Here’s Why We Think Republic.co Is So Cool

Republic, with which I’ve partnered, is an investment crowdfunding platform open to everyone for investing in early, middle and late stage private deals across tech startups, real estate, video games, small and medium sized business (SMB) and crypto. The company is grinding 24-7-365 to bring venture capital and private startup investment opportunities to the general public all over the world; with a respectable focus on equality within equity crowdfunding. Also, in a time of fierce competition among newer private companies, the Republic platform is a great way for these up and coming startups to gain access to capital. I asked my analysts to write up a report on why we like Republic so much and we would like to share a few of our thoughts as to why we think this platform could be a potential money maker for individual investors and fund managers. We are also featuring a couple of the startups they currently have on their platform.

First a little background on the company, Republic was founded in 2016 by Kendrick Nguyen, Paul Menchov and Peter Green as a for profit early stage venture investment platform. As of today Republic has over 100 investment opportunities listed, profiled and open for the public to invest in. In March 2021, the Securities Exchange Commission made changes to the regulations that control crowdfunding. The SEC increased the maximum amount that a company could raise through regulation crowdfunding from $1.07 million to $5 million. This is important because more and more small startups will be attracted by the larger potential fundraising amount, thereby increasing the choices that individual investors will have in investing in private companies. The Republic startup list is packed with a diversity of industries, founders, business models, products, investment opportunities and more. Furthermore, the vetting of these companies is super strict in its scrutiny. That’s just one way Republic can ensure the platform provides access to valuable and meaningful companies for the Republic user base to invest in, helping to filter out any frauds and scammers.

Republic’s process for screening companies goes like this- First, there’s an initial screening using the FTPM model. The F is for founders, P is for Product, T is for traction and M is for mission. When looking at founders they look for genuine skills, education, diversity, network, charisma, abilities, vision, track record and other important things. Next, Republic determines if the product is worthy and will command a presence in the marketplace in the future. They want to make sure the product is top-of-the-line, in demand, potentially a solution to a great problem, fashionable, disruptive and revolutionary as well. When reviewing the traction of a company Republic looks for positive signs like which companies have previously invested in the startup, is the press good, is there measurable progress and growth potential? Determining the mission of a startup is the other facet of this screening model. Republic wants to know that the companies it hosts will be determined to make an impact on our world and in our lives. Second, there is a regulatory process that includes rigorous disclosures, financial reviews by licensed accountants, deal page making that includes spot checks for accuracy and background checks on all key players in the deal. Finally, diligence continues when the campaign is live – inquiries from the general public must be explored per their regulators and material changes during the campaign must be disclosed to all investors to give them a chance to review and reconsider their investment before the campaign closes.

Republic boasts to be completely SEC compliant from the ground up since conception. The platform also comes with a social interactive experience, advisory services, investor education, articles about the companies on the platform, articles about investing and even its own crypto currency called The Note (we’ll get into that later on).

Republic has raised $64 million from a handful of high quality institutional and individual investors. The company has also acquired these 5 organizations along its journey- NextSeed (investments in revenue-sharing SMBs), Compound (real estate investment platform), Fig (video games investment platform), SheWorx (global collective of ambitious female entrepreneurs) and RenGen Labs (place to connect with companies issuing private equity and security token offerings). After reviewing the startups on Republic.co it’s no surprise these acquisitions were necessary for the company to be able to provide the investor with such a diversity of industries and technologies.

Looking deeper into their site, they have an open to the public presentation revealing their investment portfolio. This is a complete list of co-investors (see image below), companies that have raised privately on the site, as well as the many startups that have raised money publicly.

We are always looking for forward thinking business models and we’ve found that some of their private fundraising rounds include companies like SpaceX, Relativity Space, Robinhood trading platform, Coinmine, Carta and a ton more. Republic currently celebrates having helped more than 300 growing companies raise over $250M since 2016.

Moving on now, once an individual has created an investor profile on Republic they can link their bank account and begin investing in private companies ranging from small minimum investments of $50 for some and up to around a minimum of $1,000 or so for others. Most tech startup investments made on the Republic platform are held under a contract called Crowd Safe. This contract is modeled after Safe, a Y Combinator financial instrument for angel investors and VCs. Crowd Safe is just Safe, but for large groups. This contract doesn’t grant you immediate equity in the startup that’s been invested in. Instead, it’s a contractual agreement to provide the investor with equity when a “trigger event” occurs, such as the company’s acquisition or IPO. If there’s no trigger event then there’s a likely chance you won’t see any return on your investment. Remember, always be cool, calm and never rush in (only fools do). Roughly 95% of startups eventually fail. On the other hand, a $100 investment could bring heavy returns if the startup takes off.

To make sure you understand your risks, the site offers full risk disclosures stating that, “Crowdfunding investments are risky and speculative. You should do your own research and scrutinize all disclosed risk factors before making an investment decision.” They go on to reveal risks concerning speculation, illiquidity (Investing in startups is generally long-term), having no voting rights (Crowd Safe standard), cancellation restrictions, limited information regarding valuation and capitalization, limited disclosure, a startups lack of professional guidance and even mentioning possibility of fraud (standard liability statement). This all sounds pretty scary, but it’s really just standard disclosure stuff and we like the fact they present it clearly and fairly on their site, that’s important and we appreciate their transparency.

Republic’s commission is about 6% of the total amount raised and 2% of the securities offered in a successful financing of a project. The strict numbers vary from one startup to the other depending on Republic’s deal with each startup. Republic may charge different commissions for specific types of offerings, when they do, you will see full disclosure of how they are being compensated. Republic currently does not charge investors.

When you make an investment on Republic as a non-accredited investor you get a message from the founder, always coupled with a chat dialogue box so you can connect with the founder and ask questions about the company. Even if you don’t invest in a company on the Republic site every single startup has a chat forum for some Q&A with the founders.

The site also has The Deal Room. This is a special access investor portal for investors who have been classified as accredited investors by the site, in which the minimum investment is usually $10,000 dollars. An accredited investor is an individual or entity which meets certain income and net worth guidelines (per regulation standards). The Deal Room has its perks too. If you are an accredited investor and are granted access to The Deal Room you get to invest side-by-side with the top VCs, access to deal-specific Special Purpose Vehicles (SPVs- a subsidiary created by a parent company to isolate financial risk) and investments above and beyond $10,000 dollars.

Here’s the deal, there’s a lot of companies that are either hosted on the site now or have come through since 2016 and innovation seems to be a focal point when Republic screens these companies. Scrolling through we see Clocr, a cloud based software for passing down digital legacies/assets (crypto, emails, personal profile information, passwords, etc.) to would-be heirs. Scrolling further we see Akua, an alt-meat company using an ocean-farmed kelp for meat based alternatives. Not only does Republic provide an assortment of industries and products under its umbrella of startups but it also stays the path with its promise to support equality in the venture capital space.

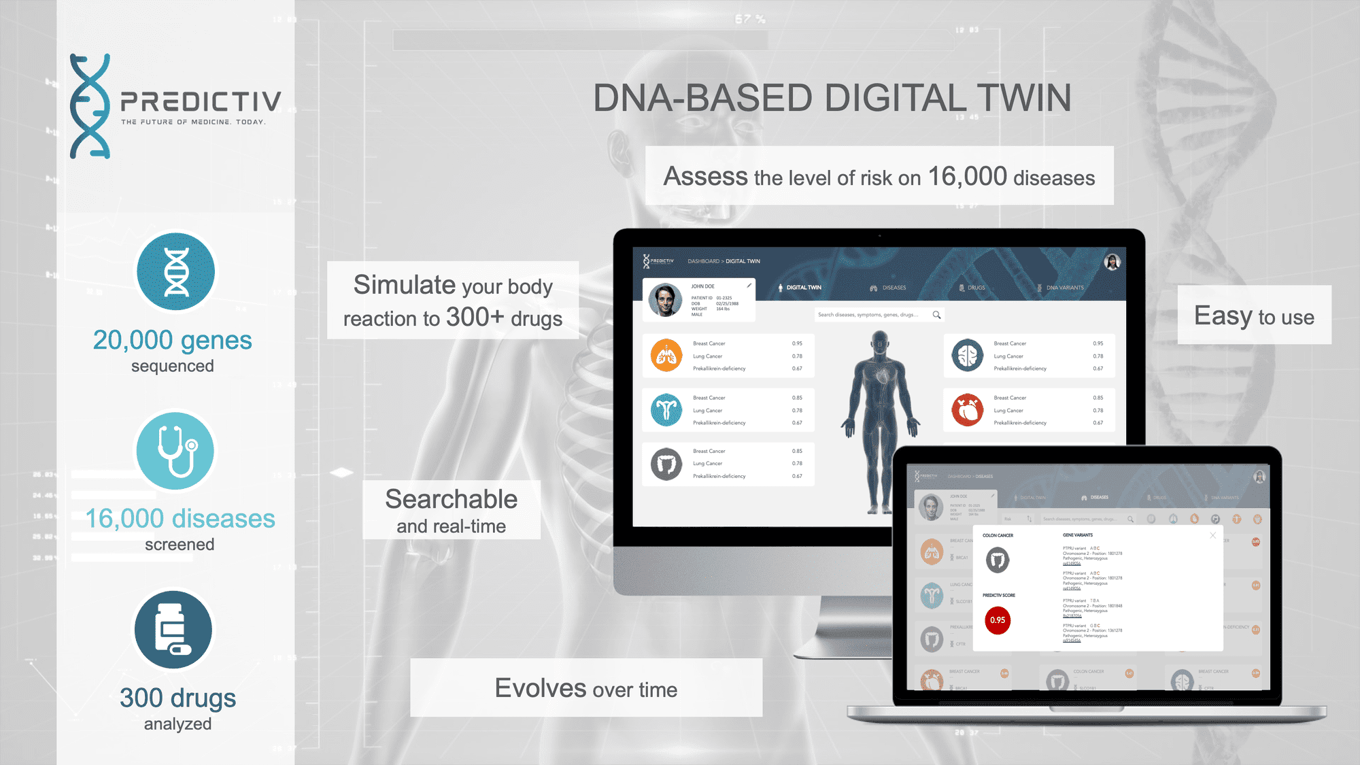

One of the companies we like on Republic is a startup called Predictiv. This company provides a personal genomics solution for predictive medicine using technology and DNA to provide more efficient and timely health solutions to all people. Basically, you order a kit and then send in your DNA and wait. The company then issues you a digital twin based on that DNA, hosts a face-to-face interview with a genetic counselor and voila, you’ve been set up with a personalized preventative plan. When you go in for a check up or diagnosis the doctor can pre-check meds and services in accordance with what your DNA prefers and requires. This is a huge time saver and will help to alleviate any misguidance in prescribing meds, diets, hereditary issues and any other procedures.

The crowdfunding platform gives Predictiv a $5.5 million dollar valuation cap and has a minimum investment of $100 dollars. The company boasts a comprehensive solution to assess the level of risk on 16,000 diseases, the ability to simulate personalized reactions to 300+ drugs, an A.I. engine validated at the FDA COVID-19 challenge (95% automated), two patents and 18 months to break even with $70M in revenue by 2024 at a 75% operating margin. Last but not least, Predictiv provides information on 1,000 times more diseases than its competitors.

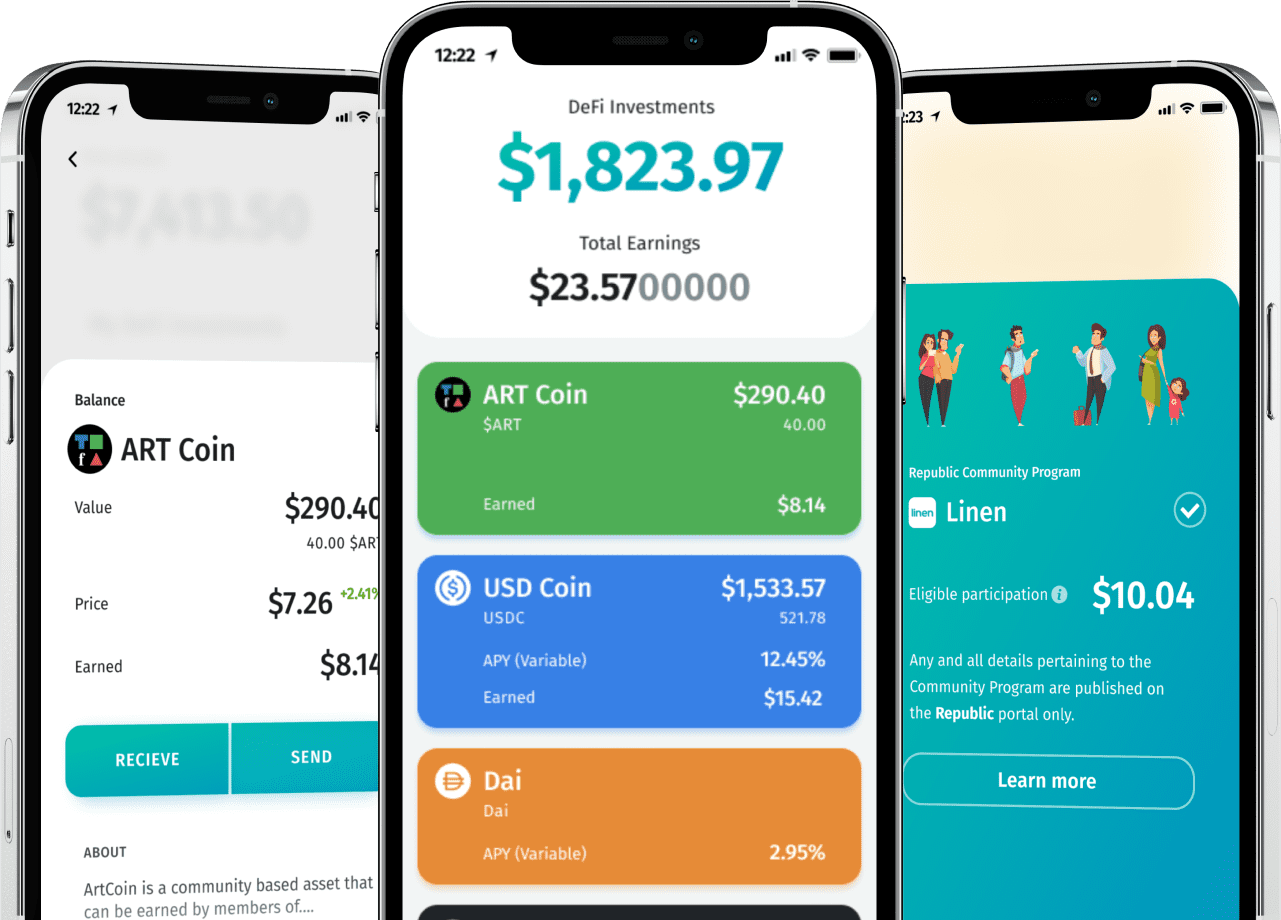

Moving on to the next startup I’d like to mention, if you’re a regular at Trading With Cody then you know how excited we are about cryptocurrency, that’s why we began to take an interest in Linen. This startup is using decentralized finance technology to help the cryptoheads invest and store their cryptocurrencies. Linen boasts that it provides a “full suite of tools for a novice to build wealth with the ownership economy: App, Wallet, Community.” The company focuses on two main areas, DeFi and social tokens.

For those that are still getting caught up with the tech wave, decentralized finance (or DeFi) minimizes the dependencies on a middle man for financial activities like exchanging assets and earning interest. The idea is to create and give the user access to a “fully self-sovereign financial system.” This way, everyone can access the system and earn network based equity tokens.

Let us explain social tokens now for those who are new to the concept. A social token is a way for brands, businesses, creators, game streamers and the etcetera to connect with their user base communities. Republic elaborates, pronouncing that “social tokens can offer a wide variety of community and ownership-oriented experiences, products, and services, such as exclusive content, early access, direct access to celebrities/influencers, etc.” And adding in, “This area is very new, and the design space is limitless.”

Linen’s funding round glides on with a valuation cap of $22 million, a funding goal of $25,000-$4,900,000 and a minimum investment of $200. Firstly, the DeFi app space is an emerging and growing market which is expected to reach $3 trillion by 2023. Secondly, Linen has already raised $1.7M privately from Coinbase, Polychain, HashKey, Youbi, and Wyre. And thirdly, this investing app can help investors earn shares in community-owned projects, all the while democratizing wealth building with the ownership economy. So, for those that are just getting caught up, welcome to the future of crypto based finance.

The team at Republic works very hard to research and educate its user base on topics ranging from the founders on its startups to understanding and investing in various markets, including real estate and cryptocurrency. One of their articles, titled Women in Investing, covers a 5 step plan to start the private investing journey. Also worth mentioning, the article is based on an open weekly discussion called the Women in Investing Clubhouse Series. As just one example of the networking and educational experiences on the platform, this series is an open door for public investors to communicate with and learn from some of the most influential female founders and entrepreneurs. Again, this is just one example of the opportunity this platform provides to the general public. Another example would be the platform’s featured investors Randi Zuckerberg, Chamillionaire, Kevin Harrington (Shark Tank), Tim Draper, Jon Najarian and Wendell Carter; you get access to their Republic investment portfolios as well.

Another interesting tidbit about Republic is that they are dedicated to integrating and utilizing blockchain technology. They have recently issued their own cryptocurrency to accredited investors called The Note, as well as allowing unaccredited investors to reserve the cryptocurrency until SEC regulations open up access for them to be owners of the crypto. The Note is sort of an equity play on Republic as a company in and of itself. As hosted startups go public or are acquired, a certain percentage of Republic’s return on those companies goes into the value of each Note. Hence, owning a Note gives you a piece of Republic’s spoils. Because of some of the limitations with owning The Note, it’s apparent that it is also a long-term investment. Now, although that sale of The Note has opened and closed, there is still a chance to invest in blockchain through some of the companies the site hosts.

One of Republic’s great accomplishments is the Token DBA. This is a tokenized presale instrument for blockchain companies to fund their growth from public investors. If a company listed on Republic is rooted in blockchain technology then a public investor now has a way to create equity in that company’s blockchain technology. Unless I’m wrong, it seems to me that this is the crypto version of Crowd Safe. Successful raises on Republic Crypto include Witnet, Coinvest, PhunCoin, Nori, Bandwagon and Totle just to name a few.

The ninny on the skinny is that we like Republic.co as we have since Cody first met Kendrick, the CEO. And in full disclosure, Cody is an advisor to Republic and owns equity in the company. Aside from all of that, we like their platform concept, the layout, efficiency of use, company selection, SEC compliance, vision, transparency, strategy and opportunity along with so much more. In fact, what’s not to like? We can make a $100 dollar investment without losing much sleep about whether or not we see returns (and boy-oh-boy if we do). And last but not least, the general public gets to get in on the action too.