Financial Conditions Warning Signs Vs The SPAC Crash Opportunities

It seems like all year I’ve been warning about valuations being out of whack with reality, especially in small cap techs, which obviously includes most SPACs. So many SPACs being slammed as the aggressive former “diamond hands” turn into weak-handed sellers who are (rightly, in most cases) trying to stop the losses that are piling up in their portfolios.

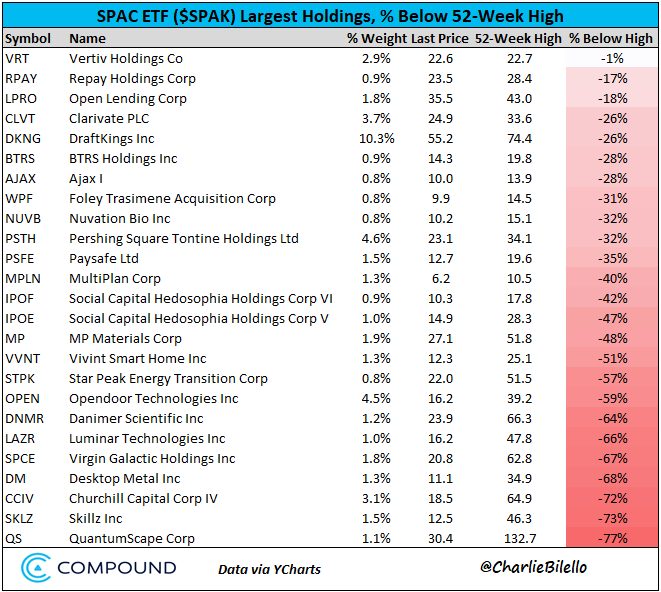

Speaking of SPACs, the markets are still suffering from SPAChaustion and a Coinbase Overhype Top, as I’ve also been saying they are for a few weeks now. Most (all?) SPACs are down big from their recent highs, as evidenced by this chart:

Remember the last few weeks when I kept saying that Virgin Galactic should do a secondary to raise a half billion dollars or more when their stock was up near $60? They didn’t and instead we saw their chairman and then their founder unload basically their bets on this stock. Our other SPAC stocks, all of which we also trimmed aggressively at MUCH higher levels, are also down big from their own highs. In fact, we are still up big on our remaining SPCE that we bought when the stock was at $8 or so and I’m going to hold those shares but I don’t plan on buying any more SPCE common stock until they prove they can start getting to the low-altitude “space” they’re trying to get to. On the other hand, I do like some of our other SPAC stocks, as noted below as you’ll see.

Meanwhile, here’s a chart that shows the Goldman Sachs “Financial Conditions Index” that as Goldman Sachs says is defined as “a weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP”:

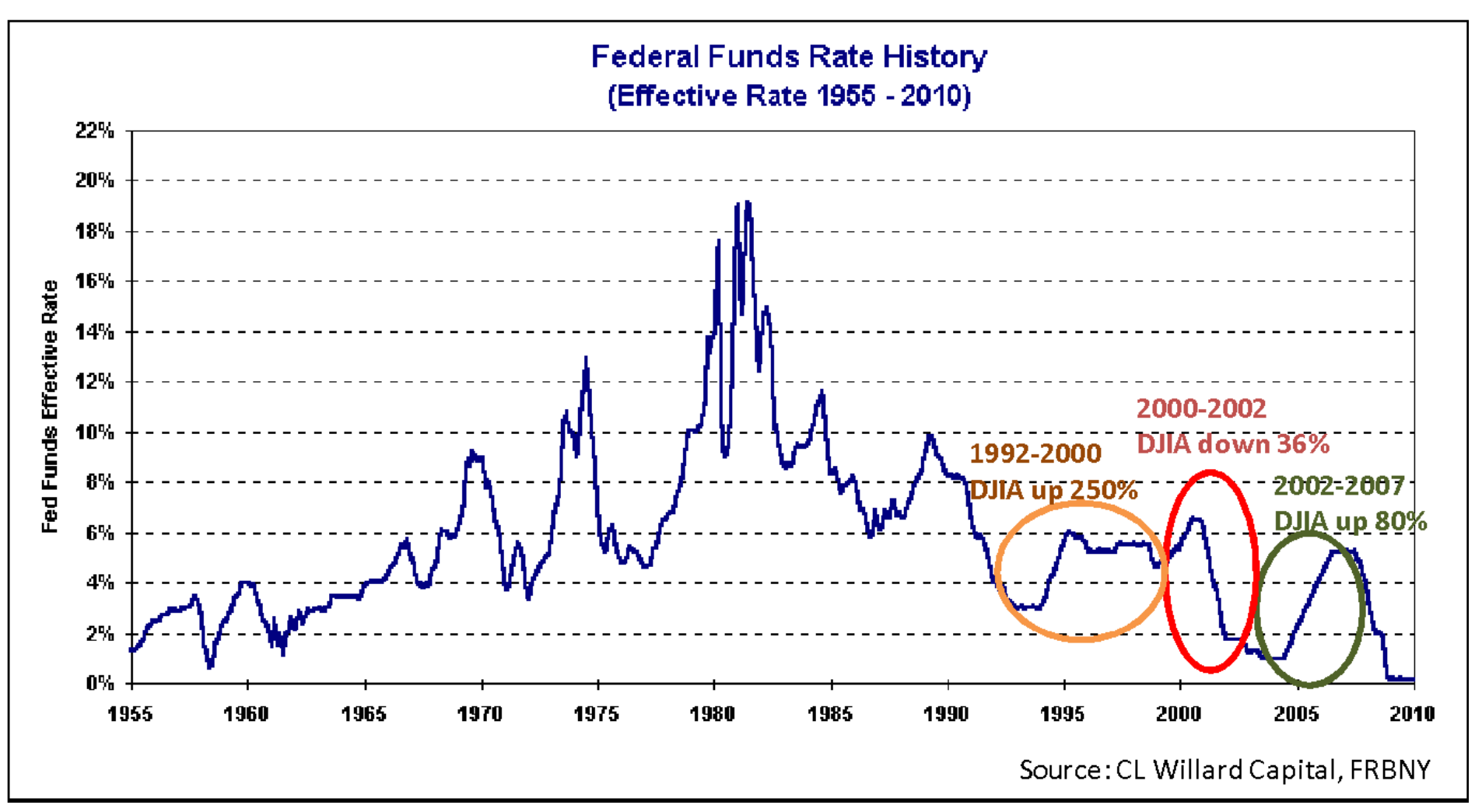

For two decades now, I’ve rightly explained how investors should actually do the opposite of the old “Don’t fight the Fed” saying. I even wrote a whole mini-ebook about it for Trading With Cody subscribers a few years ago. Here’s a chart from that book that shows why:

So I wondered how the the markets bubbles and crashes would overlay with the Goldman FCI to see if there were any insights we could glean out of it and here’s what I put together:

And here’s what I think I learned from that chart I made (you can click on any of the pictures to see them enlarged by the way): It’s probably not a good idea to load up on stock market indexes when the Goldman Sachs Financial Conditions Index chart is at all-time lows.

On the other hand, my mind keeps going back to that first chart at the top of today’s report, that SPAC Crash list of stocks. And with so many stocks down 30-90% there’s going to be some good buys. Yes, there are some SPACs that are literally down 90% from their highs. Remember when I predicted that NKLA would drop at least 90% from its highs? As of today, with NKLA now below $10, down from its $93.99 high last year, well, it’s basically down 90% from its high. I’m still short a few shares of NKLA in the hedge fund by the way.

But away from NKLA and other similarly questionable-at-best companies that came public in the now-popped SPAC Bubble, there are probably some good buys out there. I’m hard at work digging into some of my favorites to see if they’re finally at levels that I find attractive. But as always, I’m going to be VERY SELECT in what I end up investing in, paying attention to the company’s positioning and ability to create trillion dollar economies in new sectors while making sure we don’t just overpay at any valuation.

Even though it seems like Space Stocks never go up, my favorite sector to invest in for the next five or ten years remains The Space Revolution. My favorite Space stocks remain SpaceX, then followed by RocketLab (VACQ), then followed by BlackSky (SFTW). Understand though, that we are very early in the first inning of The Space Revolution and we should expect that it might be a year or two before the markets catch up to the trillion dollar industry that Space will become in the next five years or so. Then again, you never know when the markets will start to price in the trillion dollar market place, as I used to explain when we started buying TSLA at $50 a couple years ago before it fell to $40 and then suddenly went from trading at 1x forward sales to 8x forward sales as the market started to price in the trillion dollar future of the electric vehicle industry.

I might have to cull the portfolio before adding too many more names though, so be prepared for that too. Be careful out there, but don’t fear this market action as our playbook and analysis continue to help us do our best to take advantage of the pitches the markets are throwing.

We will do this week’s Live Q&A chat at 10am ET tomorrow (Thursday), in the TWC Chat Room or just email us your question to support@tradingwithcody.com.