Invest Like Rick Rubin Does Music, Dennis Rodman Hoops, A Kite Flies

I’m recharged and reset after a week of not writing and not analyzing though my brain was still in Deep Thought mode. I even found the time to watch the Beastie Boy documentary on Apple TV+, which led me to run down the Rick Ruben rabbit hole. Rick Ruben was a music producer behind many of yours and my favorite bands and songs. Here’s an old Rolling Stone article where he highlights 21 of his favorite songs that he produced and in it, I found a quote that reminds me of what we do in the stock market:

“I don’t really have any control over what’s going to happen with a recording,” Rubin tells Rolling Stone. “It’s more just experimentation and waiting for that moment when your breath gets taken away. It’s an exciting, exhilarating thing when it happens. But it’s not anything to master. You just have to recognize it when it happens and protect it evaporating. It takes luck, patience, a strong work ethic and being willing to do whatever it takes for it to be great. It’s a bit of a process we have to go through to get there.”

I often highlight a similar concept about how we can’t control the pitches that the markets send us. We have to analyze (experiment with) new trends (music), new ideas and new stocks but we are waiting for that moment when we see a pitch like Tesla two years ago $50 right before The EV Revolution took off, or Bitcoin eight years ago at $100 right before The Cryptocurrency Revolution took off and so on. And like Rubin, we have to have a process in place to go through to get there.

I pounded the table on those names and others because I was able to recognize when it happened and get out buckets out in front of the trends (protecting it evaporating). Successful investing certainly also takes some luck, patience a strong work ethic and being willing to do whatever it takes to find the next great idea (while minimizing risks). It’s a bit of a process (we call it our playbook) that we have to go through to be successful investors as we find the next great investment.

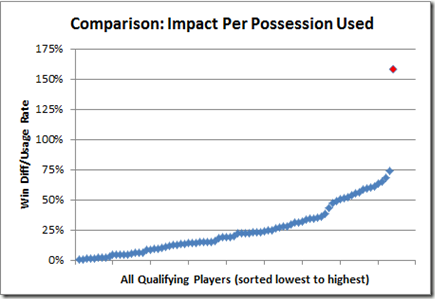

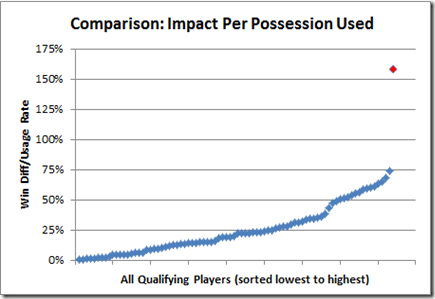

Later I came across this study that tries to prove that Dennis Rodman is probably the most “valuable” player in the history of basketball (not that DR was the greatest). Here look at this chart, which I think probably encapsulates most the ridiculously long and detailed analysis in this study (the bolded quotes in the passage I copied and pasted from the study below are mine) :

“Yes, the red dot is Dennis Rodman. This chart isn’t doctored, manipulated, or tailored in any way to produce that result, and it includes all qualifying players with positive win differentials. If you’re interested, the Standard Deviation on the non-Rodman players in the pool is .19. Yes, that’s right, Dennis Rodman is nearly 4.5 standard deviations above the NEXT HIGHEST player. If value per possession is any kind of proxy (even an imperfect one) for value relative to role, it goes a long way toward explaining how Rodman was able to have such incredible impacts on so many teams with so many different characteristics.

The irony here is that the very aspect of Rodman’s game that frequently causes people to discount his value (“oh, he only does one thing”) may be exactly the quality that makes him a strong contender for first pick on the all-time NBA playground.

Though the evidence is entirely circumstantial, I find the hypothesis very plausible, which in itself should be shocking. While I may not be ready to conclude that, yes, in fact, Rodman would actually be a more valuable asset to a potential championship contender than Michael freaking Jordan, I don’t think the opposite view is any stronger.

In fact, even if this hypothesis isn’t exactly true, I don’t think the next-most-likely explanation is that it’s completely false, and these outlandish outcomes were just some freakishly bizarre coincidence—it would be more likely that there is some alternate explanation that may be even more meaningful. Indeed, on some level, some of the freakish statistical results associated with Rodman are so extreme that it actually makes me doubt that the best explanation could actually stem from his athletic abilities. That is, he’s just a guy, how could he be so unusually good in such an unusual way? Maybe it actually IS more likely that the groupthink mentality of NBA coaches and execs accidentally DID leave a giant exploitable loophole in conventional NBA strategy; a loophole that Rodman fortuitously stumbled upon by having such a strong aversion to doing any of the things that he wasn’t the best at. If that is the case, however, the implications of this series could be even more severe than I intended.“

Re-read that money quote at the end:

“Maybe it actually IS more likely that the groupthink mentality of NBA coaches and execs accidentally DID leave a giant exploitable loophole in conventional NBA strategy; a loophole that Rodman fortuitously stumbled upon by having such a strong aversion to doing any of the things that he wasn’t the best at. If that is the case, however, the implications of this series could be even more severe than I intended.”

Now there are two main takeaways from this Rodman report. The first being that the incredible amount of value that Dennis Rodman (whom I’ve run into a couple times in my life and he wasn’t very nice, but that’s not the point here) brought to the teams he played for was probably precisely because he didn’t try to do the things he wasn’t good at. Focusing on what he was good at, and then becoming one of the best of all time at those skills like rebounding and defense and mind games to mess with the best players on the opposing teams, is what made Rodman so valuable and such an outlier. Few investors will ever separate themselves from the data series of the masses in the way that Rodman did. But there are millions of investors and just a few NBA players so there are likely more than one legendary investor out there that separate themselves from the pack over the years, but it’s rare. As a hedge fund manager, as a competitor in life, I don’t want to be just good. I strive for us to generate life-changing upside results while minimizing risks that are legendary. That’s what I’m striving for in life and in my career and in my investment approach. We’ve done great. We can do even better.

The second point is that perhaps our best edge is that we can avoid groupthink if again we, like Rodman, focus on what we’re good at — in our case, finding the next technological Revolutions that are about to create trillion dollar market places and getting in front of them before anybody else and/or at opportunistic times when the individual valuations get wildly cheap. I don’t spend a lot of time reading charts or gaming macro economic trends with derivative trades or arbitraging mergers or such things. I’m not sure that anybody who does those things will ever be able to truly become outliers over decades anyway. The same groupthink mentality that NBA coaches and execs struggle with is what we have to avoid on Wall Street. Be different, be focused, be disciplined about following your playbook.

Finally, I leave you with a couple pictures that my wife took as my family spent Mother’s Day (and the last day of my Great Reset) afternoon literally flying a kite. Like the kite, we, as investors, have to let the winds of the financial world push our fortunes higher, but we also have to be very careful about the fluctuations of the valuations that can drop our kite and then kick it higher and out of our hands, blowing the handle, the string and the kite into electrical wires (Black Swans) miles away that you didn’t even realize could affect money kite.