How to find dozens of 10-baggers by investing in revolutions

Another one of our TradingWithCody.com stocks, Solar Edge, SEDG, is up 15% after hours today, now up 200% from where we were building our long position in the name just over a year ago. I’m not sure I’ve ever had an earnings season like this one when I’ve had more than a dozen stocks I own that were up 10%, 20%, 30% or more after their reports. And I own less than 20 total stocks and only 15 of them have reported earnings so far this season — subscribe to TradingWithCody.com to see which ones are next!

In Trading With Cody marketing materials, we explain that our approach to investing is to try to find the most innovative companies in the most disruptive and revolutionary industries before the rest of Wall Street recognizes them.

And with so many of our positions up 5-fold, 10-fold or 180-fold before they popped even more this quarter, this approach has proven itself out very well over the years.

There are two types of growth, secular and cyclical. Cyclical growth happens when a company and/or a market see upside along with the broader economic cycle. Energy companies, metals markets, chemicals, housing and many commodities fall into this type of category. That is, when times are good, so too will their businesses likely be good and when times are bad, all the boats sink together.

Secular growth, on the other hand, happens when a nascent industry is taking off, about to grow into revolutionary proportions as it displaces old business models and technologies. Two factors contribute to an industry’s secular growth: Entirely new demand is created and demand from other industries is taken.

Netflix, YouTube and other web/app video sites, for example, are contributing to more people consuming more video than ever before. But people are also spending some of the time that they used to spend watching network and cable television on Netflix and YouTube. That’s a double shot of growth for the web/app video industry.

The key to long-term outperformance and making big money in the stock market is find and own the best and most revolutionary companies who are disrupting or creating new marketplaces that will have huge growth ahead — huge secular growth ahead.

When you’re looking at long-term, revolutionary-type investments, you’re obviously trying to find markets and companies that are growing quickly and with huge potential in front of them.

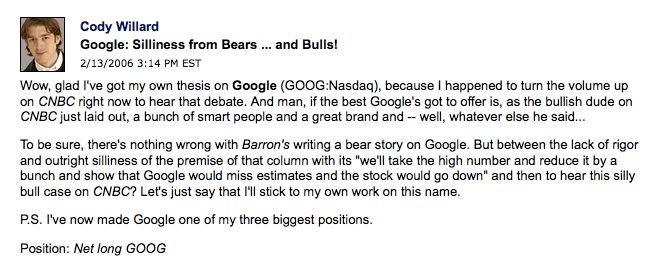

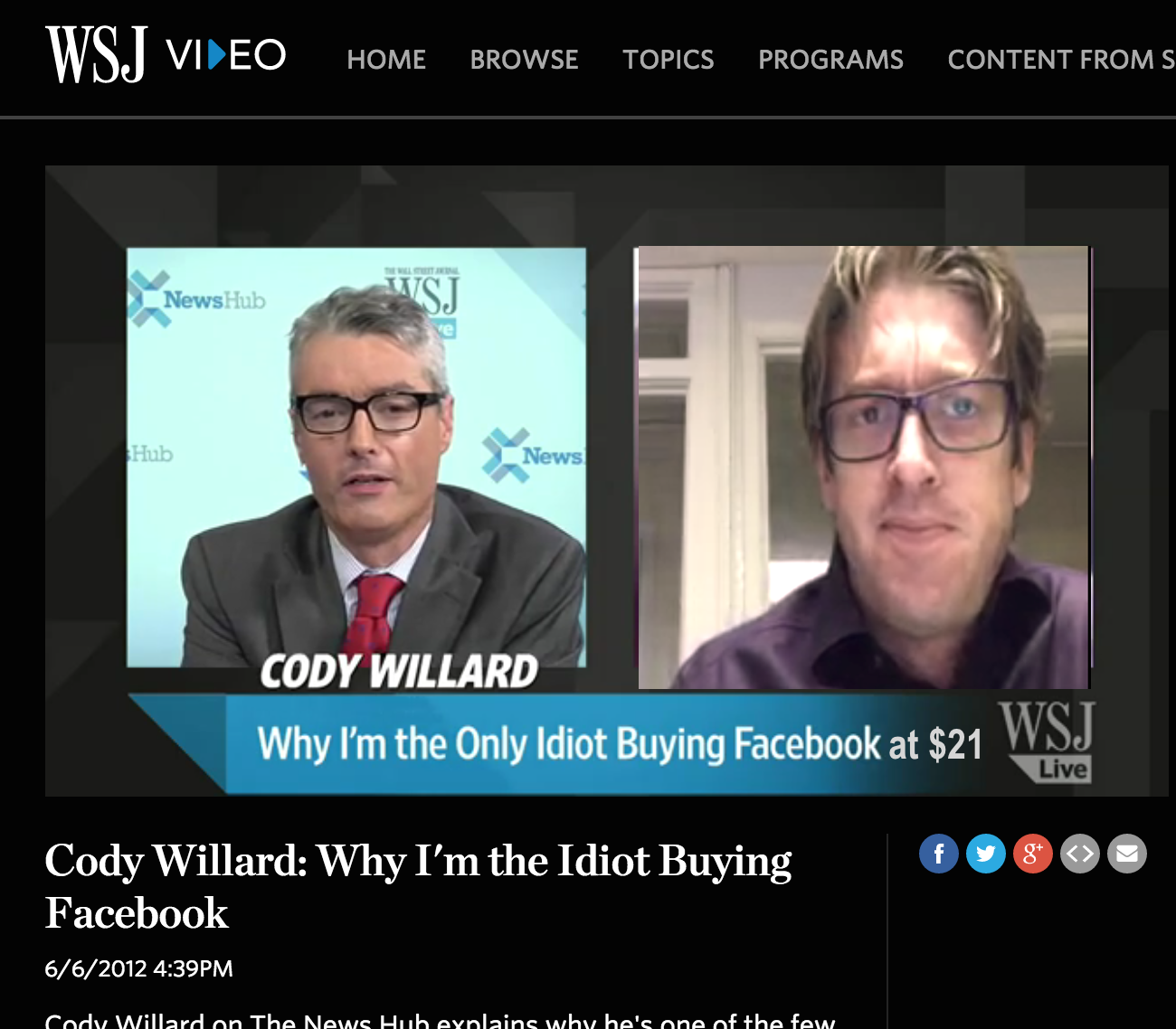

Four of my highest-profile biggest winners over the years, Amazon, Google, Facebook and Apple, are four of the most disruptive, innovative companies on the planet. Each of the four have clearly disrupted not just retail, not just search, not just PCs and not just social interaction. They’ve literally revolutionized how we live. What are some of the traits we should be looking for to try to find the next Revolutionary Companies to invest in?

Realize, too, that even for these four huge winners in the Tech Revolutions we try to invest for, each of those stocks at one point was down big for a many months or even years at a time.

All this is to underscore how important several of our rules really are:

- Analyze and invest in the very best technology revolution drivers you can find.

- Trade around the near-term fluctuations.

- Believe in your analysis even when the markets don’t.

- Know the importance of eco-system/platform, virtuous cycles, lock-in, switching costs, and critical mass.

What are some of the most innovative sectors that are becoming platforms that we should to be investing in?

Voice-Interaction, Artificial Intelligence, Virtual/Augmented Reality, Drones/Driverless vehicles, Robotics, Cryptocurrencies, 3-D Printing, Wearables, Internet-of-Things…and other industries/platforms/offshoots that don’t even exist yet.

Innovation is key to growing our economy, our society, and, if we can find great innovative companies, to invest in, we can make a lot of money. I continue to hold the big four platform plays I mentioned above and am always trying to find the next one. There are tens of thousands of publicly-traded companies out there to choose from and only a few dozen or so will Revolutionize our world.

You can try to eek out a few percentage points in cyclical stocks like Caterpillar or giant defensive stocks like Coca-Cola. Or you can try to find a few more ten-bagger secularly growing revolutionary tech companies and get your bucket out in front of the trillions of dollars those companies will create in value over the next five or ten years. Disruptive Money. Revolution Investing. These aren’t just buzz words, I created. I’ve built up a career and wealth over the years using Disruptive Money and Revolution Investing principles and I expect there’s much more career and wealth to be built upon and investing in these platforms in years ahead.

If you’re not a subscriber to TradingWithCody.com or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Here’s what I tell my subscribers:

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.