Kurzweil’s Exponential Rate Of Change And Tesla Stock’s Current Rate Of Decline

This compounding effect is why we continue to invest in Revolutionary Technologies like AI, Semiconductors, Autonomous Vehicles, the Cloud, etc.

Cody is in Austin today with the rest of the family doing some physical therapy with Amaris. Lori and Amaris even saw a Cybertruck for the first time in person:

Pretty awesome!

We wanted to share this video of Ray Kurzweil speaking on the Joe Rogan podcast this week.

Cody often references Kurzweil’s Exponential Rate of Technological Change and just how powerful that phenomenon is.

In the video, Kurzweil explains that he thinks humans generally struggle to think in terms of exponential growth, and rather think that growth will be linear in most instances. Ray talks about the exponential growth in computing power per dollar of computation and how it has continued to improve nearly perfectly at the same rate over the last eighty years.

Astonishingly, the rate of improvement has not slowed down through war and peace, through boom and bust, or through good times and bad. It’s truly astounding how humans can advance technology and then that better technology helps humans advance the next generation even further and faster than the last generation.

This compounding effect is why we continue to invest in Revolutionary Technologies like AI, Semiconductors, Autonomous Vehicles, the Cloud, etc. By the way, Ray thinks that AI will be able to do anything that a human can do no later than 2029, and he says that is a fairly conservative estimate!

Markets got a little ugly yesterday and a lot of the high-flying semiconductor and cloud stocks fell sharply as we had been expecting for the last few weeks.

Tesla (TSLA) continues to get punished as it has been hit with a slew of analyst downgrades lately. The consensus now seems to be that EV sales will be relatively flat this year and Tesla will have to keep cutting prices in order to stay competitive with BYD and the other EV makers in China.

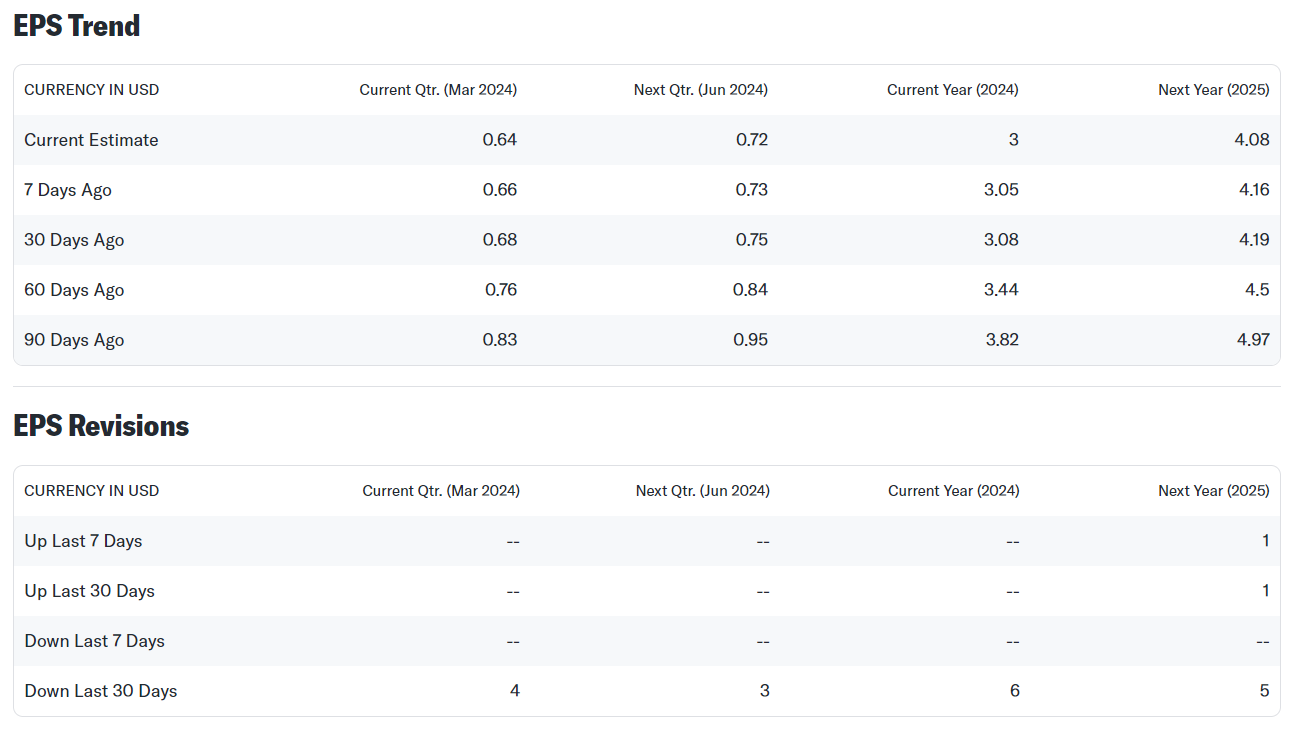

Accordingly, analysts have been cutting earnings estimates quite a bit over the last month or so:

These downward revisions in earnings estimates combined with all of the negative Elon press and Elon’s ceaseless political tweeting has put a lot of pressure on the stock, and even we have grown sick of owning Tesla lately.

That said, we obviously still like Tesla for all of the reasons that we explained in The Ultimate Tesla Book (with The Ultimate Tesla Model!). But that does not mean that we are blind to some of the near-term challenges facing Tesla at this moment. As always, we have to stay objective and part of that is recognizing those near-term issues and assessing their potential to impact the long-term fundamentals of the company.

However, most of the challenges facing the company right now are well documented and we think they are probably getting close to priced in at these levels. On the other hand, a lot of the growth that we are predicting in The Ultimate Tesla Book is based on products like the Optimus Robot and Dojo AI that are not even in the market yet. So we cannot say that Tesla is necessarily “undervalued” by traditional metrics (like TTM P/E) since a lot of the future earnings are still what might be called “pie in the sky.” Unless and until some of those new products start hitting the market, Tesla might continue to underperform.

But returning to Ray Kurzweil’s video above, the exponential rate of technological change never stops.

Tesla is at the cutting edge of AI, EVs, solar, and battery technology. The company has some of the best and brightest minds in the world building its various products, the company is profitable, has about $22 billion of net cash, and will continue to generate even more cash despite spending heavily on R&D building out its new products. Moreover, Tesla has already built one of the world’s top three or four supercomputers and the company completely redid its full-self driving (FSD) software using end-to-end neural networks trained on this supercomputer.

In sum, after years of disappointment and delays, we might all be underestimating how close the company is to achieving FSD, an Amazon Web Services (AWS)-style AI cloud service offering, or a fully autonomous Optimus Robot. If any of those AI-based products become commercially viable in the next year or so, Tesla’s stock will most likely be at much higher levels than it is right now.

We do not know what Tesla’s stock will do in the near term, and we should all be prepared that it could go even lower from here. Markets are still close to all-time highs and if they keep pulling back like we think they may, Tesla could get dragged down further in tandem with the broader markets.

But we can take advantage of times like these to slowly build up a larger position in our favorite names like Tesla using tranches, giving ourselves room to buy more if the stock keeps falling.

That’s it for now folks. Till next week!