Facebook, Meta And The Popping Of The Bubble-Blowing Bull Market

Facebook’s stock is getting slammed today, losing almost 1/4 of what it was worth yesterday and back to where it was one year ago when I was really liking the valuation and set up. I think it’s going to be a good buy around these levels, but we might need to let it wash out a little bit first.

I’m a bit worried that FANNG investors might have learned the wrong lesson by seeing the big pop in NFLX after its post-earnings report crash last week. The watched as as the stock popped more than 20% in the next week after that drop. I think a lot of traders and investors are hoping that FB will do a similar type of move and those people will likely not hesitate to load up on FB on today’s whoosh down. You don’t want to try to be too cute with the action, but I’d expect that FB will initially put in a bottom in the mid $240s this morning, will rally 5-10% intraday and then will have trouble getting back over $250 for a few weeks after that.

As for the fundamentals, I have to say I don’t think things are as bad as the 25% drop today seems to be implying. For the first quarter, the company took topline estimates down about 8%, from $30 billion where the analysts were to about $27-29 billion. FB says that Apple’s privacy changes, which were largely expected to impact sales, have indeed done so and that this year the impact could be about $10 billion for the whole. Let’s do a little more math here — the company will do about $120 billion in sales this year and $10 billion of that would be about…8%. To put this in financial perspective, let’s consider that FB bought back about $20 billion of their outstanding shares last quarter and as of today, they’ll be down about 25% on those trades — that’s about $4 billion, or almost half the entire impact of the Apple privacy changes on the company’s revenue for the entire year this year. They’ll easily lose $10 billion on the $45 billion worth of shares they purchased throughout last year with the stock opening up at about $250 a share this morning.

Meanwhile, the company outlined two other reasons they are worried about their topline estimates for this year, one of which doesn’t matter and one of which is a big concern for the markets in general. The one that doesn’t matter is this, because you can’t try to game fiat currency arbitrage impact:

“Based on current exchange rates, we expect foreign currency to be a headwind to year-over-year.”

The one that does matter is this:

“We will lap a period of strong demand in the prior year and we’re hearing from advertisers that macroeconomic challenges like cost inflation and supply chain disruptions are impacting advertiser budgets.”

If FB is seeing macroeconomic challenges of inflation and supply chain disruptions impacting their gigantic $120 billion-a-year advertising business that stretches across the entire economy from small to big and from digital to oil, then its likely that the entire economy could be teetering on a pullback (r-word? “recession”?) here.

And if our economy has been driven, at least in large part, by the free-flowing money that came during the now-ended 13-year long Bubble-Blowing Bull Market that allowed thousands of crappy, fraudulent and/or silly companies (and cryptos and other assets) to roll around in free money, then this year we could see some fundamental economic pain that we haven’t seen in many years.

The good news is that downturns like the one the markets and perhaps the economy are in here are necessary for washing out the excesses and bad businesses. The really good news is that these kinds of wash outs are what gives smart, patient investors the opportunities to buy good companies when they’re being punished by the broader markets and economic forces.

The bad news is that it can be painful to put these bottoms and to let these individual stocks play these dynamics in the markets out. So be patient, so don’t be greedy. If you have, like me, been patient already and defensive, then you’ve probably got some cash to put to work here and/or some shorts to cover. I don’t want to draw a line in the sand and I want to respect the fact that this downturn could either get more vicious before its over or the market could just stagnate for a while and punish both the bulls and bears for a few months at least.

Stepping back from all these weeds that we’re in, let’s remember this about Facebook, for example —

We want to invest in the metaverse and this is the the company that’s making the leading platform that the metaverse will likely be built upon. And we’ve got a side business that already kicks out tens of billions of dollars of profit every quarter too. FB might be stuck around here and/or in a fade move for a while. But I plan to keep my long-held FB in my personal account in place as it has been since we first bought it back at $20 or so after FB’s post-IPO crash. I plan to build up my FB position a bit more in the hedge fund over the next few weeks, but I’ll be patient about doing so for now.

The markets, after years of blowing bubbles, are not doing so any more and I am certainly not surprised at how vicious some of these moves downward have been so far this year as being on the other side of the Bubble-Blowing Bull Market is going to create some balance and clean up many excesses. But the opportunities are arising for great stock picking where good analysis is what drives performance instead of just being a function of the broader markets direction.

Some reminders of old times for more perspective before I go as here’s my FB analysis from nine years ago when we started buying the stock before it went up 10-fold:

How Facebook gets to $100 per share (Trading With Cody)

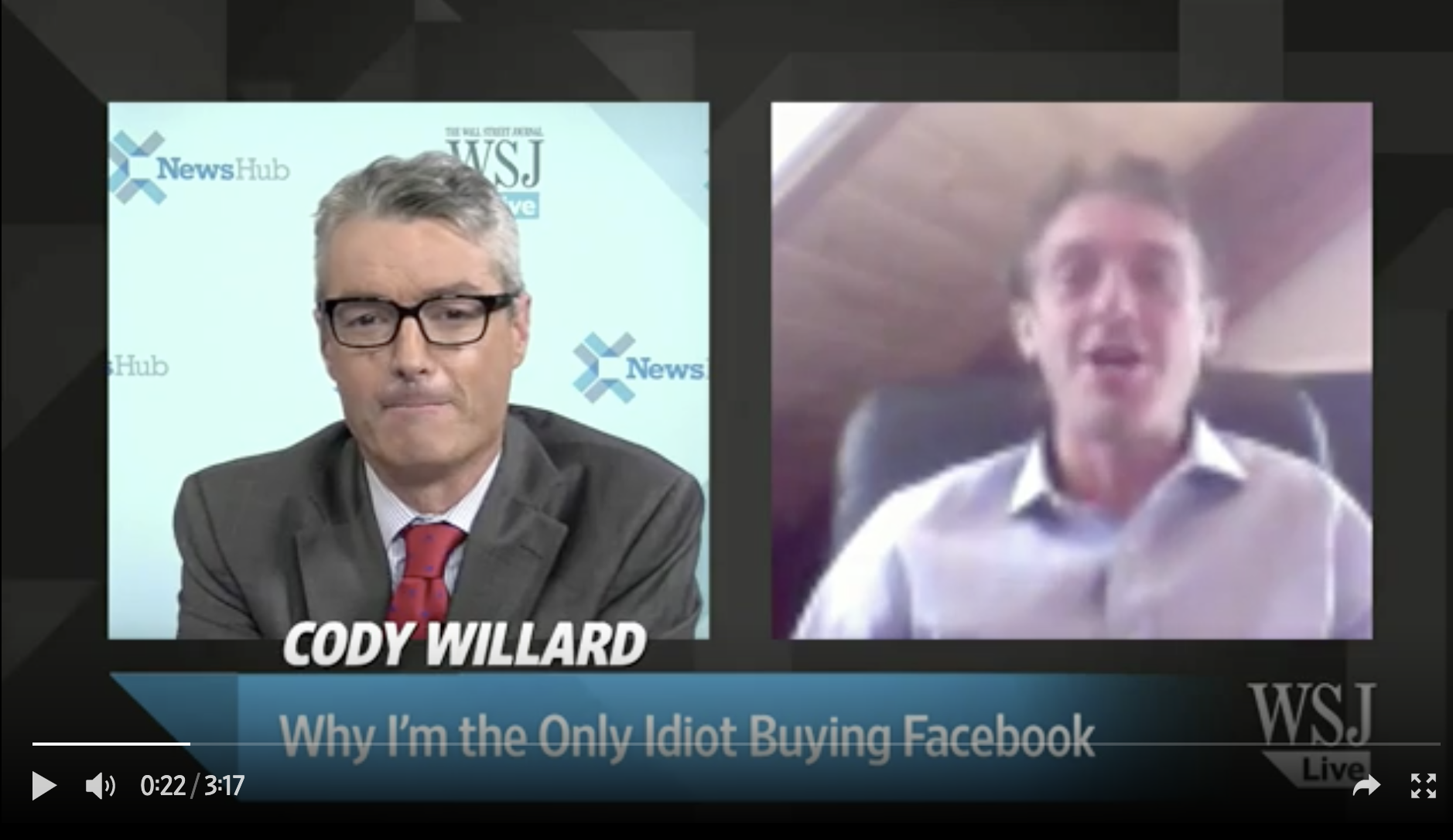

Cody Willard: Why I’m the Only Idiot Buying Facebook (Wall Street Journal)