Getting interested: Where I’d buy more of each of our positions

It’s an ugly day out there in the markets, and many of our stocks that are up 300% or more in the last few years are getting hit hard again today.

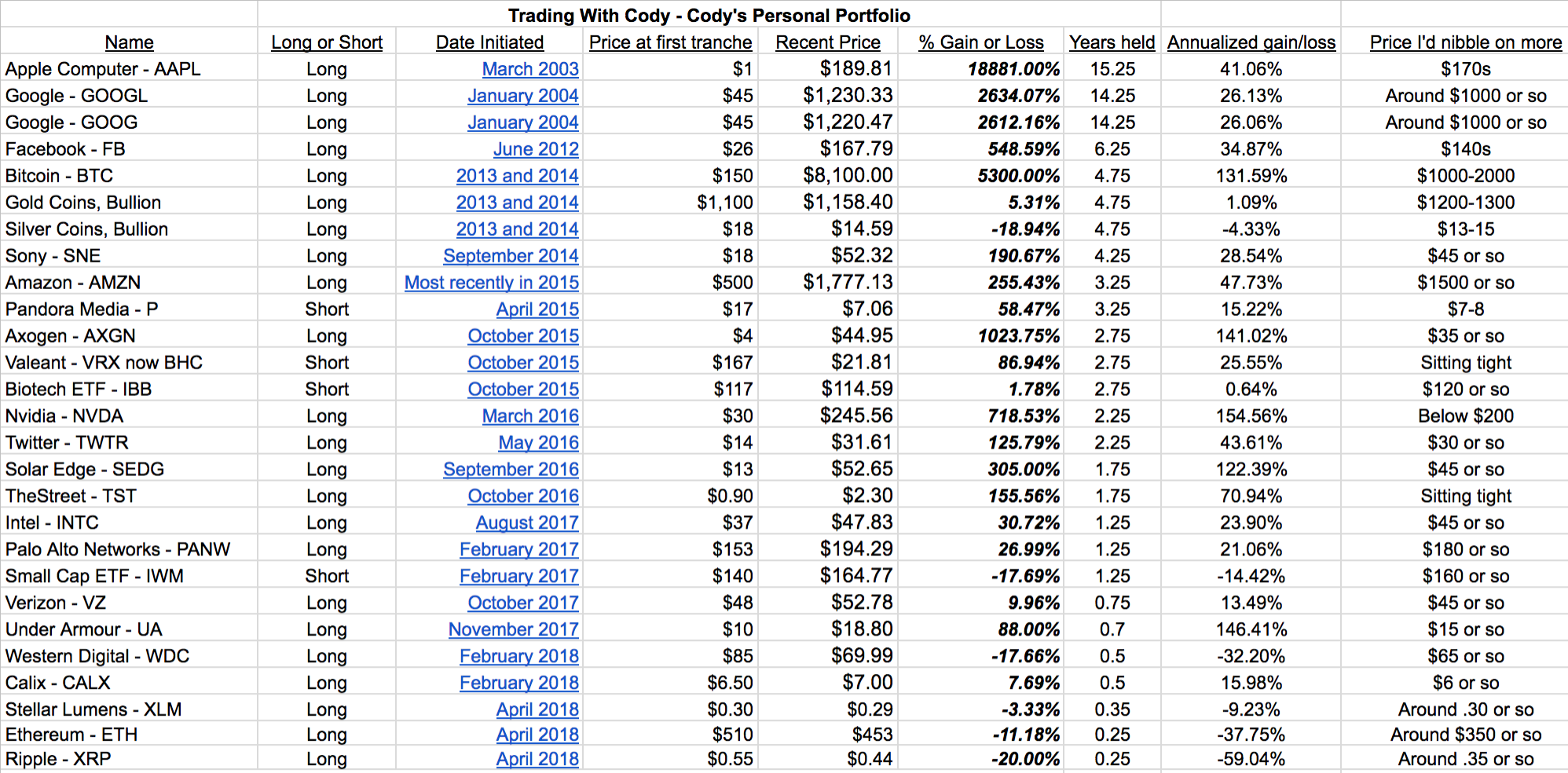

Here’s a list of “Where I’d buy more of each of our positions.” There’s a hyperlink on the “Date Initiated” column for each of the positions so that you can easily go back and read my original posts on TheStreet, The Financial Times, WSJ, Marketwatch and Trading With Cody, even as far back as a decade and a half ago for Apple and Google.

Before that, though, here’s some valuable commentary from the Trading With Cody Chat Room today:

Lots of subscribers asking: AXGN crashing down 20% in 3 days. What’s going on?

Cody: I’ve been warning that AXGN valuation was way ahead of itself. Not surprised by this pullback. I do think AXGN is almost a 7 out of 10 instead of the 6 out of 10 I gave it in the most recent Latest Positions analysis.

Subscriber: When do you decide that a stock is just on a pullback versus it’s time to sell? Is it that something fundamentally is wrong? Broken chart?

Cody: There’s not a set way of establishing pullback vs sell-it-all necessarily, but I typically like to buy what others are calling “broken charts” if I believe the company’s fundamentals are going to be much better than the rest of Wall Street expects. Axogen had no reason being at $55, valued at $2 billion, trading at nearly 20x next year’s sales estimates. That’s why I kept trimming some. Remember this write-up on May 30 when Axogen was hitting $50 the first time? “I’m quite frankly awed by this company’s execution and even more so by the stock’s performance since we bought it. Axogen’s cutting edge Revolutionary nerve repair solution are gaining traction and new applications. The stock, at this valuation, has priced in a lot more growth ahead. As I’ve said since the first time I bought it, it’s possible the company gets acquired by a bigger player in the medical equipment/science field, and that’s probably helping the valuation be propped up here. I’ve trimmed some near these levels with the stock up 10-fold from where we bought it but hold my remaining shares steady.”

Subscriber: Cody got me into AXGN at $5 (also NVDA at 40ish) so I am not complaining. Not every pick has been a home run but trust me, he gets it right more than he gets it wrong.

Subscriber: Interesting how quickly the crowd resorts to, “Cody what have you done for me lately?” I am an older investor and have been with a number of “investor sites.” Cody’s TWC is by far the best I have been associated with. Tremendous results and you do not have to be on-line 6 hours a day because his thesis is investing, not trading. If you can’t sleep at night, lighten up a tad!

Cody: Thanks for the kind words and yes, let’s not be freaking out, people. You know this is part of investing and it’s why I’ve kept reminding you that to remember how much pain you were in the last time the markets tanked.

Cody back in real-time for this “Where I’d buy more of each of our positions” column. Here’s the chart and a screenshot of the chart of where I’d buy more of each of our positions.

| Trading With Cody – Cody’s Personal Portfolio | ||||||||

| Name | Long or Short | Date Initiated | Price at first tranche | Recent Price | % Gain or Loss | Years held | Annualized gain/loss | Price I’d nibble on more |

| Apple Computer – AAPL | Long | March 2003 | $1 | $189.81 | 18881.00% | 15.25 | 41.06% | $170s |

| Google – GOOGL | Long | January 2004 | $45 | $1,230.33 | 2634.07% | 14.25 | 26.13% | Around $1000 or so |

| Google – GOOG | Long | January 2004 | $45 | $1,220.47 | 2612.16% | 14.25 | 26.06% | Around $1000 or so |

| Facebook – FB | Long | June 2012 | $26 | $167.79 | 548.59% | 6.25 | 34.87% | $140s |

| Bitcoin – BTC | Long | 2013 and 2014 | $150 | $8,100.00 | 5300.00% | 4.75 | 131.59% | $1000-2000 |

| Gold Coins, Bullion | Long | 2013 and 2014 | $1,100 | $1,158.40 | 5.31% | 4.75 | 1.09% | $1200-1300 |

| Silver Coins, Bullion | Long | 2013 and 2014 | $18 | $14.59 | -18.94% | 4.75 | -4.33% | $13-15 |

| Sony – SNE | Long | September 2014 | $18 | $52.32 | 190.67% | 4.25 | 28.54% | $45 or so |

| Amazon – AMZN | Long | Most recently in 2015 | $500 | $1,777.13 | 255.43% | 3.25 | 47.73% | $1500 or so |

| Pandora Media – P | Short | April 2015 | $17 | $7.06 | 58.47% | 3.25 | 15.22% | $7-8 |

| Axogen – AXGN | Long | October 2015 | $4 | $44.95 | 1023.75% | 2.75 | 141.02% | $35 or so |

| Valeant – VRX now BHC | Short | October 2015 | $167 | $21.81 | 86.94% | 2.75 | 25.55% | Sitting tight |

| Biotech ETF – IBB | Short | October 2015 | $117 | $114.59 | 1.78% | 2.75 | 0.64% | $120 or so |

| Nvidia – NVDA | Long | March 2016 | $30 | $245.56 | 718.53% | 2.25 | 154.56% | Below $200 |

| Twitter – TWTR | Long | May 2016 | $14 | $31.61 | 125.79% | 2.25 | 43.61% | $30 or so |

| Solar Edge – SEDG | Long | September 2016 | $13 | $52.65 | 305.00% | 1.75 | 122.39% | $45 or so |

| TheStreet – TST | Long | October 2016 | $0.90 | $2.30 | 155.56% | 1.75 | 70.94% | Sitting tight |

| Intel – INTC | Long | August 2017 | $37 | $47.83 | 30.72% | 1.25 | 23.90% | $45 or so |

| Palo Alto Networks – PANW | Long | February 2017 | $153 | $194.29 | 26.99% | 1.25 | 21.06% | $180 or so |

| Small Cap ETF – IWM | Short | February 2017 | $140 | $164.77 | -17.69% | 1.25 | -14.42% | $160 or so |

| Verizon – VZ | Long | October 2017 | $48 | $52.78 | 9.96% | 0.75 | 13.49% | $45 or so |

| Under Armour – UA | Long | November 2017 | $10 | $18.80 | 88.00% | 0.7 | 146.41% | $15 or so |

| Western Digital – WDC | Long | February 2018 | $85 | $69.99 | -17.66% | 0.5 | -32.20% | $65 or so |

| Calix – CALX | Long | February 2018 | $6.50 | $7.00 | 7.69% | 0.5 | 15.98% | $6 or so |

| Stellar Lumens – XLM | Long | April 2018 | $0.30 | $0.29 | -3.33% | 0.35 | -9.23% | Around .30 or so |

| Ethereum – ETH | Long | April 2018 | $510 | $453 | -11.18% | 0.25 | -37.75% | Around $350 or so |

| Ripple – XRP | Long | April 2018 | $0.55 | $0.44 | -20.00% | 0.25 | -59.04% | Around .35 or so |

** NOTE FOR NEW SUBSCRIBERS:

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.

You can find an archive of Trade Alerts here.