Latest Positions: Analysis On Apple, Google, Amazon, Solar Edge, And MP Materials

Amaris is back home and doing well. Thank you for the outpouring of kind words and prayers.

Here is Part 3 of the list my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- The Trillion Dollar Club –

- AAPL Apple (6+) – Back in April, I wrote this about Apple: “AAPL used to trade for 10-15x earnings even when it had huge exponential growth in front of it and now it trades at more than 25x next year’s earnings even after this recent pullback in the stock. I could see this stock trade back at 15-20x next year’s earnings, which would mean it could hit $100-120ish levels. Wow, that sounds bearish as I type it and maybe it won’t decline quite that bad, but the upside potential from here seems constrained. I hold AAPL for 18 years now in my personal account, but I don’t own it in the hedge fund right now.” Apple did eventually trade with a $120-handle at the summer lows and I’m not sure it won’t trade down there again before this cycle is over. Analysts expect the company to go grow the topline 2% this year and 5% next year which seems reasonable as long as they can meet demand. Those same analysts expect Apple to earn $6ish to $7 next year meaning that Apple has a more than 20x forward P/E and that’s just about in no-man’s land right now. I’m a buyer of AAPL near $100 for the hedge fund, where I don’t own any right now still. I still own AAPL in my personal account as I have for nearly 20 years now.

- GOOG/GOOGL Google (7-) – Google is supposed to grow 10% topline this year and next but there’s a lot of upside and downside potential to those numbers. If GOOG meets analyst expectations of $5 per share earnings next year, I expect this stock would be higher than these current levels. That said, the real story with Google right now is the threat of ChatGPT and how easy it can be to use already. Millions of people like me are already starting to use ChatGPT to research and write and it’s replaced Google for me in some ways already. That said, Google’s got their own version of this kind of thing coming out in the next few months or so and it will likely be as good if not better than ChatGPT’s. I’m a buyer of GOOG in the low $80s and a strong buyer in the $70s.

- AMZN Amazon (7-) – ATechnically, AMZN’s no longer a trillion dollar club member, as its market cap is $930 billion right now. Amazon’s probably going to report a net loss for this year, at least according to analyst consensus. I find it mildly interesting that analysts expect GOOG to grow 10% this year and 8% next year while they expect Amazon’s topline to grow 10% this year and 8% next year. Obviously, these kinds of numbers get moved around often, especially in a volatile economy like we have had since the Covid Crash turned into the Post-Covid Blow-Off Top Bubble which turned into the SPAC/Speculative Stock Crash. Often you’ll see me talk about how I think analyst estimates are either way to high or way too low and that’s about the only way that analyst consensus can be helpful other than just providing some guidance of what consensus thinking is. Anyway, Amazon’s dominance in delivery and as the de facto store of the US ain’t going anywhere and I’ll be strongly buying this stock in coming weeks and months if it drops into the $70s. I’d recently sent out a Trade Alert about buying more of this one when it was at the recent lows a few weeks ago.

- The Energy/Materials Revolution –

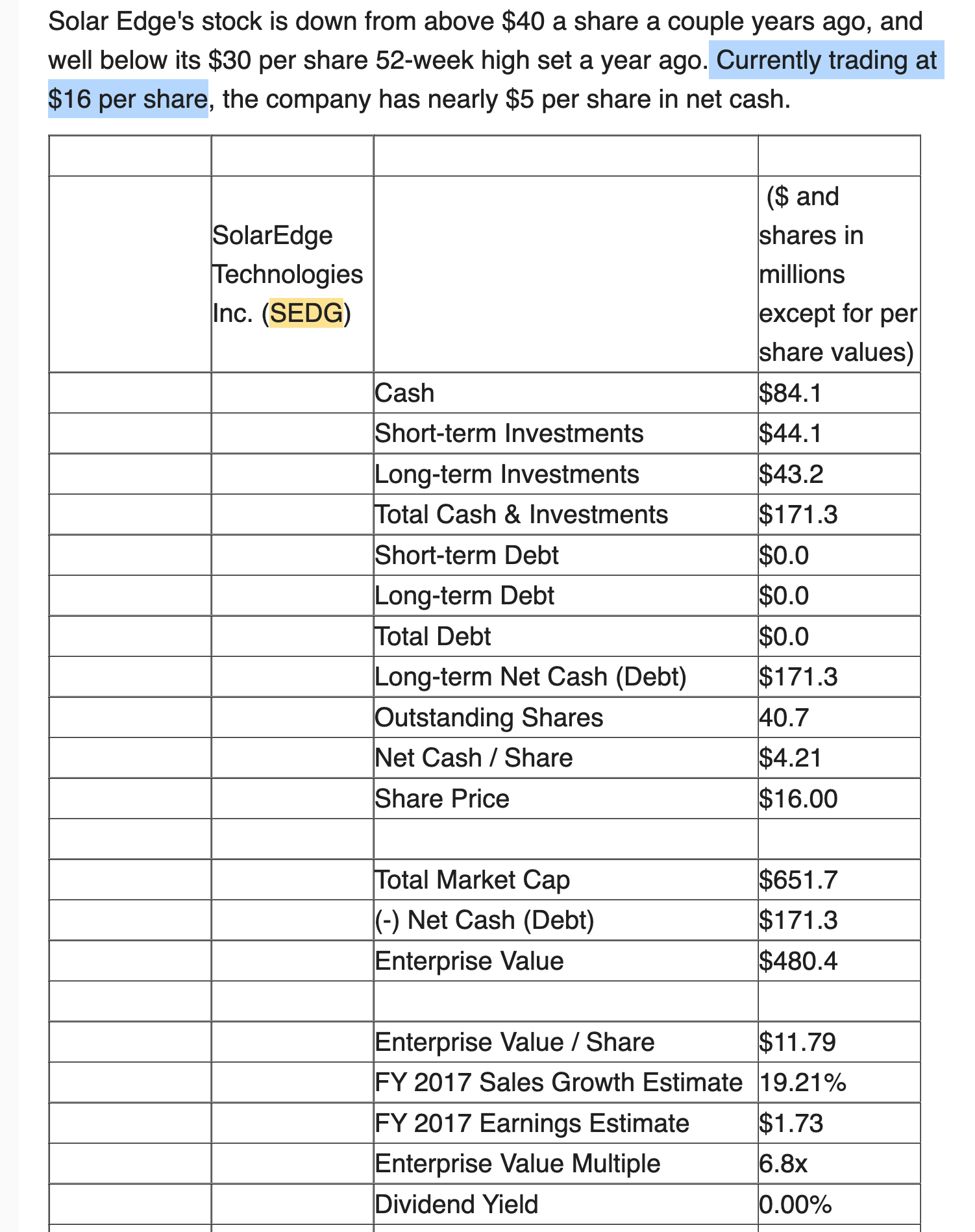

- SEDG Solar Edge (7-) – Solar Edge is going to grow its revenue more than 50% this year, by more than $1 billion to more than $3 billion. Next year they are expected to hit $4 billion in revenue. That’s pretty impressive, as I recall that this company grew its revenue only 19% back in 2016 to get to $450 million or so. The stock has gone up from $16 or so when we bought it and is currently trading at $335. It, like all those names in bold in my Latest Positions which denotes those that I consider “Forever Positions” now underscore why we invest in high growth Revolutionary names when valuations are compelling.

- MP MP Materials (7) – MP could be the only Chamath Palipatiya SPAC that ends up working. Despite forever taint being associated with the self-declared SPAC KING this is a company which can help make the US safer and more self-reliant. The fact is that this is a higher risk stock still and it needs to both execute and have high inflation for its rare earth materials over the next year or two to make growth and earnings and most importantly cash flow happen to drive this stock higher. I keep this as a mid-to-small-sized position and would be more if it got back to the low teens where we started it buying it.

- SEDG Solar Edge (7-) – Solar Edge is going to grow its revenue more than 50% this year, by more than $1 billion to more than $3 billion. Next year they are expected to hit $4 billion in revenue. That’s pretty impressive, as I recall that this company grew its revenue only 19% back in 2016 to get to $450 million or so. The stock has gone up from $16 or so when we bought it and is currently trading at $335. It, like all those names in bold in my Latest Positions which denotes those that I consider “Forever Positions” now underscore why we invest in high growth Revolutionary names when valuations are compelling.

Part 4 soon.