How Many Bearish Anecdotes Before We Take Them Seriously?

Anecdotal evidence: “Evidence in the form of stories that people tell about what has happened to them. Example: ‘His conclusions are not supported by data; they are based only on anecdotal evidence.'”

It’s important to not allow yourself to be confused by trying to extrapolate anecdotal evidence out too far into the world because there’s almost always real data that we can look at instead. On the other hand, when you add up enough anecdotal evidence, it can sure start to look like data. And there’s something to be said for simply looking at all the reality, the anecdotes around you, and accepting what you see.

I find no bullish anecdotal evidence. There are only bearish anecdotes in the world right now, I guess.

Fully-vaccinated but still cautious for my daughter with a trache on oxygen, I was on the periphery of a graduation party in a wealthy enclave outside of Dallas over the weekend. I heard my nephew and his friends mention their crypto holdings. So then I decided that I needed to do an informal poll of the 18-20ish year-old kids at his party. I kept the results in my head and here’s how they came out: 7 kids owned Dogecoin. 1 kid owned Cardano. 1 kid owned bitcoin. Each of them had made these purchases earlier this year, in 2021. One kid said he bought $1000 of bitcoin a few weeks ago and sold it when he made $50. Two kids said the only reason they don’t own any crypto is because they can’t for some reason. One awkward kid who was sitting by himself and/or his parents for most of the party was the only one who said he had no interest in crypto “because I don’t understand what it is.” He was the only kid I thought might actually know what he’s talking about.

The last group of three kids I polled asked me if I was in crypto. I told them yes, I’d been in bitcoin for years but that I was worried that we might see a crash in most cryptos this year. I said, “Maybe I should be selling more of my own crypto to you guys here. After all,” and I pointed to the 80 year-old farmer sitting under the pergola, “I don’t think he’s going to be buying my cryptos from me at higher prices. And he’s the one of the people around here with the real assets.”

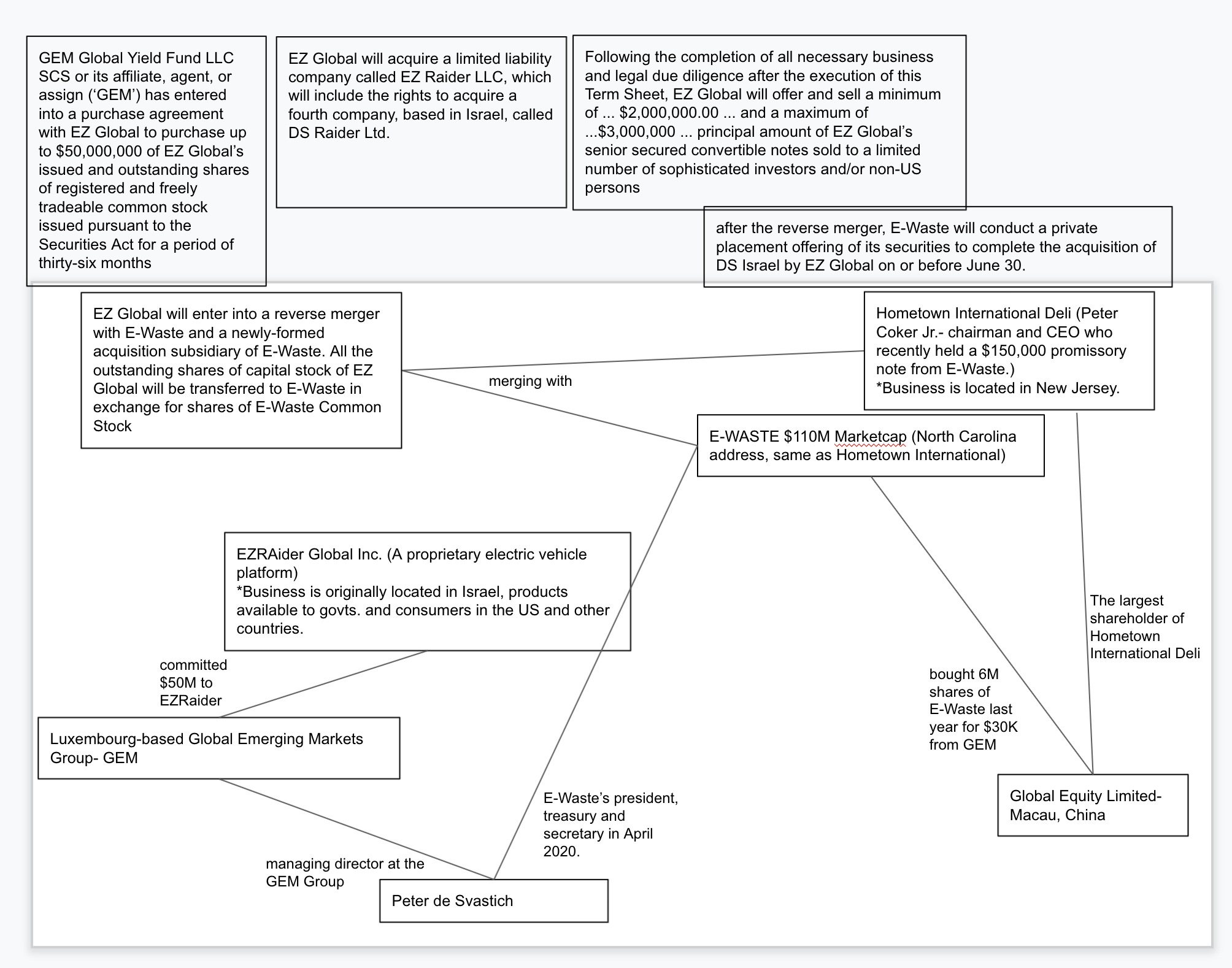

Here’s a deli in New Jersey with one shop that is worth $100 million that’s now doing a reverse merger with an EV start up. It’s one of the wackiest deals I’ve seen put together and there’s lot of chance for shadiness when a small cap penny stock does deals like this. I read this article about this on CNBC this afternoon and even after 25 years of analyzing deals, I couldn’t get my head wrapped around all the moving parts here. So I had one of my analysts put together a chart to show us what the hell is going on here:

Deals like this don’t get done when stocks are close to a bottom. I’m not sure why a deal like this would ever exist. But I do know that deals like this only get done when stocks are in a bubble.

Here’s another bearish anecdote: The most hated asset in the world right now is cash. The kids are all in cryptos, the institutions are all in stocks and starting to get into crypto, the bears (few as there are) are shorting stocks, but is anybody out there preaching cash is king? No. Word on the Street is that “Cash is trash” and that “Bitcoins are better than bonds” (to paraphrase). I thought they’d said that bitcoin was in a bubble back when it was 95% lower than its current price: “’It’s not an effective storehold of wealth because it has volatility to it, unlike gold,’ the hedge fund founder added. ‘Bitcoin is a highly speculative market. Bitcoin is a bubble.’”

Hmm.

How about the fact that retail traders who are playing with AMC’s stock are threatening Wall Street sellside analysts who are now too scared to comment to CNBC on the record: “CNBC reached out to a number of analysts who cover AMC and many refused to comment out of fear of repercussions from these retail investors. Some indicated that they had already received phone calls, emails and other messages in response to previous downgrades of the stock.”

These anecdotes are not bullish.

Earlier this year, when small cap tech stocks, cryptos and everything else went parabolic, I started writing that we were in the Blow-Off Top Phase of The Bubble Blowing Bull Market (see February 10’s Trade Alert: Strategies For This Blow-Off Top Market, for example) that we’d been riding since 2009. I do think The Bubble-Blowing Bull Market probably popped in February or March when most small cap tech stocks, every SPAC, most cryptos and even Cathie Wood’s ARKK ETF all put tops that are far away from their current levels. That doesn’t mean that stocks will go straight down or that we’re going to see a crash in the major indices from here.

But I have to admit that all the above anecdotes along with just about every other anecdote I come across in regards to trying to trade in the markets is pretty darn bearish. How many anecdotes does it take to make up a mesh of data? How many bearish anecdotes do we have to see in front of our faces before we take them serious?

My feet-to-fire guess is that the markets are right now in a rip-the-shorts’-face-off rally, a second echo blow-off top with meme stocks and the hundreds of crappy alt-crypto coins ready to crash next. I think the broader indices will struggle to get much higher than these levels and that the path of least resistance for most stocks and the broader indices is probably lower for the near-term for most of the this year.

We were loading up on Apple, Google, Facebook, Nvidia, Tesla, bitcoin, ether et al over the years when they were hated or ignored. I am happy to find some new names at cheap valuations in new future trends that can turn into our next 10-200 baggers for us. But I do think we are going to get some better, maybe much better, buying opportunities in coming weeks and months or maybe even next year or the next after that as we grind ourselves out of this current phase of the market. Having some cash on the sidelines, not being greedy, not trying to capture the next 30% meme bubble move, using fundamentals and valuations and common sense while sticking with the rest of our many long-hold winners are probably what’s going to be the best way to make sure we’re positioned for the most likely outcomes here.

We’ll do this week’s Live Q&A Chat tomorrow (Wednesday) morning at 9am ET. Join me in the TWC Chat Room or just email us your question to support@tradingwithcody.com.