Latest Positions: Analysis, ratings, graphs and more

I got back from NYC and to Ruidoso NM at about 3am Saturday morning — The Tesla sure makes the 170 mile drive from the airport in Albuquerque easier than it used to be. Lots of interesting meetings and experiences on the trip and I’ll be writing about all of it this week. But in the meantime, as promised, here is a list of my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

You’ll notice a few trades, mostly that I’m taking some profits on NVDA as well as completely selling out of VZ and DELL.

I’ve broken the list into Longs and Shorts. I’ve further broken the list down in order of highest-rated to lowest-rated. Those ratings go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- Forever assets and other permanent holdings –

- Media, hedge fund and other private investment/business holdings (9+ because betting on yourself and running a business is always a best bet)

- Real estate, including the office I work out of, some land and the ranch I live on in NM (8)

- Physical gold bullion & coins (7)

- (Driverless Revolution) –

- TSLA Tesla (8) – Tesla is one of the most volatile day-to-day, week-to-week most mega cap stock I’ve owned in a long time. That volatility can be painful when the company sets expectations too high (like they did with the leaked email from Elon last week touting the fact the company could almost get to 100,000 deliveries in the third quarter — and then delivering 97,000). It can be wonderful when the expectations get too low or the stock just too oversold. TSLA remains the most heavily-shorted megacap stock in the markets and the battleground here is fierce. The quality of the product, the Revolutionary way the car is a computer on wheels that keeps updating itself and improving after you buy it, is something the shorts just can’t get their heads around. I happen to think that it’s more likely that Ford, GM and Volkswagen are going bankrupt in the next five years than it is that Telsa goes bankrupt. In the prior Latest Positions, I’d written: “Tesla I’d look to nibble on more TSLA at $210ish or so.” With all that volatility, we’ve had a couple or so chances to buy the stock at $210ish and maybe we’ll get the chance again. There is still risk that this stock goes much lower in the next year if they don’t sell enough cars or something goes wrong with the Gigafactory 3 or…I feel safe in predicting only that the stock won’t be at $231 two years from now.

- UBER Uber (8) – Uber raised so many billions of dollars from Softbank and others in the private market when it was valued near $100 billion, that it’s still un-bloating itself. For example, why did the company ever invest in trying to develop its own autonomous vehicle technology instead of just waiting for the technology to develop. Why are there nearly 25,000 people working at Uber? What are they all doing? It’s part of the de-bloating from the excesses the company was able to raise from those billionaire tech investors in the private markets. The good news is that the company is indeed a Revolutionary company that’s got high barriers to entry (to create a global car fleet that works from the same app — there’s only one or two and it’s Uber and maybe one of the Chinese competitors. It’s also good that the company is being held accountable by the public markets. There’s a lot of potential in this company but it’s still burning cash and far from “safe.” I’m probably just holding the UBER position I’ve got steady for now, but I might buy more if it got hit down below $25 in a panicky sell-off or something like that.

- (Social Revolution)

- FB Facebook (7) – Facebook and Mark Zuckerberg have done an amazing job of weathering the PR storm. They’ve made so many mistakes with people’s privacy over the years, and they’ve spent so much money on privacy initiatives that it’s possible they’ve got things locked down. Then again, I doubt it. Anyway, there’s also the Facebook crypto (it’s not a crypto) currency, Libra, has run into issues of its own. Paypal just pulled out of the Libra project entirely and rumors in the WSJ have it that Visa and Mastercard are next to bail. I do think Facebook might be higher right now if Libra had any momentum. Instead it looks like Libra will be a shell of what it could have been if/when it does launch. Meanwhile, cash flow and fundamentals remain pretty terrific for Instagram and Whatsapp and Ol’ Grandma Facebook itself. I don’t use Facebook anymore, I’ve never really used Instagram or Whatsapp and the only social networking I create/consume is on Twitter. But more than 90% of the developed world outside of China, uses some sort of Facebook product most every month. Heck, now that I think about it, I do still have a Facebook account that’s up. I’d be a buyer of Facebook in the low $160s.

- TWTR Twitter (8) – Twitter (and Snap) are the anti-Facebook. The utility and value that you get out of the tweets, links, pics, video and commentary in your Twitter feed is somehow more valuable because of the brevity of the tweets. It’s the 21st century Internet-ification of the old Blaise Pascal saying: “I would have written a shorter letter, but I did not have the time.” The stock has broken out this year and tried to spike above $45 before it exhausted itself, as I’d expected it might in the prior Latest Positions update. Same upshot as last time too: I’d buy more TWTR below $40.

- SNAP Snap (7) – Eight years in, Facebook is still trying to be as cool as Snap. Threads is the latest wannaba-Snap-app from Facebook, this one an Instagram camera-first messaging app target at a “smaller circle of friends” than Instagram’s other visual sharing efforts, the new Threads is a stand-alone app aimed at privacy and speed. Snap’s another riskier of our longs but it’s a clear path to much higher earnings and probably higher stock price in coming years if the company can keep growing and somehow become a break out hit outside of the countries it’s already broken out in:

- (5G Revolution)

- VZ Verizon (6) – Verizon is the anti-Tesla, barely budging and hanging out at these levels for decades now. I’m thinking it might be time to move on from Verizon since it’s still going to be another 3-5 years before 5G has been deployed widely enough, long enough for all of the new services/revenue models to be developed and kicking in to matter to Verizon. I also wonder if Starlink Internet services from SpaceX and/or other new technologies might hurt the traditional wireless companies like Verizon. And with that, I’m going to go ahead and let go of Verizon here. I will certainly have Verizon on my radar and will be ready and willing to buy it back if the stock were to yield over 5% again or if it turns out Verizon does start to dominate 5G when it gets here.

- TMUS T-Mobile (7) – Same longer-term risks for TMUS as there are for Verizon here but I’m willing to give this stock a little room for now. Holding TMUS steady and I might add more near $70.

- QCOM Qualcomm (8) – There’s just not much to say about Qualcomm month-to-month here. The stock is cheap at maybe 15x next year’s likely earnings of $5 and very cheap on what could be a huge growth cycle in 5G ahead of Qualcomm. A 3% dividend doesn’t hurt. There’s still constant litigation risk with this name, but I’d load up on this stock if it got hit on litigation headlines.

- Cisco (7) – Long before Verizon or T-Mobile are going to be able to make extra money from 5G, they’re going to be investing in the infrastructure required to get to 5G. As I mentioned last time: “Cisco is a the de facto world leader in routers and Internet infrastructure that’s not named Huawei. Huawei’s losses are Cisco’s gain just as 5G and IoT are about to roll out mainstream in the next few years. Cisco’s trading at 15x next year’s earnings, growing about 5% or so right now, but that might accelerate with 5G and IoT and the Huawei ban.” While the Huawei ban might be good for Cisco, so far it has not been, as the company reports that it has been almost completely shut out of even bidding on contracts in China. I think this is one we should just have a small position in and hold onto for the nice little yield of 3% and the upside potential that Cisco could see as it benefits from IoT and 5G and the ever-increasing demand for more speed. I’d buy more Cisco below $45.

- (Cloud Revolution)

- I’d mentioned when I sent out in one of the original Slack Trade Alerts that the stock “maybe close to a 9/10 rating for WORK when it’s below $25″ and that’s probably still the case. A little anecdotal evidence of just how pervasive Slack has gotten to be in the corporate work world comes from my trip to NYC last week.

I had dinner with the CEO of Republic on Wednesday night at a sushi place in midtown. After a long day having landed in NYC at 6am, doing a hit on Fox Business while the markets DJIA was down -500 points and other meetings, I was happy that he wanted to meet for an early dinner at 6pm. When I got to the sushi place in midtown, the place was already packed and Kendrick (the CEO) was waiting for a table already. We were also waiting for another executive from Republic to join us for dinner who was uncharacteristically late to show up. At 6:10, Kendrick pulls out his phone to send her a message — not on text, not by email, but by Slack.

The next day I had lunch with one of my best friends from college at UNM back in the mid-1990s, who is an artificial intelligence expert. I mean, he’s been working the AI field since he sought out the leaders in the field in the 1990s and convinced the founder of Cycorp, one of the original AI companies, to hire him. He now works at a company called Gro Intelligence, which basically seeks out and assimilates every piece of data in the world from agriculture, weather, soil, farming and the like. He went to introduce me to the Chief Technology Officer who was hard at work on his computer in the very cool space in midtown just a block from my own hedge fund’s office. The CTO looks up and asks us to wait just a moment so he can finish what he’s typing and as I look at his monitor, I see he’s typing on Slack.

If these two anecdotes are any indication of a broader trend, Slack is apparently mission critical 24/7 in the corporate world.

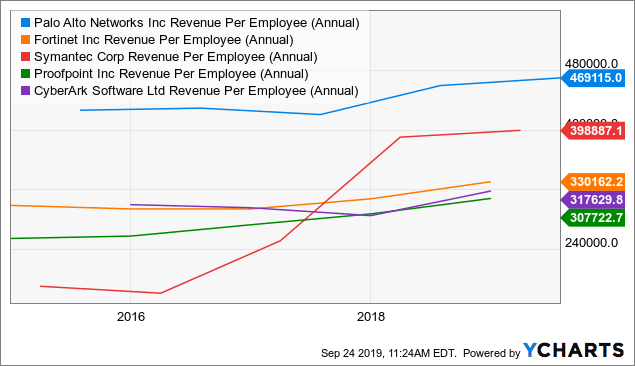

- Palo Alto Networks (7) – Palo Alto’s market cap of $20 billion makes it probably the largest pure-play cybersecurity company. The company will likely do $4 billion in revenue next year, which means it’s trading at a reasonable 5x sales. 20% topline growth ain’t nothing to sneeze at, nor is the amount of revenue per employee that the company generates:

The company’s made some interesting acquisitions in the last year to help diversify it away from the appliance business and I’m going to continue to hold it as the best cybersecurity play out there. I’d buy more near $190. - DELL Dell (6) – I’m going to sell the DELL too. It’s just not revolutionary enough and I think I’d rather own VMW, directly than DELL at this point. Speaking of which, I’m doing some hard work on VMW here, so stay tuned, as I might be buying to replace DELL.

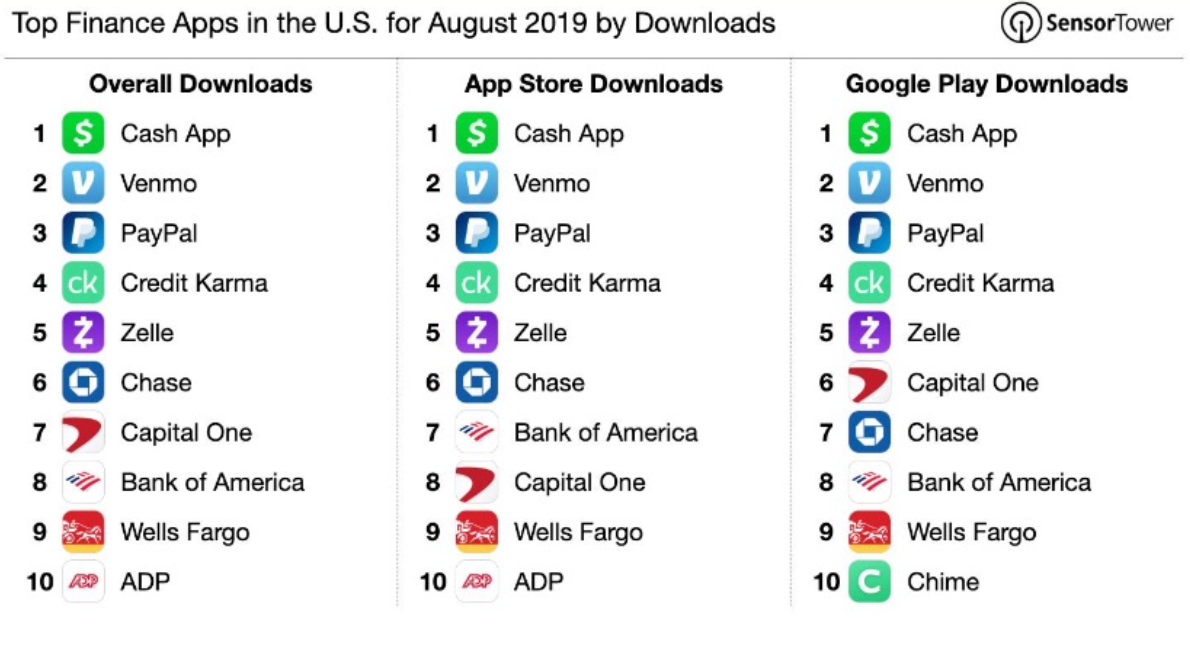

- SQ Square (8) – I like Square for the penetration they’ve got at the point-of-sale check out counter in the US. But more than anything, as I mentioned last time, I think the Square Cash App, which is now a more than $1/2 billion dollar a year business and growing quickly is what will drive the stock in the next year or two. Look at this:

You can even buy, sell or send bitcoin in the Cash App. I bought some SQ when it got below $60 as I’d noted I probably would in the prior Latest Positions update. I’d buy even more near $50. - NVDA Nvidia (6) – It’s all about next year for Nvidia, as Wall Street expects the company to grow topline 20% to a new record of $13 billion, $1 billion above the revenue generated in 2018 (2019 is looking like revenue will be down 5-10% from last year). I’m more of a trimmer than a buyer of NVDA when it’s above $180 as it is right now, and consider this a Trade Alert that I’m trimming some NVDA here. Last time, I wrote: “I might buy more NVDA near $140 and I’d probably trim some at $180.” That’s still about the way I see NVDA.

- SPLK Splunk (7) – Wall Street has turned their back on Splunk just as the company’s getting traction in lots of new sectors from cybersecurity to data crunching. The stock is trading at about 6x Wall Street’s estimates for next year’s sales but I think those estimates are likely too low. Topline growth of nearly 30% this year isn’t likely to slow to 20% next year, which is what Wall Street’s expecting. I don’t care too much about the cash-flow subscription vs sales issue that’s hit the stock and I’m a buyer of SPLK near $110.

- I’d mentioned when I sent out in one of the original Slack Trade Alerts that the stock “maybe close to a 9/10 rating for WORK when it’s below $25″ and that’s probably still the case. A little anecdotal evidence of just how pervasive Slack has gotten to be in the corporate work world comes from my trip to NYC last week.

- (Energy Revolution)

- SEDG SolarEdge (6) – We got the opportunity to buy some more Solar Edge, which we’ve owned in the personal account and Trading With Cody subscribers since it was at $14 a share, when it got hit on a Citron report. SEDG is fully valued up here though and I’m not about to load up on it.

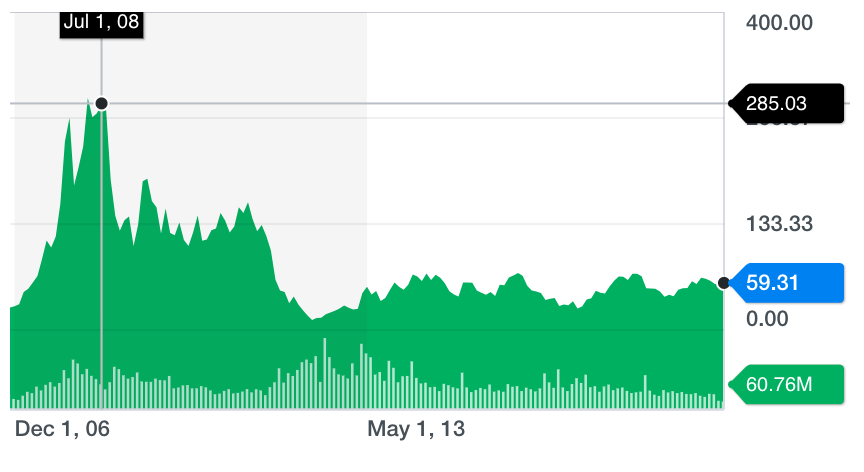

- First Solar (8) – First Solar’s is a lumpy business and that can make the stock quite volatile. With the stock trading at what you might call normalized earnings of about $3 per share, it’s trading at 20x. Longer-term, I want to own solar as the best Energy Revolution sector and now we own to of the best names. Long-time followers of mine will remember a decade ago when I was shorting solar/alt-energy stocks before many of them went bankrupt and even the good ones like First Solar lost more 90% of their market value.

I’d buy more FSLR near $50.

I’d buy more FSLR near $50.

- (China Middle Class Revolution)

- JD JD.com (7) – Another volatile little stock, this thing can sell of 10% off one Grumpy Trump Tweet about The Great Trade War with China. It’s been a good idea to buy when that happens and to trim when the stock rallies above $30. Probably still is. JD is one of the best ways to play on what hopefully will be a growing middle class in China for years to come.

- BIDU Baidu (7)– In its most recent earnings report, the company delivered something better than Wall Street had feared. And there is a lot of fear in this stock right now. And pain, frankly. I find this stock painful here and I’m having a hard time keeping it on the sheets. I keep going back to the balance sheet as BIDU has $12 billion net cash (now over 35% of the market cap). And the company’s investments range from AI to Driverless to equity in iQuiyi (IQ) and others totaling billions of dollars of worth, probably at least another $10 billion. I’m sitting tight with BIDU for now.

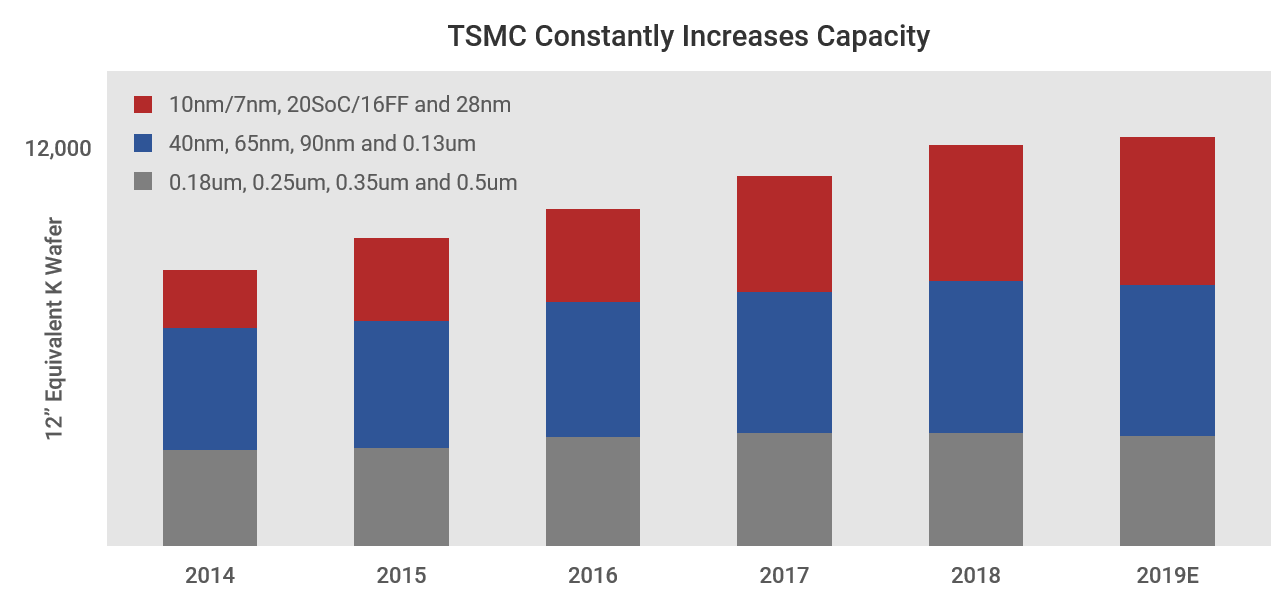

- TSM TSM (7) – TSM is scrambling to meet demand. That’s a great problem to have and in the semiconductor industry, TSM is probably the only company on the planet that can say that it can’t meet demand. There’s geopolitical risk in owning a stock in a company based in a Hong Kong-like disputed land with China. But this one is so well-positioned and such a powerful play on all chip trends, that I want to own it. The stock might be a bit extended near-term. I’d buy more below $40.

- (Defensive names)

- CPB Campbell’s (7) – Campbell’s is the best acting stock packaged food stock this year and we bought it darn near at the lows. I’m just holding it steady as they continue to “invest” in making their chicken soup a little bit better tasting and getting it even more distribution in bodegas around the world.

- GLD Gold ETF (7) – Last time I wrote: “What a rally in gold this year, one that started just soon after we’d initiated this GLD position back in April or so. I’m a trimmer of GLD here in the low $140s and would perhaps buy some of it back if it got closer to $138.” We sold some near $145 recently. I’m not a buyer of GLD til it gets back under $135. Holding what we still have steady for now.

- (The We-Were-FANG-Investors-Before-FANG-Was-a-Thing Basket)

- GOOG/GOOGL Google (7) – I bet you didn’t realize that at the rate it’s growing (call it 18% per year), Google will hit a trillion dollars in revenue in less than a decade, up for $160 billion this year. Yea, I’ve owned this stock since the day it came public and I ain’t planning on selling it until maybe it’s hitting a trillion dollars in revenue.

- AAPL Apple (7) – Apple’s latest iPhones seem to be selling better than expected. I personally haven’t upgraded yet, but I want the new Pro camera version. I’ll get around to ordering it some time. There’s still China Trade War risk in Apple, and as I wrote last time: “I’m a trimmer of AAPL here near $210 and would be a buyer back near $190 or so.” That’s still sound advice I think.

- AMZN Amazon (7) – Some very cool Alexa-enabled hardware keeps coming out. Amazon Web Services continues to kick off an amazing amount of growth and cash. I continue to hold this core name that has so many ways to win from retail to Alexa to logistics to cloud. I’d look buy more near $1700 and to trim some near $1900.

- Netflix (8) – Last time I wrote “Netflix is my least favorite of the FAANNG names right now.” Well, NFLX was at $330 at the time and by the time the stock fell close to $250, I started buying some for the first time in years. I like NFLX a lot here, as the hype/worry/concern about the competition from other streaming platforms has been overblown. All these OTT services for $5 are probably complimentary to Netflix’s more complete and more expensive at $15 or whatever. It’s cable/satellite/broadcast that these services nail the coffin in, not Netflix.

- (Other)

- AXGN Axogen (6) – I’m going to sell Axogen out of the hedge fund. I’m holding onto the shares I bought below $5 per share in my personal account, though I trimmed quite a few of those over the years as it ran to $40. Sitting tight with the remainder in the personal account.

- (The Space Revolution)

- BA Boeing (7) – Boeing is a global duopoly, but it’s got headline risk from how stupidly they’ve handled the Max jets since day 1 apparently. There’s a good chance this stock could get juicy if The Space Stock Bubble is coming in the next 2-5 years as I expect it will.

- Private holdings in space companies (8) – More on this in coming weeks.

Shorts –

- Primary short portfolio

- IBB Biotech ETF (7) – IBB’s been one of the best hedges we could have in the markets this year, but that could change in a heartbeat, I suppose. I do think medicine-related businesses will be under fire as the Republicans and Democrats who run for offices in the next elections will pretend that they’re going to do something about it. Closer to the election, if biotechs and hospitals and other healthcare industry stocks are getting crushed, there might be some good buying opportunities.

- QQQ Nasdaq 100 ETF (6) – We traded these hedges nicely over the last few weeks and I’ll continue to hold some short hedges and puts.

- SMH Semiconductor ETF (6) – We traded these hedges nicely over the last few weeks and I’ll continue to hold some short hedges and puts.

- IWM Small Cap ETF (7) – We traded these hedges nicely over the last few weeks and I’ll continue to hold some short hedges and puts.

- SPY Small Cap ETF (7) – We traded these hedges nicely over the last few weeks and I’ll continue to hold some short hedges and puts.

- EWU and EWUS British ETFs (6) – I’m mostly out of these short hedges, but still have a small short exposure in each.

- Tiny short hedges, rated about a (7) – in VHC, GLUU, CVNA, EVBG, HTZ and others. We’ve had some huge homeruns in our small shorts this year. I might cover these at any time and I’m not expecting to make much money on these shorts. They’re just hedges for the hedge fund and I’m not sure any of these are no-brainer shorts. Please don’t just go around blindly shorting these for your personal portfolio.

Cryptocurrencies/tokens –

-

- Bitcoin (7) – We’ve had a good year buying bitcoin futures before they popped, trimming them on huge rallies and nibbling them back when they sell-off again. I’d be a buyer of bitcoin near $7000 and a trimmer above $10,000.

- Stellar Lumens (6) – I think it’s best not to group all cryptos together and that over time, each will trade on its merits and perceived/accepted values. That’s probably what’s happening right now with Bitcoin.

- Ethereum (6) – I think it’s best not to group all cryptos together and that over time, each will trade on its merits and perceived/accepted values. That’s probably what’s happening right now with Bitcoin.

- Ripple (6) – I think it’s best not to group all cryptos together and that over time, each will trade on its merits and perceived/accepted values. That’s probably what’s happening right now with Bitcoin.

Disclosure: At the time of publication, the firm in which Mr. Willard is a partner and/or Mr. Willard had positions in some of the positions mentioned above although positions can change at any time and without notice.

Remember: I wouldn’t rush into a full position all at once in any of these stocks or any other position you’ll ever buy. Patience and allowing the market and time to work to your advantage by buying in tranches is key. Maybe 1/3 or 1/5 of whatever you might consider to be a “full position” in any particular stock. And I wouldn’t ever have more than 5-15% of your portfolio in any one stock position at any given time. The younger you are and/or the higher the trajectory of your career income, the more concentrated and risk-taking you can be with weighting in your portfolio. But spread your purchases and your risk out over time and over a several positions no matter your age or risk-averse level.

Scaling into a position using an approach of buying 1/3 or 1/5 tranches over time is how I build my personal portfolio positions, but there’s no scientific way to go about investing and trading. Sometimes you have to pay up for the latest tranche but I try to be patient and wait for a temporary sell-off to add to the existing position.

** NOTE FOR NEW SUBSCRIBERS:

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.

You can find an archive of Trade Alerts here.