F2F Market prediction, Stocktwits IR, NXPI, Lifetimer & more

Here’s a musical anecdote about why I love the App Revolution still. I got a new Peachtree integrated amplifier for my office that I mentioned last week in the chat and I also got two new Klipsch speakers. When you get new speakers, you need to break them in and according to Klipsch, I need to play the speakers at “louder than normal” volume for 100(!) hours. The integrated amp has a wifi transmitter built into it which gives it the ability to stream Spotify straight into the system so the Peachtree’s DAC can process the song’s signal directly from digital to analog and into the speakers.

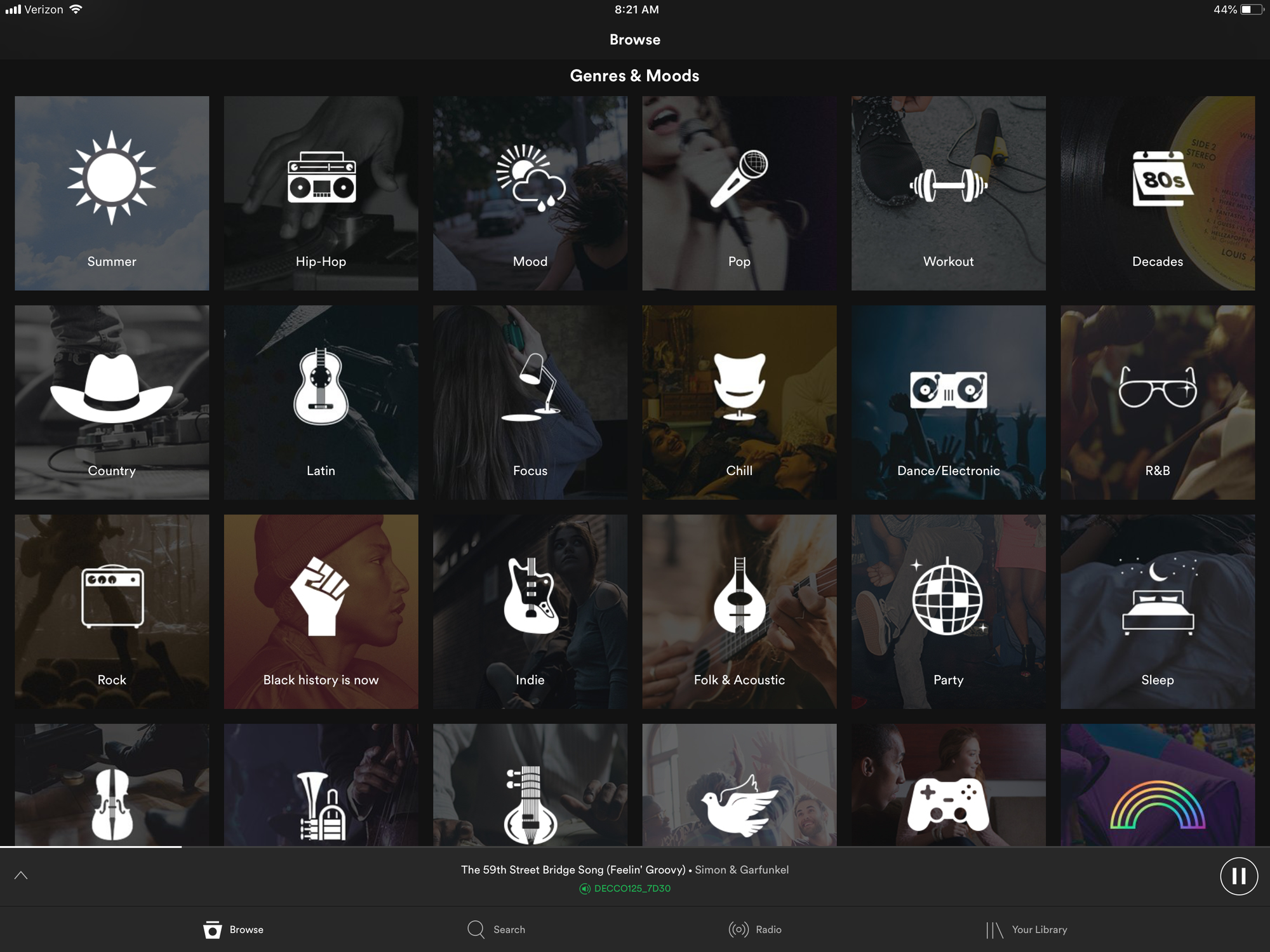

So at 9pm every night, I pull up my Spotify app on my phone or iPad and set it to play on the Peachtree amp at volume 8 or so and let it blast a 6 hour playlist of various genres overnight. I’m not sure how I’d be able to break in these big ass speakers in this office complex without the App Revolution.

Here’s the transcript from this week’s Trading With Cody Live Q&A Chat.

Q. Hi, Cody: Could you give some advice about market direction in next few weeks after US-CHINA “plot a road map by November for ending trade war”? Do you think SP500 Index can go up to 3000 in next 1-2 months? Or Nasdaq index can go over 8000 in next few week? Feet on fire. Thanks a lot.

A. One thing to remember is that other factors can affect the markets over a time frame of a few weeks. And another, probably more important thing to remember is that the markets usually price in the headlines as (or even before) they develop. So stocks could already be pricing in positive US-China Trade War developments right now and we could get a sell-the-news reaction if there is actually some positive developments in The Great Trade War of The 21st Century. Feet-to-fire (F2F) guess (“feet on fire,” as you put it, is what I’d call it when the markets have crashed and I’m hustling to nibble call options and buy more stocks! LOL) for the markets for the next 1-2 months: Markets go up another 3% from here, fall 5-7% in a mini-crash, then trade sideways into year-end. I wouldn’t try to profit with that feet-to-fire market guess I just laid out though!

Q. Cody if you were to put all your eggs in two investing baskets for say the next 3-5 years, what stocks would they be and why?

A. Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money. If you haven’t yet read my #1 Amazon bestseller, “Everything You Need to Know About Investing” then spend a couple hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand. Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into. But I’d be very slow and cautious right now about building positions.

Q. Cody many stocks mostly china related have been taken down hard with all the tariffs and trade talk are there any you would consider for a trade or investment?

A. I’ve always said that if I were to invest in China, I’d probably buy BIDU and TCEHY. Each of them is down right now, 20-30% from their recent all-time highs, but I personally probably won’t look at buying them unless they get down another 20-30% from here.

Q. Cody when you have time another small medical device company to take a look at TRXC.

A. It’s an interesting company. Topline has grown from a few million a couple years ago and is expected to be up another 75% next year to more than $40 million. Not profitable. They’ve got $100 million in cash, but about $20 million in debt. $1 billion market cap. So it’s trading at 25x next year’s sales estimates — not cheap! Interesting enough that I’ll try to reach out to management there to see if I can talk to them and get a better feel for the story at TRXC. TransEnterix, Inc., a medical device company, engages in the research, development, and sale of medical device robotics to enhance minimally invasive surgery. The company offers Senhance System, a multi-port robotic surgery system, which allows up to four arms to control robotic instruments and a camera in Europe. It also develops SurgiBot System, a single-port system robotically enhanced laparoscopic surgical platform.. TransEnterix, Inc. is headquartered in Morrisville, North Carolina.

Q. Cody, TRXC should talk to you. There is somebody who claims to be IR that posts on StockTwits. I find that odd to say the least but in this new technology age, who knows. Maybe that will become the norm!

A. No, having an IR from the company post on StockTwits is a red flag for sure, if true. I’ll give the company a call this week and see what happens.

Q. GM Cody. What is your opinion on NXPI ?

A. On the one hand, the stock is cheap! Trading at 11x next year’s earnings estimates and about 3x sales estimates. On the other hand, the topline is hardly growing single digits while other tech companies are putting up 20-40% topline growth. Also, management has seemed like total pawns in the Qualcomm game. I don’t know if I have any faith that NXPI can figure out a go-alone strategy of growth. No dividend yield for holding it either. Probably not a stock for me, but I did email Robert Marcin, my favorite value investor, asking him to look at it after I got your question and looked at the stock afresh this morning.

Q. CNBC reporting huge short interest in gold futures.

A. Yeah, everybody hating on gold right now. I be on the other side.

New Trading With Cody subscriber: Hi Cody. I am a new Trading With Cody subscriber, but I had followed you from thestreet.com and realmoney.com and had been subscriber of Revolution investing for a few years. I can say that I am a fan of yours in investing since you banged the table for investing in Apple at Realmoney.com. I know I might have missed the window, but can I still get the TradingWithCody For Life subscription?

Cody: Thanks for the kind words! Here’s the link to join TradingWithCody.com for life. I won’t tell support that I shared the link if you won’t! LOL

Subscriber replies: I have tried and paid thousands of dollars for others services and I can say (proof is in the pudding anyway), that for long term investors, your service is the only one I needed. I am now a new Trading With Cody for lifer. Thank you for AAPL, SNE, VZ, etc.

Cody: Well, thank you again for the kind words and for becoming a lifetime subscriber.