Facebook, Bitcoin, Cryptocurrencies: Where’s the fear?

Hi everybody. Amaris is still in the hospital in Albuquerque and I’ve driven back and forth there (170 miles each way) twice this week. I’m headed up there again this afternoon. We don’t know when she’s getting out yet, so I’ll likely work from Albuquerque tomorrow. I’m scheduled for a one day trip to LA on Friday for a meeting and then we’ll see where we’re at this weekend. My family and I are a bit stressed, stretched and tired at the moment, so bear with me if I don’t write again until next Monday.

I do want to hit on a few topics this morning though while I’m in the office. First, Facebook again. The Facebook privacy crisis has, as I’d expected, weighed on Facebook’s stock heavily so far. The rest of the tech sector has also been hit hard this week, down a couple percent so far but still up a handful of percentage points on the year. I think Facebook’s stock could struggle here for a bit for all the reasons I laid out on Monday. I’m not going to sell all of my long-held FB stock which I’ve owned since it was in the $20s, as I do think Facebook earnings will continue to grow strongly in coming years and that there’s still long-term upside in the name. That doesn’t mean the stock will ever go up in a straight line of course.

Another slightly bearish anecdote about FB’s stock for the near-term comes from a our own Trading With Cody Chat Room, where just one day after I sent out “Four reasons this latest data problem is indeed a problem for Facebook” I get this question from a rather long-time subscriber: “Hey Cody, how about buying some FB long dated call options at some point?”

I suppose one of the reasons a Trading With Cody subscriber might ask that question is because we have indeed made some very nice extra profits when we’ve nibbled on some FB call options to complement our core FB common stock position a few times in the past few years. That’s great, but I also think we should maybe think about being more defensive than opportunistic right now.

Getting that question about if we should buy FB calls despite having just sent out a report to you guys about why I’m concerned about FB right now — well, it reminds me a bit of that story I recently told you guys about my “Great Cryptocurrency Crash” speech (you can watch the whole speech here) at The Money Show in Orlando a few weeks ago. I’d spent 45 minutes giving a speech warning people about cryptocurrencies and why they should be fearful of the whole cryptocurrency market right now and how I had written a book predicting The Great Cryptocurrency Crash that was published on the day bitcoin hit $20,000 and that I thought bitcoin would hit $1000 or less before The Great Cryptocurrency Crash was over. And after I finished the speech, I was mobbed by dozens of people from millennials to grandparents and every question I got was, “Well, do you think we should buy bitcoin anyway?” And “Should we buy bitcoin for our grandchildren?”

Where’s the fear in the market and in the public? Why isn’t anyone scared about losing all their money?

Be fearful when others are greedy.

On that note, here are the results of my recent one question poll that I asked Trading With Cody subscribers and I also separately asked the general public to answer.

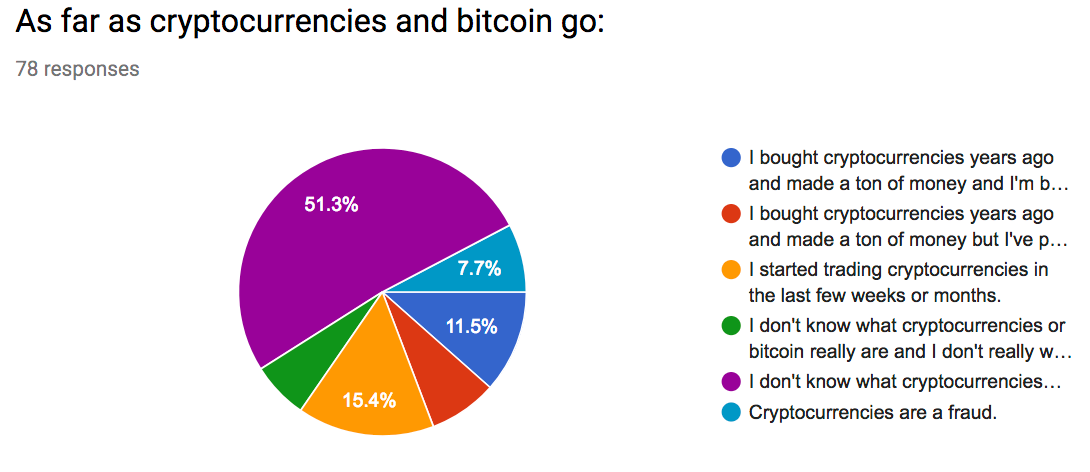

Trading With Cody Subscribers:

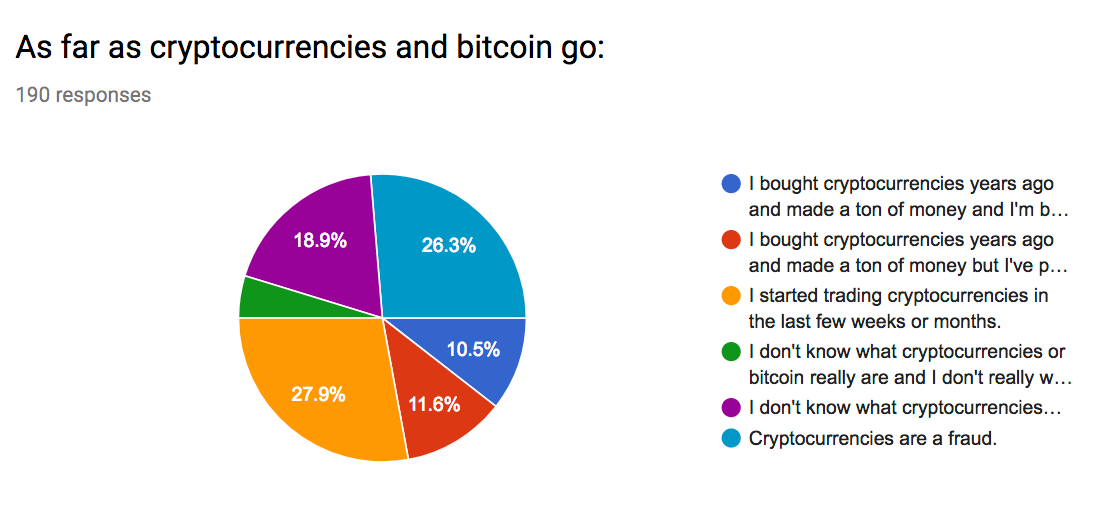

General Public:

What sticks out to me from comparing and contrasting the two data sets of my subscribers vs the general public is the TWC subs are clearly interested in learning more and very few of you think cryptocurrencies are a fraud. More than 1 in 4 people in the general public think cryptocurrencies are a fraud. Also notice that more than 1 in 4 people in the general public just started trading cryptocurrencies in the last few weeks or months. That’s a big %! Even the 15% of TWC subs who have have started trading cryptocurrencies in the last few weeks or months is rather high. Please be careful out there!