Latest Positions: Cloud Revolution, Energy Revolution, China Middle Class Revolution

“Man just wants to forget the bad stuff, and believe in the made-up good stuff. It’s easier that way. – A commoner in the play Rashomon. One of my favorite plays/movies, and one told in flash backs. (It’ll make sense below). Some day I’ll have to write up some analysis about how understanding the concepts of different perspectives that Rashomon teaches us can also help us when we invest.

Here is a Part 2 of 3 of my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position. I’ll send out Part 3 tomorrow.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- (Cloud Revolution)

- WORK Slack (8) – For the last few months, I’d been trading texts with a group of money managers extraordinaire in a group text message thread chat thingee. I asked them all to move our discussions over to Slack. So I created a Slack Channel for us and now our conversations have quotes, charts, automatic postings of my Tweets or TradingWithCody articles and many more features. Our conversations are fuller and deeper and longer because of Slack. We all love the change to Slack from a group text chat. None of us would have bothered moving if someone had suggested Microsoft Teams. Just sayin’.

- Palo Alto Networks (7) – I’m tired of Palo Alto selling off after earnings report, which it seems to do every dang time, but the fact is that the company is transitioning from being an appliance/edge security company to being a cloud security company. The recurring revenue model that is happening with this transition is dragging on earnings and cash flow near-term but will kick in bigger earnings and cash flow in the next few years than if they’d kept to their old model. Think of Adobe and Microsoft moving from selling software on disks to a subscription cloud services model. This is similar.

- SQ Square 7) – I noticed that a new analyst picked up coverage of Square with a buy rating a $105 price target not because of the company’s primary point-of-sale check out counter business but because (flashback alert): “Square’s Cash App is picking up momentum vs. PayPal’s Venmo, according to an analysis of Google Trends searches, says Macquarie’s Dan Dolev. He notes Cash App had a revenue run rate of about $635M in Q3 vs. $1M three years earlier.” Sounds like he’s reading Trading With Cody, huh? In the prior Latest Positions, I’d written this: “I like Square for the penetration they’ve got at the point-of-sale check out counter in the US. But more than anything, as I mentioned last time, I think the Square Cash App, which is now a more than $1/2 billion dollar a year business and growing quickly is what will drive the stock in the next year or two. You can even buy, sell or send bitcoin in the Cash App. I bought some SQ when it got below $60 as I’d noted I probably would in the prior Latest Positions update.” Ah, a flashback in a flashback like a bad 1970s movie.

- NVDA Nvidia (6) – Simply put, Nvidia has continued to defy the skeptics and even to impress bulls like me. AI, servers, graphics are growing secularly over time as I’d expected when I bought this stock three years ago at $30. The latest quarterly report was a thing of beauty and has brought upgrades from late-to-the-party sellsiders like Morgan Stanley at this point. The stock is at 52-week highs but is still down from 30% away from its all-time highs set back last year. This is a stock that I have in the portfolio and seem to forget about and it’s been a great performer overall for us. I think it’s more of a trim than a buy right now, but it seems like I’ve been saying that a for the last year. Anyway, I’m sitting tight on my shares.

- TSM TSM (7) – Taiwan Semiconductor TSM has been a terrific performer for us this year since we bought it a few months ago and perhaps our least volatile stock over that time period too. Realizing that this company is based in the disputed territory of Taiwan, the steady Betty nature of this stock this year probably underscores just how well positioned this company is for the next decade or two as it remains years ahead of any competition in making chips. That is, China says its part of China, the people in Taiwan tend to say otherwise — sound like Hong Kong which is obviously front and center in the news as the civil protests there over Beijing’s power have grown in size and duration? Yes, but TSM just keeps heading higher. Did you realize that TSM with a market cap of $259 billion is worth about as much as one Disney DIS? TSM’s forward P/E is slightly less than TSM’s.

- (Energy Revolution)

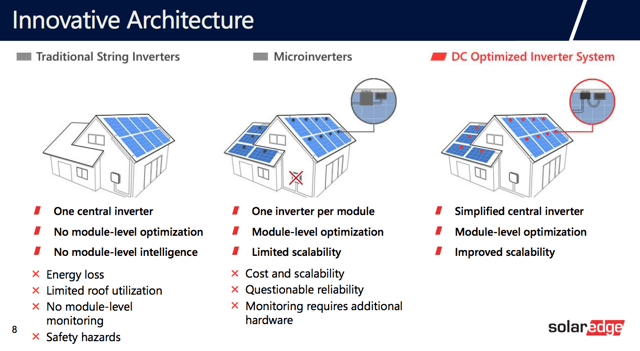

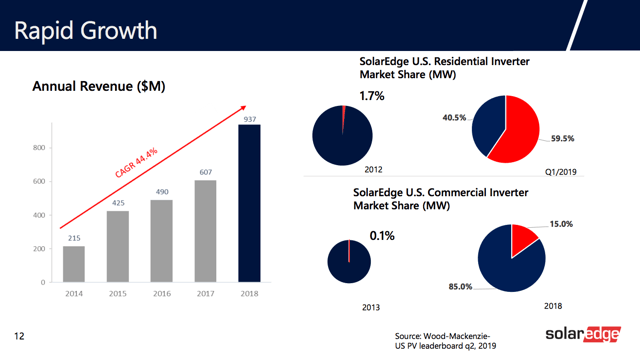

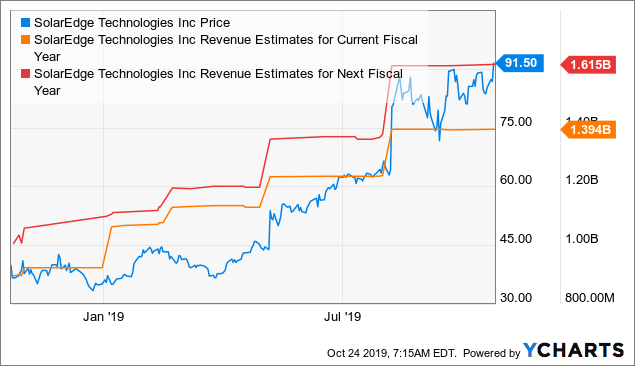

- SEDG SolarEdge (7) – This is a stock that has outperformed even my bullish expectations this year. I’ll let the company speak for itself this time:

And here’s a chart from a writer on Seeking Alpha that reflects how long-term Revolution can work, in this case with Solar Edge:

- First Solar (7) – In the prior Latest Positions write up, I’d noted that (flashback alert) “I’d buy more FSLR near $50.” When FSLR recently got close to $50, I did exactly that. At this moment, the sellside analysts expect First Solar’s revenue to decline 5% next year. As I’ve noted before, this company’s revenue and earnings can be lumpy, even smoothed out over two or three years. Longer-term, the revenue growth from being a leading player in the secularly growing industry of solar power is likely to keep this company growing for decades to come, and probably the stock too.

- SEDG SolarEdge (7) – This is a stock that has outperformed even my bullish expectations this year. I’ll let the company speak for itself this time:

- (China Middle Class Revolution)

- JD JD.com (7) – Last time I’d written (flashback alert) “Another volatile little stock, this thing can sell of 10% off one Grumpy Trump Tweet about The Great Trade War with China. It’s been a good idea to buy when that happens and to trim when the stock rallies above $30. Probably still is.” Can the stock break out above $33? Before year end, might be a lot to ask for. The company reported another strong earnings and seems to be, as I’d also noted: “JD is one of the best ways to play on what hopefully will be a growing middle class in China for years to come.” Which is why we ended up flipping from short to long in this name in the mid-$20s and plan to hold it for many years if they keep doing what they’re doing.

- BIDU Baidu (6)– One of the main reasons I bought this stock was not just because it had sold off and looked cheap on many metrics, but because sentiment and expectations for the company seemed so terribly low. Well, for the last couple quarterly reports, Baidu reported decent numbers but the stock has rallied both times because expectations were apparently so low. That said, at some point the company’s investments need to start showing some real dividends for the company or the stock will likely end up gyrating around these levels for a long time.