Headlines, the markets, our economy and what our playbook says to do about them

Chop your own wood, and it will warm you twice. – Henry Ford

It’s amazing how refreshed I feel after taking just a couple days away from the market to get some R&R.

Let’s talk markets and run through the headlines to get back in the flow of things this morning.

Big numbers and it looks like unit sales for automobiles are going to trend towards 15 million globally this year, which is quite a bit better than most analysts have modeled. Europe demand will drop into year end, but global growth is there despite all that fearmongering about a pending economic collapse that you have read in the headlines every day this year.

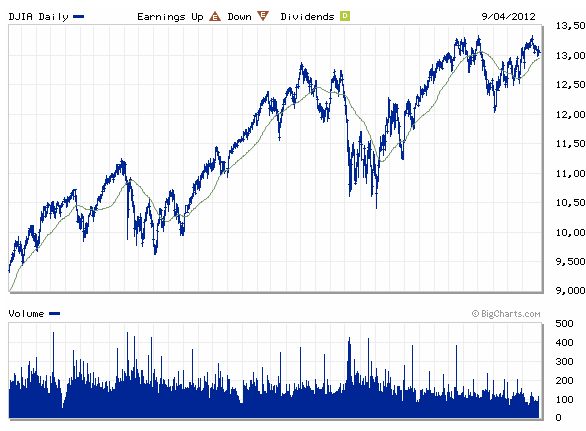

Wall Street Posts Third-Straight Monthly Advance – Markets have lost some of that recent oomph, and several individual stocks including Apple, F5 and FIO have pulled back. But the fact remains that the right stance this summer was to be long and strong, not short and/or scared, as most money managers I know were. We need to do a new “Who’s more scared right now, the bulls or the bears?” poll to get some idea of current market stance. I think the bulls are starting to get confident again, and that’d be a contrarian indicator of at least a likely near-term top. Then again…

Morning MarketBeat: September’s Historically Tough for Stocks and No matter how you slice it, Sept. is a downer – The headlines remain full of worry.

I don’t think that much if anything has changed from our playbook. The corporate economy’s still booming, Main Street’s still suffering, and whoever the next President is will create more overt and covert means of continuing that trend. The market has shocked most investors and pundits by remaining in outright bull market mode, and that remains the intermediate-term path of least-resistance. Near-term, though, we might be a bit toppy, if only because sentiment has turned so positive and that is a contrarian indicator.

At any rate, the playbook remains: Buy weakness, get aggressive on panic, sell into strong rallies.

And to further underscore all of this aforementioned analysis, let’s play the “Can you tell which of the following are new headlines and which headlines are much older” game?

- Merkel calls for solidarity with euro nations

- Troika urged to ease Portugal’s budget targets

- Merkel urges Italy to make budget cuts

- Bailout fatigue in the eurozone

- Eurozone nations agree to cut debt

- Europe’s debt crisis to weigh on stocks, traders look to…

Answers: Headlines #1 and 2 are from this weekend. #2 and 3 are from 2011. And #5 and 6 are from 2009, when the market was much, much lower than it is today.

No trades for me so far today. I’m basically positioned as I want to be, mostly net long, but not aggressively so, as according to our playbook.