Latest Positions: Bitcoin, Gold, Tesla, Uber, Rivian (And A Minor Trade Alert)

First off, we will do this week’s chat tomorrow at 10:00am ET in the TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com. Also, as you might have noticed, we gave the website a big makeover this weekend, one of the changes being the addition of a calendar on the front page and in the chat room that shows all of our upcoming events. From now on, we will normally plan on chat being Wednesdays at 3:00pm ET. If things change in a given week (like they did this week), we will make sure and send an update and update the calendar.

We were off to the races today with the Nasdaq ripping up nearly 2.3%. We were well positioned for today’s rally having covered shorts and adding to our longs (including buying calls on the likes of U, SHOP, and SPOT) as mentioned in last week’s write-up. TSLA and RIVN closed up 7.3% and 8.4%, and most of our other longs were up anywhere from 4 to 5%. Great to have days like today, but as always, we have to remain disciplined, which led us to a little trimming today (sold a tiny bit of GOOG, INTC, and BITO) and buying a few puts on RIOT, MARA, DIA, SMH, etc. These were fairly small trades for us and we are in no rush to change our positioning just yet.

Here is Part 1 of the list of my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- Forever assets and other permanent holdings –

- Media, hedge fund and other private investment/business holdings (9+ because betting on yourself and running a business is always the best bet)

- Real estate, including the ranch I live on in NM (6)

- Physical gold bullion & coins (8)

- (Driverless/EV Revolution) –

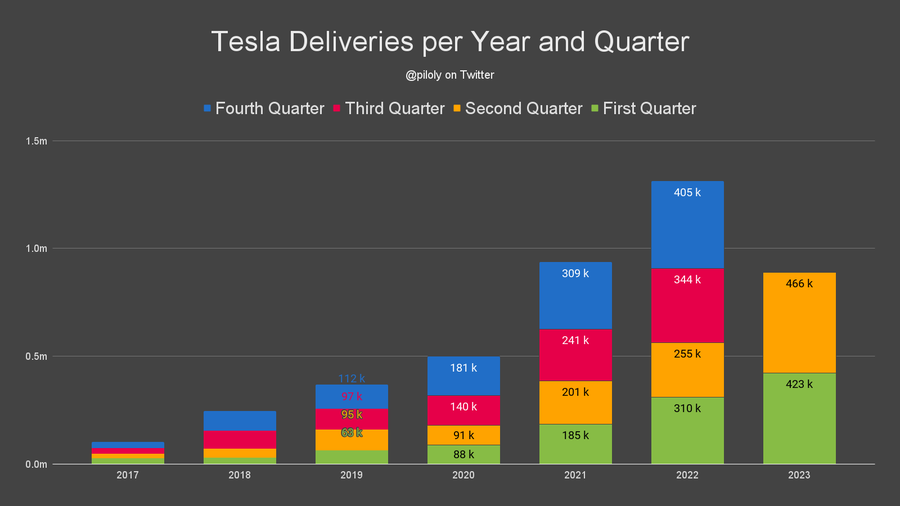

- TSLA Tesla (8) – TSLA has had a nice bounce over the last couple of days after falling hard from nearly $300 to $215 (~28% drawdown) in less than a month. The stock is now back to $256 and it remains one of our biggest long positions. When we did the last latest positions update on TSLA on April 19, the stock was at $180 and all the talking heads could talk about were Tesla’s price cuts. However, we made clear that “Tesla is clearly playing the long game with these cost cuts and these will likely keep customers from choosing one of the many competitors that they would otherwise consider buying in the near future” and that “TSLA is basically the only company that is able to profitably produce EVs at scale.” Tesla turned in another great quarter in Q3 delivering over 466,000 vehicles, more than it did in all of 2019 when we first started buying the stock. While the company’s gross margin dropped to about 18% from 20%, we stand behind Elon’s strategy of focusing on market penetration over near-term profits. Even though Tesla makes the best product on the road, there are hundreds of EV makers in China and elsewhere that could seriously cut into TSLA’s demand if it cannot keep its cars affordable for average consumers. Even at 18% gross margins, Tesla is still way above the industry average (especially for EVs) and with the possibility to sell high-margin software down the road, we are not terribly worried about TSLA’s profit-earning potential. Moreover, TSLA is currently producing the first Cybertrucks, which has the potential to be the best selling vehicle of all time. And as we tweeted last week, TSLA is still one of the best AI plays with its trillions of data points collected from the millions of Tesla drivers which it is now using to power its 12.0 version software which is entirely machine-taught and does not contain a single line of human code. If you haven’t seen the live streamed video that Elon did on Friday last week that revealed 12.0, you should watch it here. We would look to add to our TSLA around $200.

- RIVN Rivian (7-) – In the last latest positions update, we said “With the shares trading at $12-$13, the market is basically saying that RIVN is going to zero. It has a $11.8bb market cap and about $9.9bb in net cash on the balance sheet. That means you are paying only $1.9bb for RIVN’s actual business.” Well, Rivian did not go to zero and has now more than doubled from where we were buying it back then. Rivian turned in two solid quarters, beating revenue expectations both times and most recently raising their full-year production guidance to 52,000 vehicles from 50,000. We also got the chance to test drive the R1T at Rivian’s newly-opened Manhattan showroom last month (details here) and the product was outstanding. And just in the last week, we have either personally seen or heard about a half-dozen Rivians here in New Mexico. In every instance where someone brought it up to us, they mentioned that they were captured by the sight of the vehicle and immediately wondered to themselves, “What’s that?” Every person we have spoken with said they liked the looks of the vehicle and a few are currently contemplating purchasing one. Rivian remains on track to be one of the few non-Tesla winners in the EV race, and is currently the only other US EV pure-play currently cranking out units. That said, the stock has made a sizeable move since we started buying it, and don’t necessarily want to chase it. As noted in my recent “Where I’d Buy More” article, we were buyers just last week when it had a $19 handle or below.

- TSLA Tesla (8) – TSLA has had a nice bounce over the last couple of days after falling hard from nearly $300 to $215 (~28% drawdown) in less than a month. The stock is now back to $256 and it remains one of our biggest long positions. When we did the last latest positions update on TSLA on April 19, the stock was at $180 and all the talking heads could talk about were Tesla’s price cuts. However, we made clear that “Tesla is clearly playing the long game with these cost cuts and these will likely keep customers from choosing one of the many competitors that they would otherwise consider buying in the near future” and that “TSLA is basically the only company that is able to profitably produce EVs at scale.” Tesla turned in another great quarter in Q3 delivering over 466,000 vehicles, more than it did in all of 2019 when we first started buying the stock. While the company’s gross margin dropped to about 18% from 20%, we stand behind Elon’s strategy of focusing on market penetration over near-term profits. Even though Tesla makes the best product on the road, there are hundreds of EV makers in China and elsewhere that could seriously cut into TSLA’s demand if it cannot keep its cars affordable for average consumers. Even at 18% gross margins, Tesla is still way above the industry average (especially for EVs) and with the possibility to sell high-margin software down the road, we are not terribly worried about TSLA’s profit-earning potential. Moreover, TSLA is currently producing the first Cybertrucks, which has the potential to be the best selling vehicle of all time. And as we tweeted last week, TSLA is still one of the best AI plays with its trillions of data points collected from the millions of Tesla drivers which it is now using to power its 12.0 version software which is entirely machine-taught and does not contain a single line of human code. If you haven’t seen the live streamed video that Elon did on Friday last week that revealed 12.0, you should watch it here. We would look to add to our TSLA around $200.

-

- UBER Uber (7+) – When we published our deep dive on Uber on February 1, we stated that Uber was “firmly entrenched as the go-to provider in the sharing economy, with remaining issues acting simply as speedbumps on the road to market dominance. Add in the revolutionary possibilities of AVs with FSD, UBER’s AI tech, the reshaping of the economics of vehicle ownership, and UBER is positioned to achieve a $200bb +/- valuation in the next four to five years.” The stock is up more than 50% since then. Uber’s results since publishing our deep dive have surpassed even our expectations. The company turned in its first quarter of GAAP operating profitability in Q2 led by continued revenue growth in its core mobility business and continued cost-cutting. It also kicked out an impressive $1.14bb in free cash flow in the quarter. When we published our analysis, Uber had a $61bb market cap and that has already grown to a $93bb market cap (a 52% gain) in just 8 short months. Lyft, on the other hand, is down 36% since we wrote that article (comparison chart below). In our view, Uber is now firmly entrenched as the dominant rideshare company in the US and is quickly expanding its dominance abroad. We remain excited about Uber’s prospects but we have some near-term worries about the delivery business and are currently hedging our Uber position with Doordash (DASH) puts. We would look to add to our Uber stake around $30.

- (Crypto and Gold Revolution)-

- BTC Bitcoin (7) – We wanted to start off the latest positions with Bitcoin following the 5%+ pop today following some important news. Bitcoin had sold off quite a bit lately, dropping down to about $26,000 (when we bought more BITO) after hanging around $30,000 for most of July. Today, a federal court held that the SEC must review an application from Grayscale to convert its Bitcoin closed-end trust (GBTC) into an exchange-traded fund. GBTC was trading at roughly a 30% discount to its Bitcoin holdings because as a closed-end fund, there are no redemption rights and thus no way to close the arbitrage between the NAV and the price of the stock. GBTC immediately jumped about 17% today following the court ruling and closed roughly half of the discount to its NAV. Importantly, the court ruling only requires the SEC to review Grayscale’s application, not necessarily approve it. If the GBTC is converted into an ETF, then its shares would become redeemable at the closing NAV for the day. The giant asset manager Blackrock is also seeking approval of a Bitcoin ETF. It seems likely that at some point, the SEC will approve the creation of a Bitcoin spot ETF which would allow institutions (like our hedge fund) direct exposure to Bitcoin without actually holding the cryptocurrency and with less risk of it being lost or stolen by a third-party. The ability for major institutions and investment managers to own Bitcoin semi-directly would make it that much more standardized as the world’s cryptocurrency, so we are certainly looking forward to the day that an ETF is approved. That said, we would not say that the long-term bull thesis for Bitcoin depends on the SEC approving an ETF in the next year or two. Bitcoin has already been established as the safest, most reliable, most stable cryptocurrency and has reached the point of critical mass as both a store of value and form of currency. We are not looking to buy GBTC anytime soon but might add to our BITO holdings if Bitcoin gets back to around $25,000.

- Gold/GLD Gold ETF (7) – Gold has pulled back to $1,964 as of this writing after reaching a high of $2,055 in May, and is now up only 6.4% on the year. The pullback is probably mostly attributable to the lowering of inflation expectations as the headline CPI number has been cut in half this year from 6.4% YoY in January to 3.2% YoY in July. Gold is still a decent inflation hedge and although inflation is certainly starting to level off, we think there is probably risk to the upside as the supply chain remains stretched in many instances, wages are sticky, and consumption remains strong. We are not anticipating any major price moves in the near term per se, but would buy more if Gold gets back to around $1850.

That’s it for now folks. More to come later this week!

Remember: I wouldn’t rush into a full position all at once in any of these stocks or any other position you’ll ever buy. Patience and allowing the market and time to work to your advantage by buying in tranches is key. Maybe 1/3 or 1/5 of whatever you might consider to be a “full position” in any particular stock. And I wouldn’t ever have more than 5-15% of your portfolio in any one stock position at any given time. The younger you are and/or the higher the trajectory of your career income, the more concentrated and risk-taking you can be with weighting in your portfolio. But spread your purchases and your risk out over time and over a several positions no matter your age or risk-averse level.Scaling into a position using an approach of buying 1/3 or 1/5 tranches over time is how I build my personal portfolio positions, but there’s no scientific way to go about investing and trading. Sometimes you have to pay up for the latest tranche but I try to be patient and wait for a temporary sell-off to add to the existing position.** NOTE FOR NEW SUBSCRIBERS:

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple of hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.

Disclosure: At the time of publication, the firm in which Mr. Willard is a partner and/or Mr. Willard had positions in some of the positions mentioned above although positions can change at any time and without notice.