Five Things I Learned This Week

I can’t believe another week is almost gone by. It’s been a wild one too, eh? Ups and downs, which are nothing new. But the flow of earnings reports and Fed watching and economic data updates were something special. Here’s what I learned this week:

1) Inflation has probably peaked, at least the rate of inflation has probably peaked. I was right a few weeks ago when I’d predicted in the article called Here’s How Inflation Will Play Out Over The Next Two Years: “There’s also the building inventories at Target and Wal–Mart and other retailers that will require them to sell much of it at slashed prices.” I should have shorted some of each stock when I wrote that. Here’s what Wal-Mart said this week: “Food inflation is double digits and higher than at the end of Q1. This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel. During the quarter, the company made progress reducing inventory, managing prices to reflect certain supply chain costs and inflation, and reducing storage costs associated with a backlog of shipping containers.”

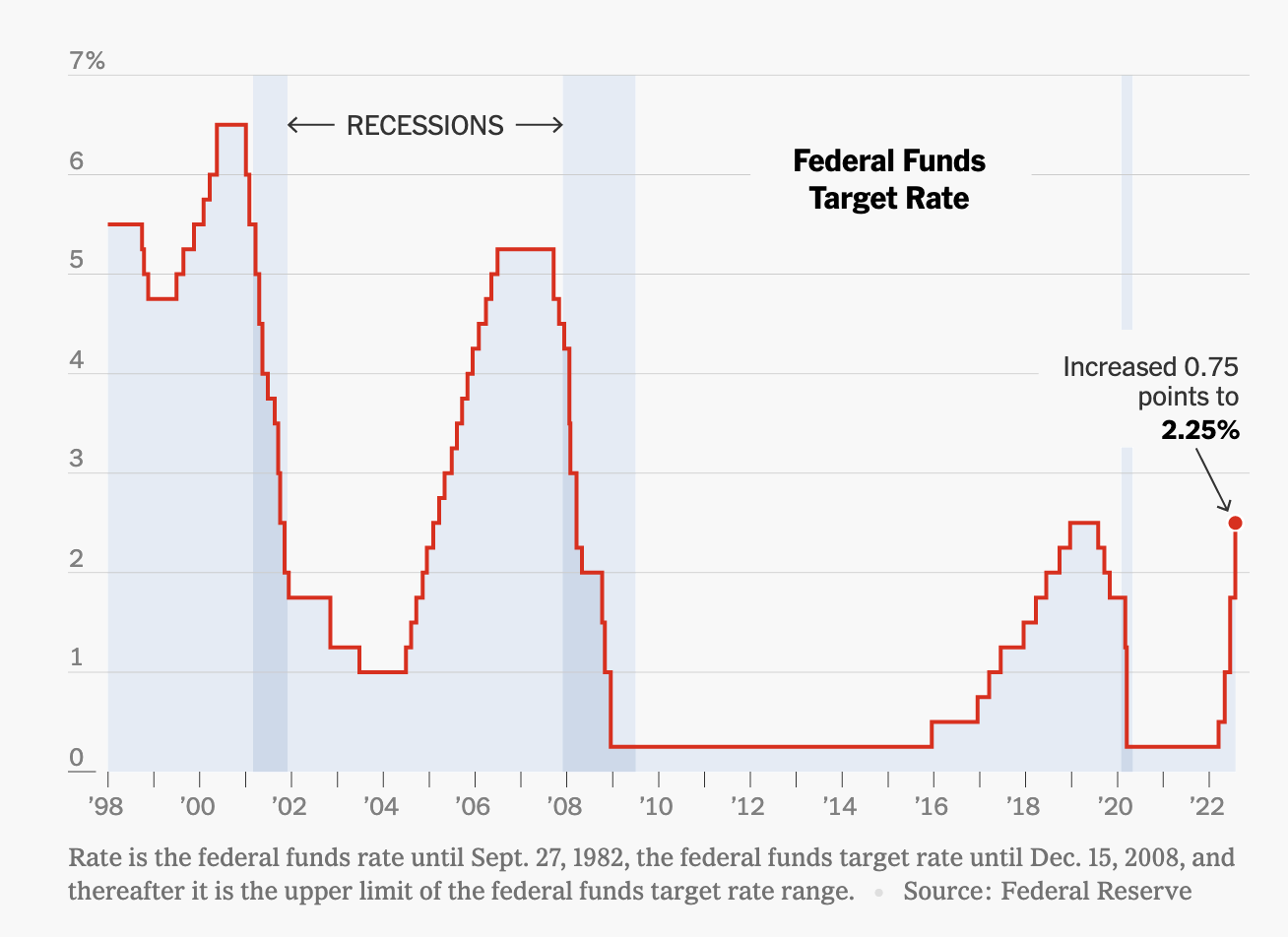

The Fed’s doing is usual of being wrong about everything and they are jacking up interest rates trying to fight inflation that’s already starting to come down. That said, I do want the Fed to leave interest rates somewhere close to reality and as I’ve always pointed out — the Fed will always have to chase the rates that the markets are setting. We’ve certainly seen that to be the case over the last few months as the Fed has chased rates higher. The Fed’s now moved rates up more aggressively than at any time in the last few decades.

It’s ironic that the Fed’s main job is to maintain stability in prices…that chart of the Fed chasing interest rates up and down for the last twenty five years isn’t exactly “stable”, is it?

The economy’s probably already in recession as I’ve been saying for the last two months or so. That said, with the trillions of dollars that are about to be spent investing in bringing back the supply chain of every manufacturer in the US, the recession might already be about to end.

2) My favorite new play on The Onshoring Revolution is Rockwell Automation, as I’d mentioned in the Trade Alert I sent out last week. The company reported a stellar quarter and talked about how strong demand is building up to be and they, like any high tech manufacturer, themselves are struggling to get all the semiconductor chips they need for the factory robots they’re selling. I nibbled a small second tranche and will continue to buy more on any weakness in coming days or weeks.

3) I participated in a panel about the intersection of blockchain and space on the The America’s Future Series. We hit on a lot of important topics and I even made a joke implying that humankind has never actually made it to the moon yet. Wait til you see their reactions. Click on the image to watch the video on youtube.

4) Meta’s quarter was pretty bad and the guidance was awful too. The stock is still pretty cheap on a price to earnings valuation, but cheap ain’t gonna make the stock go up without some revenue stabilization. I’m willing to hold a position here as they develop and build their lead in The Virtual Reality Revolution with their Occulus platform. But that could take another couple years to move the revenue needle.

5) As for the markets, I continue to buy/cover on weakness and slowly add hedges in the hedge fund on rallies. For the last two months or so, I’ve been explaining that we are definitely on the other side of The Bubble-Blowing Bull Market and as the markets crashed, I’ve started getting more bullish after about 18 months of having preached caution and defense before that. Easy does it and I’m not chasing the upside right now after this big rally the last two days.

We will do this week’s Live Q&A chat at 1pm ET tomorrow (Friday) in the TWC Chat Room or just email us your question to support@tradingwithcody.com.