Latest Positions: AAPL, GOOG, AMZN, Energy/Materials Companies, ROK, And Shorts

Here is a Part 3 of the list my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

- Longs –

- The Trillion Dollar Club –

- AAPL Apple (5+) – Last week we were joking that AAPL stock is like America’s savings account at this point because the shares have been extremely resilient despite market turmoil and 4+% interest on savings accounts. Then this week they made a joint announcement with Goldman Sachs they will start offering a high-yield savings account using the Apple Card. It’s just a bit ironic that what has come to be viewed as one of the “safe haven” stocks on Wall Street is now also offering its own literal savings account. Other than that news and the opening of a store in India, not much else is new with AAPL except that its stock price just keeps going up. With a $2.6tt market cap, the company is now trading at roughly 28x 2023 earnings estimates and revenue is expected to decline 1.5% over that same period. AAPL is now only 18% away from its all-time high of $182 set back in January of 2022. You don’t need me to try to make the bull case for Apple because the whole world already knows it now. The iPhone is one of the best products ever made and Apple’s platform/ecosystem is so great that consumers get locked into its products, never leave, and constantly buy more. As all long-time TWC readers will remember, AAPL was hated by the Street forever and forever it traded at an 8-12 multiple. Even more mind-blowing was that at the time the company was still growing revenue 15%-20% per year! Now everyone loves it and it is one of the most covered/talked about stocks in the world so I don’t really feel like we have much of an edge on the stock at this point. I still own it in my personal account obviously and will likely never sell it but I don’t own it in the hedge fund and haven’t for some time. I think there is definitely more risk to the downside with AAPL than to the upside and would encourage you to trim a little if you have never done so. We have a lot of exciting revolutionary companies that we are investing in right now and we think there are better places to park capital than in AAPL at the moment.

- GOOG/GOOGL Alphabet (6+) – Google has had a good run since we loaded up on it back when it dropped below $90 in early March when the headlines were dominated by things like “ChatGPT is a Google killer.” We have been trimming it since it got above $105. Google has an amazing track record of creating innovative solutions and products that revolutionize people’s lives. That said, Google has basically had a monopoly in search for over a decade and even if its version of ChatGPT (dubbed “Bard”) is successful, Google will now likely be in a duopoly with ChatGPT. Besides Google’s ChatGPT problem, the company’s revenue growth has also dropped significantly with the large pullback in global ad spending. One of the most troubling numbers we saw in the last quarterly report was that Youtube revenue was actually down almost 8% in the fourth quarter from the year-ago quarter. Google is likely going to face continued competition from platforms like TikTok, Instagram, etc. for an ever-shrinking bucket of ad dollars. Given these headwinds and the fact that the stock is trading at about 21x 2023 earnings, we do not want to chase GOOG into this run up. We would be buyers again below $90.

- AMZN Amazon (7+) – It’s funny that both Google and Amazon have similar stock prices at the moment ($106-$107) and it seems like for the last couple of months the two stocks have almost traded in tandem. Amazon has a $1.11tt market cap and Google has a $1.35tt market cap, so even those numbers are pretty close together. Maybe Google and Amazon could quietly merge together and the regulators and markets wouldn’t even notice because the stocks have grown so similar anyways? Jokes aside, Amazon is sort of finding its footing again post-pandemic following the massive growth in online shopping and in AMZN’s headcount accordingly. Amazon is in the same pattern as META in that it is in cost-cutting mode and focused on increasing profitability even with slower growth. Unlike Google, Amazon is not facing any kind of existential threat to its core online marketplace but it is facing some competition for AWS (MSFT Azure, Google Cloud, and Oracle), which has historically generated most of AMZN’s profits. Analysts still think that the company will grow revenue 8-12% over the next couple of years but trading at 75x ’23 earnings AMZN is not cheap (which is nothing new). AMZN, along with GOOG, AAPL, ORCL, MSFT, and others has been caught up in the “tech is the safe haven” trade and we think that is not very bullish setup for these stocks over the next 12-18 months. AMZN’s revenue and earnings will likely drop if a recession comes and the stock will probably lose ground accordingly. That said, of all of the mega-cap tech stocks right now, we probably would buy AMZN here before we would chase anything else, just because it still has more room to grow in our minds and is not facing some sort of potentially existential threat like GOOG.

- The Energy/Materials Revolution –

- SEDG Solaredge (6) – Solaredge and just about every other solar stock has been on fire for the last month. Why? Good question. It feels like solar is in its own bubble at the moment with many of these companies skyrocketing despite not being very profitable and with revenue growth likely to slow. While the IRA might boost some subsidies for solar, California (historically the largest solar market in the US) is set to cut its solar subsidies. Additionally, rising interest rates change the economics for these solar systems and there are likely many customers who would have installed solar panels on their house if they could have borrowed money at 3% but now cannot do it at 7%. We have been spending a lot of time researching these names and it is clear that this is a crowded field and we would rather be short than long most of the solar companies that are not called Solaredge. All of that said, it is clear that solar as a whole is a secularly growing industry and we want to continue to bet on the decentralization of power. But if 2022 taught us anything, we cannot pay unreasonable premiums for stocks just because they are growing rapidly. We trimmed some SEDG the other day and would buy more if this stock ever gets back to the $200 range.

- SMH NuScale Power (8+) – NuScale has bopped around between $8-$9 since we started buying it. In case you missed it, here is the link to our full-scale write up on NuScale which went out last week. As we mentioned in the report, this is a long-term play as it will take several years before NuScale starts generating meaningful revenue. However, the company has some big backers, including Uncle Sam himself, and we do not think NuScale is going away any time soon. That said, it could take some time before the stock gains much traction as the company is not very well known and only a handful of Wall Street analysts even cover this stock. As NuScale signs up more customers, it will rapidly grow its revenue and by the time Wall Street catches on, it will have already missed a big move up in the stock. We make money by finding names like NuScale and investing in them before they go mainstream, but that strategy only works if we are willing to be patient in the interim. We are still adding to our position in this name and will likely buy more if it drops back down close to $8.

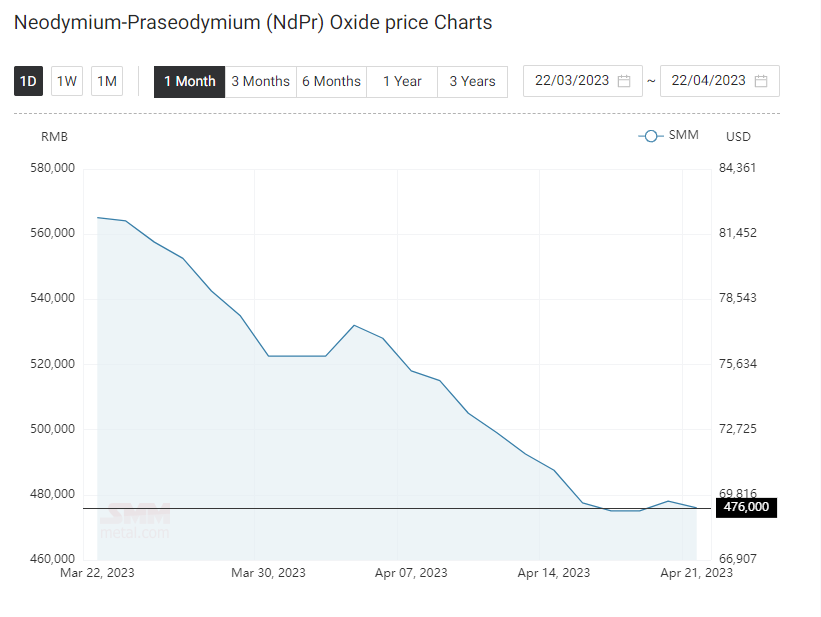

- MP MP Materials (8+) – MP Materials has been extremely painful since we wrote about it back in February. This is one of those trades where we have to trust our analysis and not let the movement in the stock price affect our thinking. That said, MP is still a commodity company and its revenue/earnings will be affected by changes in the price of its main product, Neodymium-Praseodymium (NdPr). As the price of NdPr has tanked over the last several weeks (see chart below), so too has MP’s stock. Additionally, there is concern that China may cut off the export of rare earth minerals. However, it is not likely that China will stop importing rare earths from companies like MP because China itself is running out of supply. Additionally, as we talked about in the write-up, MP is constructing its own refining facilities in addition to its own permanent magnet factory in Texas. Right now, MP still has to ship all of its raw production to China for processing. We mentioned in the report that this would likely be a more difficult year for MP as it transitions away from selling to China and toward producing its own finished products. Once this is completed, MP’s earnings will be less tethered to the price of raw NdPr oxide and margins will likely be higher as the company will be producing highly sought-after permanent magnets and selling them to American EV makers, solar turbine manufacturers, defense companies, etc. We still believe in the long-term vision for MP and have been adding to our position with this big pullback.

- The Trillion Dollar Club –

-

- The Reshoring/Automation Revolution –

- ROK Rockwell Automation (7-) – Rockwell had a pretty amazing start to the year rallying all the way to $305 in early March and since then has slowly given up a big chunk of those gains. ROK’s last quarter was okay but the stock is not cheap by traditional industrial standards trading at 24x 2023 earnings estimates. That said, ROK is likely worthy of a higher multiple because it is the best pure play on the ongoing re-domestication of US manufacturing. With labor costs higher than ever, productivity so so, and labor costs being one of the stickier pieces of the inflation puzzle, companies relocating facilities to the US will want to figure out ways to cut labor to the maximum extent possible. ROK is a big part of that equation as their products allow companies to automate huge portions of the production process and eliminate the need for human input. As we were talking about yesterday with enterprise software, there is a chance that ROK could even benefit as companies look to reduce costs (via cutting labor) and replace that labor with cheaper automation products/software from ROK. Analysts are only predicting ~4% revenue growth this year and if the company is able to beat those numbers (as we expect) we think the stock is likely higher from here. We would not rush to buy this stock just yet and would rather like to see some accelerating growth this quarter to get us really excited about buying this stock again.

- The Reshoring/Automation Revolution –

- Shorts –

- IWM Small Cap ETF (8+) – This is a short hedge for my small cap longs. I continue to think small caps look like they are probably ripe for underperforming the broader markets for the next few weeks, months or quarters.

- SMH Semiconductor ETF (8) – This is a short hedge for my several semiconductor longs.

- MSFT Microsoft (7) – We think too many people are hiding in the big tech “safe haven” trade and plus MSFT has really been hyped up because of the ChatGPT hysteria. Obviously, MSFT is a great company and extremely profitable but we think the valuation is stretched and it is a good hedge for our mega-cap tech longs.

- Financials, rated at about a (6+) – in BAC, BX, and WFC. We still think there is likley more pain to come amongst many of these financials that had too much exposure to long-dated treasuries/mortgages in addition to the brewing commercial real estate problems. Obviously, these have pulled back some already so don’t want to lean on these too hard.

- Car companies/dealers rated about (7) – in GM, LAD, and CVNA. The car market was red hot during the pandemic and many of these car dealerships were pushing out inventory at elevated prices and carrying the loans which went to consumers with bad credit. We are short GM because we think they will likely fail to ever successfully produce EVs and this is more of a TSLA hedge for us than anything.

- Old Internet rated about a (8) – in CHTR and VSAT. We think Starlink is almost definitely going to take out companies like VSAT, SATS, and IRDM and thus these are mainly SpaceX hedges. We also think there is a good chance that Starlink makes the old fiber business (like CHTR) uneconomic just due to the relatively smaller CapEx required compared to trenching fiberoptic lines all over the country.

- Tiny short hedges, rated about a (7) – in GE, GDRX, MU, RBLX, and others. These are just companies with bad fundamentals that are good hedges for some of the long names in the portfolio. As always, I might cover these at any time and I’m not expecting to make much money on these shorts. They’re just hedges for the hedge fund and I’m not sure any of these are no-brainer shorts. Please don’t just go around blindly shorting these for your personal portfolio.

Remember: I wouldn’t rush into a full position all at once in any of these stocks or any other position you’ll ever buy. Patience and allowing the market and time to work to your advantage by buying in tranches is key. Maybe 1/3 or 1/5 of whatever you might consider to be a “full position” in any particular stock. And I wouldn’t ever have more than 5-15% of your portfolio in any one stock position at any given time. The younger you are and/or the higher the trajectory of your career income, the more concentrated and risk-taking you can be with weighting in your portfolio. But spread your purchases and your risk out over time and over a several positions no matter your age or risk-averse level.

Scaling into a position using an approach of buying 1/3 or 1/5 tranches over time is how I build my personal portfolio positions, but there’s no scientific way to go about investing and trading. Sometimes you have to pay up for the latest tranche but I try to be patient and wait for a temporary sell-off to add to the existing position.

** NOTE FOR NEW SUBSCRIBERS:

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple of hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.

Disclosure: At the time of publication, the firm in which Mr. Willard is a partner and/or Mr. Willard had positions in some of the positions mentioned above although positions can change at any time and without notice.

That’s it folks. Rock on!