Latest Positions and Where I’d Buy More of Each of Our Stocks

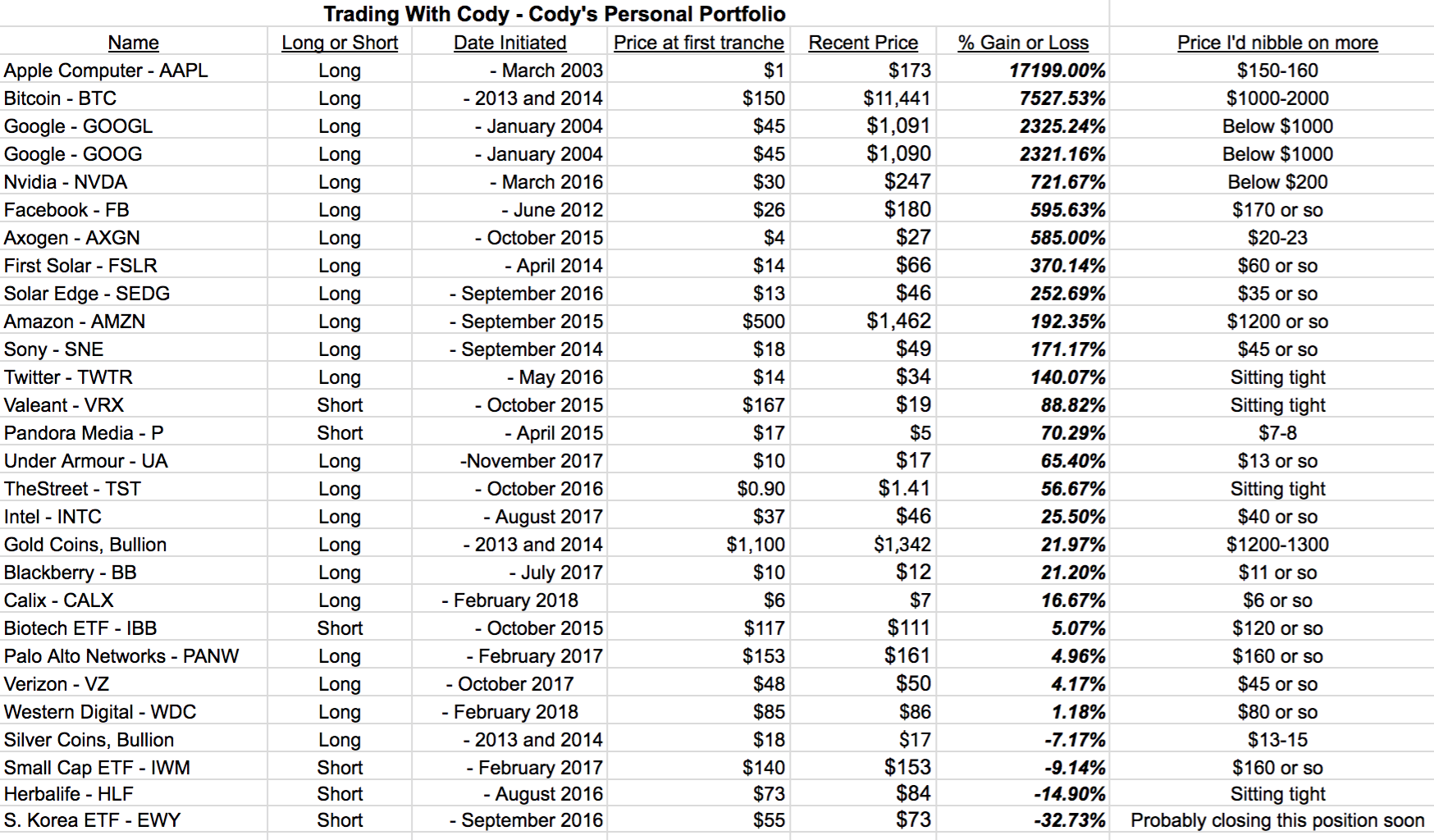

Here’s an update on that list of of the Revolution Investments that I’ve made in my professional career that I still hold in my portfolio, including those I’ve made over the last almost seven years since Trading With Cody launched. I’ve recently added a handful of new names that I think could go up big in coming years, including Calix, Western Digital and Verizon. Here’s where I might nibble more on some of our other existing names.

| Trading With Cody – Cody’s Personal Portfolio | ||||||

| Name | Long or Short | Date Initiated | Price at first tranche | Recent Price | % Gain or Loss | Price I’d nibble on more |

| Apple Computer – AAPL | Long | – March 2003 | $1 | $173 | 17199.00% | $150-160 |

| Bitcoin – BTC | Long | – 2013 and 2014 | $150 | $11,441 | 7527.53% | $1000-2000 |

| Google – GOOGL | Long | – January 2004 | $45 | $1,091 | 2325.24% | Below $1000 |

| Google – GOOG | Long | – January 2004 | $45 | $1,090 | 2321.16% | Below $1000 |

| Nvidia – NVDA | Long | – March 2016 | $30 | $247 | 721.67% | Below $200 |

| Facebook – FB | Long | – June 2012 | $26 | $180 | 595.63% | $170 or so |

| Axogen – AXGN | Long | – October 2015 | $4 | $27 | 585.00% | $20-23 |

| First Solar – FSLR | Long | – April 2014 | $14 | $66 | 370.14% | $60 or so |

| Solar Edge – SEDG | Long | – September 2016 | $13 | $46 | 252.69% | $35 or so |

| Amazon – AMZN | Long | – September 2015 | $500 | $1,462 | 192.35% | $1200 or so |

| Sony – SNE | Long | – September 2014 | $18 | $49 | 171.17% | $45 or so |

| Twitter – TWTR | Long | – May 2016 | $14 | $34 | 140.07% | Sitting tight |

| Valeant – VRX | Short | – October 2015 | $167 | $19 | 88.82% | Sitting tight |

| Pandora Media – P | Short | – April 2015 | $17 | $5 | 70.29% | $7-8 |

| Under Armour – UA | Long | -November 2017 | $10 | $17 | 65.40% | $13 or so |

| TheStreet – TST | Long | – October 2016 | $0.90 | $1.41 | 56.67% | Sitting tight |

| Intel – INTC | Long | – August 2017 | $37 | $46 | 25.50% | $40 or so |

| Gold Coins, Bullion | Long | – 2013 and 2014 | $1,100 | $1,342 | 21.97% | $1200-1300 |

| Blackberry – BB | Long | – July 2017 | $10 | $12 | 21.20% | $11 or so |

| Calix – CALX | Long | – February 2018 | $6 | $7 | 16.67% | $6 or so |

| Biotech ETF – IBB | Short | – October 2015 | $117 | $111 | 5.07% | $120 or so |

| Palo Alto Networks – PANW | Long | – February 2017 | $153 | $161 | 4.96% | $160 or so |

| Verizon – VZ | Long | – October 2017 | $48 | $50 | 4.17% | $45 or so |

| Western Digital – WDC | Long | – February 2018 | $85 | $86 | 1.18% | $80 or so |

| Silver Coins, Bullion | Long | – 2013 and 2014 | $18 | $17 | -7.17% | $13-15 |

| Small Cap ETF – IWM | Short | – February 2017 | $140 | $153 | -9.14% | $160 or so |

| Herbalife – HLF | Short | – August 2016 | $73 | $84 | -14.90% | Sitting tight |

| S. Korea ETF – EWY | Short | – September 2016 | $55 | $73 | -32.73% | Probably closing this position soon |

PS. I’m including a screenshot of the above chart in case they aren’t easily read on your device.

And here is a list of my latest positions with updated commentary and ratings for each position. I’ve broken the list into Longs and Shorts. And from there, I’ve broken down each list into refined categories in order from the largest positions within each category to the smallest. I also give each stock a current rating from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.”

Longs –

- Forever assets and other permanent holdings –

- Media and other private investment/business holdings (9+ because betting on yourself and running a business is always a best bet)

- Real estate, including land and the ranch I live on in NM (8)

- Physical gold bullion & coins (8)

- Primary stock exposure portfolio

- AAPL Apple (7) – Apple’s lack of innovation is finally starting to worry me. I like my iPhone X’s bigger screen in a smaller form factor. But I can’t believe that Apple made it harder to to switch between apps I have open, which I used to do constantly by double-clicking the physical button on the old iPhones. Now Apple makes you swipe up and hold and it takes a split second too long for my liking and then I have to pick my thumb up to swipe through the apps. Likewise, I got the latest version of Apple’s MacBook Pro a few weeks ago and it too has made itself less efficient than my old version. The new MacBooks took away a row of physical buttons at the top of the keyboard that I used to use for volume or brightness and replaced them with a tap panel that requires me to push an icon to select what feature I want to adjust and then swipe up or down to raise or lower it. It’s sort of like how they want me to use touch panels on my car radio and on my oven at home. Just give me knobs and physical buttons! But I digress a bit. Apple’s going to struggle for 2018 is my best guess right now, in large part because of these steps back in their products’ efficiencies. And don’t get me started on this ridiculously overpriced Apple HomePod. I can’t hardly bring myself to even order one to test out when I know how bad Siri is on my iPhone anyway. Anecdotally, the other day I saw a friend of mine tweet that he’s going to purchase a Windows for the first time in a decade because the latest Windows laptops/tablets are better than the latest “wacky” Apple laptops. I’m likely to trim some Apple soon, just a bit, as I’ve got such huge gains in it and want to reduce its size a bit.

- FB Facebook (8) – I still can’t believe that Facebook stole Instagram for $1 billion and turned it into a $100 billion entity. Meanwhile, there’s still the WhatsApp asset that Facebook will slowly but surely monetize next. And as I keep saying, that’s the story of the Facebook stock and why it’s gone from $20 to $180 since we’ve owned it. But the fact that it would take “just” another 80% rally to make Facebook the first ever trillion dollar market cap company — I just can’t fathom that the company can create another $400 billion dollars of value this year. Despite the hit the stock took when the company announced that they’re going to try to make people’s Facebook feeds more about each person’s friends rather than corporate sponsored posts, I like that CEO Mark Zuckerberg keeps innovating and tweaking and trying to improve the service.

- GOOG/GOOGL Google (8) – Do I have to call it Alphabet? I mean, it’s Google. General Electric didn’t change their name to General ABC’s as it became a conglomerate over the years. Anyway, Google’s Android, Google’s Driverless cars, Google’s Search, Google’s Assistant, Google Fiber, Google’s Ventures, Google’s Cloud, Google’s Google Google. Anyway, Google Alphabet remains a must-own for me, as it has since the day it came public at $45 a share over a decade ago.

- AMZN Amazon (8) – Did you see that Wal-Mart announced this morning that they’ve failed once again in their online efforts and that any chance of beating Amazon is once again, gone? Remember a few weeks ago when I wrote this during a Trading With Cody Q&A Chat: “I’m not a believer that WalMart and its bureaucratic executives in charge will ever be able to come close to what Amazon and the genius Jeff Bezos has created. Matter of fact, Look at these headlines from 2005 that were touting how WalMart was getting serious about ecommerce to stave off the Amazon juggernaut. I would bet that $AMZN will outperform $WMT in the next five years, but not quite to the extent over the last five years.” Well, that didn’t take long! Amazon’s going to start selling a new Alexa-centric smartphone sometime this year or next two and this time, Amazon’s going to win big in that arena too.

- NVDA Nvidia (7) – Our largest five holdings are all clicking on all cylinders with every one creating their own Revolutions, their own trillion dollar markets and their own economies. Nvidia can’t make their processors fast enough to stay up with all the demand from AI, driverless and cryptocurrencies. The cryptocurrency/mining platform is not sustainable long-term, but AI and driverless is most definitely not just sustainable but revolutionary. Meanwhile, the graphics side of the business is also growing steadily if not outright revolutionary.

- SNE Sony (7) – Sony’s surprised just about everybody but Trading With Cody subscribers for the last five years as the stock has gone from left-for-dead to being a real-turnaround success story. I continue to think that Sony’s movie and TV library is one of the great undervalued assets in the world right now and while Sony’s smartphone camera supply business is booming too, there’s a double upside potential here. That said, the stock has gone from $15 to $50 since we bought it so I’m not exactly plowing into more right now. In fact, I might trim some Sony while it’s above $50 here soon.

- AXGN Axogen (7) – This is a company whose products are helping hundreds of people get working hands. Think about that. This company and people like my best friend from college who is now a hand transplant surgeon are delivering what would truly have been considered a miracle at any time in mankind’s history. And the company’s growing because there are 100x more people out there who need hand transplants and other transplants and surgeries that require nerve reconstruction. I do think this stock is stretched and will have a hard time getting to $40 this year, but it remains one to hold steady for the long-term and is always a possible acquisition target too.

- SEDG SolarEdge (7) – Solar Edge was up 25% last week after a blowout earnings report and is now up more than triple from our cost basis. Earnings estimates for Solar Edge were way too low and analysts are scrambling to catch up to the stock now. I’m trimmed 10% of my Solar Edge into the pop and am holding onto the rest. Steady as she goes.

- TWTR Twitter (7) – Twitter is now up $20, up triple, from the mid-teens where we were buying it. Last time I wrote: “I expect the stock could get to $30 or $35 this year and maybe even $40 if growth reaccelerates.” So it goes, as the stock blew through $35 and might very well be headed to $50 if the company can continue to deliver upside to the analysts’ estimates. The aforementioned change to Facebook’s feeds is a boon for Twitter. Video content on Twitter continues to grow too and video is quite monetize-able. That said, we’ve seen this company fail to deliver on its promises in the past, so let’s not assume it’s all upside from here. I’m likely to trim some more of this name soon too.

- FSLR First Solar (7) – In the previous Latest Positions write-up a month ago, I wrote: “I could see this one swinging between $50 and $100 at various points in a wild volatile year for solar in 2018.” Well, indeed it has been already for FSLR. I continue to hold my position here steady as it remains the single best financed and positioned solar company in the US.

- INTC Intel (8) – I mentioned Intel as an exciting stock to own for 2018 at the Orlando MoneyShow a couple weeks ago. People yawned. I think Intel’s got some good upside from driverless and IoT, but they do need to execute.

- Palo Alto Networks (8) –I’ll tell you right now, my favorite pure play in the cyber security world is Palo Alto Networks. It is a stock that has not moved much in the last year so, and frankly I think it might be pent up. Without a doubt cyber security and protecting networks, especially inside of giant corporations is paramount right now, so if you can find a company like Palo Alto that is a great, great huge margins, fast growing, maybe the defacto standard. It’s sort of, you can’t go wrong with Big Blue (IBM) back in the 50’s and 60’s you can’t go wrong with Palo Alto right now.

- VZ Verizon (8) – Another stock I mentioned as an exciting stock to own for 2018 at the Orlando MoneyShow a couple weeks ago. And, yes, people yawned. I like that. I think 5G’s going to pay off big for Verizon shareholders over the next year to five years.

- Under Armour (7) – Good bounce after a stronger-than-expected earnings report for UA. There’s a good franchise and good distribution and good growth in this name if they can, yes, execute.

- BB Blackberry (7) – I wanted to see Blackberry give us a tangible win in the driverless car platform side of things, and they did recently. So I’m holding onto BB for now.

- TST The Street (7) – There’s still more upside in this name if they can kick off several million dollars in cash flow this year.

- CALX Calix (7) – Calix is a supplier to telecom companies, a fiber optic supplier to telecom companies, a passive optical network fiber optic supplier to telecom companies. All that to say that look, so when you sign a company with America, North America’s largest telecom company, Verizon, and the potential is there for it to become … This is again, a small cap company that’s doing a few hundred million dollars in sales right now. There’s the potential for this thing to do 10 times that if Verizon actually implements and distributes this passive optical network, um, that this company is supplying into the Verizon networks. Now it helps 5G is the reason they’re doing that and so Verizon’s going to spend 10 or 20 billion dollars investing in 5G in coming years. So absolutely you want to capture, as I like to say, there’s five or ten billion dollars of cash flowing into 5G’s spending infrastructure from Verizon alone and … the company I’m talking about is putting their bucket out in front of that spending and that’s a good thing. So the stock popped a little bit on that news. The reason why I didn’t pop more than a few percent to five, 10 percent from where we started buying it last week when this Verizon news was announced this week, the reason it didn’t pop more is simply because we don’t know how much Verizon is going to put it and build on this company’s products. We just know that they’re doing a trial and that they’re implementing it and that that’s a very good sign that Verizon is going to be using this company’s products. So that’s why the stock is up a little bit.

- WDC Western Digital (8) – The industry has never had so few competitors, having reduced itself down to three major players. The cost of building new fabs runs six or seven or more billions of dollars, when it used to cost “just” a billion or so a decade ago. The aforementioned secular growth of demand for flash storage from the aforementioned Revolutionary sectors. So the company could earn $18 per share in 2020. You throw at 12-15 P/E on that and you can end up at $250 or higher price for the stock. The best case scenario is that the company could earn $20 per share with a 15 multiple to hit $300 in the next two to three years.

- Primary short portfolio

- P Pandora (8) – Rinse and repeat: Pandora radio sucks. Their subscription product is worse. And the company’s trying to compete against Google, Amazon, Apple and Spotify. I remain short even when the stock hits new lows. I’m still short but might cover a little bit of this one soon, just to be disciplined and lock in some of these huge profits.

- IWM Small cap ETF (8) – I wonder if I’d been sitting in front of my computer when the markets hit their recent near-term bottoms, I wonder if I’d had trimmed some of these puts. Shoulda, woulda, coulda. Anyway, I do expect more near-term market weakness and/or a sideways market for the next few weeks or months, and these will be a decent hedge in the case of a sell-off. But they are just a hedge.

- S&P 500 SPY (8) – I wonder if I’d been sitting in front of my computer when the markets hit their recent near-term bottoms, I wonder if I’d had trimmed some of these puts. Shoulda, woulda, coulda. Anyway, I do expect more near-term market weakness and/or a sideways market for the next few weeks or months, and these will be a decent hedge in the case of a sell-off. But they are just a hedge.

- Biotech ETF IBB (8) – Biotech stocks have been drastically underperforming for the last year and a half and I expect they will underperform for the next year and a half.

- EWY SouthKorean ETF (7) – Will cover soon, but want some of this overseas exposure to the downside in case there is a near-term sell-off in early 2018 where I’d probably cover this position for real finally.

- HLF Herbalife (7) – I’m getting worn out on this short too. I don’t think Herbalife can make the kind of money it used to before it changed its business model in a settlement with the Justice Department last year. Well, whatever, I’m sitting tight on this name for now.

Remember: I wouldn’t rush into a full position all at once in any of these stocks or any other position you’ll ever buy. Patience and allowing the market and time to work to your advantage by buying in tranches is key. Maybe 1/3 or 1/5 of whatever you might consider to be a “full position” in any particular stock. And I wouldn’t ever have more than 5-15% of your portfolio in any one stock position at any given time. The younger you are and/or the higher the trajectory of your career income, the more concentrated and risk-taking you can be with weighting in your portfolio. But spread your purchases and your risk out over time and over a several positions no matter your age or risk-averse level.

Scaling into a position using an approach of buying 1/3 or 1/5 tranches over time is how I build my personal portfolio positions, but there’s no scientific way to go about investing and trading. Sometimes you have to pay up for the latest tranche but I try to be patient and wait for a temporary sell-off to add to the existing position.

** NOTE FOR NEW SUBSCRIBERS:

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.

You can find an archive of Trade Alerts here.