Important lessons on why stock-picking and active portfolio management are key to long-term success

One of the trickiest parts of being a successful investor is keeping perspective on time horizons and expectations for the long- vs. short-terms. What’s your goal as an investor or a trader? It’s always that you want to maximize your long-term upside while limiting your risk over that time frame. Whether you’re a buy-and-hold investor or a swing trader or a day trader, your goal is to grow your capital over time in the safest manner possible.

And we often get lost in the short-term, as we can’t figure out why the market is paying “only 6x earnings for this year’s projected Apple earnings.” Shouldn’t the market be paying more like 10x earnings or even 15x earnings for a company with this kind of growth profile? How about Google, why is it up so much recently after having lagged its Apple brother for the last few years?

Take a look at this clip from back when I was in the first part of my career as a TV anchorman, back in on June 11, 2008 –

Fox Happy Hour Cody’s Big 3: Bear, Illuminati, iPhone

I hit on a three topics there that you guys have read from me many times.

First, I called out the permabears and the fact that were capitulating just at what I thought was the very market top as the crises they (had always and still do) predicted were actually about to hit the markets and economy. We have to be flexible in our analysis and our positioning. You can’t just always be a bull or always be a bear and you can’t just always be net long or net short. You’ve got to be willing to change your mind when your analysis dictates.

Second, I called out our idiot Treasury Secretary and Federal Reserve Chairman who were lying and saying that the banks were fine while at the time the banks were actually truly insolvent and entering a huge crisis that would entirely derail the US economy and stock markets. The banks and their shareholders and bondholders should have been entirely wiped out in a lawful society as only depositors should have been protected with taxpayer money and not people who’s money was risked as investors. But instead bank profits as a percentage of GDP are at even higher levels than they were as the present Treasury Secretary and same ol’ Fed Head continue to allow for false accounting, endless bailouts and looting at the biggest banks who are still supposedly “too big too fail”.

Third, and perhaps most importantly, you see me tell everybody that the smartphone revolution is hitting and that the easiest and smartest and best ways to invest in that smartphone revolution would be to simply buy AAPL and GOOG.

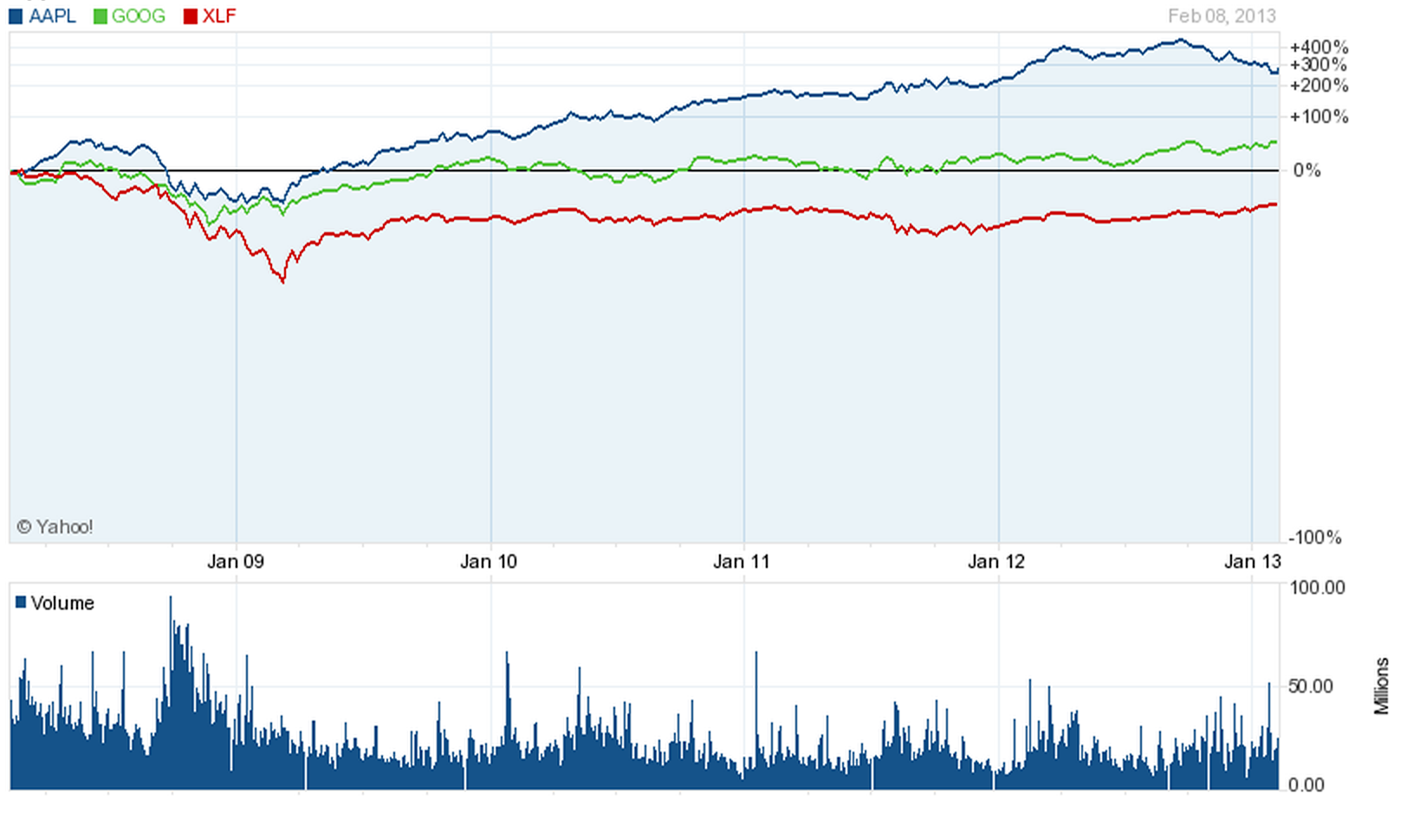

Apple was at $170 or so at the time. Google was at $500. Apple’s is, even though it’s down big from its highest levels last year, still up nearly 250% since then. Google’s up more than 50%.

But recall that Apple’s and Google’s stock prices both pulled back hugely and repeatedly and/or went sideways for many months at a time in the years since then. If you’d bought the big panicky pullbacks and sold the big euphoric spikes along the way, you’d have complemented your gains today.

The entire mega-cap banking and brokerage industry also crashed, but while Apple and Google have grown their businesses and their stocks have risen big-time since the above clip was originally broadcast back in June 2008, the bank stocks are still down big from the levels back then. The big bank ETF, XLF, is still down more than 30% from the June 2008 levels.

Apple and Google, while their stocks crashed too, were never at risk at going bankrupt and wiping out their shareholders. And their stocks, as noted above, are up big-time from their levels back then. Which means they gave us more upside with less risk than buying the broader markets and especially the financial sector itself.

That’s why you should never take a simple a “Buy and hold and forget about it” approach to the markets. By picking the best technology plays in a revolutionary new market and buying the panics and selling euphoria, we’ve far outperformed the broader markets over the long-run.

I’ve got several new stock picks and some portfolio cleaning up to do starting tomorrow and on over the next 10 days, and we’ve got a never ending task of managing our risk and growth portfolio profiles over the next 3000-10,000 days ahead.

Stay objective, stay flexible, say contrarian.