Is the higher education industry doomed?

Last week was another in a long series of market glitches that continue to sap investor confidence.

The 2008 global mini recession aside, we’ve had the Flash Crash (and lots of tiny ones), MF Global, PFG, Nasdaq botching the Facebook IPO and now Knight Capital. When systems trip themselves up so badly, and technical issues make it so that you can be right about your trades but still lose money, it’s totally fair to sit on the sidelines and not participate. Right?

Well no, it’s not. Wall Street is always going to find a way to mess up and not take the blame. It’s your job to stay on top of your trading partners. Don’t go with a broker because they’re the cheapest, quality costs. And it’s not OK to jump out of the market entirely because of some glitches. Keep buying stakes in companies that can meaningfully increase earnings over time, get them on the cheap, and you’ll do fine.

I want to talk about two companies in our TradingWithCody portfolio, Apollo and Pearson. I deliberately decided to target two of the biggest linchpins in the educational-industrial complex; they benefited from a 50-year trend and are about to get absolutely decimated as it reverses.

Some corporate history on Apollo first, specifically about their flagship hedge fund (yes, I’m calling it a fund, not a college) The University of Phoenix :

“In 1976, Dr. John Sperling, a Cambridge-educated economic historian and professor, founded University of Phoenix on an innovative idea: making higher education accessible for working adults.

“In the early 1970s, while a tenured professor at San Jose State University in California, Dr. Sperling and several associates conducted field-based research on new teaching and learning systems for working adult students. From this research, Dr. Sperling realized that the convergence of technological, economic and demographic forces would herald the return of working adults to higher education. He saw a growing need for institutions that are sensitive to the learning requirements, life situations and responsibilities of working adults. These beliefs resulted in the creation of University of Phoenix.”

Read it again, it says that Apollo was in the right place at the right time, there was a demographic imperative (mostly expanding housing and suburban sprawl, not expanding incomes) and people needed degrees for jobs which never before required them. Now Doc Sperling, who today is executive chairman, went to a school that is more than 800 years old and founded a school that is 1/20th as old and 1/1000th as prestigious.

UofP Capital, L.P. aka The University of Phoenix served an underserved population of adults and non traditional students, despite the credentials they earned being less than sterling. But that trade for Apollo is over, the low-hanging fruit of awarding workers pieces of paper so their H.R. departments could approve modest wage bumps, is done. From the June 25 Q3 report :

“Net revenue for the first nine months of fiscal year 2012 totaled $3.3 billion, which represents a 9.2% decrease compared with the first nine months of fiscal year 2011. The decrease in net revenue was primarily attributable to University of Phoenix’s 9.7% decrease in net revenue principally due to lower University of Phoenix enrollment, partially offset by selective tuition price and other fee changes.”

Not only is UofP’s experiencing a classic revenue cliff but they are actually losing pricing power. The fees and tuition levels that took them 40 years to build up is collapsing. In 2009-10 Federal taxpayers subsidized for-profit colleges to the tune of $32 billion, only to have half of those students drop out. Here’s how Apollo grabbed their piece of the pie according to a report from Senator Tom Harkin :

“If a prospect says, ‘You’re too expensive,’ the recruiter could respond, ‘Can you afford not to go?’” or “If you are going to make more money, wouldn’t these loans be easier to pay back?,” according to a 2007 training manual cited in the report.

That should scream out at you as a perfect parallel to loan officers telling you to refinance your house because prices always go up. I expect revenue to halve within two years as increased regulatory oversight and the pool of people willing to go into debt to not finish a two-year degree evaporates.

The situation is no better at Pearson, but the market and the media haven’t realized it yet. Instead of targeting individuals like Apollo, Pearson goes after school districts and state houses with their textbook offerings. Remember having to write your name in your textbooks on the first day of school so when you turned it back in on the last day your school would know if you destroyed it? Think for a second about how archaic that is and if it can really survive in the iPad age.

Right now school systems are content to buy new editions every year, but as distribution costs go to zero with e-books, so will Pearson’s pricing power. Paying the same price to update an app or e-book as it costs to get a physical book just won’t continue. Pearson and their ilk are in the same business that telecom supply companies were in for decades. They’ve built in a high-switching cost product, with opaque pricing, that is bundled together with stuff the customer really doesn’t need. They are the Too Big to Fail of education. As NYU professor Diane Ravitch puts it :

“With the U.S. Department of Education now pressing schools to test children in second grade, first grade, kindergarten–and possibly earlier–and with the same agency demanding that schools of education be evaluated by the test scores of the students of their graduates (whew!), the picture grows clear. Pearson will control every aspect of our education system.”

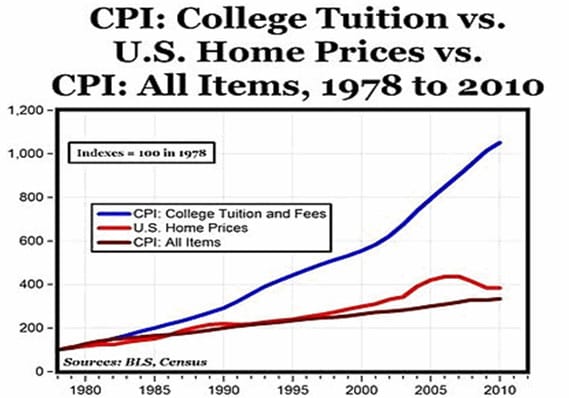

Not going to continue or at least not expand. School districts are pushing back and from my research it looks as though Pearson’s inroads into testing are actually backfiring. And even if you don’t agree with the specifics of what I’m saying, take a look at this chart and tell me if it’s sustainable :

Education is goods & services like everything else we consume. Can the long-run cost be nearly five times the cost of food and clothing and housing and recreation and transportation and medical care? And this isn’t a problem of scarcity or supply and demand, it’s an artifice of 50 years of policies that are coming to a close. Read this quote from The New York Times :

“At Ohio State, ‘college can be a reality for everyone , no matter your income or background,’ its website says, while at Ohio Northern, future students are urged to get over the ‘sticker shock,’ and focus instead on ‘return on investment.’

“Oberlin College’s Web site tells prospective students that its financial aid policy is simple: ‘We meet the full demonstrated financial need of every admitted student.’ The University of Dayton declares itself ‘one of the most affordable private Catholic schools in the country’ and a ‘lifetime investment, appreciating over the course of time.’

“The costs for these colleges? At Ohio State, about $25,000 a year for tuition and fees, room and board and living expenses; at Ohio Northern, about $48,000; at Oberlin $60,000; and at Dayton $48,000.”

What those prices are actually competing with is a world of free, on-demand education, that is increasingly high-quality. The world expert at financial valuation, NYU’s Aswath Damodaran, has put his entire class online through Lore . You can take a class from Princeton, Cal-Tech, Johns Hopkins, Michigan and UPenn for free through Coursera . Harvard, MIT and Berkley are putting their courses online for free with edX . And if you want to just learn a practical skill in a highly paid industry, the Stanford professor who invented the Google self-driving car will teach you programming at no cost on Udacity .

The spread between $60,000 annually and free is an enormous gulf that will close over time. And I think we’ve got two of the best plays on that Investing dynamic.