate with the growth DallasNews has been seeing with its digital circulation revenue. Meanwhile, we model employee compensation dropping over the next two years as the company continues to trim headcount. In sum, we think the company could reasonably return to 2-5% topline growth for the next 4-5 years while expenses are reduced. Since the company is already operating close to breakeven, even a slight improvement in operating margins will produce a big earnings yield for shareholders. As shown below, we model DallasNews kicking out $2/share in earnings as soon as 2024 with what we see as very reasonable changes to the current operating structure.

Peer Comparison.

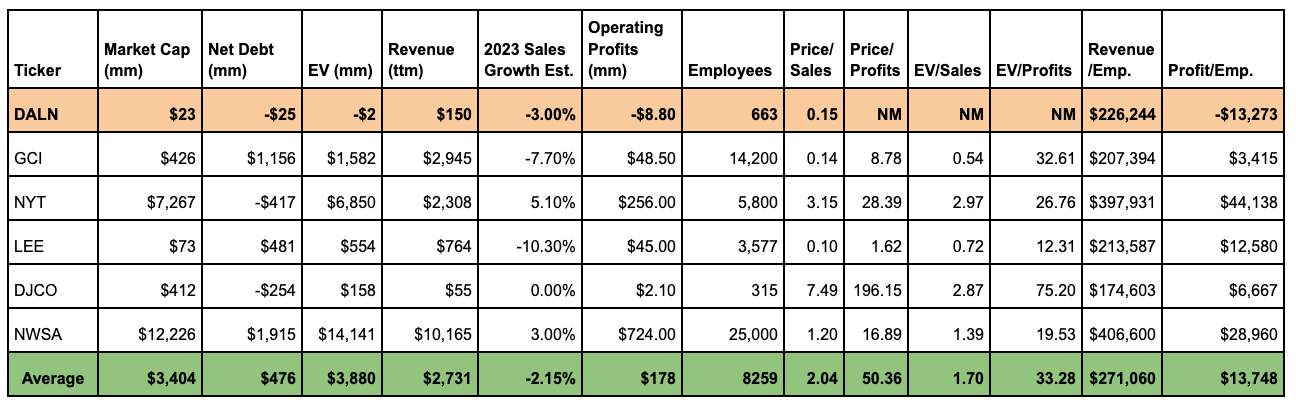

We ran a comparison of DallasNews to some comparable companies in the print media business (Gannett, Lee, Daily Journal) as well as to market leaders like NYT and NewsCorp (DowJones, WSJ parent). DallasNews is clearly trading at a big discount on a price/sales metric (0.15), and with a negative enterprise value, the business itself is essentially priced by the market at $0. We would also mention that there is obviously improvement to be had on the profitability front as DALN is the only company that is running at an operating loss. Although we are cognizant of the struggles in the print media business, clearly there are steps that could be taken at DallasNews to bring it in-line with its peers on an operating basis. Both NYT and NWSA are expected to grow in the mid- to low- single digits this year having somewhat successfully made the transition to becoming digital platforms. We see both the revenue and profit goals as attainable, thus opening up major opportunities for the company and its shareholders going forward.

Ownership.

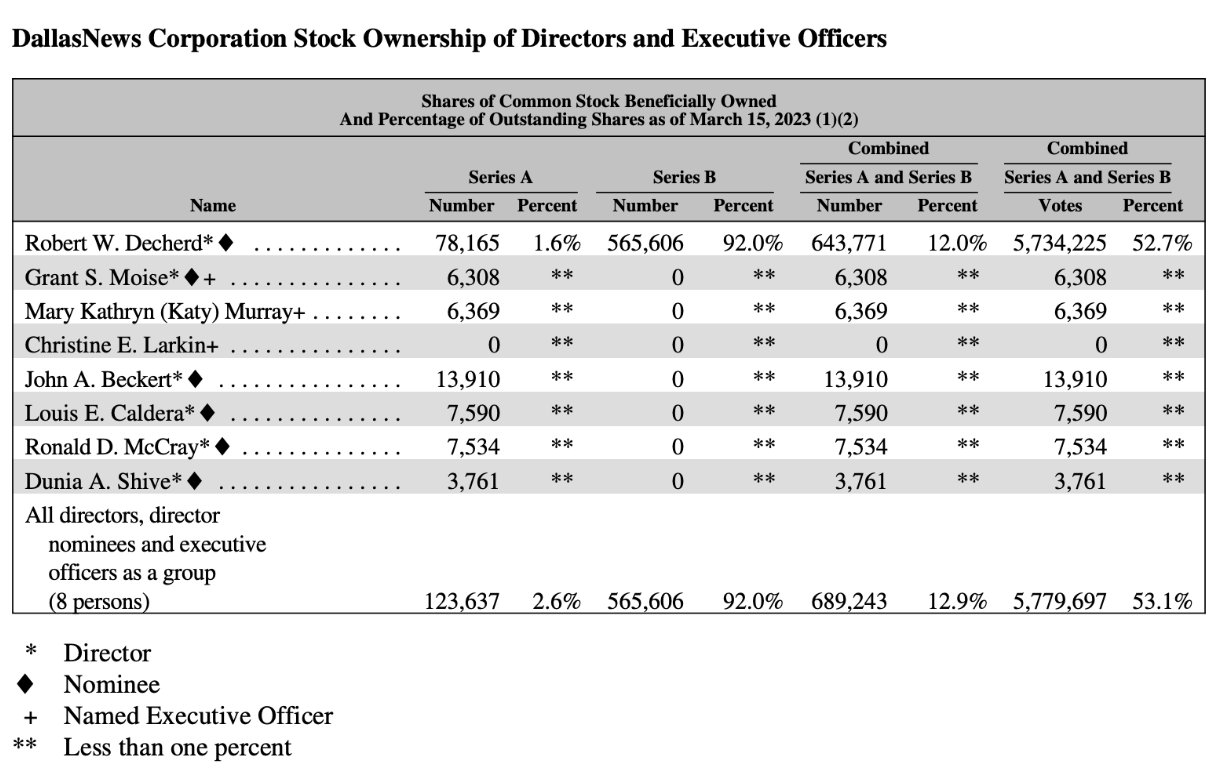

DallasNews went public in 1981 but the Dechard family has maintained effective control over the organization since purchasing a majority interest from A.H. Belo in 1926. The ownership of the company as of its last shareholder meeting is shown below:

Series A shares (which are the publicly-traded shares we can buy) are only entitled to one vote per share, while Series B shares are entitled to ten votes per share. Through his ownership of 92% of the outstanding Series B shares, Robert Dechard has control of 52.7% of the voting interest in the company. On the other hand, you can see that the remaining directors and officers of the company do not hold meaningful positions in DallasNews. For example, Grant Moise (CEO) owns 6,308 shares, which have a market value of $26,809 at today’s closing price.

As we mentioned in the intro, the hedge fund owns just over 5% of DALN and the fund is currently probably the second-largest shareholder in the company.

Summary.

The market has left DallasNews for dead even though it has the potential to be a profit generator in the next 2-3 years. The company’s location in one of the hottest metroplexes in the country, combined with the potential to use AI to help generate content, gives us confidence that this company can return to stable growth in the years to come. We will be traveling to Dallas to meet with the management team in coming months and are excited to learn more about the business from those who know it best. This will be a long-term holding for us if it all works out and are excited to be major shareholders of this potentially profitable enterprise.

Remember, don’t rush into a whole position all at once as this stock is illiquid and can bounce around quickly anytime someone tries to buy or sell much of it at all.